Tom's Guide Verdict

Aura tries to do it all when it comes to identity protection and generally succeeds with comprehensive protection at an affordable price. It lacks a competent credit simulator, though.

Pros

- +

Good value

- +

Quick access

- +

Monthly credit reporting

- +

Emphasis on child safety

- +

Includes malware protection, password manager and VPN

Cons

- -

No calculators or credit simulators

Why you can trust Tom's Guide

Monthly cost: $12

Yearly cost: $264

Family plan: $384/year

No. of bureau scores: 3

No. of bureaus monitored: 3

Frequency of credit reports: Annual

Type of credit score: VantageScore 3.0

Credit-improvement simulator: No

Credit-lock/freeze button: Yes

Security software: AV, PW manager, VPN, Safe Browsing extension, Anti-tracking, Ad Blocking

Investment account monitoring: Yes

Max. ID-theft coverage: $5 million

Data Breach Alerts: Yes

Medical Records/Payday Loan Monitoring: No/Yes

Online Predator/Cyberbullying Alert: Yes/Yes

Title Change Alert: Yes

Two Factor Authentication (2FA): Yes

Extras: Child activity overview

With everything from malware protection to VPN access and a password manager, Aura takes traditional identity protection to new levels. Its three bureau credit scores and monthly credit reports are complemented by a credit lock button for Experian transactions. Although it has consistently ranked at the top of our list of best identity theft protection services it does fall short in one few key areas: It lacks a credit calculator and simulator to improve your credit scores.

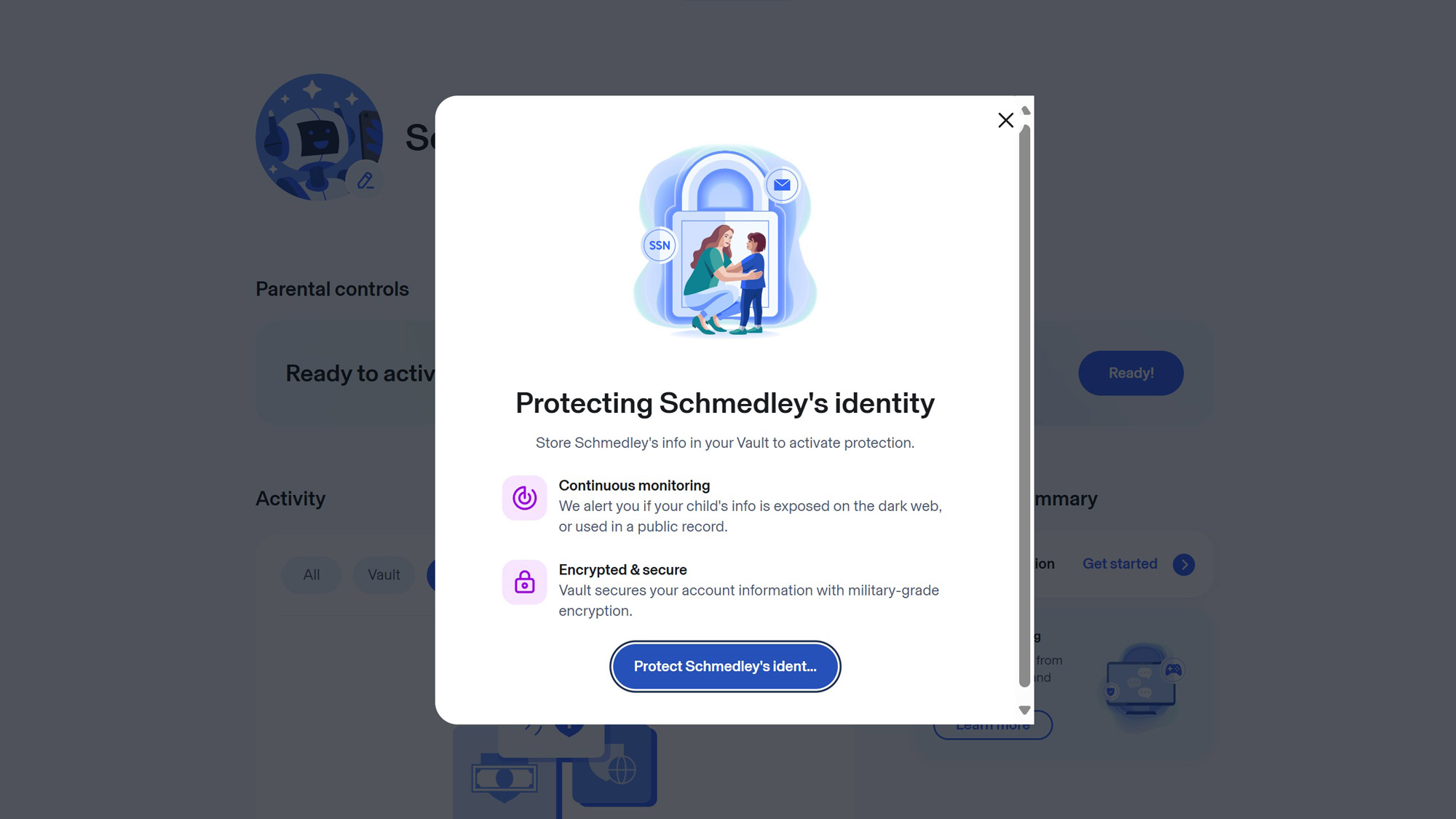

While it can keep an eye out for your family and children as well with sex offender and cyberbullying alerts, Aura uses sophisticated machine learning techniques to model a child’s behavior. Its plans are reasonably priced, include up to $5 million of identity insurance and makes it easy to get started protecting or recovering a stolen identity.

I reviewed the service by signing up with my own information to test what it was really like to set up, use, and how useful all the features were in actual day-to-day practice.

Aura review: Costs and what’s covered

To simplify things, Aura has similar coverage for an individual, couple or entire family. Securing the identity of a single person costs $15 a month, but the company discounts that to $12 a month for the first year; annual plans cost $144.

| Row 0 - Cell 0 | Individual | Couple | Family |

Pricing | $9.99 per month (annual), $12.99 per month (monthly) | $17.99 per month (annual), $19.99 per month (monthly) | $24.99 per month (annual), $47.99 per month (monthly) |

Users | 1 adult | 2 adults | 5 adults, unlimited kids |

Devices | 10 | 20 | Unlimited |

The individual plan includes $1 million of identity theft insurance, all sorts of alerts and notifications as well as three credit bureau monitoring and annual reports. This plan not only monitors your home and vehicle’s title but includes an array of software, bringing Aura to the level of a security suite with home-grown malware protection and access to VPN infrastructure from Hotspot Shield for up to 10 systems per adult user and Aura’s own password manager.

Aura’s Couple plan covers two attached adults, although they don’t need to be married. It mirrors the individual plan for both and ups the insurance to $2 million. The Couple plan costs $29 per month, although Aura discounts it to $22 for the first year. It costs $264 if you prepay a year’s worth of coverage.

The Family plan can cover up to five adults and an unlimited number of children with a total of $5 million of identity insurance that includes child credit monitoring, spam call protection, cyberbullying and sex offender alerts. There’s even Safe Gaming software. The Family plan costs $50 a month or $32 a month ($384 annually) if a year is paid for upfront – about half of LifeLock’s comparable plan.

The company recently added a Kids plan ($13/month, $10/month if paying annually) that can protect an unlimited number of children. It doesn’t include credit monitoring or reports but has parental monitoring of social media interactions, content and site filtering. The plan includes screen time limitations as well as the ability to pause the Internet connection at any time and a look out for cyberbullying with PCs.

Aura rates an A+ rating from the Better Business Bureau. There were some billing issues noted but the company’s customer support staff appears to be courteous and effective.

Aura review: How we tested

I signed up for Aura Family coverage in the late Spring 2025. I added my personal and financial information to the web interface and set up the Aura app on my Samsung Galaxy S25 phone.

I checked on my credit scores and identity information at least every few days for three months using a mix of the app and desktop and notebook computers. I explored the features and the interface, and kept track of the alerts.

