Tom's Guide Verdict

With full coverage from malware to identity protection, LifeLock seems to do it all, but at a price that some might not be willing to pay

Pros

- +

Thorough computer security, identity insurance and identity protection

- +

Three credit bureau monitoring, scores and reports

- +

Built-in scam protection

- +

Add on Norton 360 security suite available

- +

Credit advice

Cons

- -

Expensive

- -

Software can be overwhelming

Why you can trust Tom's Guide

Monthly cost: $35

Yearly cost: $340

Family plan: $80/month

No. of bureau scores: 3

No. of bureaus monitored: 3

Frequency of credit reports: Equifax: daily; TransUnion and Experian: annual

Type of credit score: VantageScore 3.0

Credit-improvement simulator: Yes

Credit-lock/freeze button: Yes

Security software: Optional AV, VPN, PW manager

Investment account monitoring: Yes

Max. ID-theft coverage: $3 million

Data Breach Alerts: Yes

Medical Records/Payday loan Monitoring: Yes/Yes

Sex Offender/Cyberbullying Alert: Yes/Yes

LifeLock is not only one of the oldest providers of best identity theft protection services, but it’s one that offers some of the most comprehensive coverage available on the planet. It also continues to add new features every time I turn around, but LifeLock is among the most expensive identity theft protection services.

It might be worth it because it has everything from credit monitoring and alerts to dark web monitoring, scam protection and plenty of insurance, should something go wrong. Some may chafe at LifeLock’s potentially overwhelming software and a pricing structure that can get close to $1,000 a year for a family when traditional defenses like malware scanning, VPN access and a password manager are added.

LifeLock aims to thwart just about anything the web can throw at you – and succeeds. Its lineup of products might be a bit complicated and expensive but LifeLock can do it all by protecting from every conceivable angle of attack. That is, if you can afford it.

LifeLock review: Costs and what’s covered

| Row 0 - Cell 0 | Standard | Advantage | Ultimate Plus |

Pricing | $89.99 annual, $7.50 per month (first year) | $14.99 per month (annual), $22.99 per month (monthly) | $19.99 per month (annual), $34.99 per month (monthly) |

Users | 1 adult | 1 adult | 1 adult |

Devices | Unlimited | Unlimited | Unlimited |

Providing the most extensive coverage of any identity protection service, LifeLock has a complex array of products with optional add-on Norton 360 software and several utilities. Together, they create a shield to defend you against the most prevalent digital dangers. If the choices seem hard to swallow, take LifeLock’s quiz before signing up. At the end, the site will suggest an appropriate protection level.

The LifeLock lineup starts with the Identity Advisor. It combines dark web monitoring with data breach alerts and costs $4.99 a month or $39.99 for the first year. This rises to $49.99 a year after 12 months.

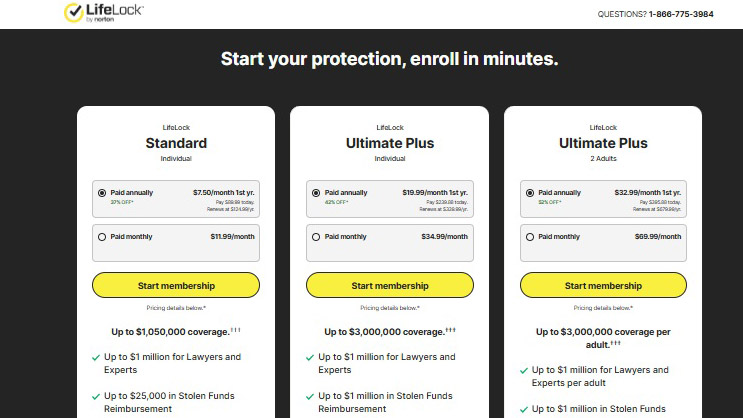

The more traditional Standard plan observes action on your Social Security number and includes single bureau credit agency monitoring. It comes with $1 million for identity restoration as well as $25,000 for stolen funds and $25,000 for personal expenses spent to recover your persona – $50K more than many of its competitors.

It lacks a specific $25K for ransomware attacks, though. Standard coverage costs $89.99 a year or $7.50 a month for the first year. Starting on day 366, the plan’s price rises to $124.99 annually or $11.99 monthly.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

LifeLock’s Advantage subscription ups the coverage to a total of $1.2 million and adds things like a payday loan lock and alerts if someone takes over your buy-now, pay-later account. It includes single bureau credit monitoring and costs $179.88 or $14.99 a month for the first year. After that the price becomes $22.99 a month or $239.99 a year.

The company’s Ultimate Plus Individual plan costs $239.88 annually or $19.99 monthly for the first year; after that, it’s priced at $339.99/year or $34.99/month. It increases the insurance level to $3 million with $1 million each for experts, stolen funds and personal expenses. With three bureau monitoring, reports and scores, it is built around an instant TransUnion credit lock and can alert you about social media and phone account takeovers as well as if someone is trying to steal your home’s title or your investment accounts.

There’s also a couples version of Ultimate Plus that doubles the overall insurance to $3 million for each adult. It costs $395.88 a year for the first year and $679.99 after that; monthly payments are $69.99.

Overlayed on this scheme are Family plans that can include up to five children for the Ultimate Plus plan until they reach 26 years old. While the adults get full credit reports and scores with up to $3 million in identity insurance, the kids are limited to Standard plan’s $1,050,000 of total protection and don’t get credit reports. Its cost starts at $38.99 a month (or $467.88 a year) for the first year. After that it rises to $79.99 a month and $799.99 a year.

On top of that, there’re several options for extra coverage that can close any loose ends with Norton 360 Select software. It starts with the company’s well regarded malware protection and extends to everything from VPN access and a password manager to ransomware, hacking and scam protection. Windows computers get 500GB of online storage and the software can be used on an unlimited number of notebooks, desktops, phones and tablets.

On its own, Norton 360 Select costs $190 a year but is available as an adjunct to the LifeLock protection. While the first year adds $99.99 to the total, after that it’s $159.99. This brings the total payment dangerously close to $1,000 a year for a family – double or triple the cost of other similar plans.

