Tom's Guide Verdict

Why get second-hand credit and identity protection when you can go to the source with TransUnion’s IdentityForce security products. Mid-priced and effective, the UltraSecure+Credit plan falls short of complete protection by lacking traditional malware protection and a full VPN.

Pros

- +

Mid-priced plans

- +

Excellent credit simulator

- +

TransUnion credit-freeze button

- +

Lots of detailed defenses and information

Cons

- -

No malware protection

- -

VPN for mobile app only

Why you can trust Tom's Guide

Monthly cost: $35

Yearly cost: $350

Family plan: $40/month

No. of bureau scores: 3

No. of bureaus monitored: 3

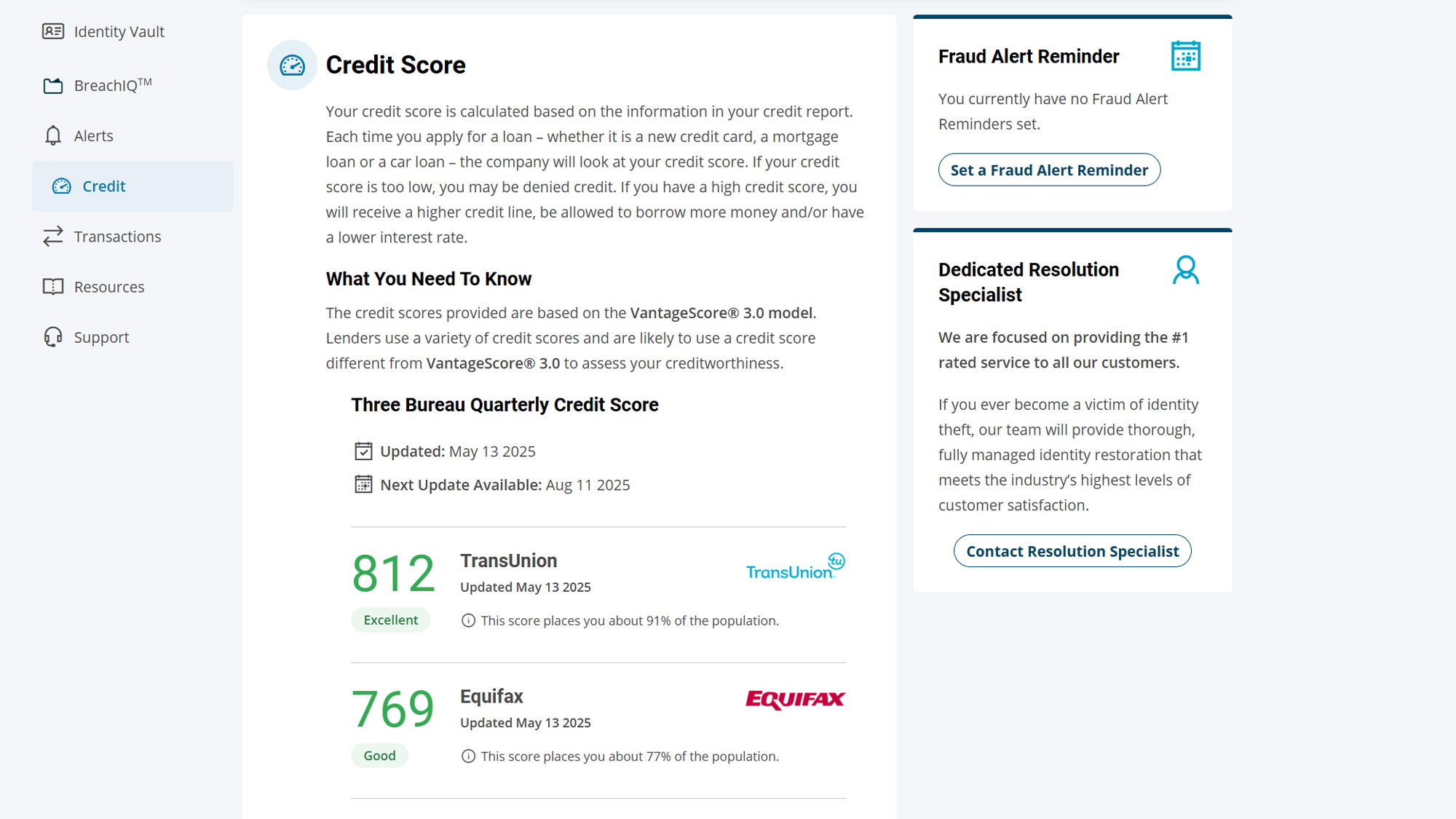

Frequency of credit reports: TransUnion: daily; Equifax and Experian: quarterly

Type of credit score: VantageScore 3.0

Credit-improvement simulator: Yes

Credit-lock/freeze button: Yes

Security software: VPN, browser extensions

Investment account monitoring: Yes

Max. ID-theft coverage: $2 million

Data Breach Alerts: No

Medical Records/Payday loan monitoring: No/Yes

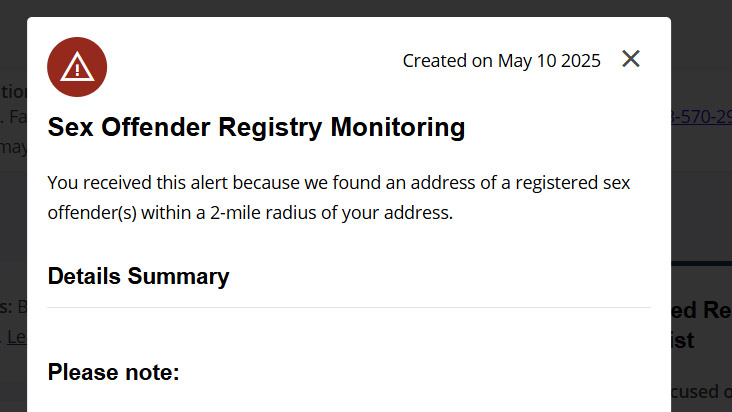

Sex Offender/cyberbullying Alert: Yes/Yes

Title Change Alert: No

Two Factor Authentication (2FA): Yes

Extras: Deep credit simulator

With a focus on identity protection that none of the other best identity theft protection services can match, TransUnion’s IdentityForce offers a good mix of credit scores and advice with identity insurance. Bitdefender and McAfee even use the service for their own products. IdentityForce plans are reasonably priced and inclusive while the included credit simulator is among the best ways to try out scenarios for improving scores.

The IdentityForce plans, however, have fallen behind the pack when it comes to comprehensive protection. They not only lack the malware defenses offered by competitors but the service’s VPN only works with the mobile app. Still, IdentityForce UltraSecure+Credit offers an array of identity defenses and insurance for a mid-priced subscription.

IdentityForce UltraSecure+Credit: Costs and what’s covered

| Row 0 - Cell 0 | UltraSecure | Family | UltraSecure + Credit |

Pricing | $99.90 annual, $9.90 per month (first year) | $159 annual, $15.90 per month | $19.99 per month (annual), $34.99 per month (monthly) |

Users | 1 adult | 2 adults, unlimited children | 1 adults |

IdentityForce is part of TransUnion, one of the Big Three credit monitoring agencies, so if you get one of their plans, you are going right to the source for credit data, monitoring and financial protection. There’s a 30-day trial for the two mid-priced plans, starting with the UltraSecure subscription that includes everything from fraud and dark web monitoring to mobile app VPN access. It includes up to $1 million in identity insurance and restoration specialists on standby to make you and your online life whole again. UltraSecure has security utilities that augment but don’t replace traditional malware software, so for complete coverage you’ll need to also get a security suite.

Getting individual UltraSecure coverage costs $9.90 a month or $99.90 for the first year. After that it costs $9 more. The Family plan, which covers two adults and an unlimited number of children up to 26 years old, costs $15.90 a month or $159 a year, a first year savings of $15. It also has TransUnion’s ChildWatch to keep an eye on your offspring’s social media accounts, and Social Security data while monitoring bank account activity.

IdentityForce’s UltraSecure+Credit is a big step up at $19.90 a month or $199 a year for an individual or $23.90/$239 for a family. UltraSecure+Credit takes identity protection up a rung with credit scores and reports from the top three bureaus. There’s an instant daily TransUnion report of updates to your credit status as well as quarterly reports from Equifax and Experian. The insurance level is doubled to $2 million and the plan includes phishing and botnet protection but nothing for traditional malware detection.

Either way, the pricing is in the middle between the dirt-cheap Bitdefender plans and the expensive ones from LifeLock. Oddly for companies that have been in this business for years, neither TransUnion nor IdentityForce have a Better Business Bureau rating.