Aura review: Setup and support

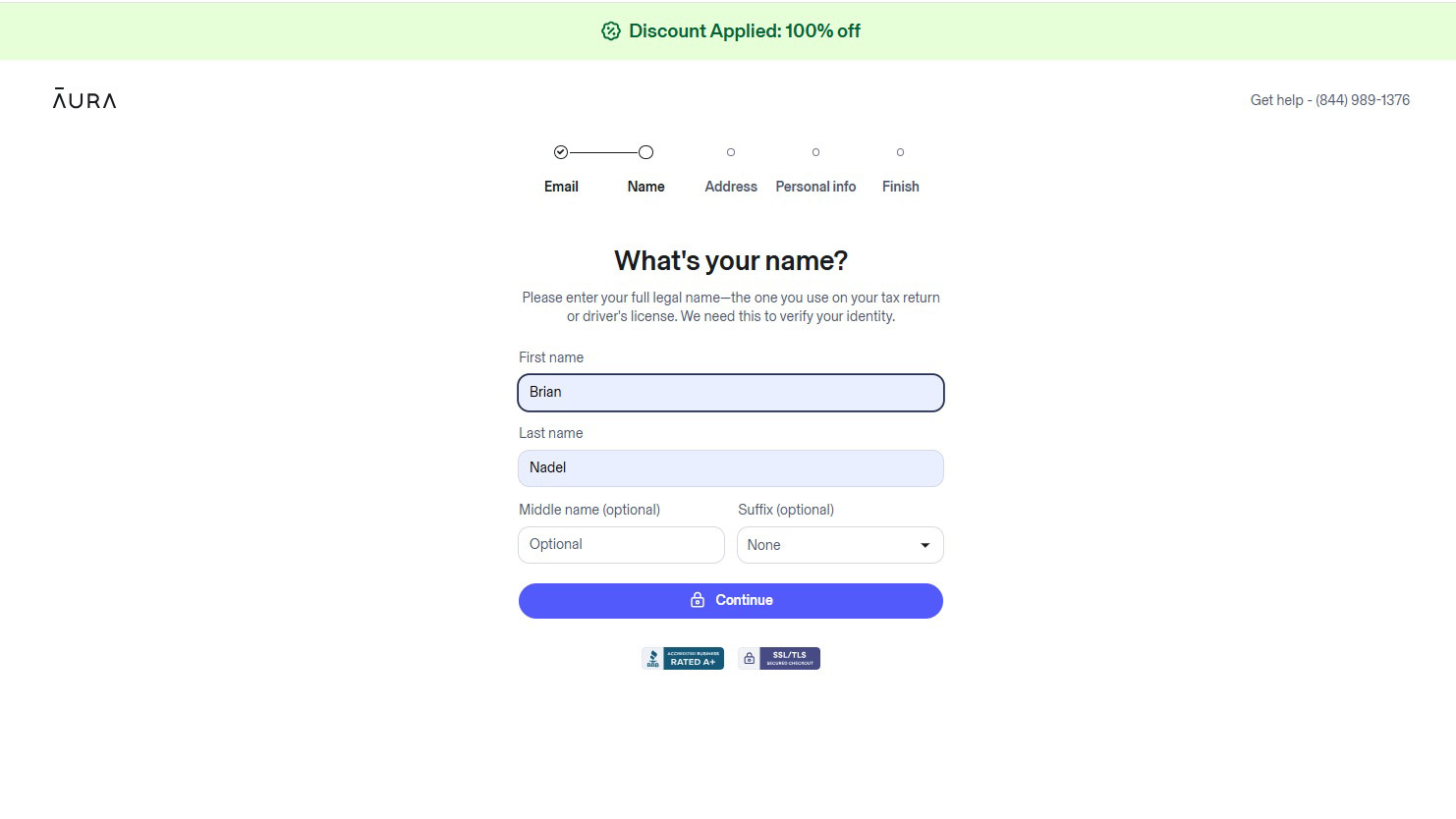

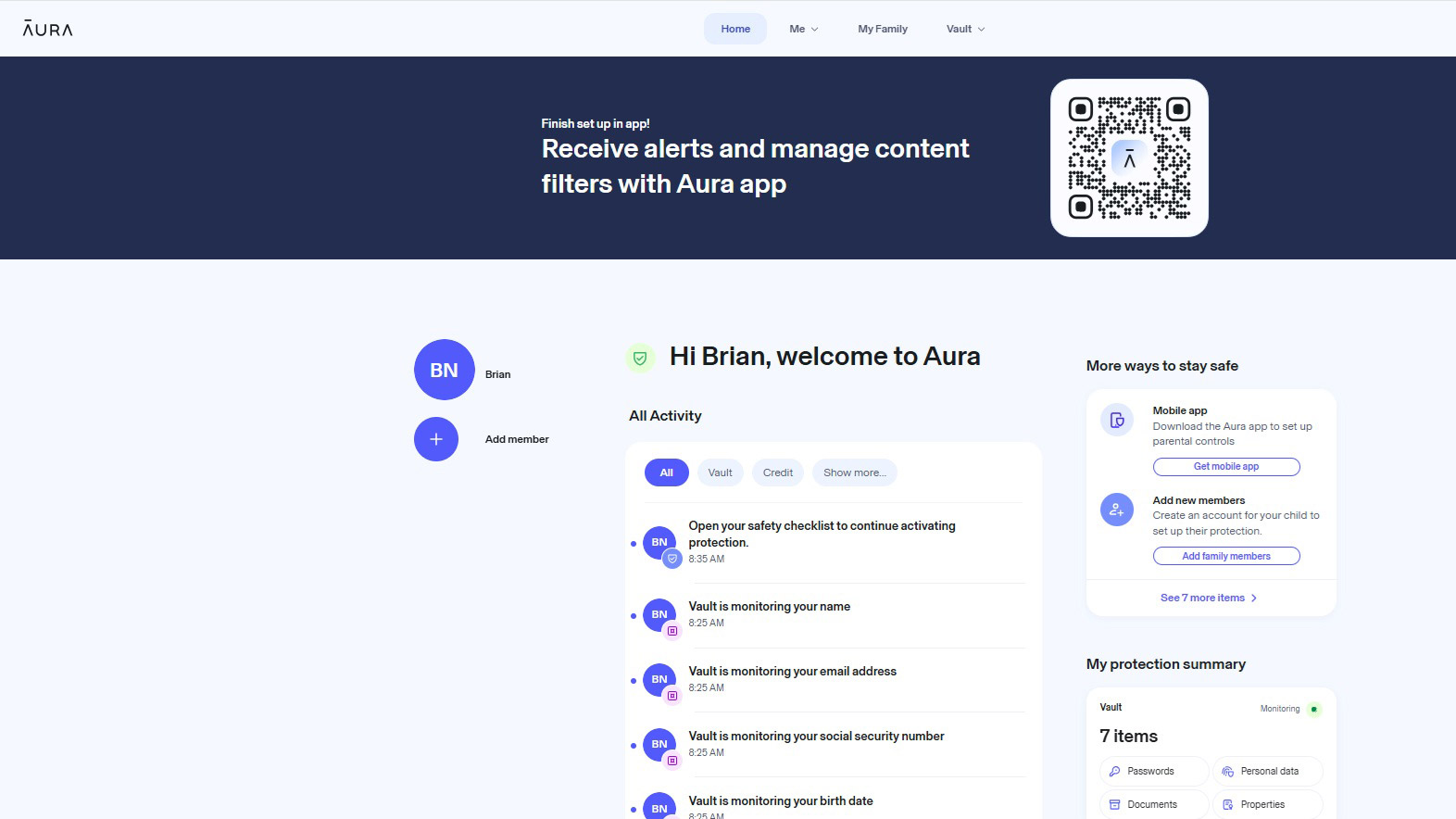

Aura’s setup process took nearly 23 minutes.I went through the Safety Checklist by verifying my identity with three questions about mortgages and credit cards. My VantageScore 3.0 credit rating popped up on the interface and I was offered a download of the Windows-only Safe Gaming app.