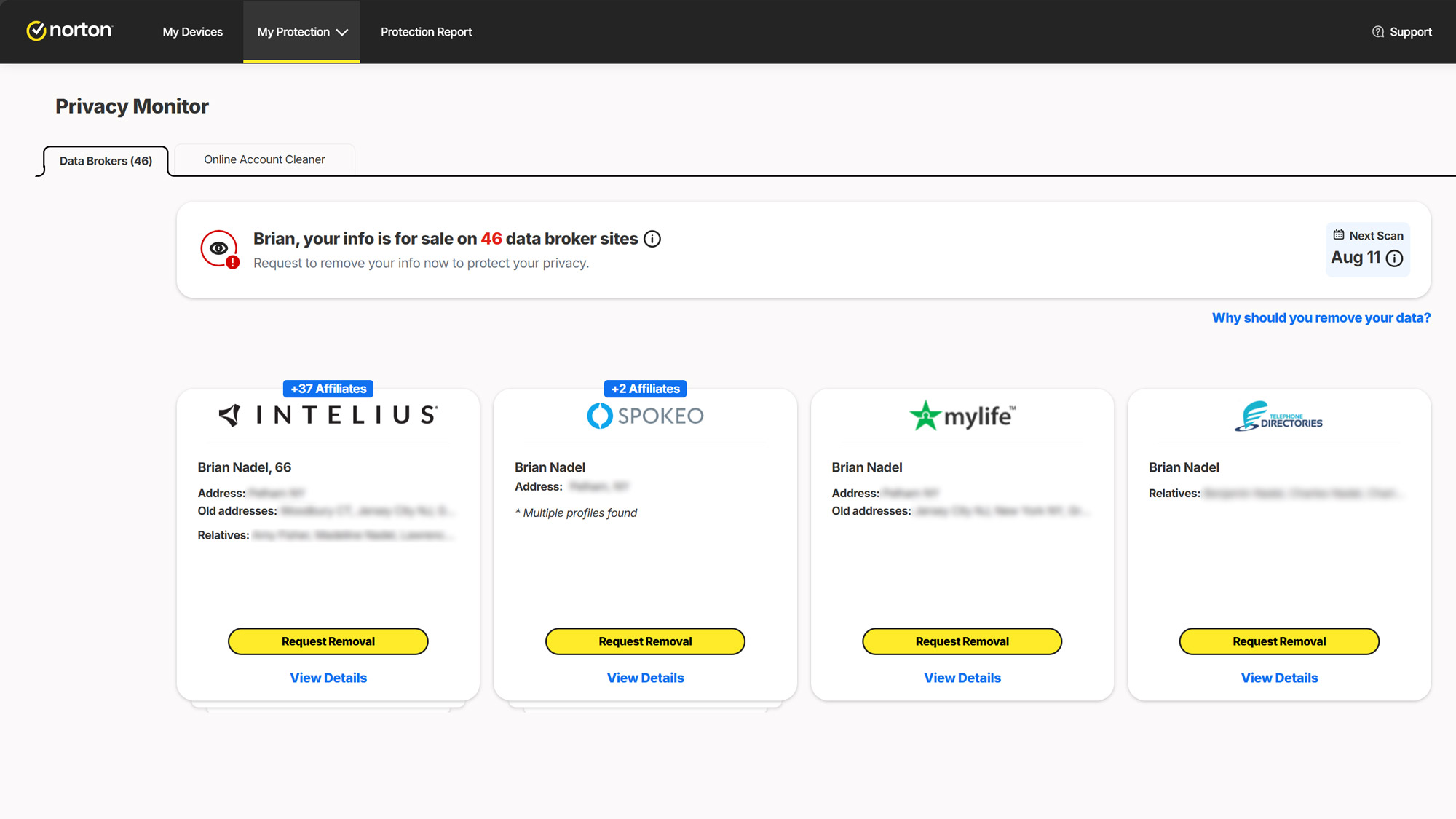

On top of all this are several utilities that can each add to the tab. The free Privacy Monitor scans for your personal information at data brokers and shows vulnerabilities. To remedy the situation, you’ll need the $110 Privacy Monitor Assistant to fix them.

Meanwhile, the $50 Computer Tune Up can help with balky computers and the company’s Utilities Ultimate costs $60 and promises several techniques to speed up a Windows or Mac computer.

LifeLock, Norton and its corporate parent Gen have A+ ratings from the Better Business Bureau. That said, the organization has alerted customers about cybercriminals imitating Norton and LifeLock to steal your online credentials, including emails I’ve received with fake payment invoices.

LifeLock Ultimate Plus review: How we tested

In early spring I signed up for LifeLock’s Ultimate Plus plan, set up an account and added my personal information. Over the course of three months, I used the service just about every day to check my credit scores, look for breaches and check on potential scams. At the end, I canceled the service.

LifeLock Ultimate Plus review: Setup and support

To get started, I had to share the appropriate personal information then load Norton 360’s software as well as activate credit monitoring on my main computer. I also installed the app on my Galaxy S25 phone via a QR code.

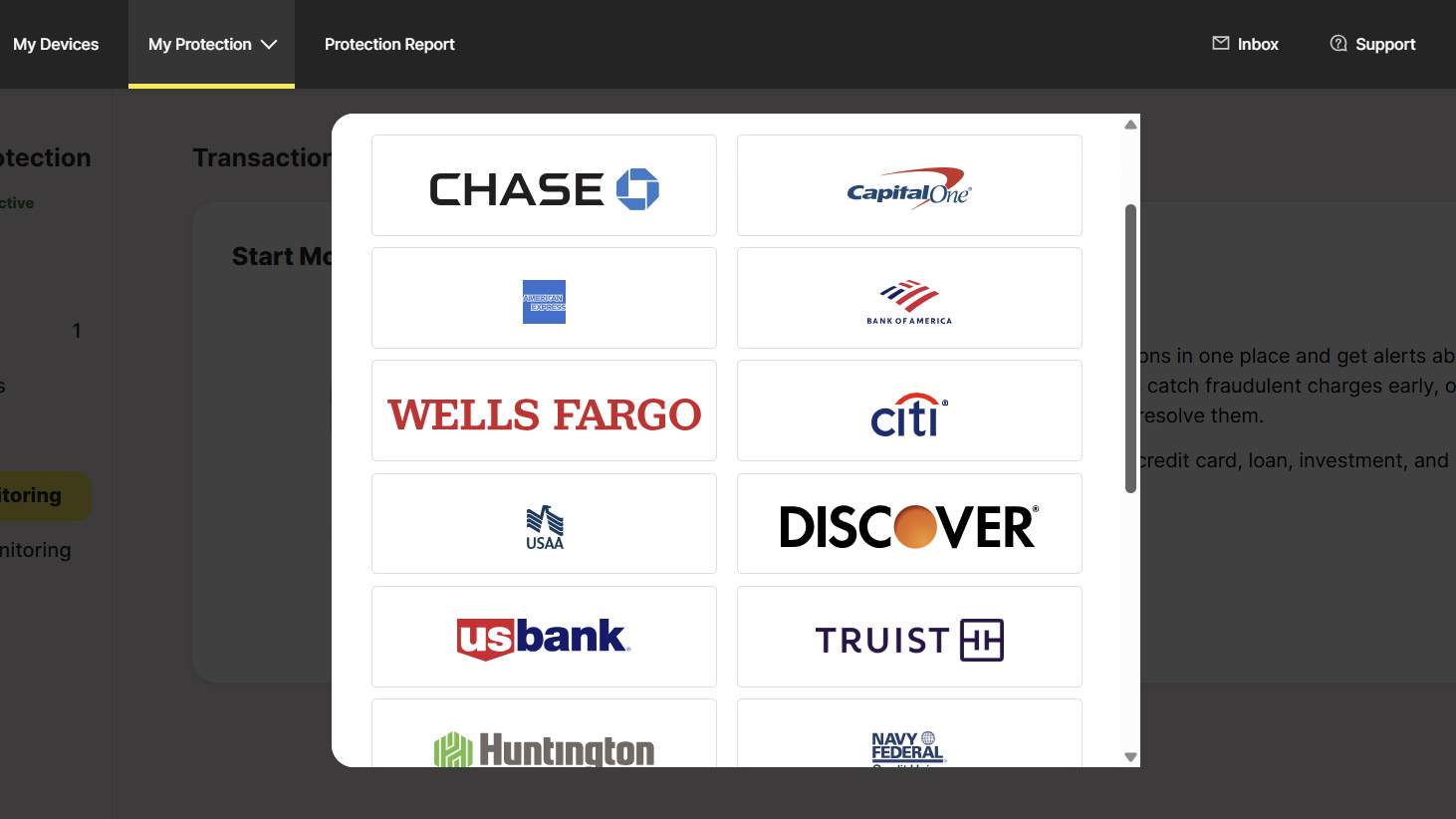

Adding data for accounts and credit cards took a few minutes and I was done. Start to finish, it took just under 12 minutes – about average for this genre.

LifeLock has lots of self-serve options on its support site, including help understanding and navigating the complex world of credit scores and reports. There’s an extensive FAQ section, lots of helpful articles and an innovative AI powered search section.

The company’s trained staff is standing by 24/7 to answer questions or start an identity breach incident. They respond to phone calls and emails as well as a link on the site and app.