IdentityForce UltraSecure+Credit review: How we tested

During the late spring, I signed up for IdentityForce UltraSecure+ Credit and entered my information. After that, I checked in on nearly a daily basis to obsess over my credit score, breach alerts and other identity indicators. After three months, I canceled the service.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

IdentityForce UltraSecure+Credit: Setup and support

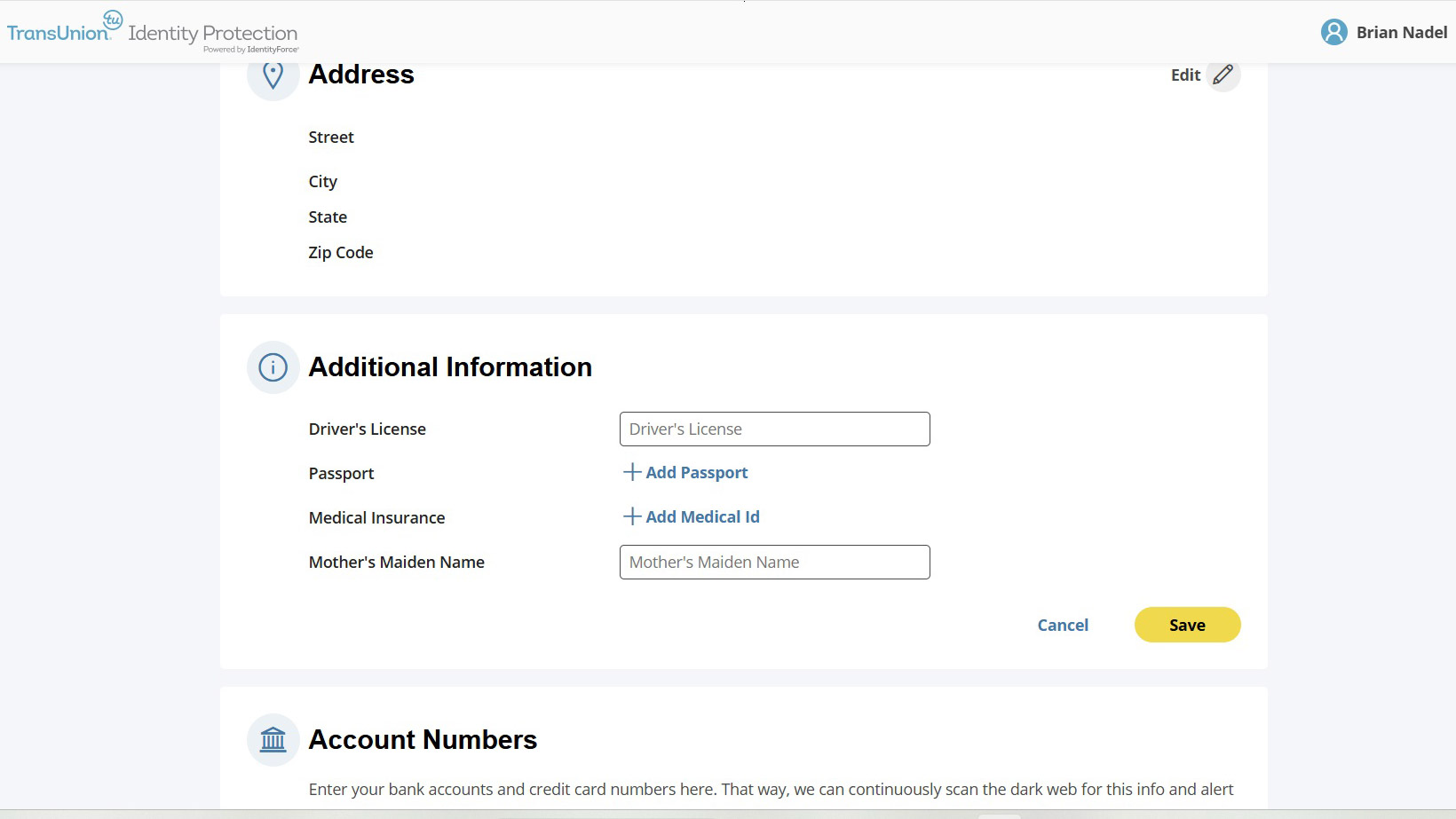

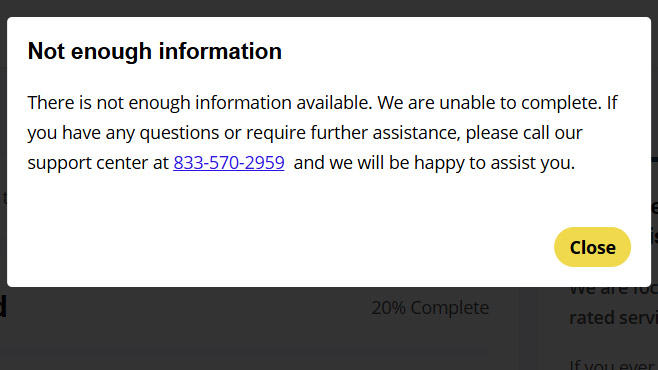

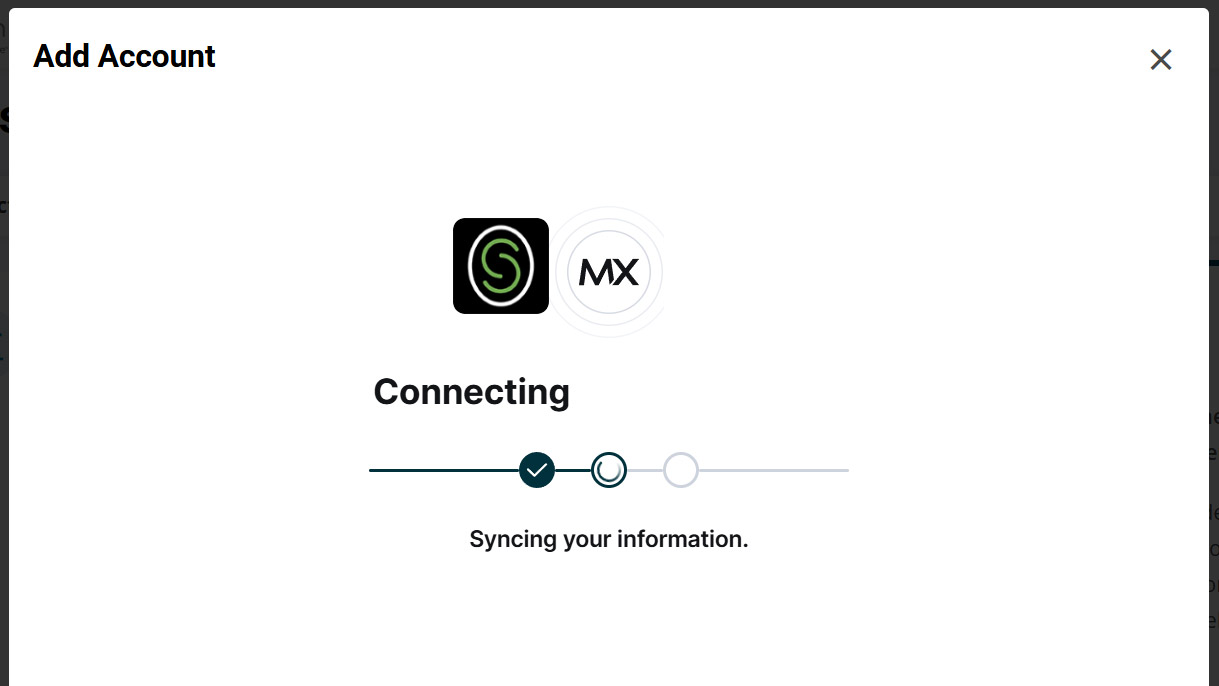

To get IdentityForce and TransUnion protecting my identity, I entered my address and a password for the account as well as answers to three challenge questions to revive the account if I forget my password. I set up two-factor authentication with my Samsung Galaxy S25 phone.

