Computing

Latest about Computing

-

-

Razer Blade 18 (2025) review

By Eric Vander Linden Published

-

MacBook Pro OLED tipped to launch next year and it could sport a Samsung display

By Scott Younker Published

-

The best password managers in 2025

By Anthony Spadafora Last updated

-

Plex users need to change their passwords — there’s been another breach

By Amber Bouman Published

-

Mullvad VPN brings the QUIC protocol to WireGuard for improved obfuscation

By George Phillips Published

-

Best 15-inch laptops in 2025: Our top picks tested and rated

By Alex Wawro Last updated

-

Macs under attack from ‘cracked’ apps spreading dangerous info-stealing malware — don’t fall for this

By Anthony Spadafora Last updated

-

Explore Computing

Computing Hardware

-

-

I built the coolest gaming PC ever — here are 5 parts to buy so you can too

By Dave Meikleham Published

-

How is this RTX 5070 gaming laptop SO cheap?! Get $1,280 off now, $80 off my favorite portable SSD and more — Power Picks

By Jason England Published

-

Nvidia's rumored gaming laptop APU could match RTX 4070 performance — here's what we know

By Darragh Murphy Published

-

Computex day 3: the most eye-catching tech from the world's biggest computing event

By Jeff Parsons Published

-

Best of Computex day 2 — here's 5 new gadgets from the show floor you need to see

By Jeff Parsons Published

-

Asus just revealed GeForce RTX 5060 Ti ahead of launch — here's your first look

By Dave LeClair Published

-

15% OFF

15% OFFNewegg Promo Codes

By Louis Ramirez Published

-

Looking for an RTX 5090? Scalpers are happy to sell you one for a shocking price

By Dave LeClair Published

-

Intel wants to replace traditional laptops and PCs with a more environmentally friendly solution

By Scott Younker Published

-

Computing Peripherals

-

-

I tested the adorable NuPhy Air75 V3 — and it fixes everything that was wrong with the V2

By Peter Wolinski Published

-

This Foldable Keyboard and Mouse Combo Helped Me Stay Productive in a Busy Hostel — and It’s the Best Choice for Students

By Jason England Published

-

Grab a budget keyboard for even less for back to school at Amazon right now - these are my top 3 picks under $50

By Ashley Thieme Published

-

I review keyboards for a living — here's the fastest ones I'd buy with my own money

By Tony Polanco Published

-

I just got my first gaming keyboard — here’s why I’ll never use a regular board again

By Ashley Thieme Published

-

My partner almost left me because my keyboard was too loud — so I got this silent one that just hit its lowest ever price

By Nikita Achanta Published

-

This wired Logitech keyboard is the smartest $49 office upgrade you can make — here's why

By Ashley Thieme Published

-

The power bank I use every day just hit its lowest price ever — and it'll charge your laptop

By Dave LeClair Published

-

Only $54 and perfect for gamers and typists alike — the Keychron C1 Pro 8K is my new favorite mechanical keyboard

By Ashley Thieme Published

-

Desktop Computers

-

-

I spent a week with this AI-powered mini PC and the buttons on the front earned it a permanent spot on my desk

By Anthony Spadafora Last updated

-

Score RTX 5060 Ti Alienware Gaming PC for Nearly $400 off in Labor Day Sale

By Darragh Murphy Published

-

Mac Mini with M5 and M5 Pro just tipped to launch this year — here's what we know

By Scott Younker Published

-

I took the Framework Desktop out to my living room — and I can’t believe I’m actually gaming in 4K on an iGPU

By Anthony Spadafora Last updated

-

5 questions to ask yourself when buying a PC, from someone who reviews them for a living

By Alex Wawro Published

-

HP made a gaming PC for people who don't want to look like they own a gaming PC — meet the Omen 35L Stealth Edition

By Tony Polanco Published

-

This gaming PC feels like an Xbox 360 with an RTX 5090 inside - here's why

By Alex Wawro Published

-

I downsized to a mini PC years ago and I’ve never been happier — these are my top picks

By Anthony Spadafora Last updated

-

I tested the Framework Desktop — and it made me rethink everything I knew about mini PCs

By Anthony Spadafora Published

-

Internet

-

-

The best password managers in 2025

By Anthony Spadafora Last updated

-

Plex users need to change their passwords — there’s been another breach

By Amber Bouman Published

-

Mullvad VPN brings the QUIC protocol to WireGuard for improved obfuscation

By George Phillips Published

-

Macs under attack from ‘cracked’ apps spreading dangerous info-stealing malware — don’t fall for this