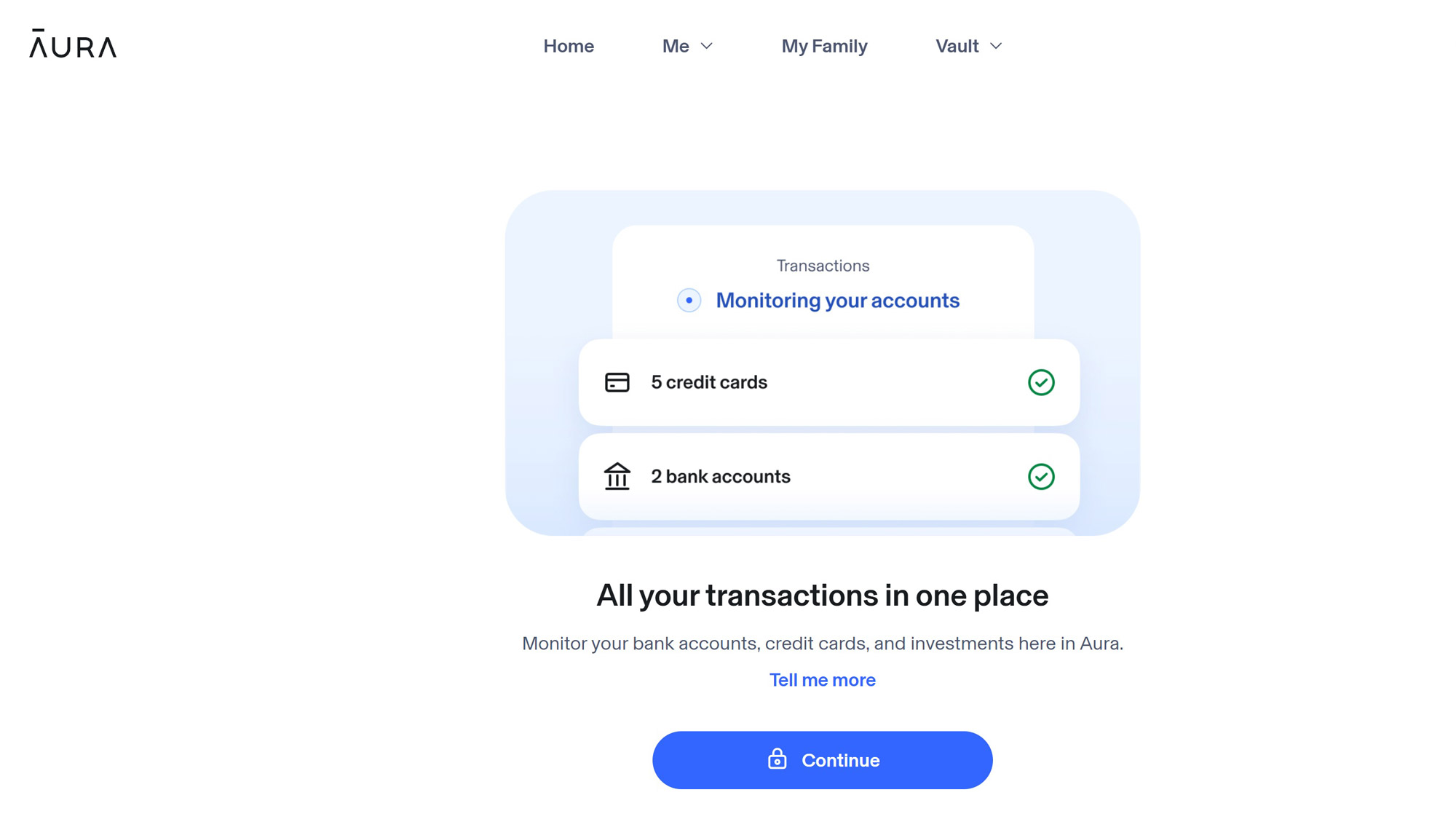

Aura uses Plaid to monitor bank and investment accounts and I tried to set up service but it refused to send me a verification code on my first few tries. I succeeded later.

A big bonus is that Aura now has 24/7 customer support via an 800-number hotline for anything from a late night credit question to a vacation identity emergency. Every support page has a Get Help button and there’s lots of DIY assistance as well as identity-theft related articles.

Aura review: Credit scores and identity monitoring

| Row 0 - Cell 0 | Individual | Couple | Family |

3-Bureau Credit Monitoring | ✓ | ✓ | ✓ |

Instant Credit Lock | ✓ | ✓ | ✓ |

Bank Fraud Monitoring | ✓ | ✓ | ✓ |

Financial Transaction Monitoring | ✓ | ✓ | ✓ |

Monthly Credit | ✓ | ✓ | ✓ |

Score | ✓ | ✓ | ✓ |

Annual Credit Reports | ✓ | ✓ | ✓ |

The Aura Individual, Couple and Family services include monitoring and scores from Equifax, Experian and TransUnion. In addition to annual credit reports, the plans show the VantageScore 3.0 rating that mimics the FICO credit ratings.

The service lacks an instant or daily credit report to help spot problems or attempted fraud as it happens, although it has alerts and notifications for lots of nefarious actions. Aura can watch for duplicate charges on your plastic and spot transactions over a preset threshold.

It can warn of someone attempting to set up bankruptcy proceedings or break into your investment account and monitor the outside world for someone on the sex offender list moving into your neighborhood. The service uses artificial intelligence to tag potential cyberbullying of a child.