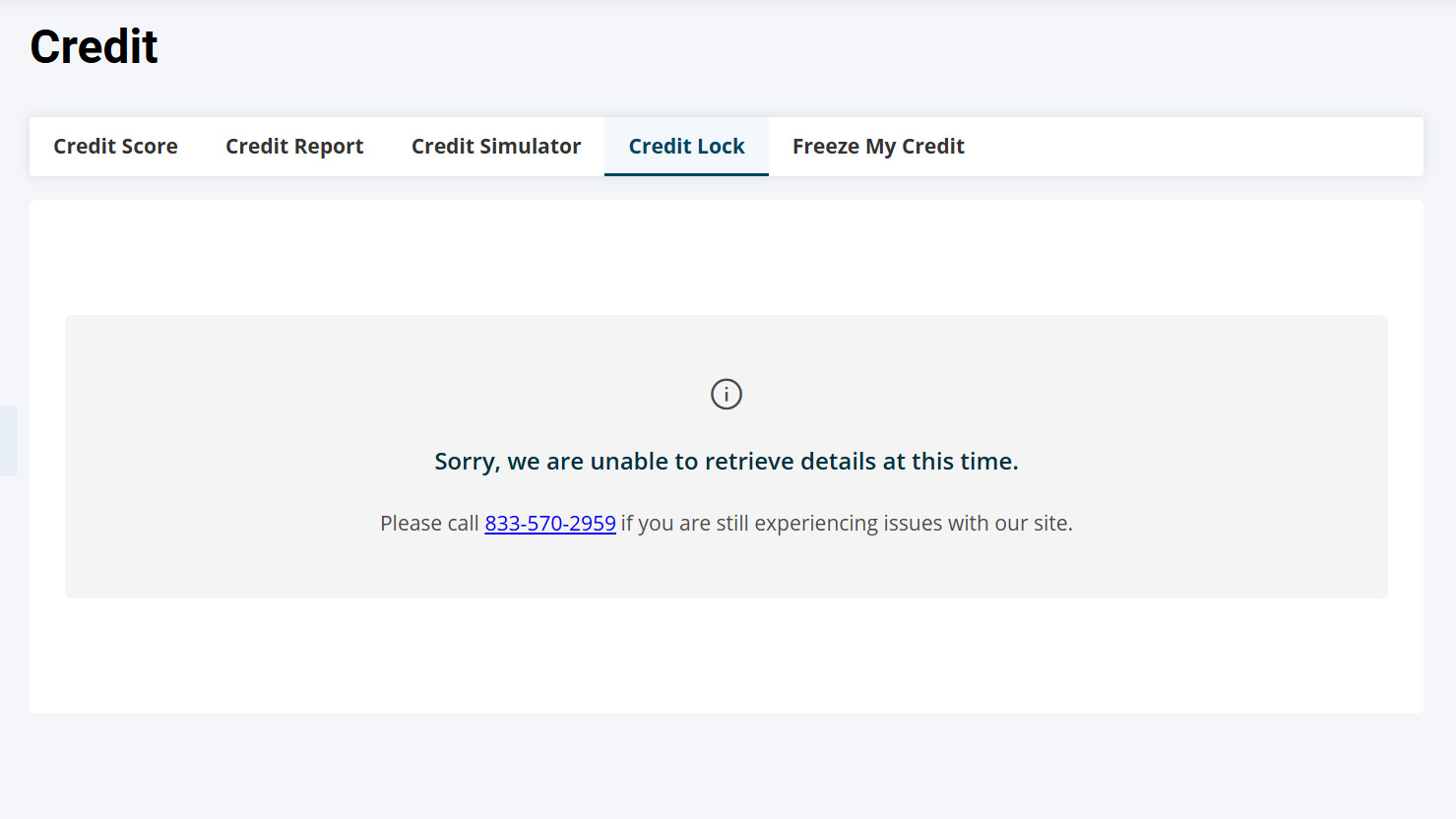

I hit a snag after entering my Social Security number with the interface telling me there wasn’t enough information to finish, and I had to call IdentityForce. In a minute it was fixed, though I did have to hold for a few minutes beforehand, and I was soon looking at the dashboard and my credit scores. Later, my credit reports were unavailable – again, fixed with a quick call.

While it took two days to get fully set up, the actual work only amounted to only about a half an hour. On the other hand, half of it was taken up by installation detours.

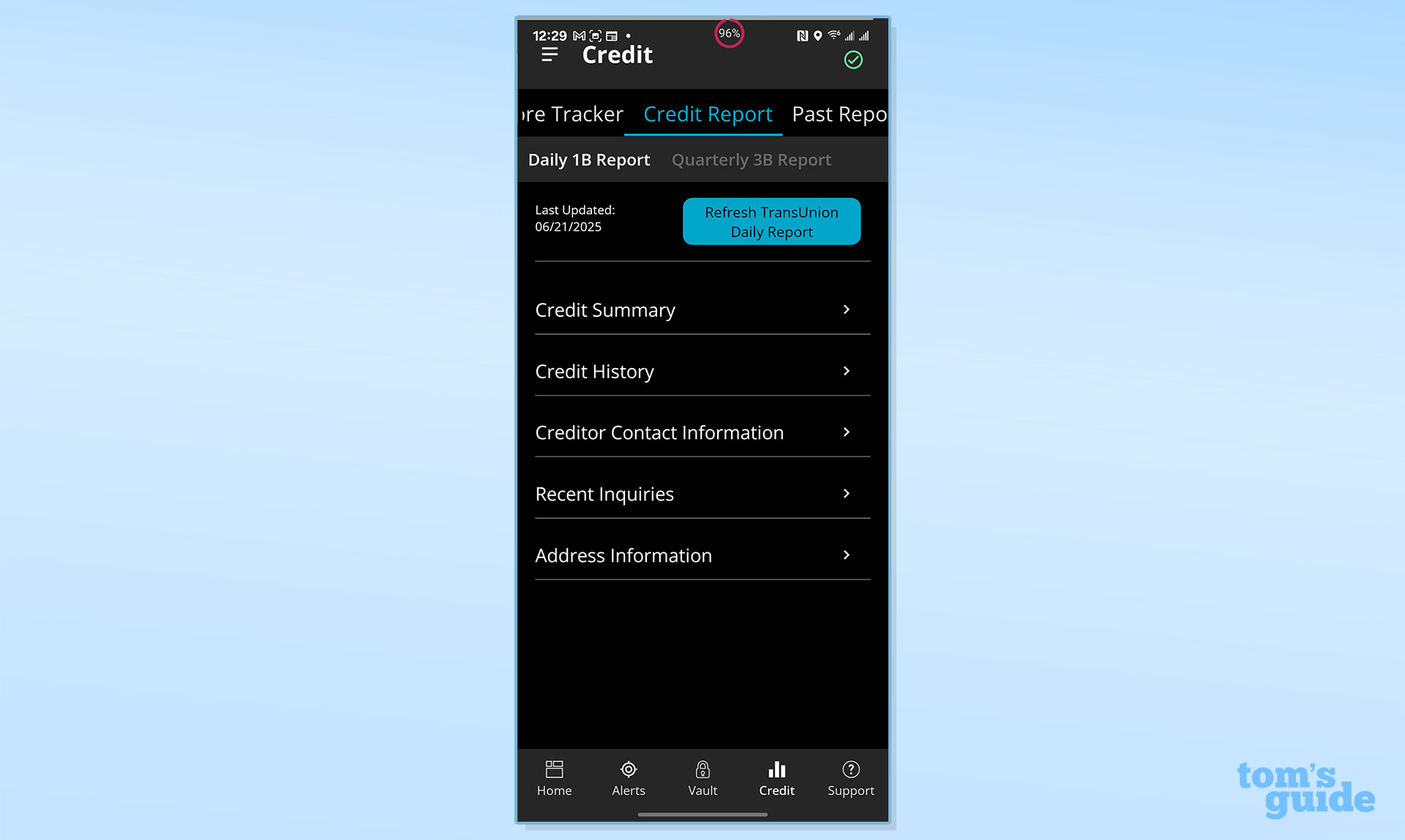

IdentityForce UltraSecure+Credit review: Credit scores, reports and monitoring

| Row 0 - Cell 0 | UltraSecure (Individual) | UltraSecure (Family) | UltraSecure + Credit (Individual) | UltraSecure + Credit (Family) |

Dark web monitoring | Yes | Yes | Yes | Yes |

Smart SSN Tracker | Yes | Yes | Yes | Yes |

Bank and credit card alerts | Yes | Yes | Yes | Yes |

Identity restoration | Yes | Yes | Yes | Yes |

Identity insurance | $1 million | $1 million | $2 million | $2 million |

Credit monitoring | No | No | Yes (3 bureaus) | Yes (3 bureaus) |

Credit reports | No | No | Yes (3 bureaus) | Yes (3 bureaus) |

Credit score tracker | No | No | Yes | Yes |

Credit score simulator | No | No | Yes | Yes |

With the power, data and monitoring of TransUnion behind it, IdentityForce’s credit and identity products are among the best and deepest in the business. The same goes for Bitdefender Ultimate Security and McAfee+ Ultimate, which use a different mix of IdentityForce features that are delivered as a service provider for their products’ identity defenses.

