What is Venmo? Everything you need to know

Here’s everything you need to know about Venmo, including how it works, customer service, fees, limits, cards, businesses and more

Here at Tom’s Guide our expert editors are committed to bringing you the best news, reviews and guides to help you stay informed and ahead of the curve!

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Daily (Mon-Sun)

Tom's Guide Daily

Sign up to get the latest updates on all of your favorite content! From cutting-edge tech news and the hottest streaming buzz to unbeatable deals on the best products and in-depth reviews, we’ve got you covered.

Weekly on Thursday

Tom's AI Guide

Be AI savvy with your weekly newsletter summing up all the biggest AI news you need to know. Plus, analysis from our AI editor and tips on how to use the latest AI tools!

Weekly on Friday

Tom's iGuide

Unlock the vast world of Apple news straight to your inbox. With coverage on everything from exciting product launches to essential software updates, this is your go-to source for the latest updates on all the best Apple content.

Weekly on Monday

Tom's Streaming Guide

Our weekly newsletter is expertly crafted to immerse you in the world of streaming. Stay updated on the latest releases and our top recommendations across your favorite streaming platforms.

Join the club

Get full access to premium articles, exclusive features and a growing list of member rewards.

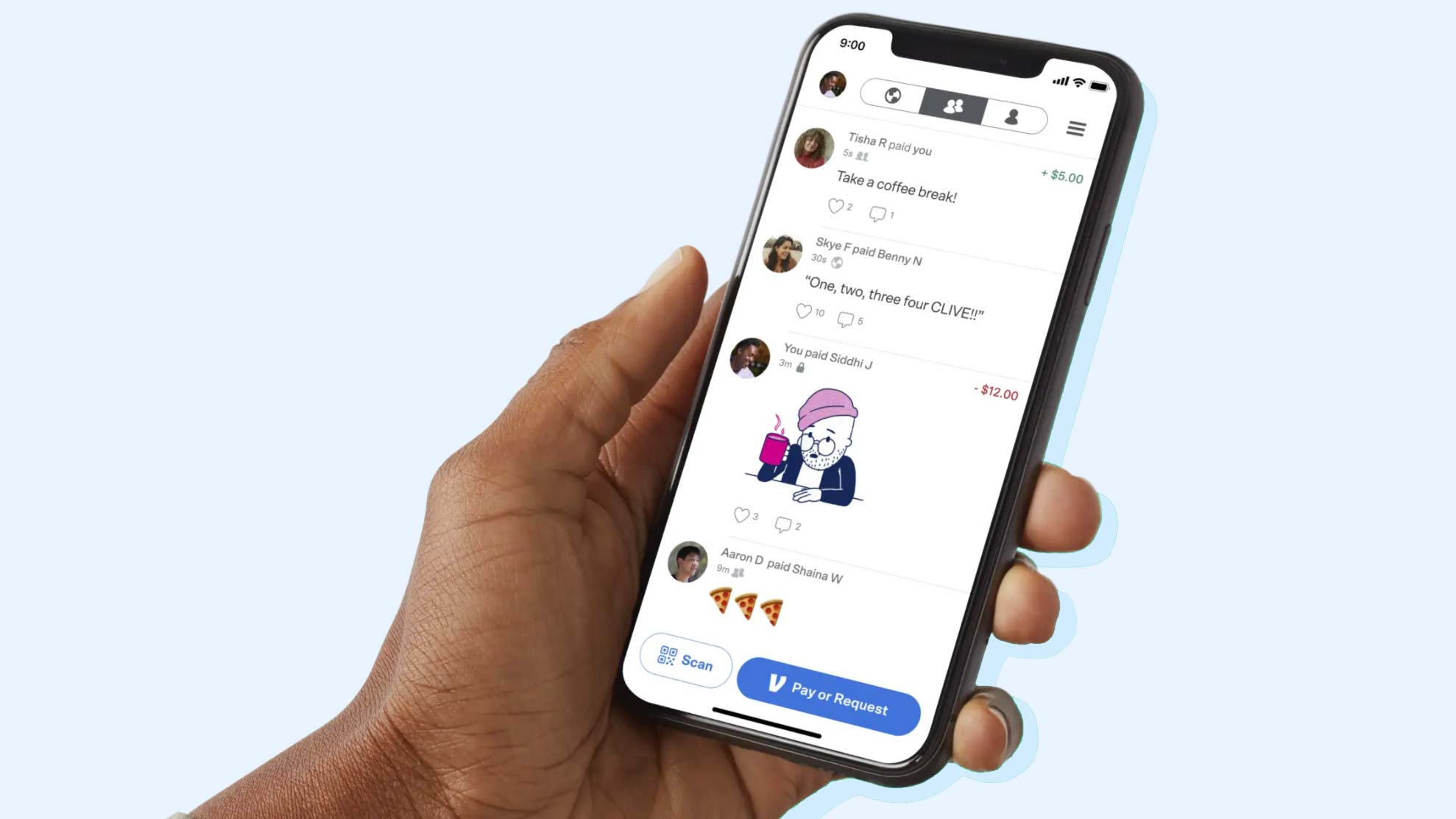

Venmo began as an app that allows you to pay and request money from friends, and while it’s still the simplest and most popular way to split cab fare, Venmo has grown into a financial platform that may be all you need in addition to a traditional bank account.