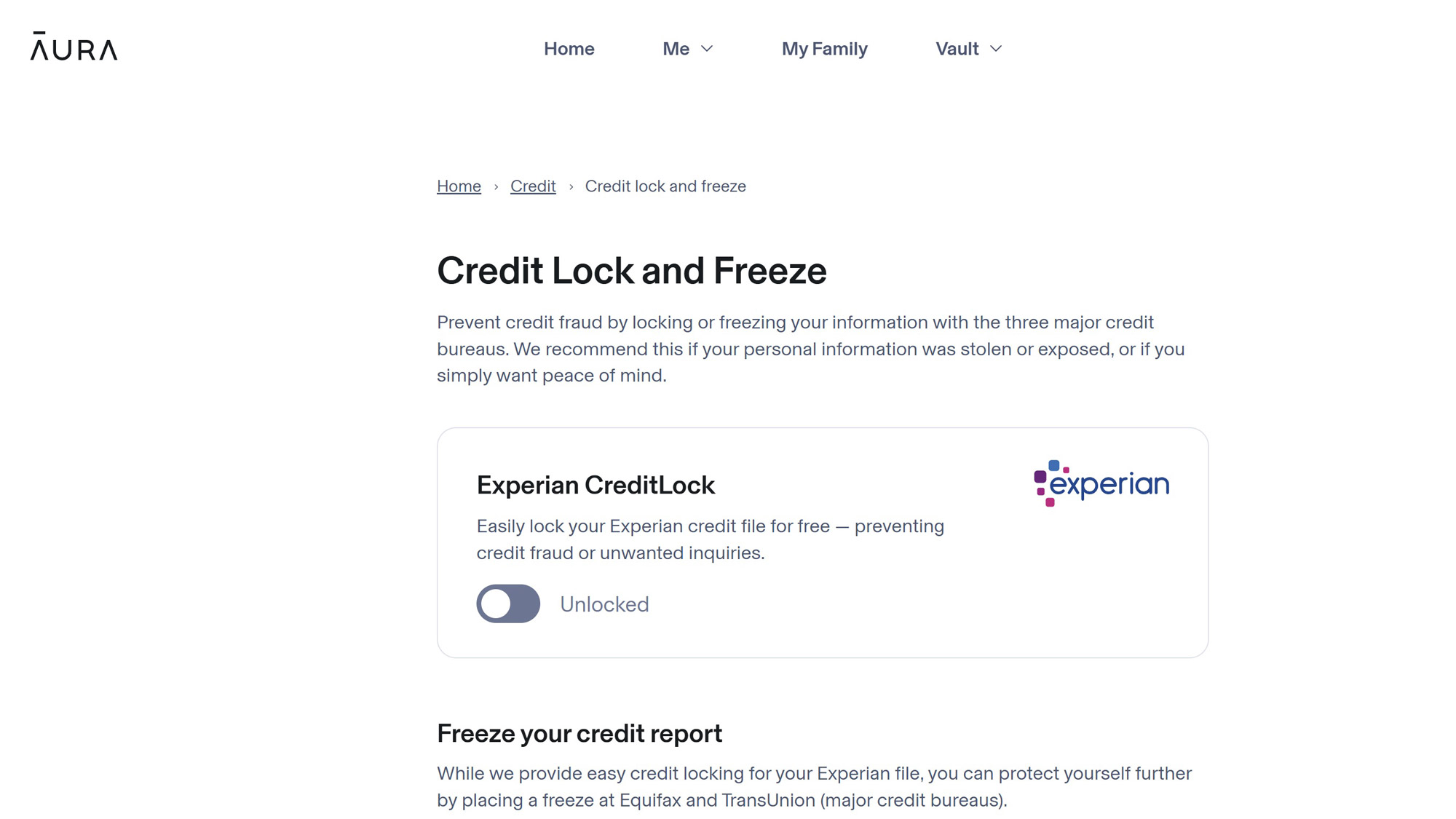

Aura can help with suspected fraud, like a new credit card that you don’t recognize. The service’s Experian credit lock can freeze any new transactions. It only takes a moment to flip the switch on or off.

Aura review: Insurance and services

| Row 0 - Cell 0 | Individual | Couple | Family |

Identity insurance | $1 million | $2 million | $5 million with child identity theft coverage |

Account Breach Alerts | Yes | Yes | Yes |

SSN & Personal | Yes | Yes | Yes |

Info Dark Web Alerts | Yes | Yes | Yes |

Home & Auto Title Fraud Alerts | Yes | Yes | Yes |

Stolen Identity Alerts | Yes | Yes | Yes |

Identity Verification Monitoring | Yes | Yes | Yes |

U.S. Based Expert Fraud Remediation | Yes | Yes | Yes |

Child SSN Monitoring | - | - | Yes |

Child 3-Bureau Credit Freeze | - | - | Yes (3 bureaus) |

Underwritten by Assurant, the identity insurance that Aura provides includes 24/7 White Glove treatment. In most instances, your case will be handled by one individual who has been trained in resolving identity theft issues. Once started, the case manager can deal with restitution, new identity documents and help with getting your online life back.

The Family plan I signed up for includes up to $5 million of insurance while the Couple and Individual plans include $2 million and $1 million in identity insurance. None include an extra $25,000 of ransomware coverage, however.

There’s no deductible and it covers the gamut of experiences, from outright credit card fraud to someone remotely draining your bank account. It can pay for experts like lawyers, investigators and accountants to make you digitally whole. Aura will even send you up to $2,000 a week if you miss work and up to $1,000 in travel expenses. Finally, Aura’s lost wallet coverage is a must-have for those who travel a lot (or are just forgetful).

Aura review: Notifications and alerts

The alerts available with the Aura plans are comprehensive and customizable. They can be set to be emailed or sent by SMS text messaging. There’s the expected monitoring of Social Security number, driver’s license and passport as well as alerts for duplicate credit card transactions and bank transactions over your preset threshold. Aura’s unusual transaction monitoring flags new payment attempts that are out of the ordinary and explains why they were tagged.