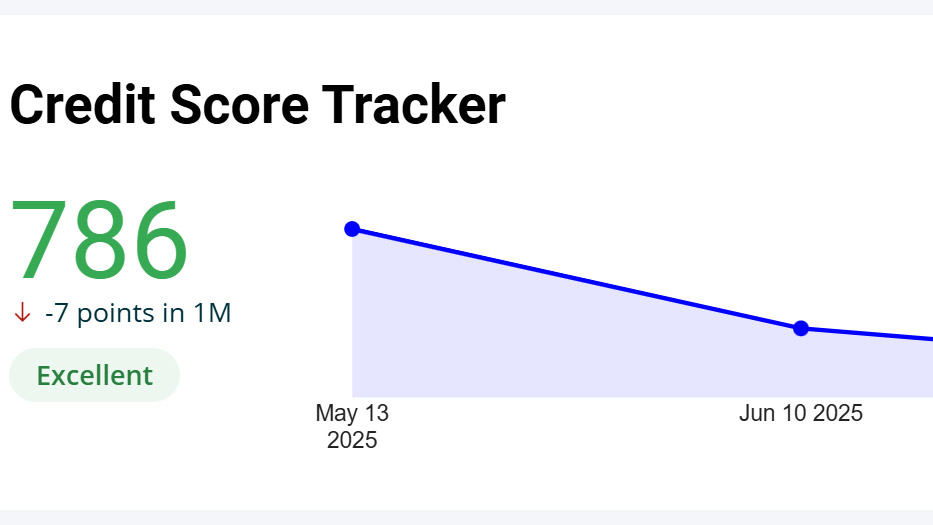

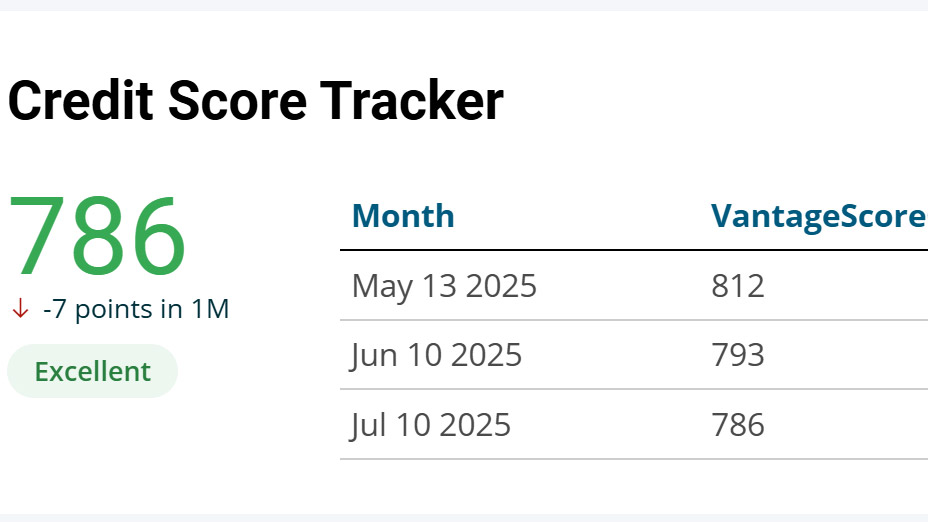

In addition to the expected instant scores for the Vantage 3.0 credit worthiness score that mimic the more popular FICO scores, the UltraSecure+Credit’s Credit Score Tracker is a fever chart of changes over the year.

There’s also a TransUnion Credit Lock button to stop any transactions. The interface has links to stop credit for the Equifax and Experian credit bureaus as well.

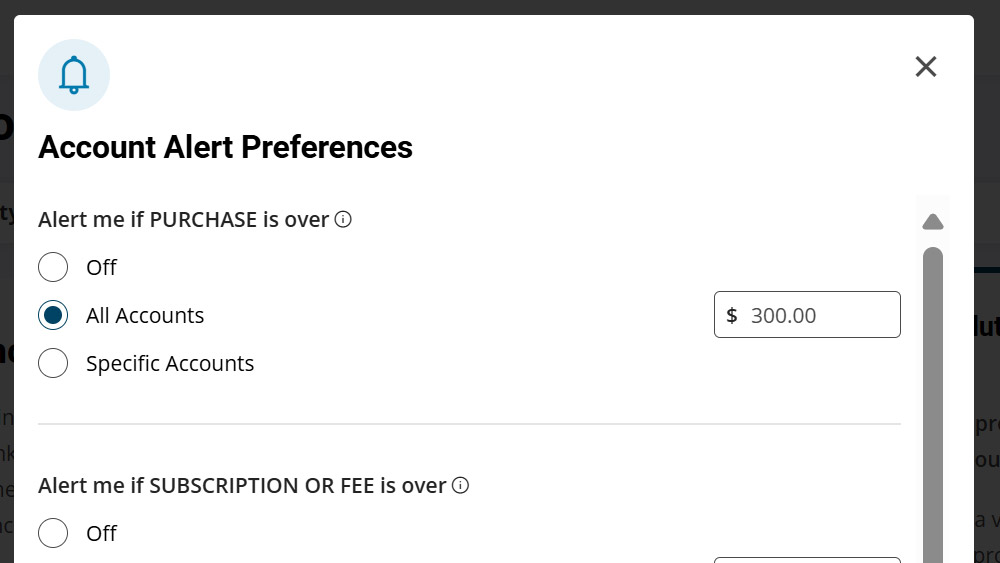

The UltraSecure+Credit plan has transaction alerts for spending that rises above a preset threshold and the service examines healthcare payments and payday loan companies for any indications of fraud or abuse. On the downside, neither plan includes home title change monitoring, an increasingly popular crime these days. IdentityForce will let you know if someone has sent in a change of address form, which can be an initial step in someone trying to steal your home.

IdentityForce UltraSecure+Credit: Insurance and services

IdentityForce includes between $1 and $2 million of identity-theft insurance, depending on the plan. It is underwritten by Lloyd’s and the coverage does not have any deductibles. The service starts with a variety of help from experts like lawyers, accountants and investigators to get to the bottom of your identity theft and start to rebuild your life.

In addition to covering lost funds from theft or fraud, the policy includes reimbursement for things like getting a new driver’s license, passport and other documents. It can compensate you for lost workdays, travel and childcare if you need to go to hearings and meetings. IdentityForce has a crew of trained and certified agents ready to handle your identity crisis. They are available 24/7.

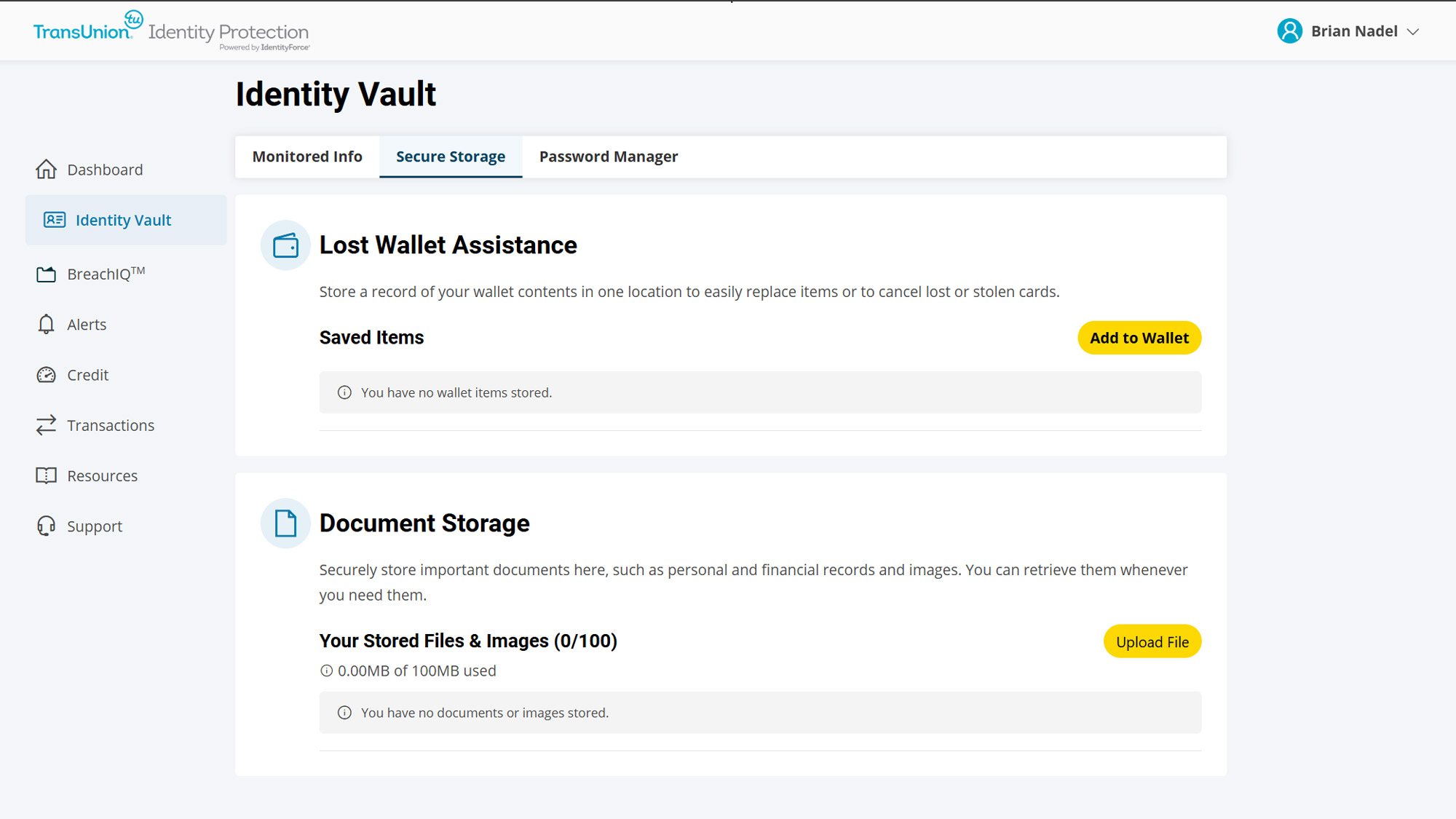

Plus, if your wallet is lost or stolen, IdentityForce has your back. It can quickly cancel your credit cards but not advance your money to get home if you’re traveling.