LifeLock review: Credit scores and identity monitoring

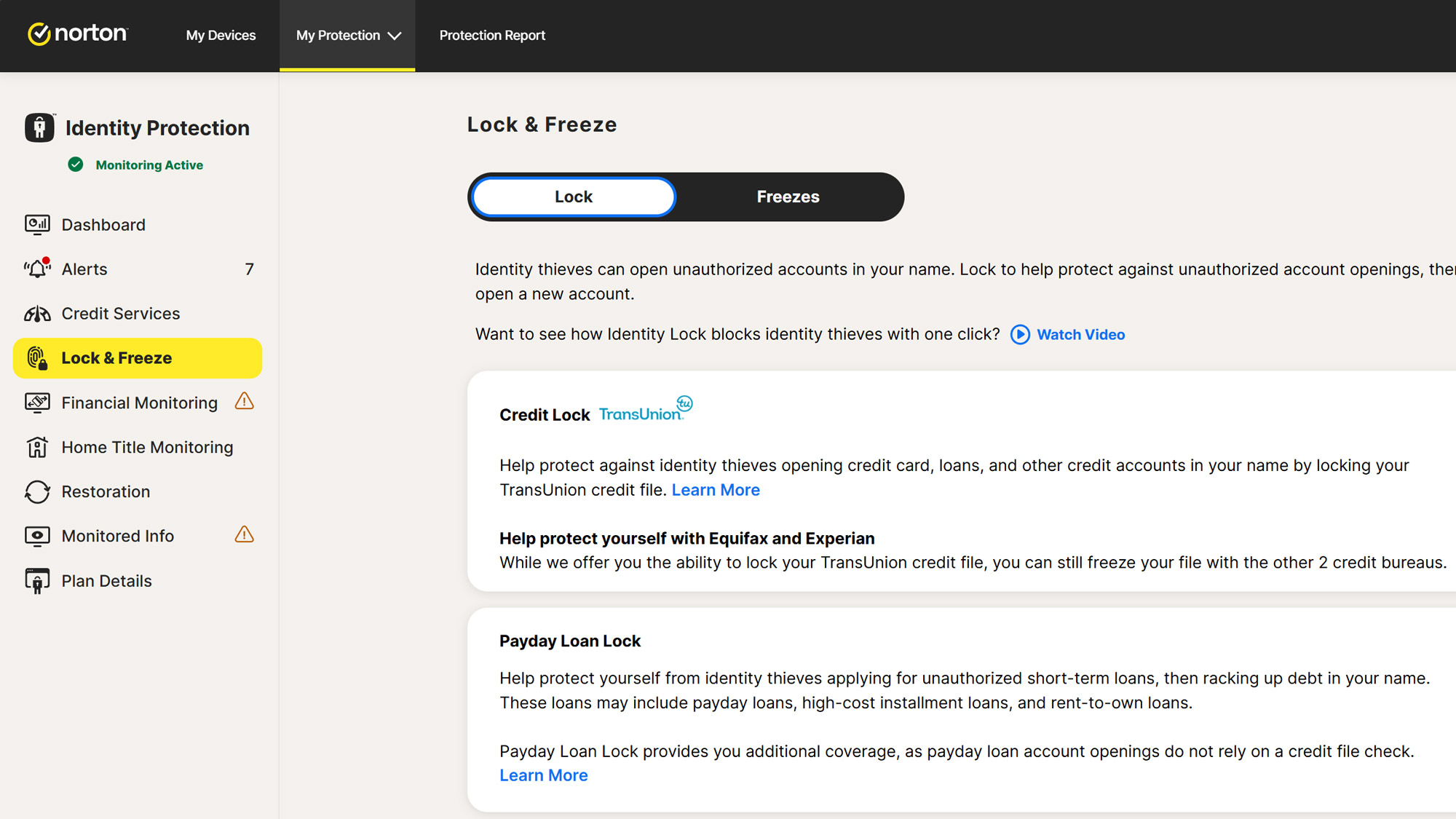

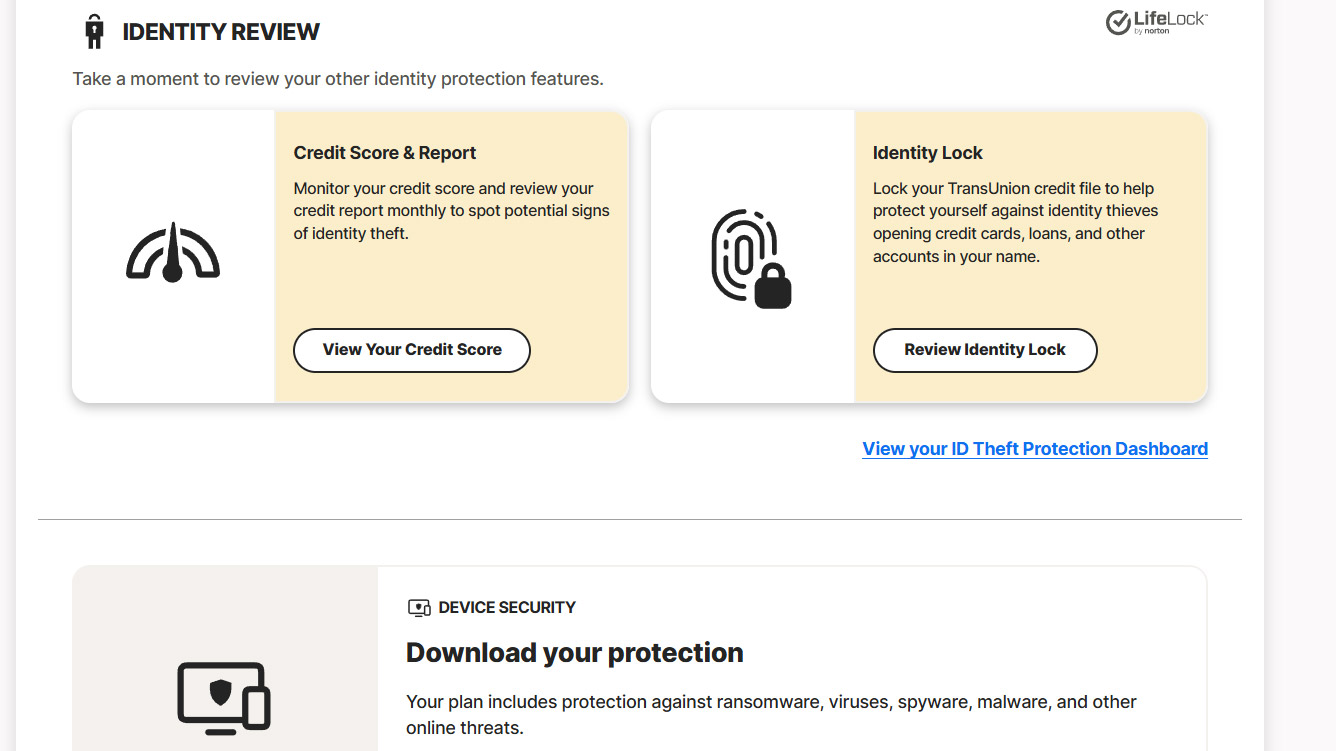

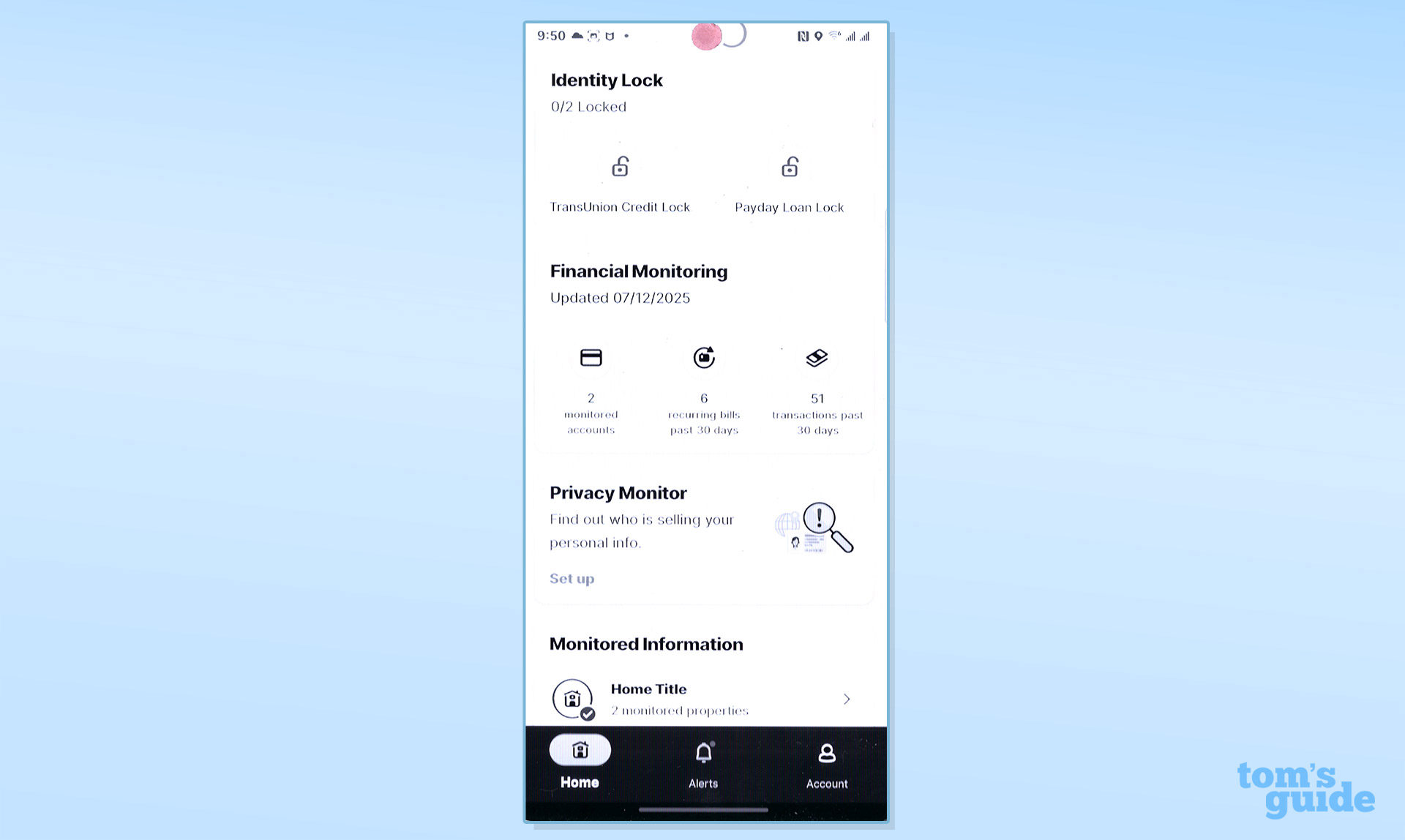

Like many competitors, LifeLock checks for activity on credit cards, bank and investment accounts. It provides the peace of mind with credit locks for Experian and Equifax as well as a lock for TransUnion. It’s easy to switch either on or off with a tap or click.