By Anthony Spadafora Last updated

-

Proton VPN sign-ups in Nepal rocket to 8,000% over the baseline in response to social media ban

By George Phillips Published

-

7 steps to stay safe after receiving a data breach notification letter

By Amber Bouman Published

-

These iCloud Calendar invites look legitimate but are tricky phishing attacks — here’s how to tell

By Amber Bouman Published

-

ESET review

By John Brandon Published

-

Grab Norton VPN for $2.50 per month with Tom's Guide's exclusive deal

By George Phillips Last updated

-

Laptops

-

-

Razer Blade 18 (2025) review

By Eric Vander Linden Published

-

MacBook Pro OLED tipped to launch next year and it could sport a Samsung display

By Scott Younker Published

-

Best 15-inch laptops in 2025: Our top picks tested and rated

By Alex Wawro Last updated

-

I've tested the best budget laptops of 2025 — here are my top picks (so far)

By Darragh Murphy Last updated

-

Act fast! The MacBook Air 15-inch M4 is on sale for its lowest price ever

By Tony Polanco Published

-

Forget the iPhone 17 — here’s the 9 Apple deals I’d shop this week on iPads, MacBooks, AirPods and more

By Millie Davis-Williams Published

-

15 laptop deals I'd buy with my own money — save on Alienware, Dell, Apple and more this weekend

By Louis Ramirez Published

-

Best Chromebook deals and prices in September 2025

By Millie Davis-Williams Last updated

-

Best RTX 40 laptop deals in September 2025 — I found the best deals on RTX 40-series gaming laptops from across the web

By Millie Davis-Williams Last updated

-

Software

-

-

Want to keep Windows 10? Here’s the one thing you must do before the October deadline

By Darragh Murphy Published

-

Hate tolls? This hidden Waze setting helps you avoid them

By David Crookes Published

-

Google Messages leans into minimalism — No more colorful circles

By Dave LeClair Published

-

Microsoft's next big Windows 11 25H2 update isn't going to make anyone happy — here's why

By Darragh Murphy Published

-

I Love macOS, But These 3 Apps Fix What Apple Still Gets Wrong

By Jason England Published

-

Microsoft confirms latest Windows 11 update is tanking streaming app performance

By Alyse Stanley Published

-

Waze's 'when to leave' feature is a game-changer — here's how to set it up

By Kaycee Hill Published

-

Best Android games

By Tom Pritchard Last updated

-

Google Maps just made it easier to see the places you've been — here's how

By Tom Pritchard Published

-

Tablets

-

-

M5 iPad Pro launch at iPhone 17 event now looks likely — what we know

By Darragh Murphy Published

-

I went hands-on with the Samsung Galaxy Tab S11 — and I'm already dreaming about all the work I could do on it