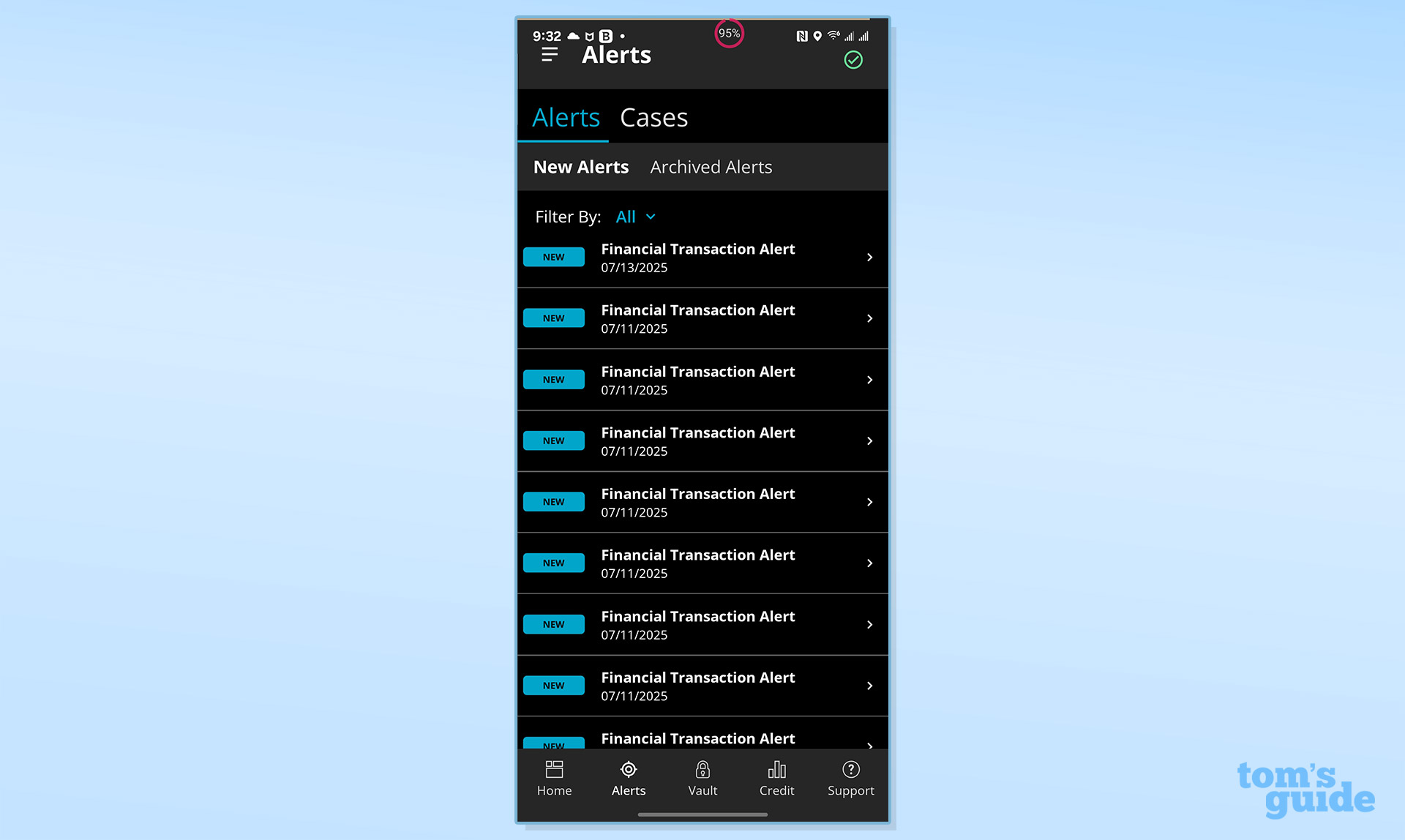

IdentityForce UltraSecure+Credit: Notifications and alerts

IdentityForce didn’t skimp on alerts and notifications about your personal data. The range includes everything from your Social Security number or email address to your name showing up on court records.

The alerts can be sent via email or text messaging. The web and mobile app interfaces also have places to check to see if there are alerts pending with additional details.

The service monitors your credit cards and bank accounts but unlike other services it does so at the online account level and requires filling in your online account credentials. It can alert when a transaction exceeds your preset threshold.

The notification works for someone trying to take out a payday loan in your name but lacks the depth to watch for fraud using your medical records. If someone on the state’s sex offender database moves into your area, an alert pops up.

Over the spring and summer, IdentityForce alerted me 64 times. The majority of them were for results from its ongoing dark web scanning.