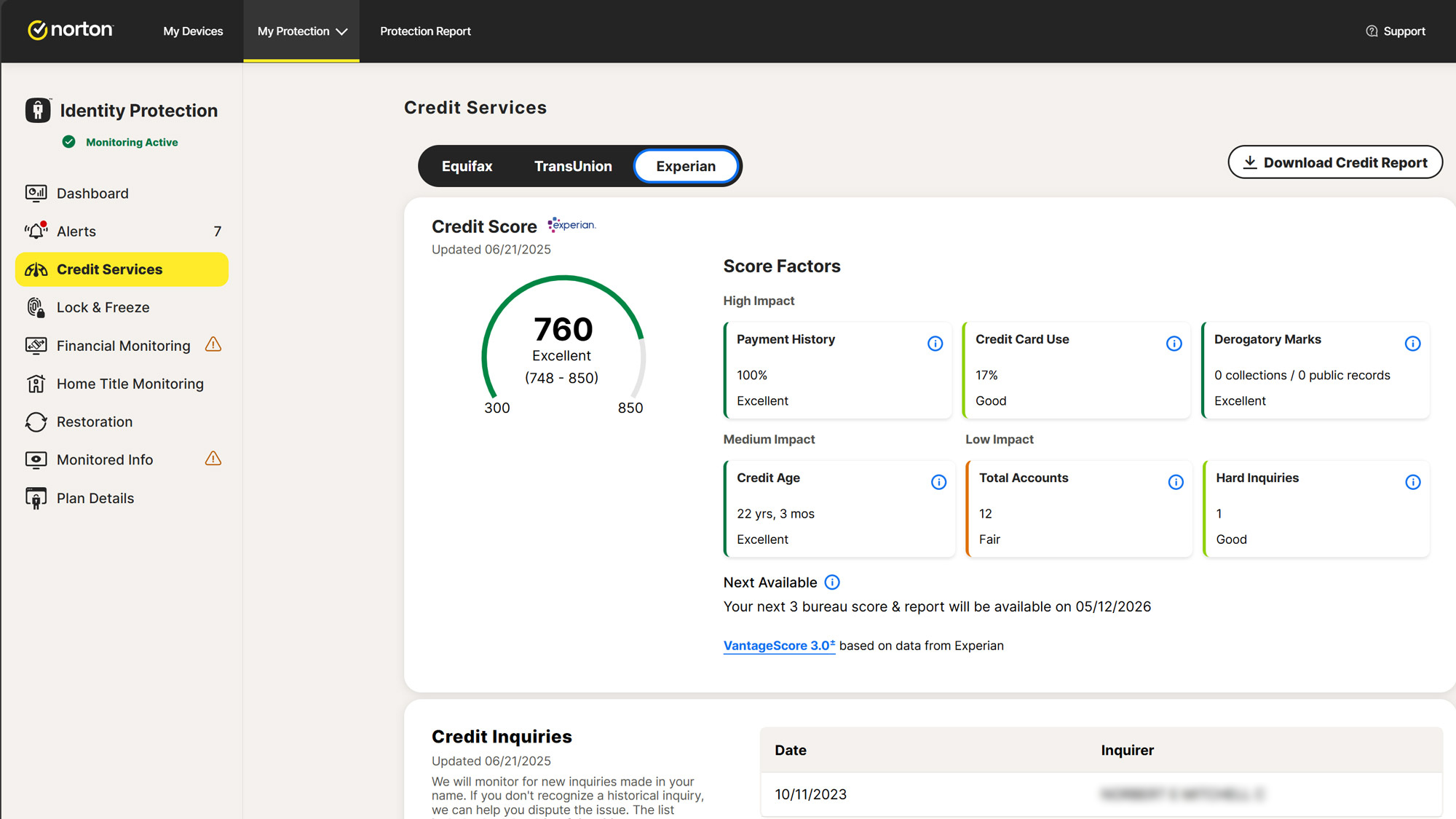

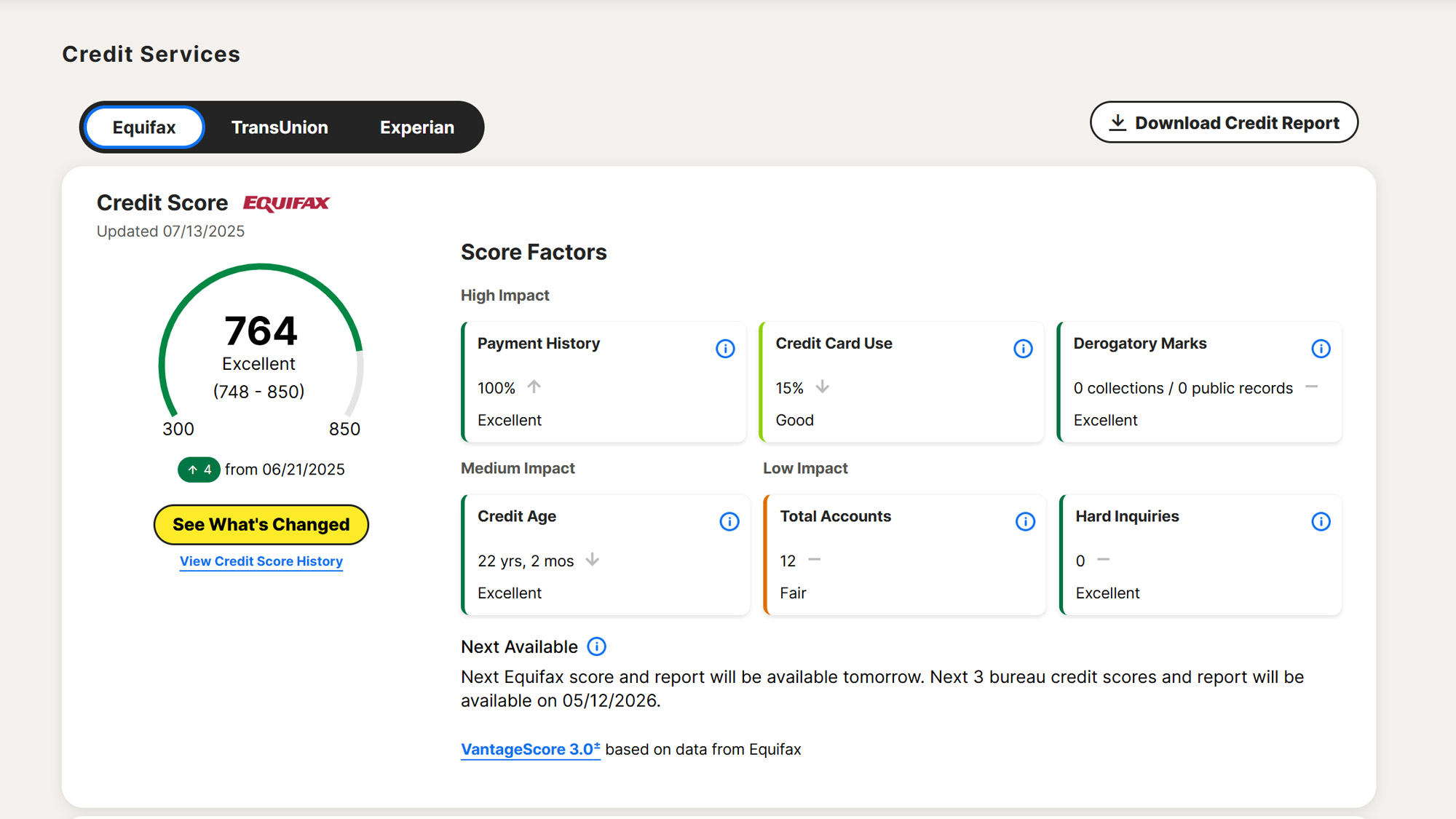

There’s easy access to current credit scores with the Vantage 3.0 rating system. It’s a good stand in for the FICO creditworthiness mark. While other services allow side by side comparisons between the credit bureau’s scores, you need to move to separate pages to see the individual scores in LifeLock. Up top is a download link for the full report.