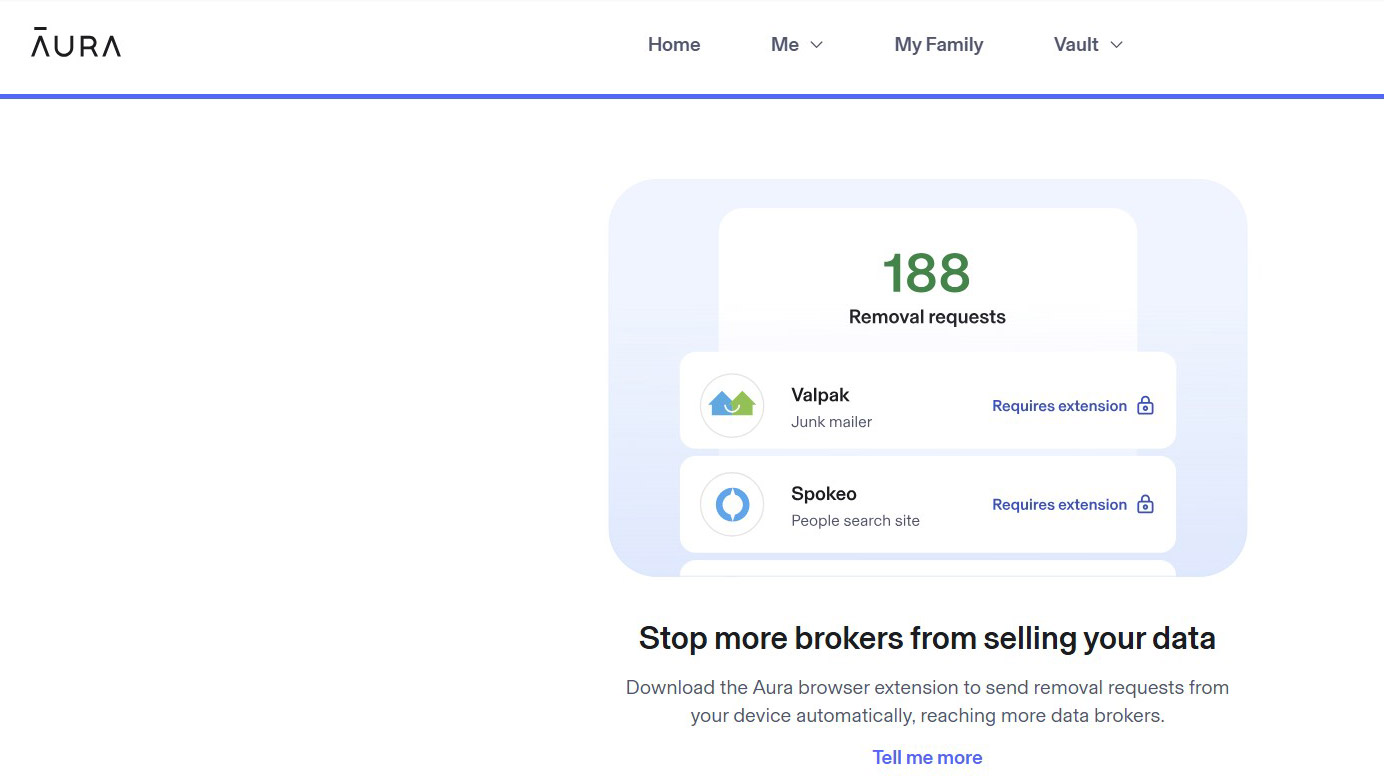

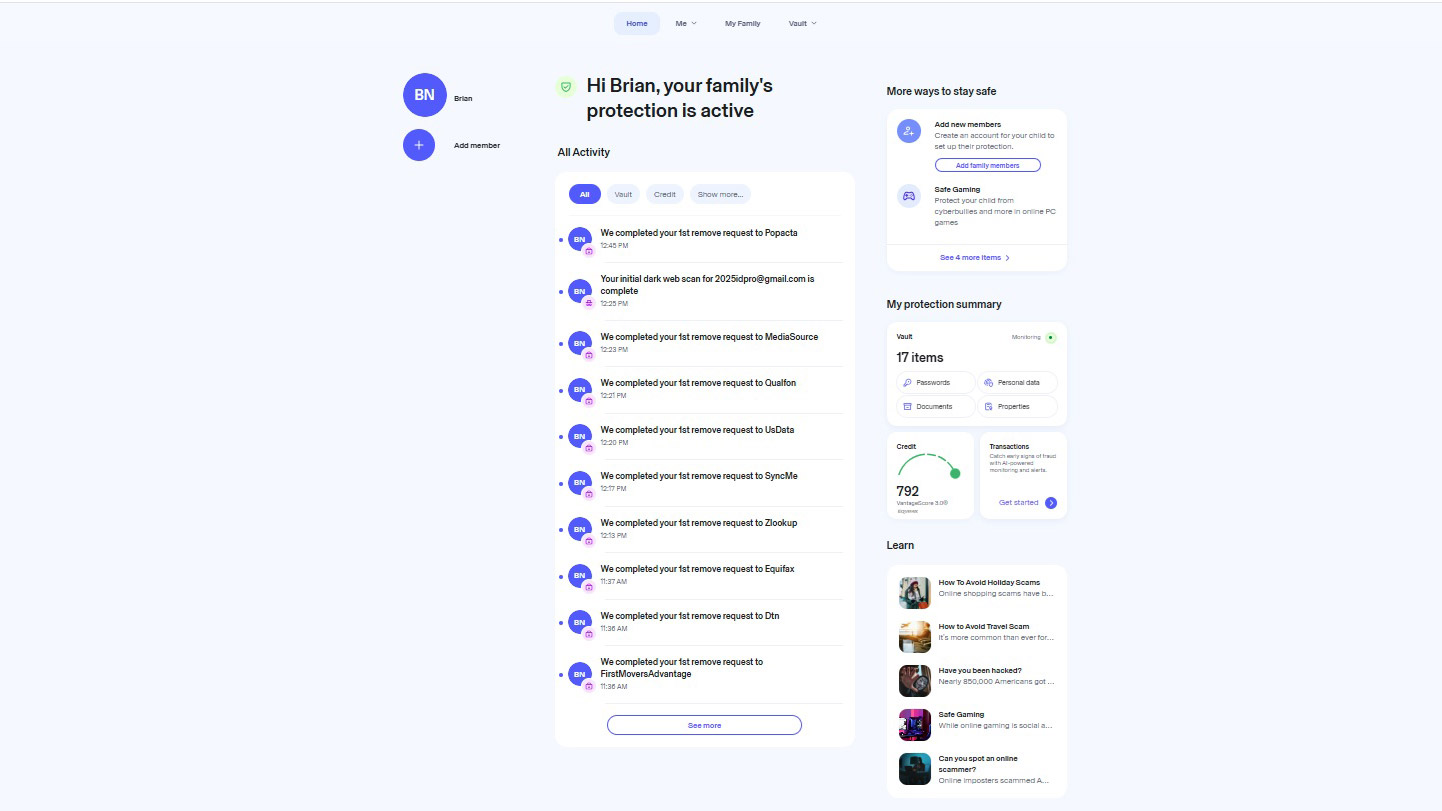

In addition to a home title change alert, if someone sets up an address change to divert your mail, it will be relayed to you. Over my three months with Aura, it sent me over 75 alerts, most of which were for the service finding and eradicating my personal information on data broker servers. By far, this was the most notifications of the six identity protection services I looked at.

Aura review: Interface and extras

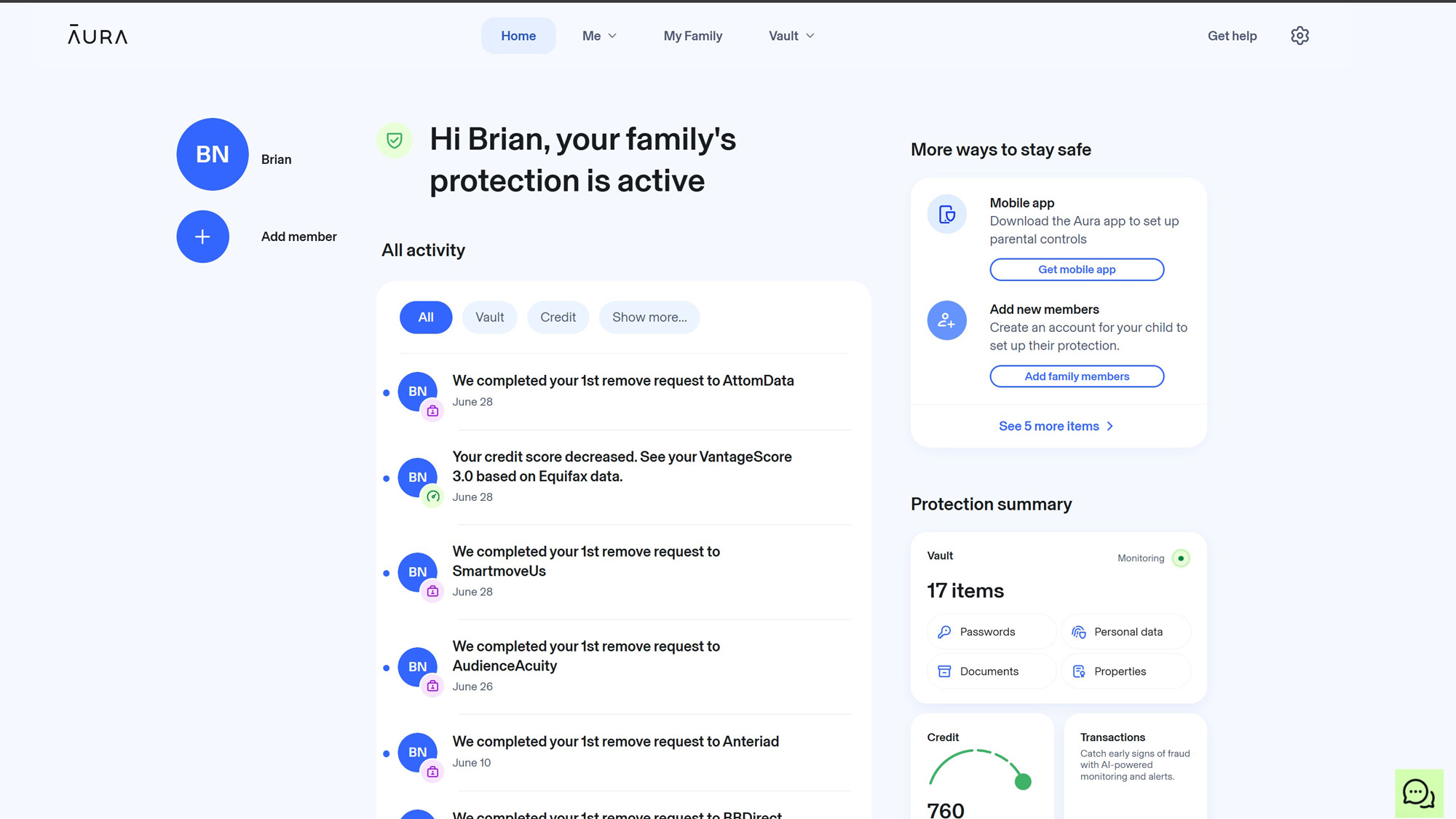

With the choice of online access and via a phone or tablet, Aura provides freedom of choice for interacting with the service. Its web-based interface is bright, open and tinged with light blue. It not only shows covered family members but welcomes you by first name. Like the web interface, the home page of Aura’s mobile apps are essentially long narrow strips of data and links, so get ready for a bit of scrolling.

I was able to get connected and see my data in an average of 3.5 seconds using a browser. The app was slightly faster at 3.4 seconds. This was the fastest of the six services I looked at.

The Home page shows a list of recent activity, including removing identity data from brokers and any credit changes. On the right is a protection summary, the current credit score and a link to recent transactions. Below are articles, although some might appear to be out of date.