IdentityForce UltraSecure+Credit: Interface and extras

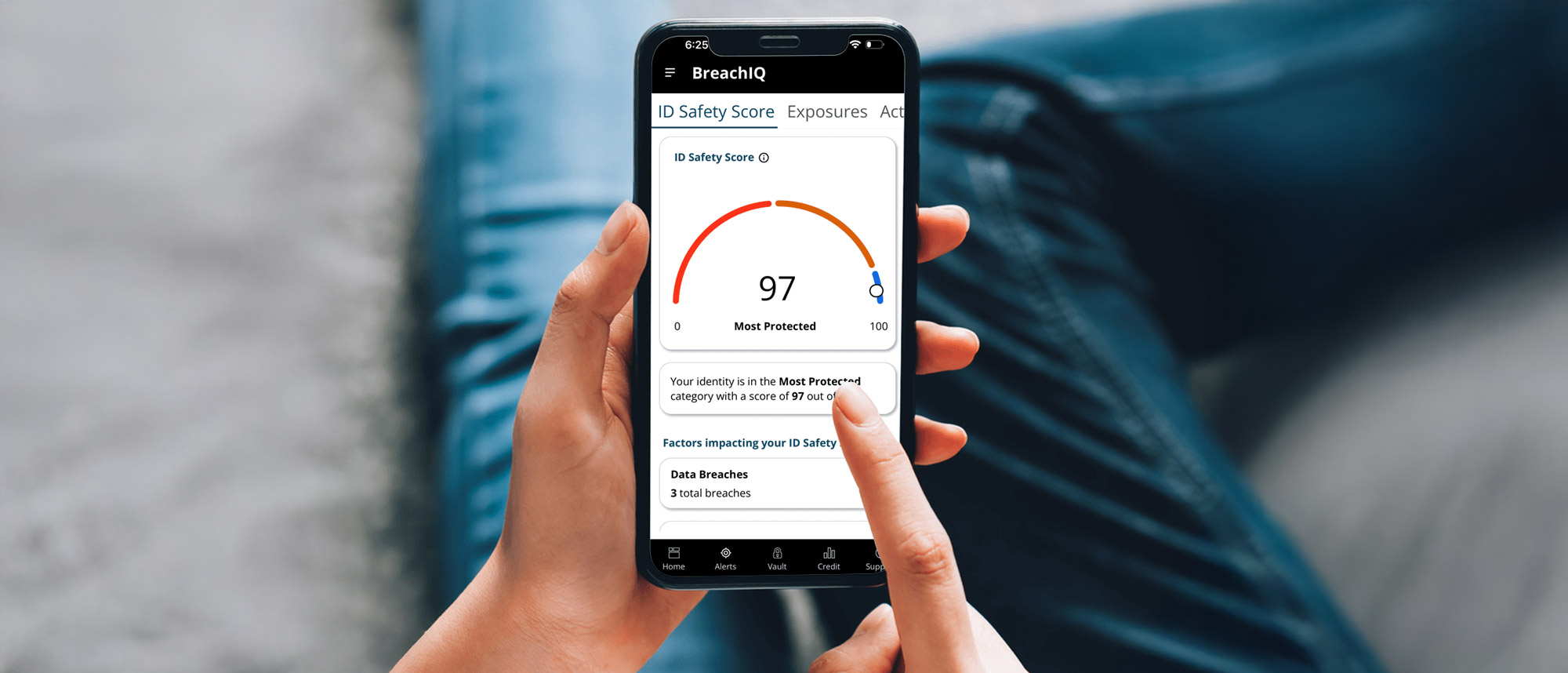

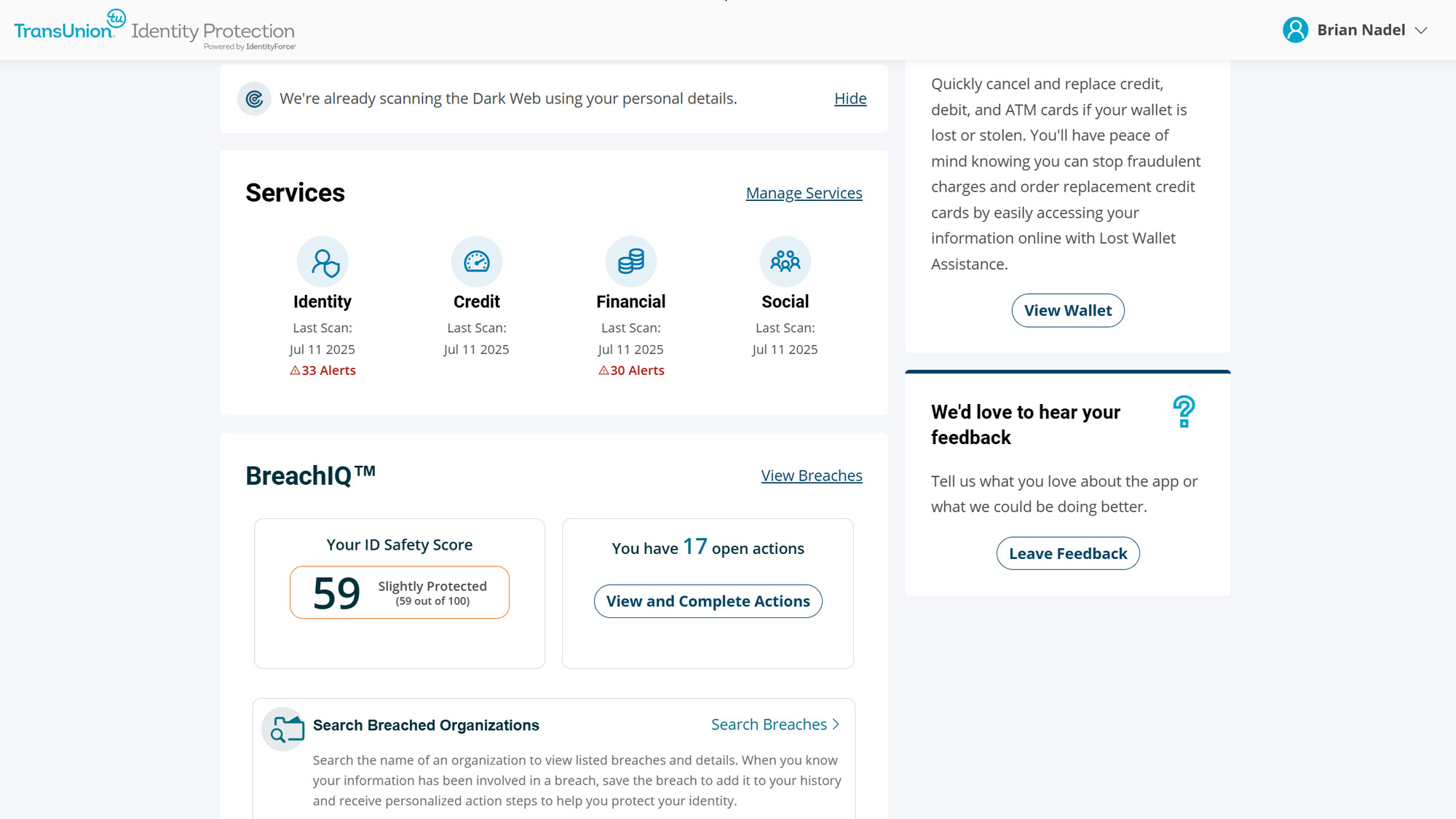

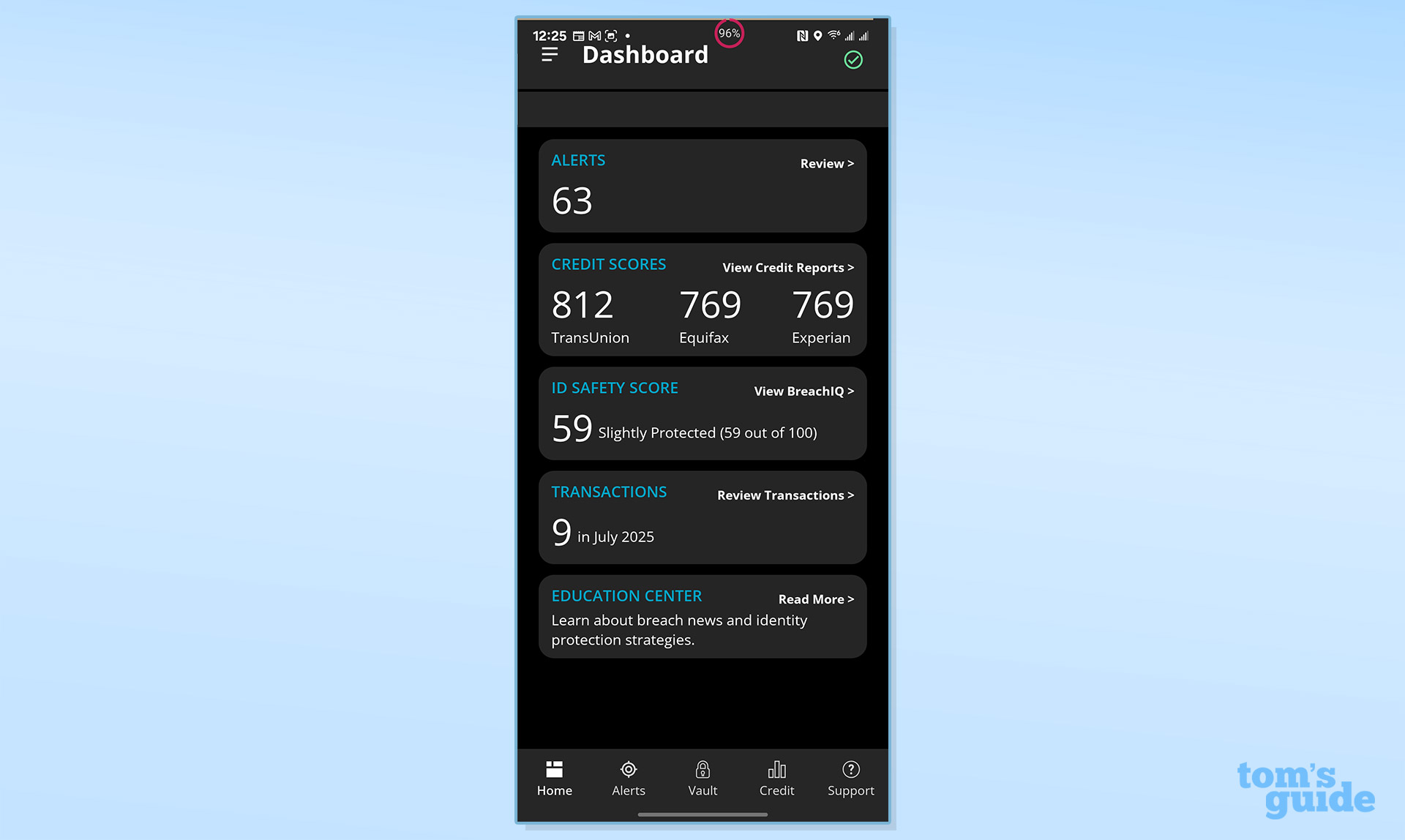

IdentityForce’s dashboard squeezes a lot of data into a small place, by hiding tabs when they’re not needed. Just tap the three line hamburger logo and they pop out on the left with for major sections: Identity Vault, Breach IQ, Alerts, Credit and Transactions. There are also sections for Resources and Support.

The dashboard holds key information including recent breaches and lots of details about your digital life and IdentityForce’s protection. For instance, the credit scores are all there as well as the tracker with the choice of a fever graph or a chart of numbers. There are also links for Credit, Transactions, Resources and Support.