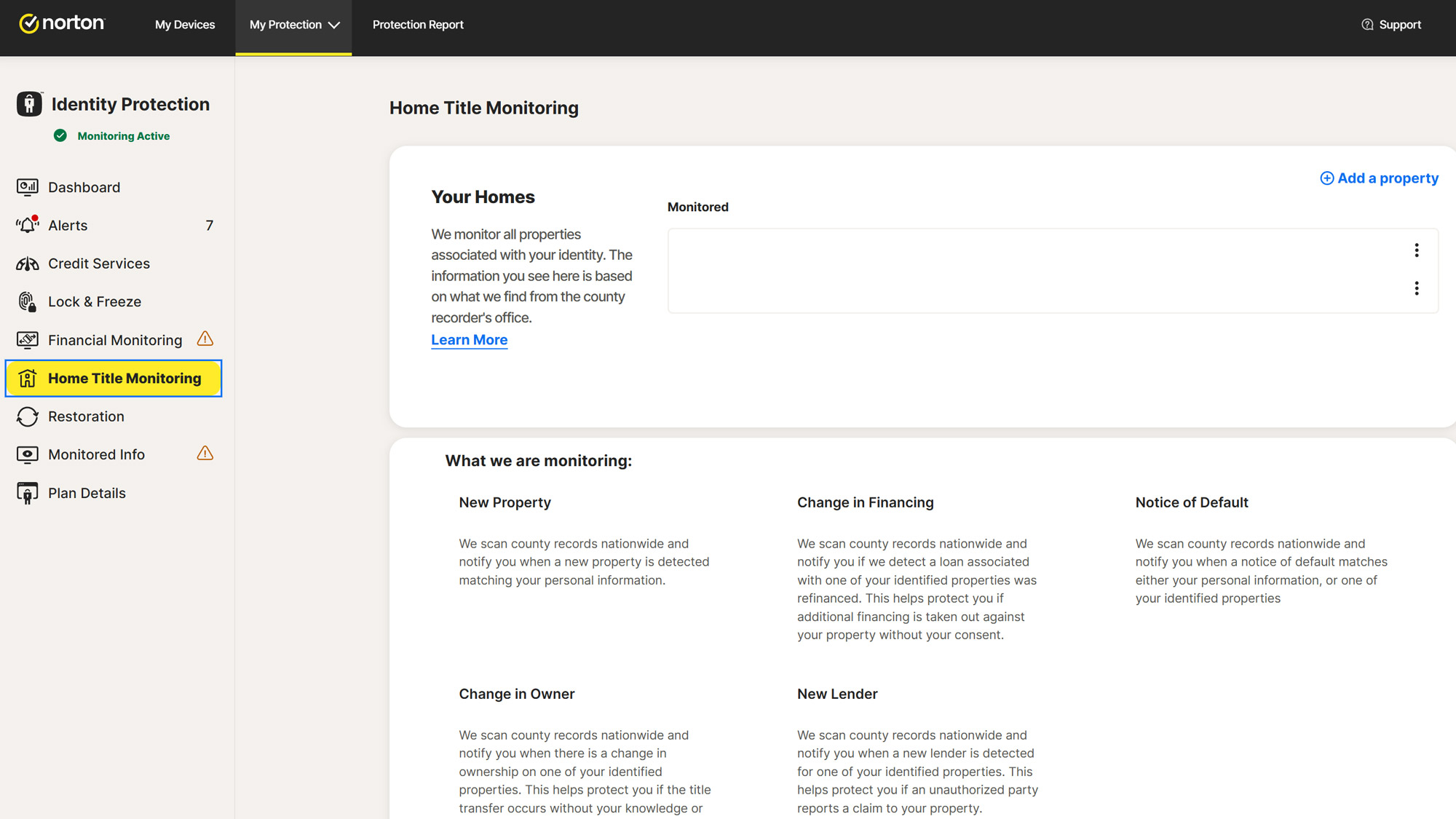

LifeLock continually scans the online world to keep an eye out for your personal information on the dark web and warns you if your Social Security number, name, address and other indicators or fragments show up. While LifeLock scans major people-search firms, like Intellius and Spokeo, to see if they have your name listed, it also looks for address changes for you as well as any changes to the title for your home.

Meanwhile, the Social Media Monitoring protection watches for indications of odd posts, cyberbullying or indications of an account takeover. It covers Facebook, Instagram, LinkedIn, X (aka Twitter), YouTube, TikTok and Snapchat.

LifeLock review: Insurance and services

| Row 0 - Cell 0 | Standard | Ultimate Plus (Individual) | Ultimate Plus (two adults) |

Insurance | Up to $1 million | Up to $1 million | Up to $1 million |

Stolen funds | Up to $25k | Up to $1 million | Up to $1 million |

Personal expenses | Up to $25k | Up to $1 million | Up to $1 million |

Identity and Social Security alerts | Yes | Yes | Yes |

Credit monitoring | Yes (1 bureau) | Yes (3 bureaus) | Yes (1 bureau) |

Identity Lock | No | Yes | Yes |

Phone Takeover | No | Yes | Yes |

Crime alerts | No | Yes | Yes |

Buy now, pay later | No | Yes | Yes |

Credit report and scores | No | Yes | Yes |

Investment alerts | No | Yes | Yes |

Home title monitoring | No | Yes | Yes |

Social media monitoring | No | Yes | Yes |

Unlike the others which underwrite their coverage with a major insurance company, LifeLock self-insures its risk. This can save on overhead but might be a problem if it gets an onslaught of claims.

With $1 million to cover lawyers, consultants, experts and accountants to forensically examine the identity theft, LifeLock’s Ultimate Plus plan also provides up to another $1 million to cover credit card theft and money stolen from a bank or investment account. There’s also a million dollars available to pay for personal expenses, like lost work, travel and the cost of getting new documentation, like a passport and driver’s license.

The Couple plan doubles this to $6 million, total. LifeLock’s Family plan adds $1,050,000 of insurance for each child; it can cover up to five siblings until their 26th birthday.