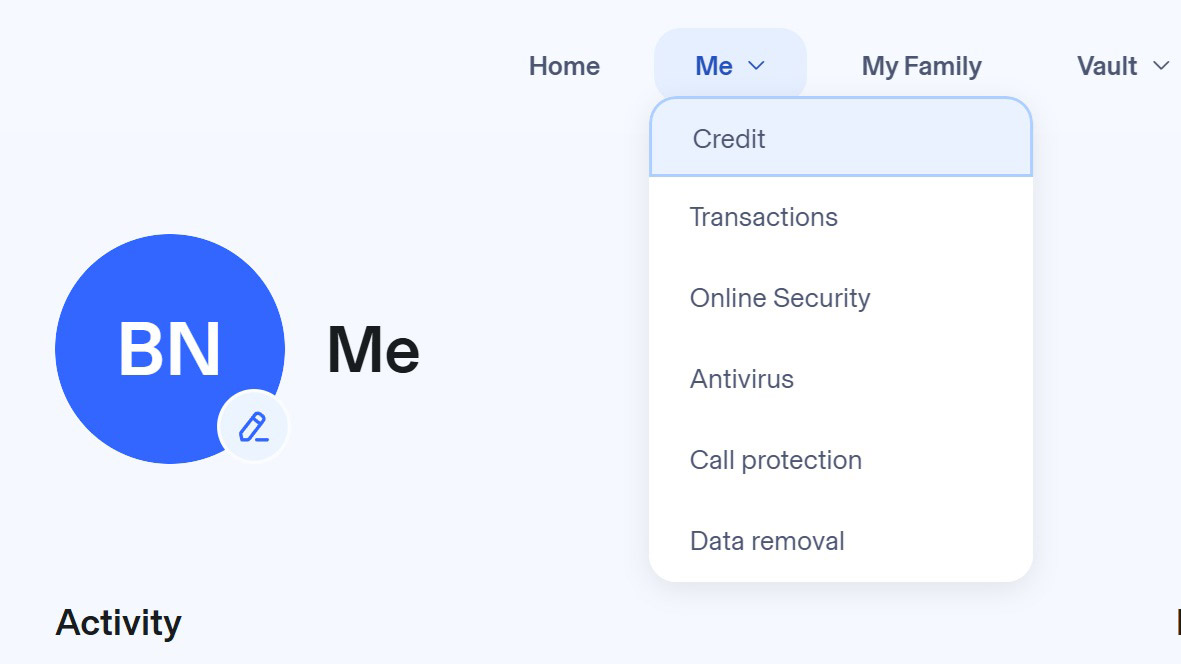

The Me page is for individuals within the family group and provides more in-depth information. The My Family area shows who’s covered and a place to add more.

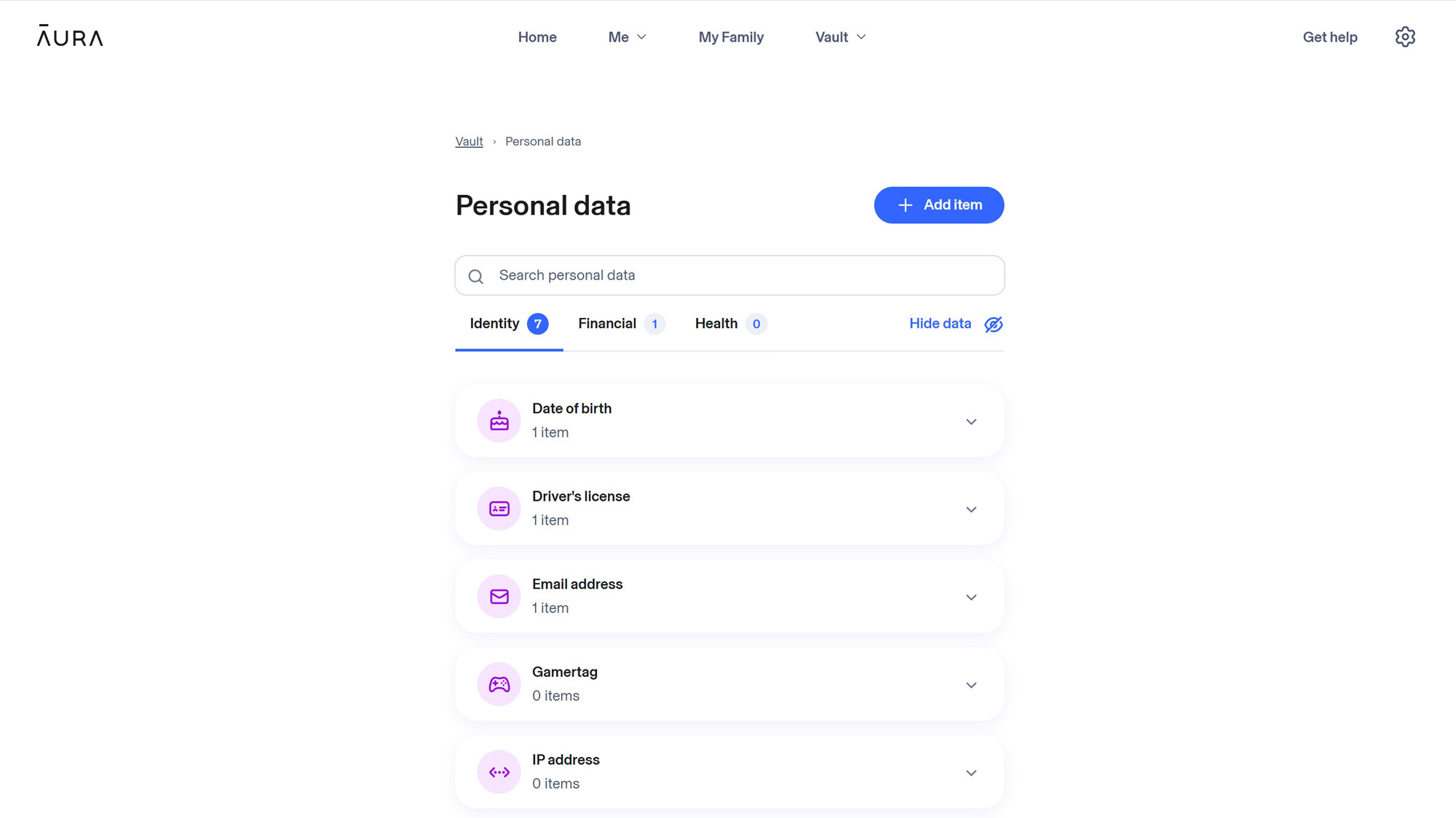

It all comes together in the Vault, an area protected by AES 256 encryption for critical or embarrassing documents. There’re places to go into depth for the password manager, stored documents and properties, although it listed both my homes twice, making me feel like a property baron. I was able to see the progress of Aura removing my data from brokers as the service removed several dozen instances of my personal data.