IdentityForce’s app has a Home screen that’s all business with a stack of key data arranged in horizontal rectangles. Each opens up at a tap with more data, like a credit summary and history beneath the credit scores. The data starts with open alerts and extends to the three credit scores and Safety rating. Recent transactions are at the bottom.

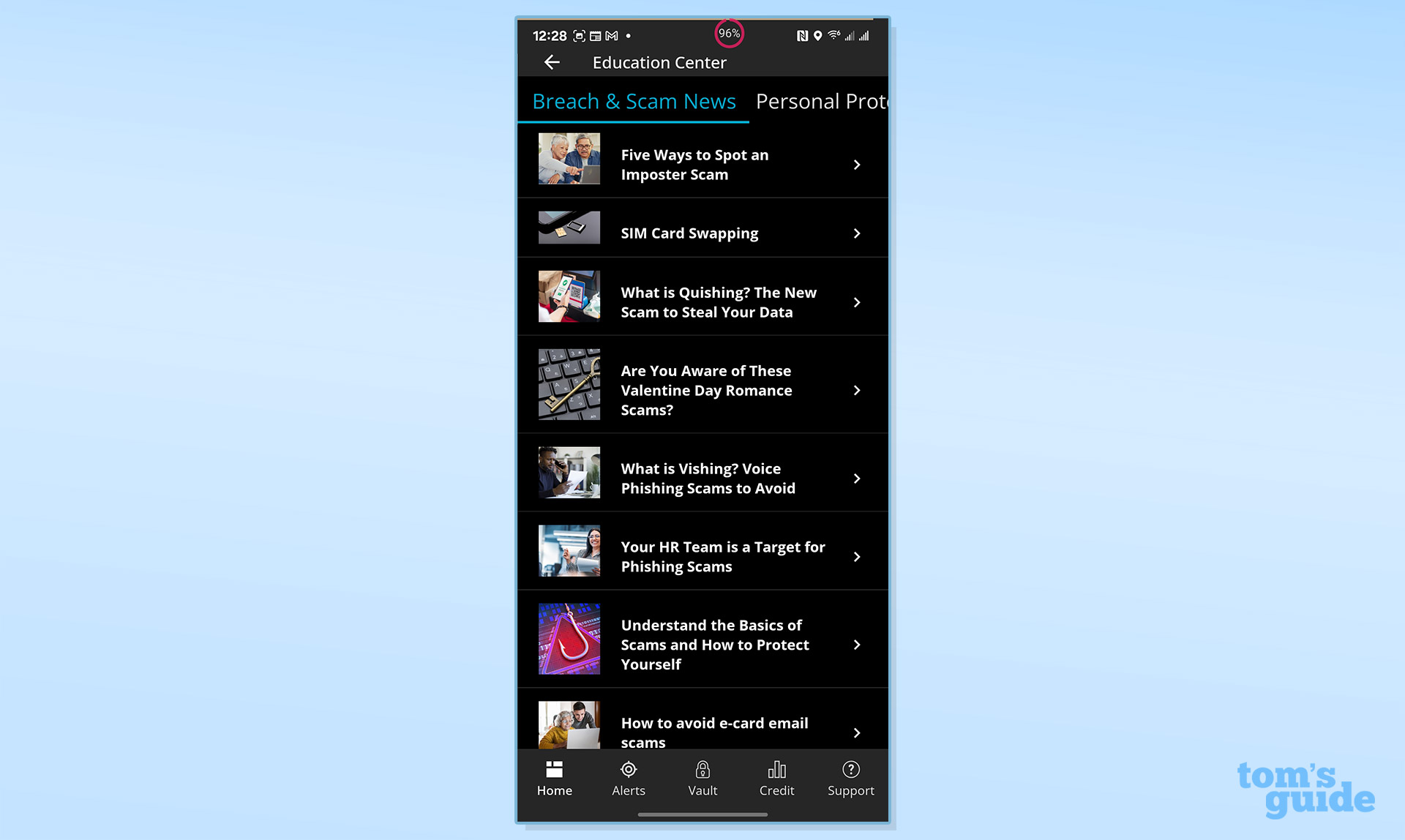

At the bottom is the app’s Education Center with evergreen articles and advice. Ironically, while others cram as much data onto the app’s screens, IdentityForce’s app has an open area at the bottom.

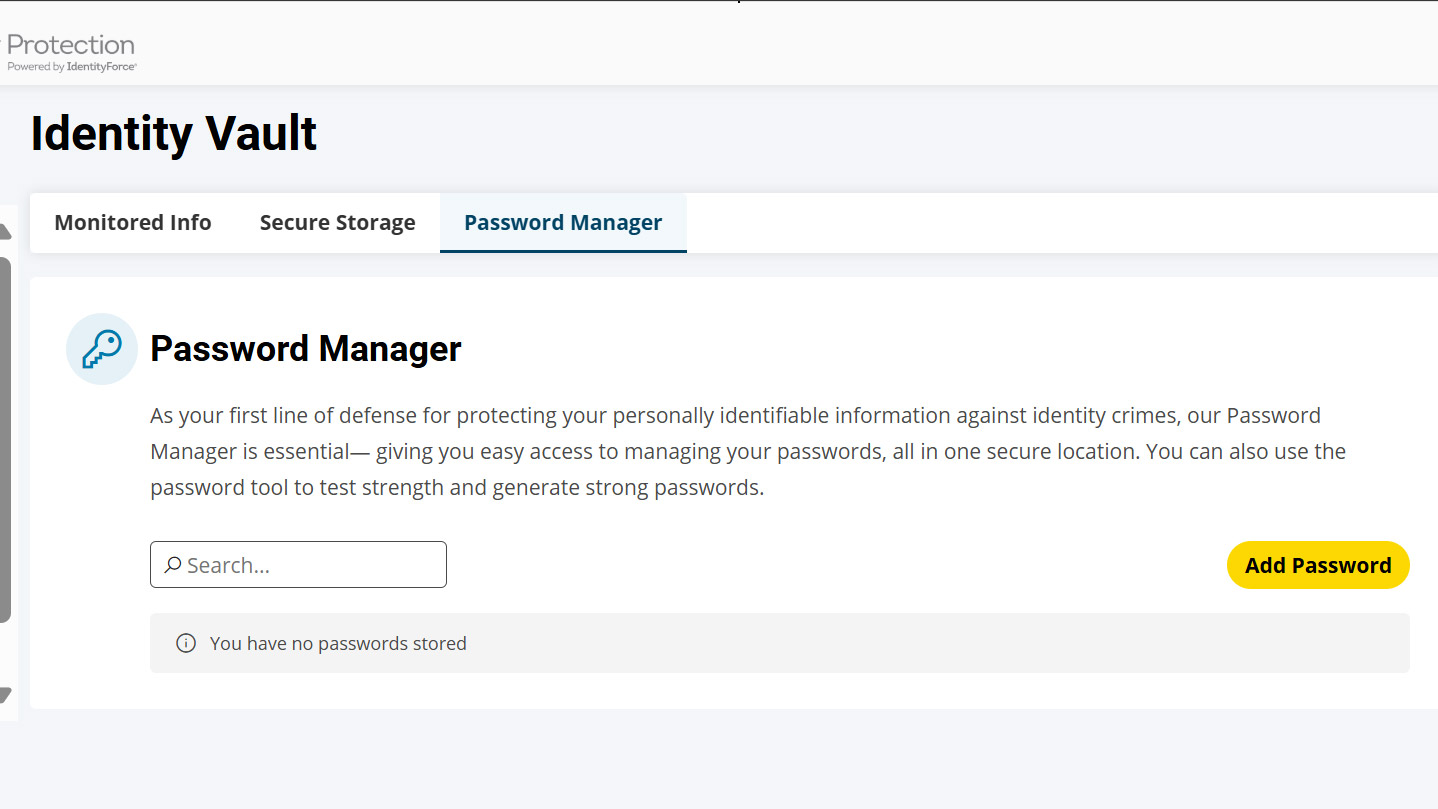

Meanwhile, the Alerts show what TransUnion came up with when scanning for your personal information and the Vault shows what it’s monitoring for. There’re top line tabs for the password manager, help with a lost or stolen wallet and a place to securely stash documents and images.