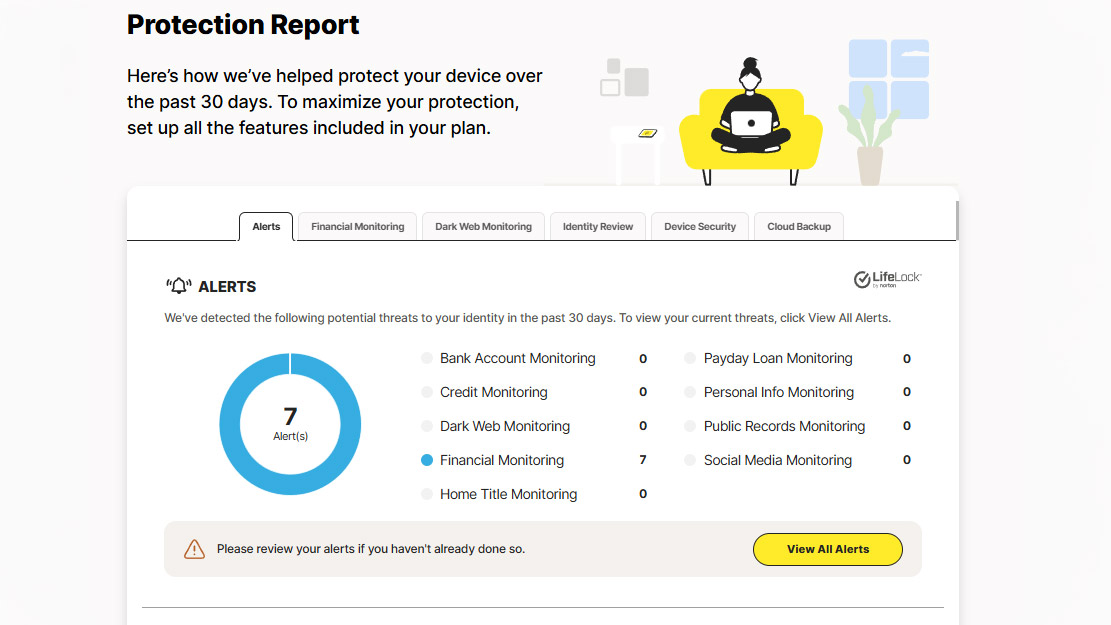

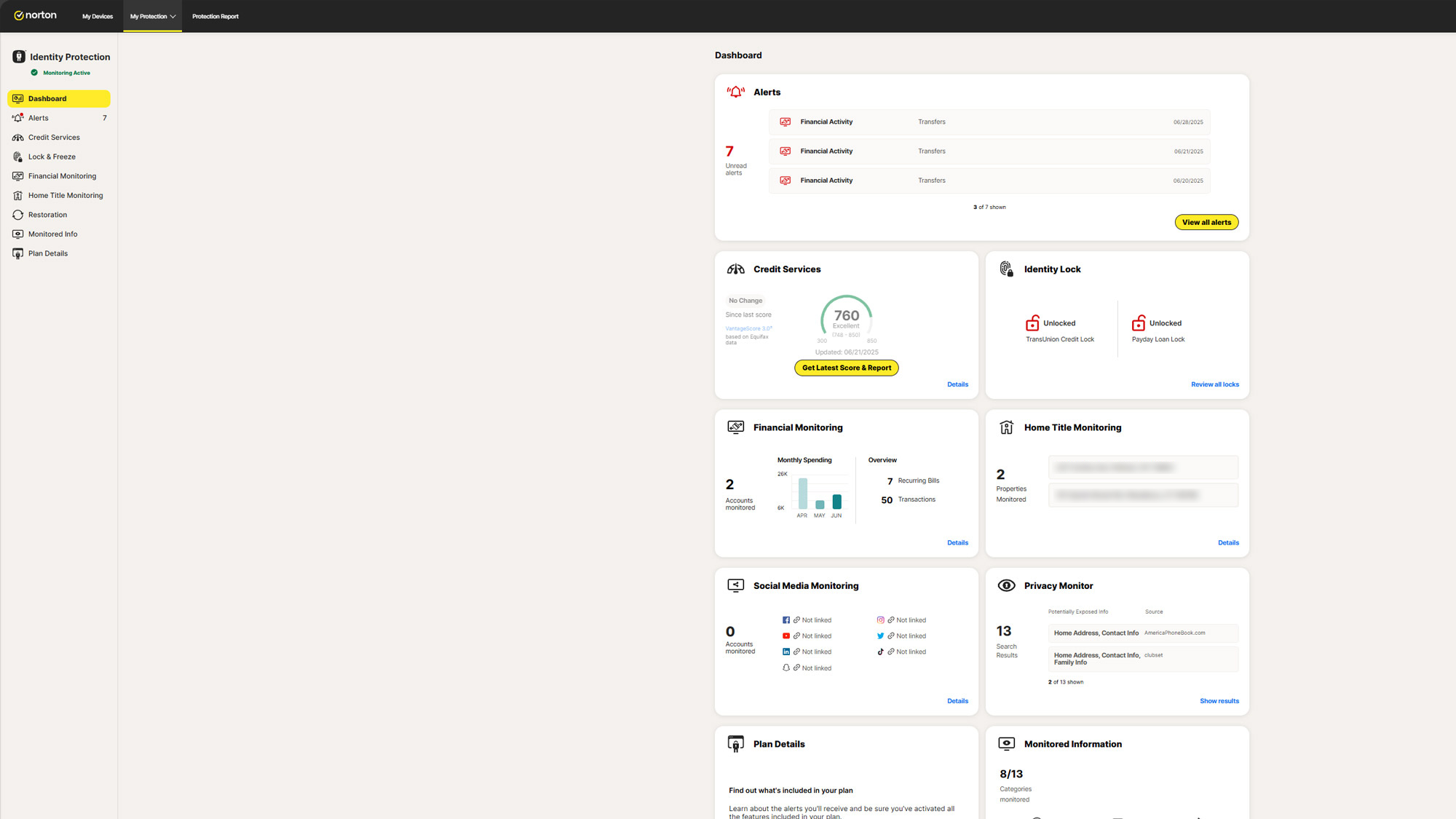

LifeLock’s Protection report makes for good reading because you’re the main character. It shows all the major security and privacy issues in one place and takes only a few seconds to be compiled.

There’s also a probing Identity review that combines the Identity Lock and credit ratings. It’s the place to download utilities and security software.

LifeLock review: Notifications and alerts

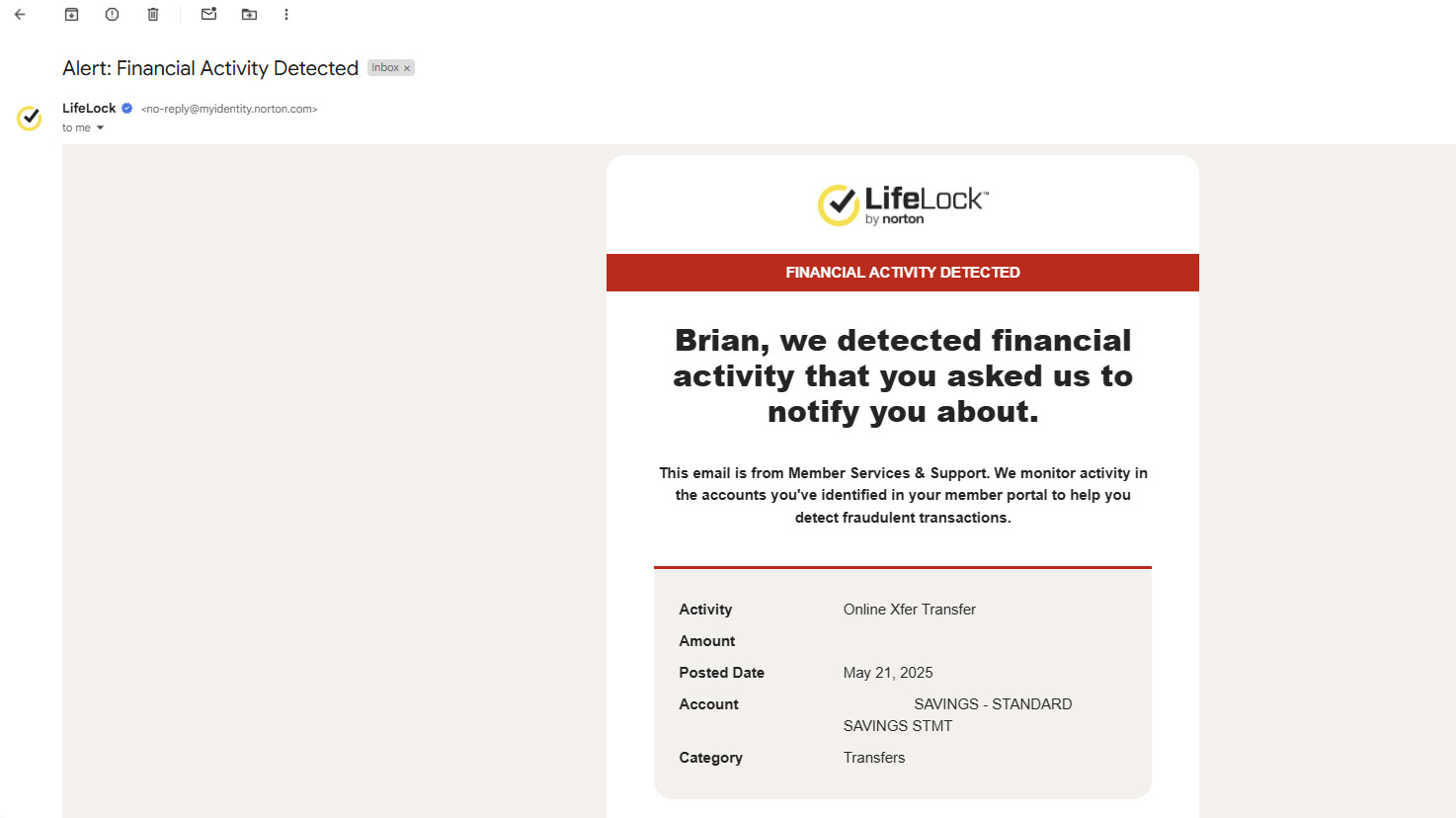

The service’s alerts that LifeLock can provide are comprehensive with notifications about data breaches and the results of dark web scanning for personal identifiers. It can find things like changes to your credit scores and account balance changes.

Should you go wild and spend over your preset transaction limit, you’ll get a notice and a suggestion to raise the limit. There are also warnings for payday loans and an innovative freeze on these types of transactions.

If a registered sex offender moves into your neighborhood or if a utility account is opened in your name, you’ll know about it. LifeLock can send these missives by SMS text, email and shows them prominently on the interface in the Alerts section.

LifeLock’s mobile app can do something the others can’t: monitor your phone’s SIM card account for signs that someone might be tampering with it.