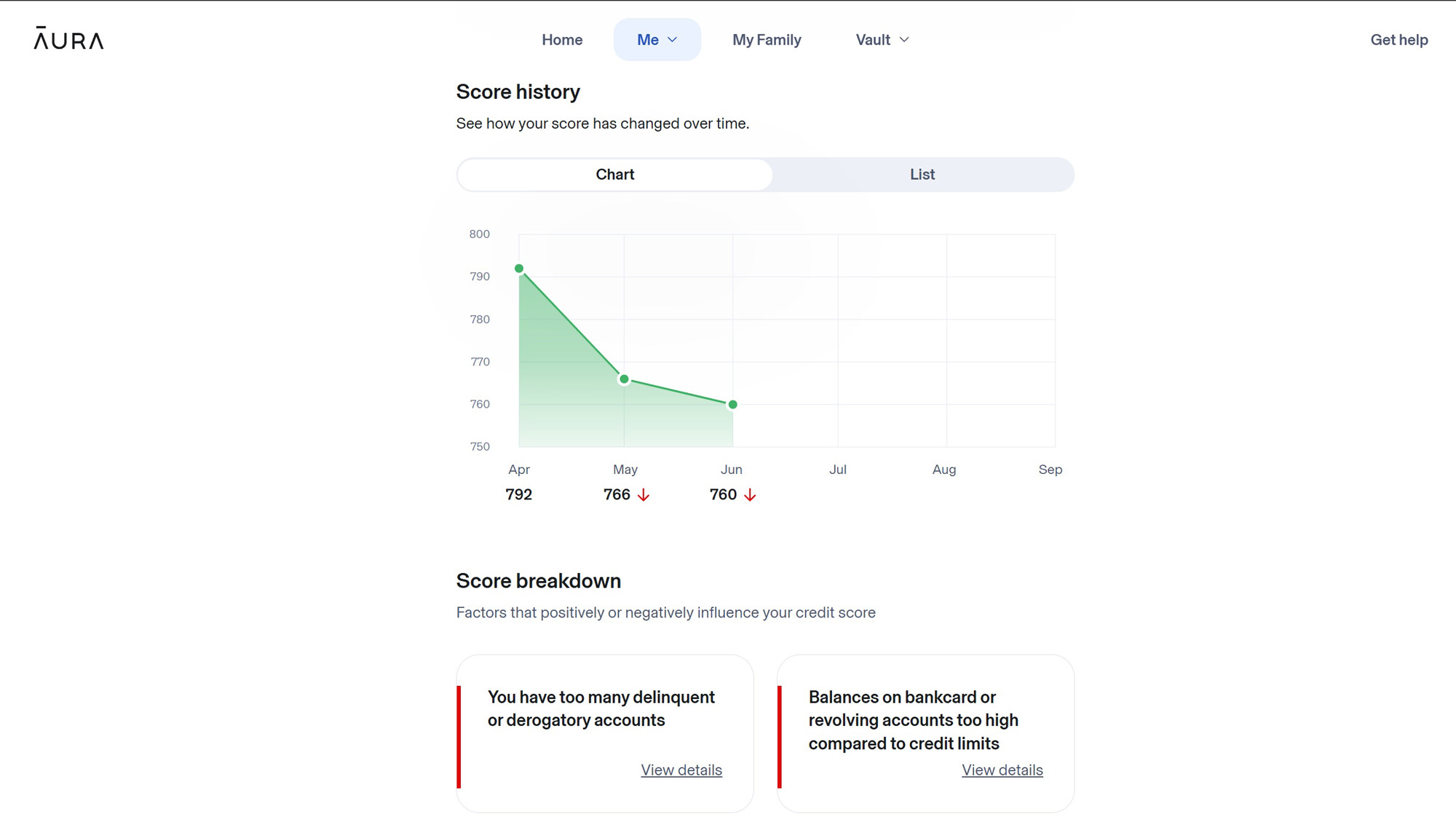

For many, the prominent VantageScore 3.0 section will be either the high- or low- point. Click to see it with an interpretation of the numeric score as well as a fever chart of its recent movements.

Below are suggestions for raising the score, but the service lacks a credit simulator to see if paying off your credit card debt would help your credit score.

In addition to helping extricate your personal data from online brokers and a dedicated tax fraud watch, Aura’s dark web monitoring can be like a beacon lighting up the night. It looks for your personal identifiers and alerts you if your Social Security number, any financial accounts, credit cards or health information shows up.

Aura review: Antivirus, VPN, and password manager

Individual | Couple | Family | |

People Search Sites & Junk Mail Removal | ✓ | ✓ | ✓ |

Antivirus / Anti-Malware | ✓ | ✓ | ✓ |

VPN with Military-Grade Encryption | ✓ | ✓ | ✓ |

Safe Browsing | ✓ | ✓ | ✓ |

Password Manager | ✓ | ✓ | ✓ |

Parental Controls | - | - | ✓ |

Safe Gaming | - | - | ✓ |

That said, the plan includes several security-minded add-ons that together make Aura for a full security suite. In addition to malware scanning and real-time monitoring, the subscription has Aura’s password manager. Unlike some of the best antivirus software such as Bitdefender and ESET, Aura hasn’t submitted its product for testing by an independent lab, so we can’t comment on its effectiveness.