IdentityForce UltraSecure+Credit review: Features

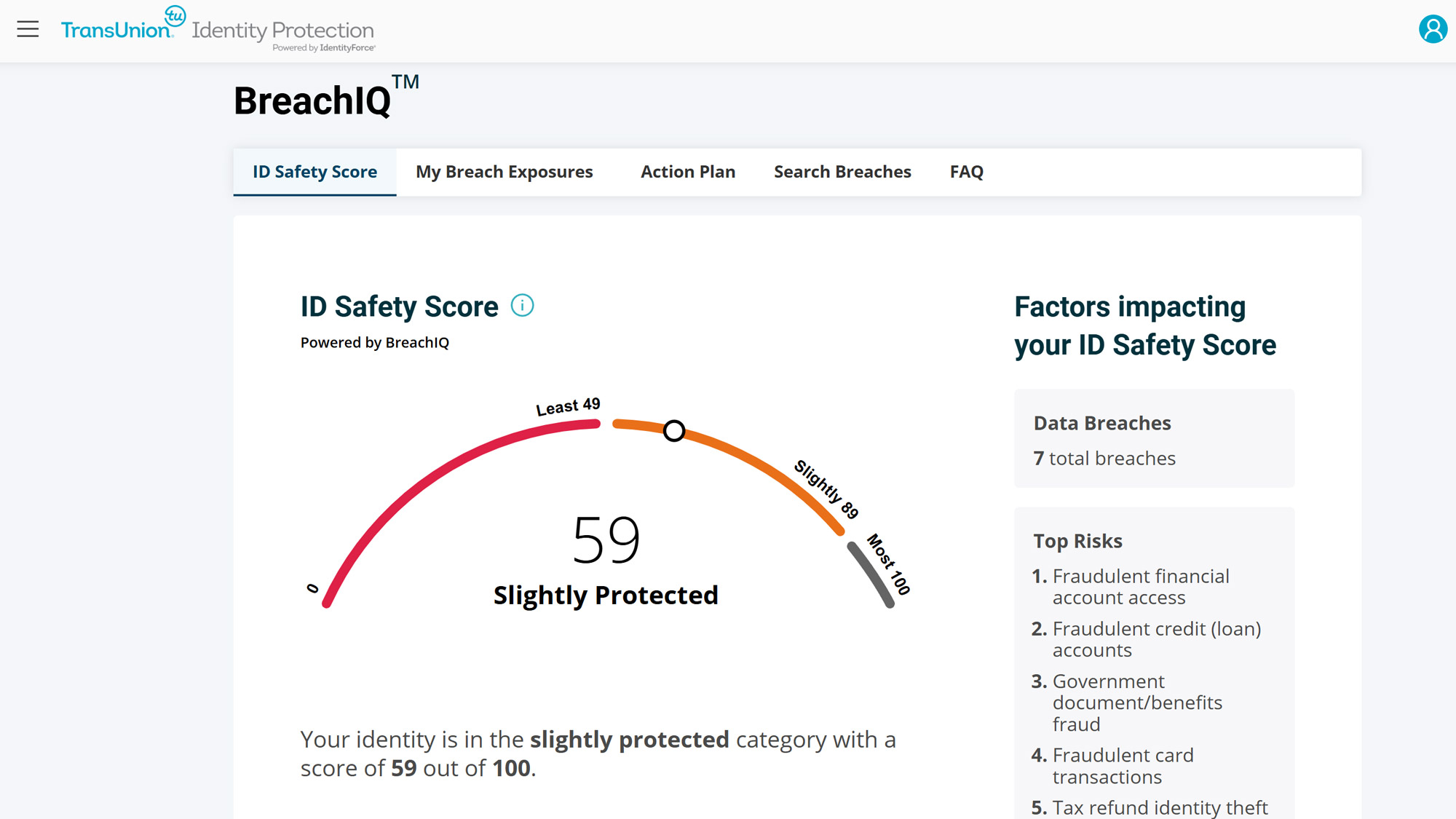

Of the features I used extensively, two stood out including the BreachIQ service where you can find out about vulnerabilities with a Safety Score. I scored a miserable 59 and might need to go to online safety summer school. It also shows when a company you’ve been associated with has had a data leak you should be concerned about or if your personal data has leaked. More importantly, the IdentityForce subscription can show what to do about it but doesn’t automatically plug the leaks.

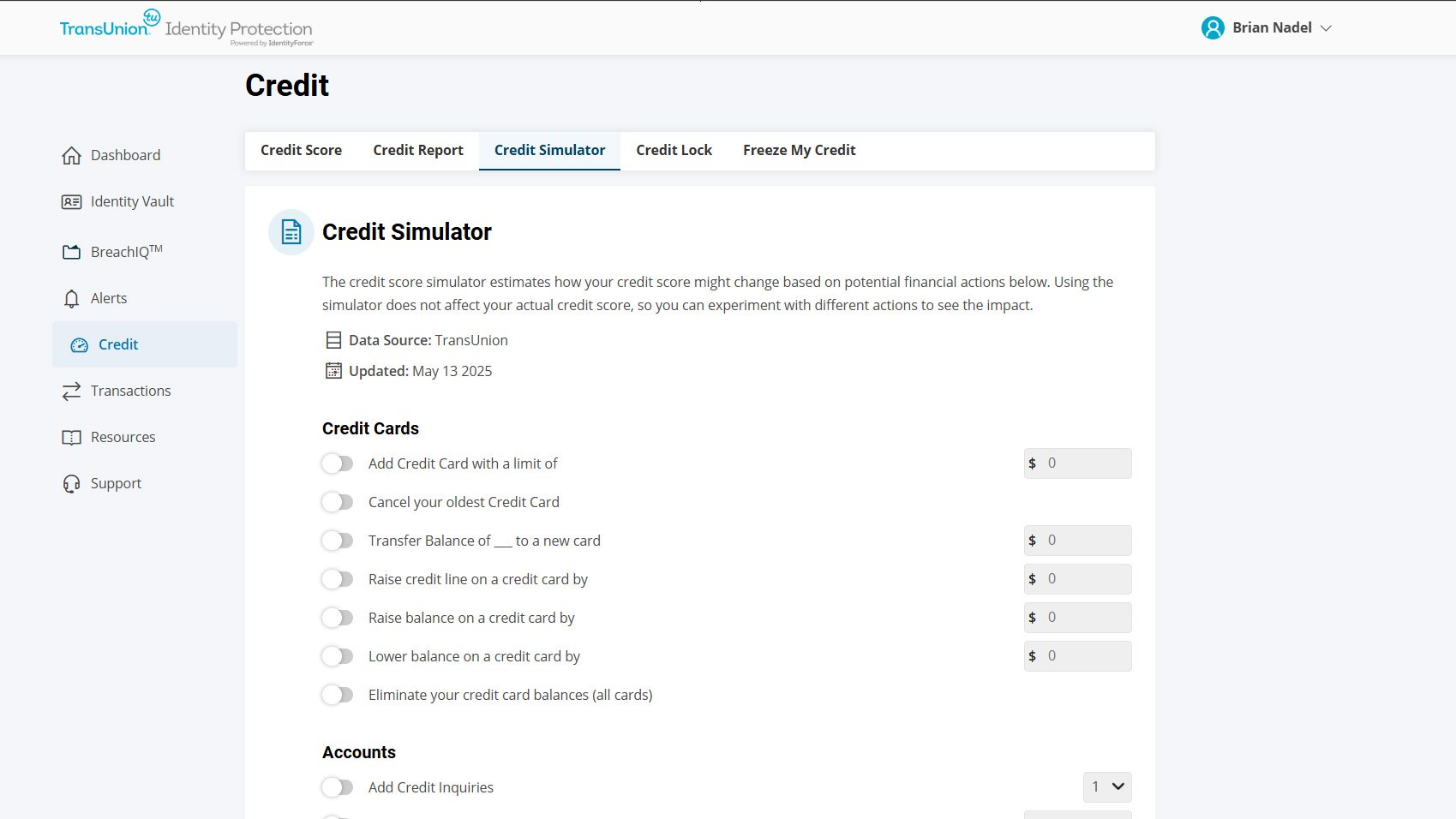

IdentityForce’s Credit Simulator is among the best and can help those seeking to improve their ratings by making changes to credit and buying habits. It has places for dozens of items rather than a few that include adding or deleting credit cards, transferring balances and paying everything off. The results show up in a few seconds.

IdentityForce UltraSecure+Credit review: Verdict

In depth monitoring, scores and advice about everything to do with credit are the driving forces behind IdentityForce. With its links to TransUnion, it does many of these things better than the others, but the service’s VPN is only for phones and tablets and I was waiting for a long time for the app to make its data connection.

Its credit simulator and freeze button and depth of data about credit are among the best in the business. Too bad it lacks the malware defenses that others provide, so you’ll need to get a security suite for the full protection you and your digital home deserve.

Brian Nadel is a freelance writer and editor who specializes in technology reporting and reviewing. He works out of the suburban New York City area and has covered topics from nuclear power plants and Wi-Fi routers to cars and tablets. The former editor-in-chief of Mobile Computing and Communications, Nadel is the recipient of the TransPacific Writing Award.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.