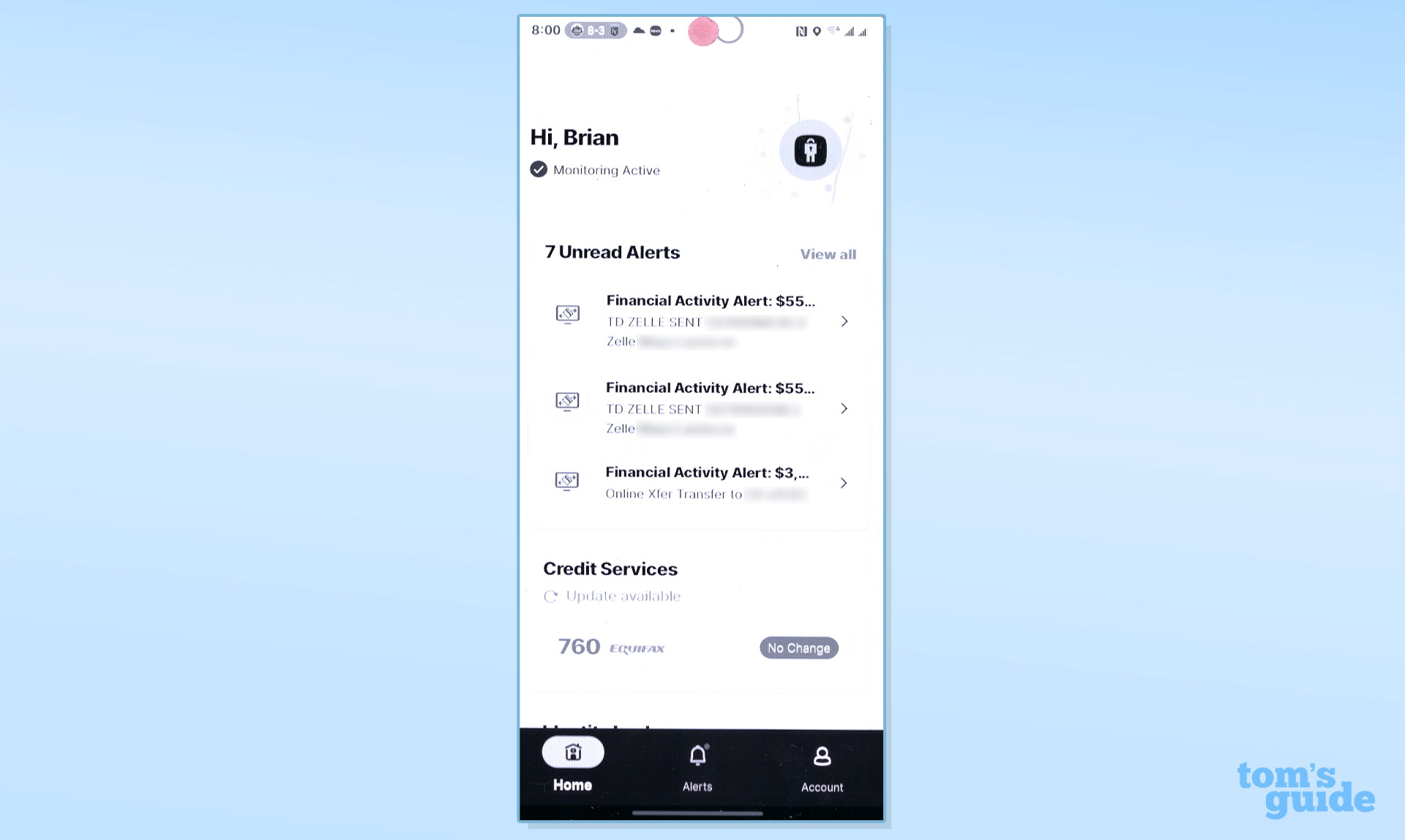

I got a total of 20 alerts from LifeLock during my three month evaluation period. They were mostly for large (at least for me) bank transactions.