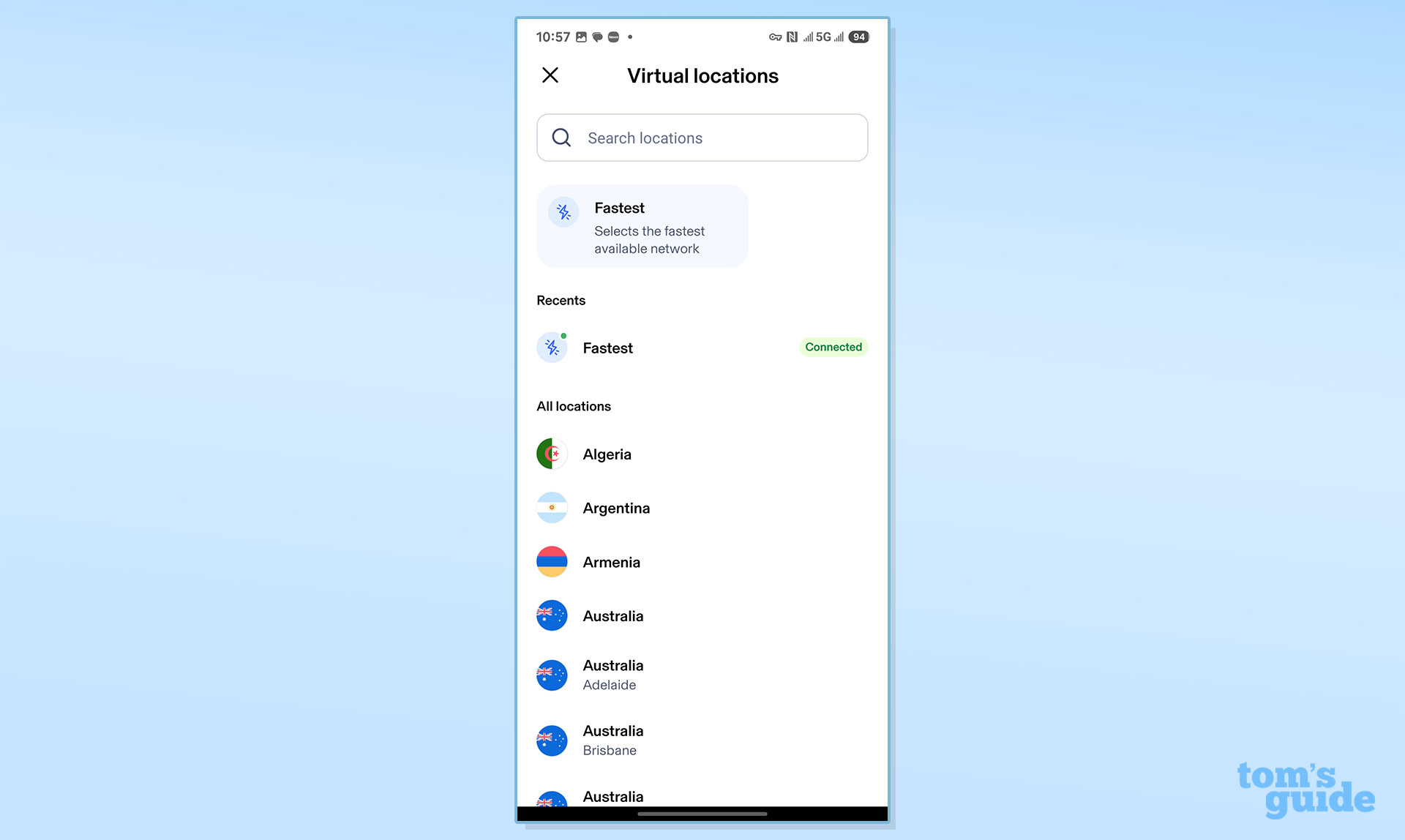

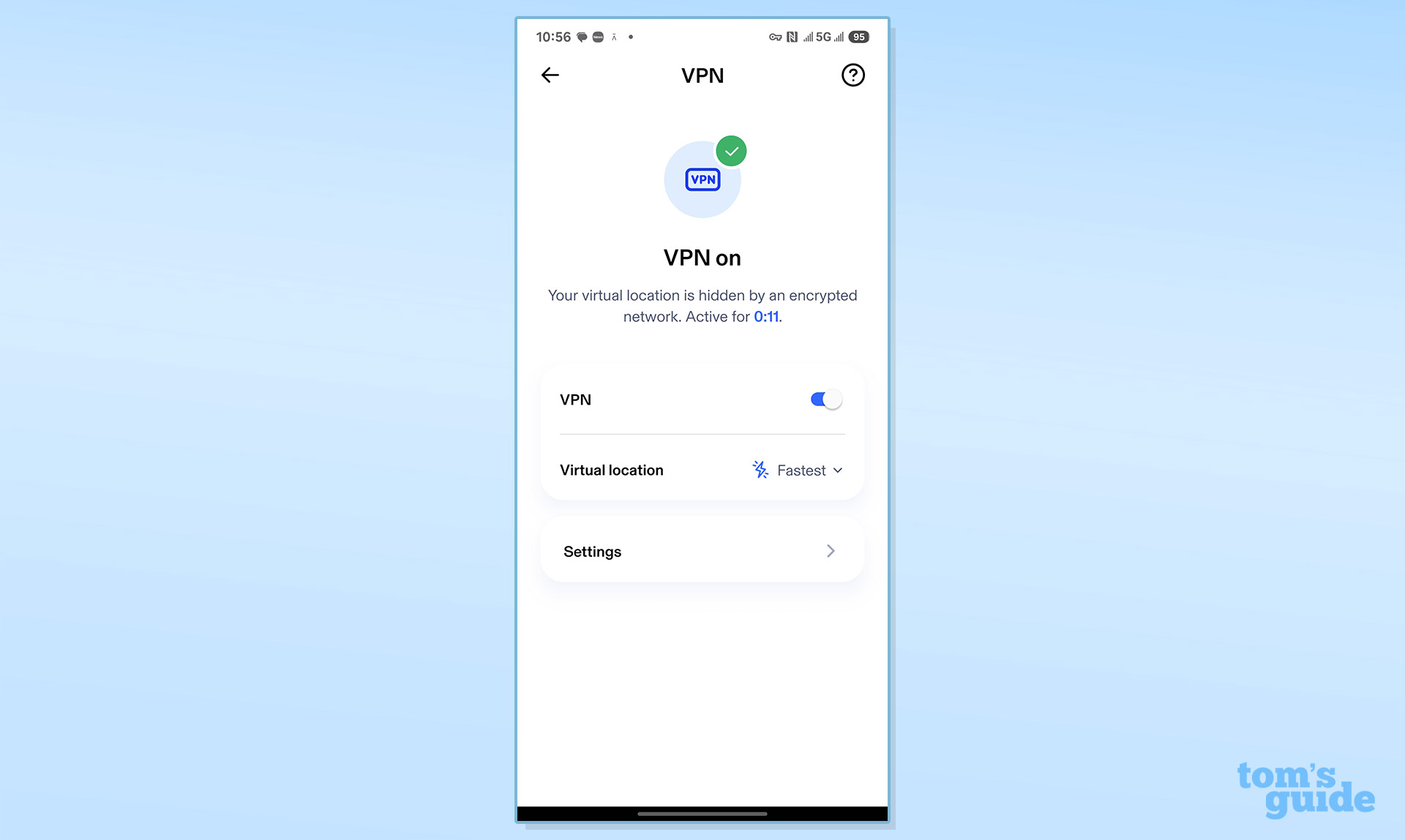

The gem feature here is unlimited VPN access for 10 systems per covered person with Hotspot Shield’s global infrastructure in nearly 90 countries, including two dozen connection points in the US. It has a kill switch and supports split tunneling.

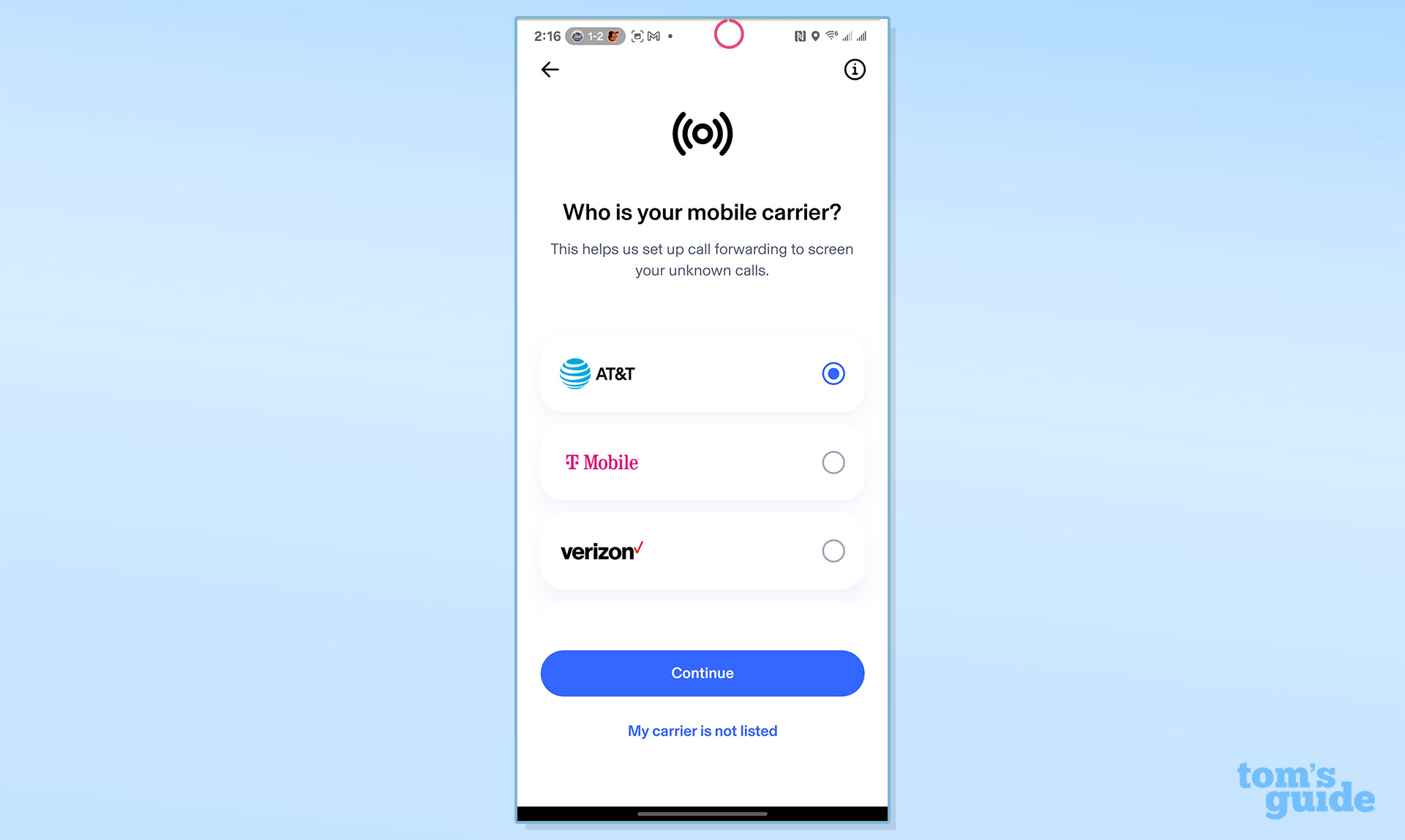

In Aura’s app, the Calls tab let me turn on call protection that attempts to filter out calls from unknown callers, spam, scams and phishing attempts. It worked well in my three month appraisal of Aura.

Aura review: Parental controls

On top of Aura’s parental controls for restricting web sites, limiting screen time and pausing the internet for some family time, the Family plan’s latest addition is its AI-powered digital parenting tools. They seek to model what your child’s online baseline looks like and ferret out subtle changes over time that might be the start of cyberbullying, self-harm, or exposure to harmful content.

The subscription also includes the Safe Gaming app that keeps an eye on the back and forth gaming comments that might indicate inappropriate behavior or the start of cyberbullying. It only works with Windows computers, though.

Aura review: Verdict

While an excellent value compared to other identity protection schemes, Aura succeeds with a family oriented plan that has the expected parental controls but adds cyberbullying alerts and the ability to watch your children’s activities. The clan is covered with between $1 million and $5 million in identity insurance and malware protection to VPN access and access to your credit details and scores. Plus, it’s the fastest at getting to your data that I’ve seen.

It lacks any credit simulators, but the service is a bargain for all it does to safeguard a family’s identity and peace of mind. It’s for those who don’t want to sacrifice childhood security, or a full feature set, to save money.

Brian Nadel is a freelance writer and editor who specializes in technology reporting and reviewing. He works out of the suburban New York City area and has covered topics from nuclear power plants and Wi-Fi routers to cars and tablets. The former editor-in-chief of Mobile Computing and Communications, Nadel is the recipient of the TransPacific Writing Award.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.