By Richard Priday Published

-

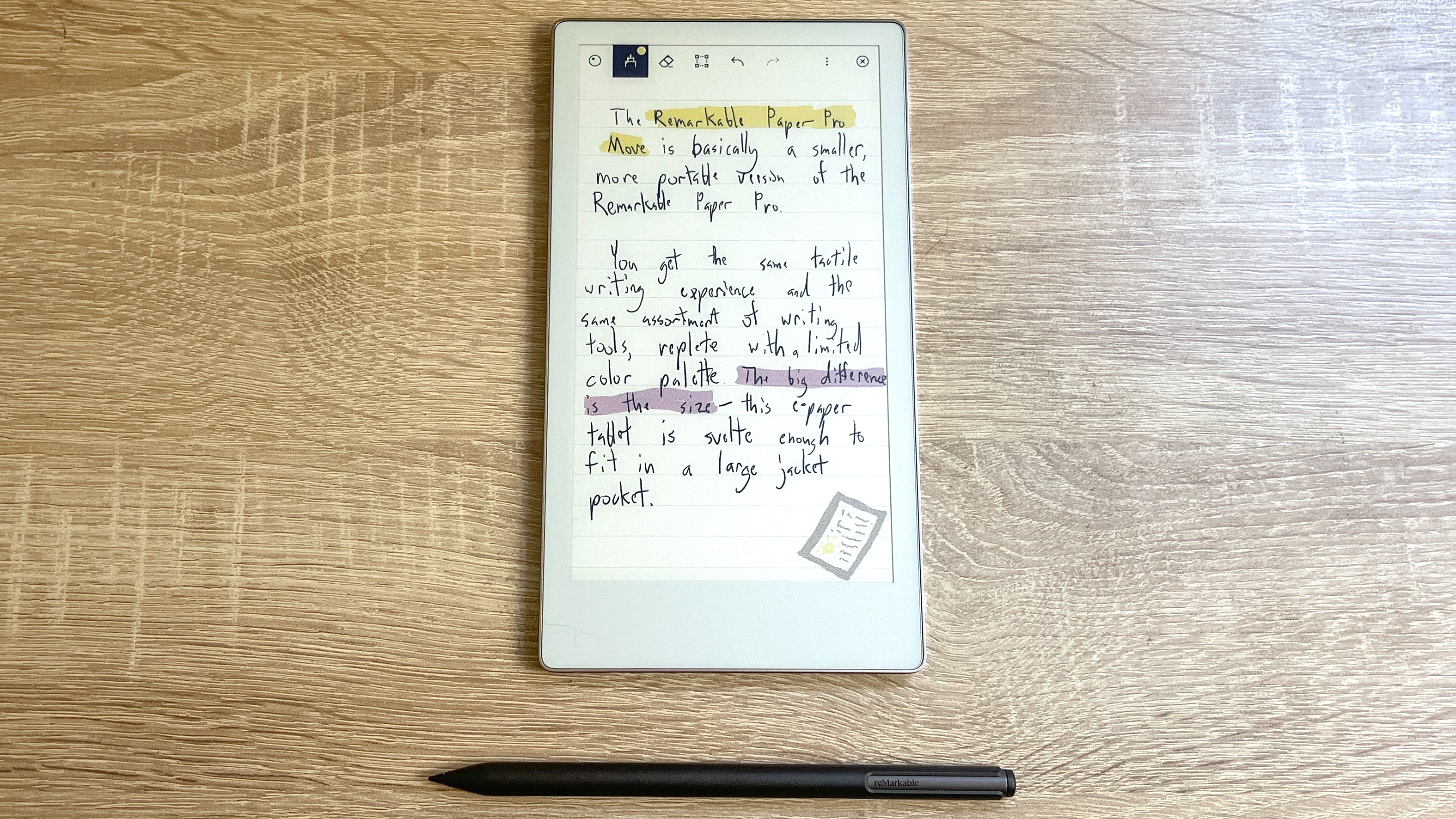

ReMarkable Paper Pro Move review: E-paper in your pocket

By Alex Wawro Published

-

Best iPad deals for September 2025

By Louis Ramirez Last updated

-

Apple Labor Day sales live — save big on MacBooks, iPads, AirPods and more ahead of Apple event

By Alyse Stanley Published

-

I Ditched My Nintendo Switch for a Week to Game on Apple Arcade — Here’s What Happened

By Stevie Bonifield Published

-

I Test iPads for a Living — 13 Labor Day Deals I’d Buy With My Own Money

By Tony Polanco Published

-

Amazon Slashes Kindle Prices Ahead of Labor Day — Save up to 25% on the Colorsoft, Scribe and More

By Olivia Halevy Published

-

M5 iPad Pro: Everything we know so far

By Jason England Last updated

-

VR & AR

-

-

Apple Vision Pro may get an all-new striking color option soon — here's what we know

By Darragh Murphy Published

-

Apple Vision Pro 2 could launch soon — here’s what a former Apple engineering manager says it must fix

By Jason England Published

-

Valve's 'Steam Frame' is looking more like a standalone VR headset to take on Meta Quest — what we know

By Darragh Murphy Published

-

Apple Vision Air expected to launch in 2027 — lighter and half the price of Vision Pro

By Darragh Murphy Published

-

Samsung's VR Headset Tipped To Cost Nearly $2k, Still Less Than The Apple Vision Pro

By Scott Younker Published

-

Meta 'Hypernova' smart glasses will reportedly be revealed next month — and they're cheaper than we thought

By Darragh Murphy Last updated

-

Apple Vision Pro is finally getting an upgrade — here’s what we know

By Jason England Published

-

I used a Meta Quest 3 for work so you don't have to — and there's one huge problem nobody talks about

By Darragh Murphy Published

-

I burn kitchens down IRL, but this Meta Quest VR app taught me how to cook

By Kimberly Gedeon Published

-

More about Computing

-

-

Macs under attack from ‘cracked’ apps spreading dangerous info-stealing malware — don’t fall for this

By Anthony Spadafora Last updated

-

Proton VPN sign-ups in Nepal rocket to 8,000% over the baseline in response to social media ban

By George Phillips Published

-

M5 iPad Pro launch at iPhone 17 event now looks likely — what we know

By Darragh Murphy Published

-