LifeLock review: Interface and utilities

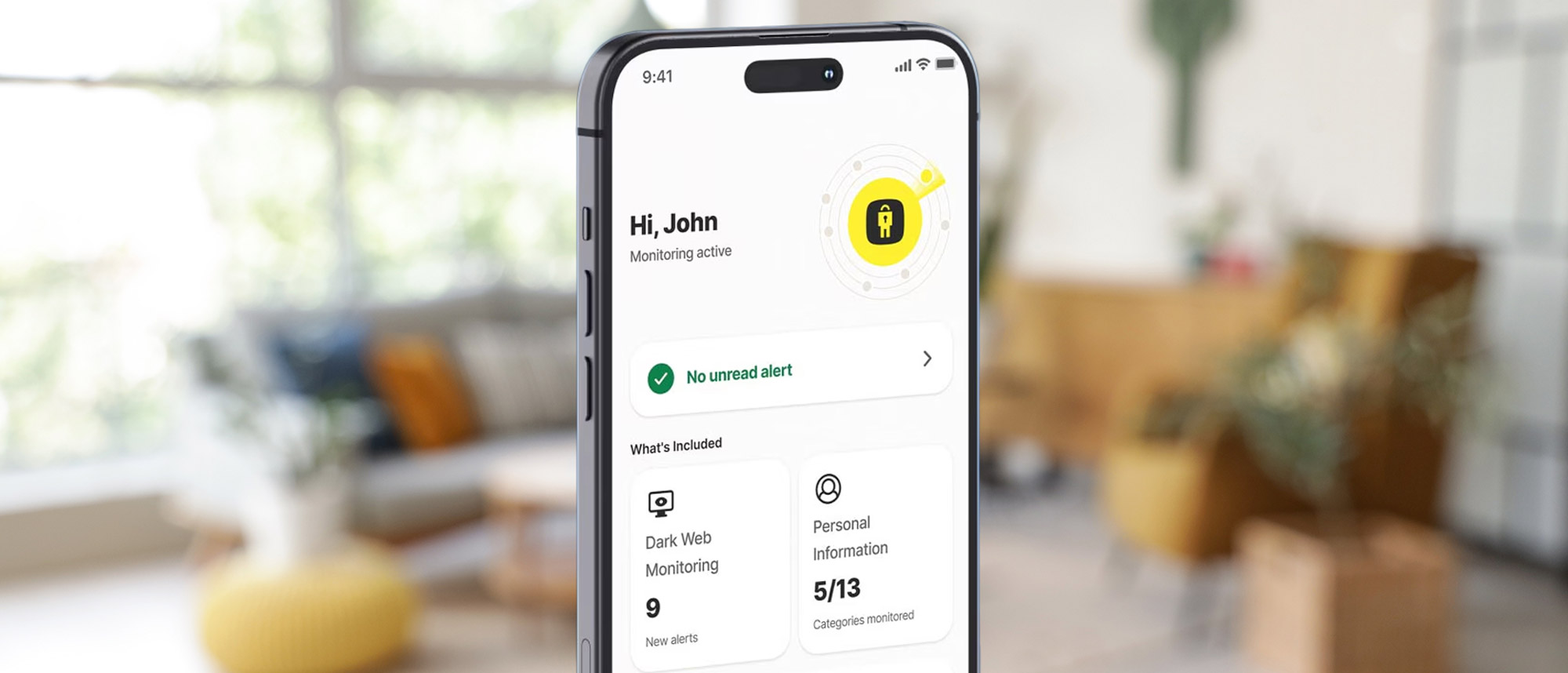

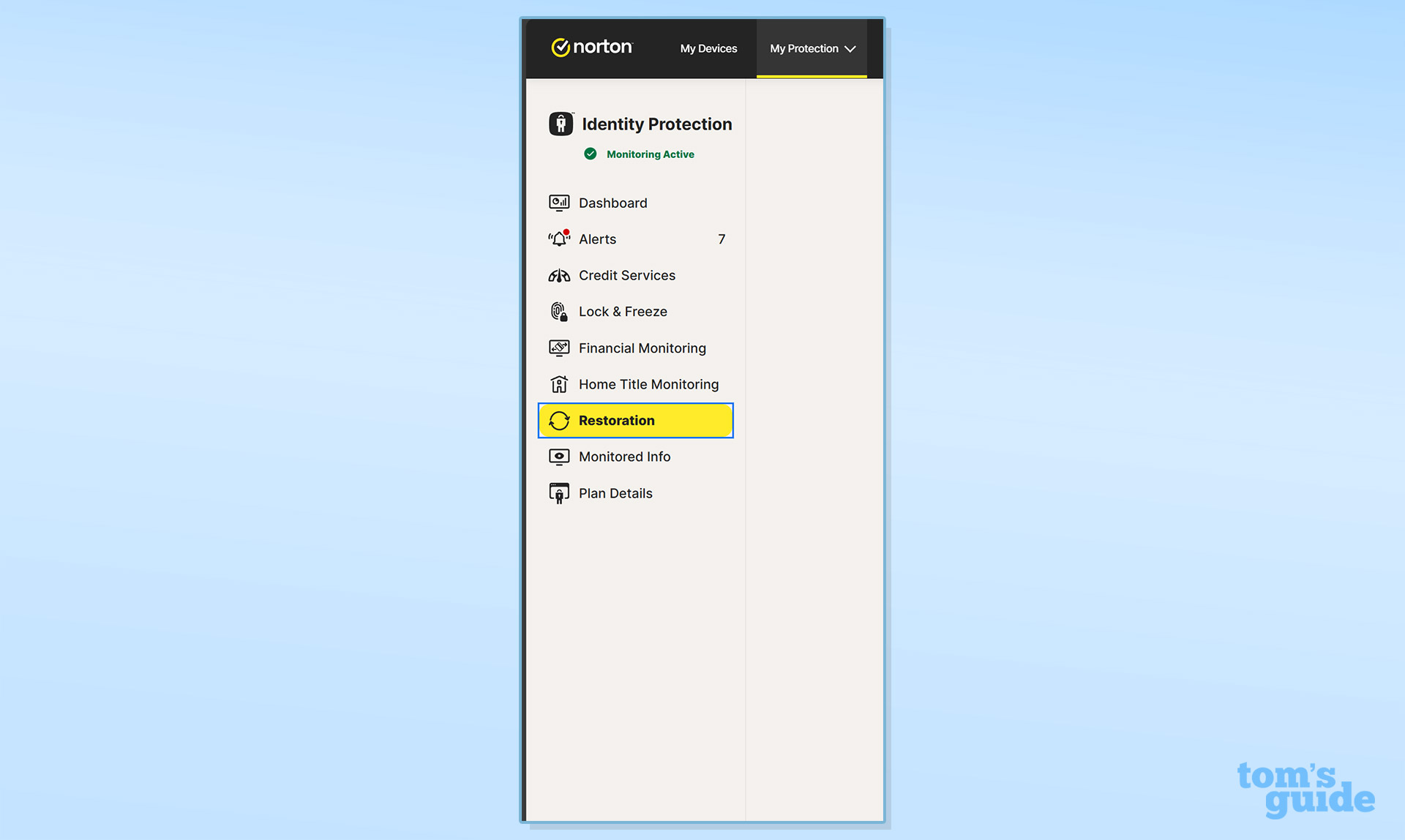

LifeLock offers either a browser version or a mobile app; there are iOS and Android versions. The browser has a bright airy look with lots of yellow in it; an appreciated touch is that when you’re in a tab, it’s highlighted in yellow.

The menu items are set up as vertical tabs on the left, with options for every major feature of the service including Alerts, Credit Services, Financial Monitoring and Lock & Freeze. Its Plan Details shows your subscription information.

The mobile apps also have a bright background, lots of yellow and red to indicate a potential problem. They only work in Portrait mode and for security purposes don’t allow screenshots.

The top navigation has the essentials, including unread alerts and the current credit situation. However, there’s a lot of scrolling involved, and using horizontal elements might have helped. Below the fold are links for identity and financial monitoring as well as the Privacy Monitor.

Norton LifeLock Ultimate review: Features

Some of the noteworthy features that I checked out while testing include the Privacy Monitor which checks with data brokers and people-finding services for your data. It can request removal but you’ll need to pay $110 a year for the Privacy Monitor Assistant to make it automatic.

Quietly added last year, Ultimate Plus includes LifeLock’s Credit Score Insights simulator. Rather than concentrating on paying off credit card balances or getting new cards, it looks at the totality of your credit and the critical elements that affect your VantageScores. It included interesting analytic items like credit age and derogatory report remarks.

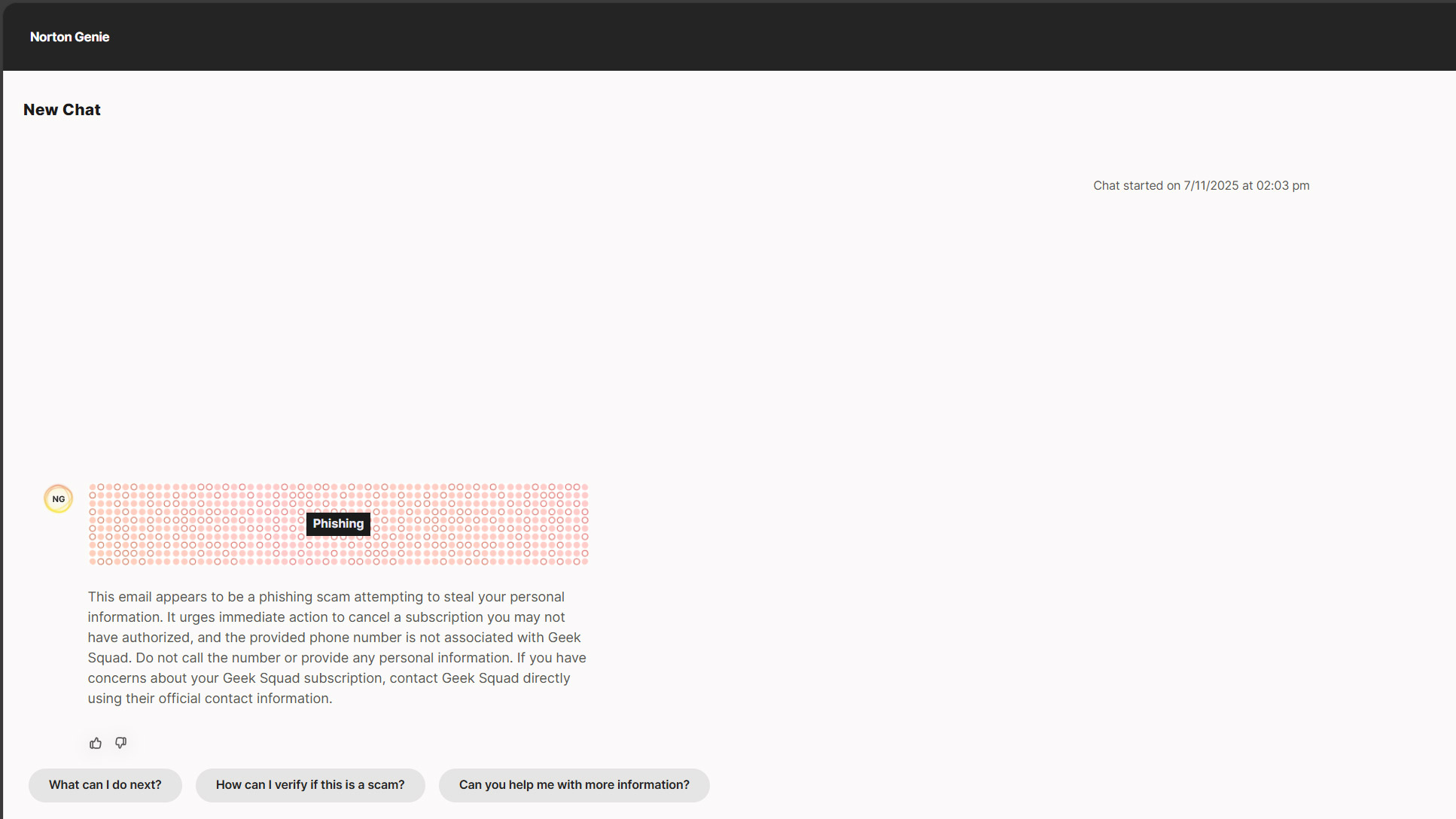

The latest addition is access to Norton’s Scam Protection, which checks if emails, texts or images are part of a scam. I tried it with a fraudulent invoice purportedly from BestBuy. It spotted it a mile away but took about 30 seconds to let me know.

Norton LifeLock review: Verdict

LifeLock continues to be the 800-pound gorilla in the identity protection room by trying to do everything conceivable and several I couldn’t have conceived of. In addition to credit monitoring, scores and locks, LifeLock Ultimate Plus includes up to $3 million in ID insurance to help get your life back together and its Scam Protection might be a little slow but it is thorough.

It may be comprehensive and just what’s needed in this day and age, but it can feel suffocating with all its alarms, alerts and warnings. Also, the cost of about $1,000 to protect a family’s online persona may be prohibitive to many. If that’s the case, then Identity Guard might be a better choice given it offers more affordable plans.

Brian Nadel is a freelance writer and editor who specializes in technology reporting and reviewing. He works out of the suburban New York City area and has covered topics from nuclear power plants and Wi-Fi routers to cars and tablets. The former editor-in-chief of Mobile Computing and Communications, Nadel is the recipient of the TransPacific Writing Award.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.