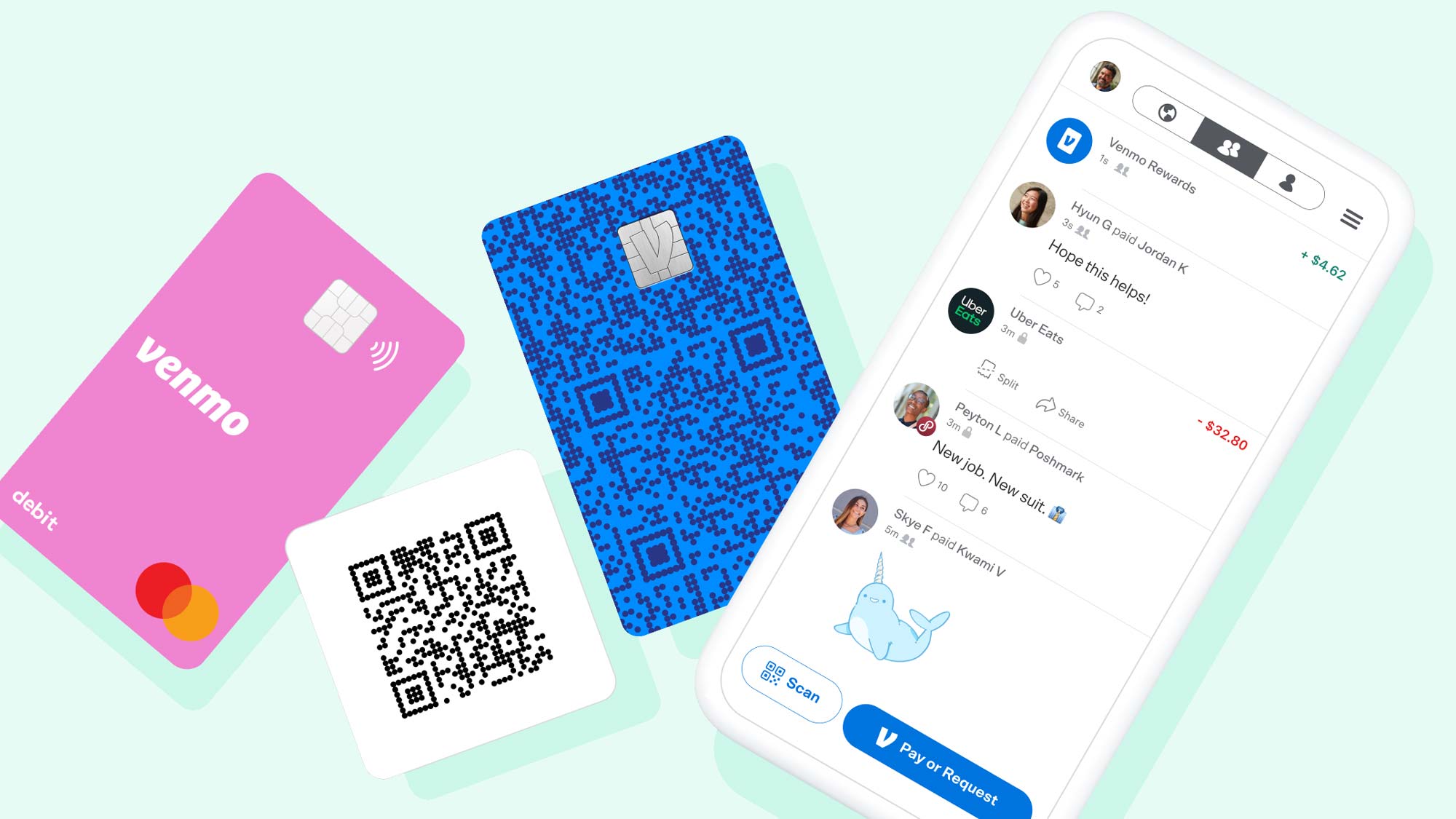

From 2021 to 2022, Venmo’s user base grew from just over 60 million users to more than 83 million—and those users were given a plethora of new ways to incorporate Venmo into their daily lives. You can get a Venmo Debit Card, a Venmo Credit Card, and get cash from your Venmo account at an ATM. You can use Venmo to checkout online at Amazon and any website that takes PayPal (which acquired Venmo in 2013) or IRL at CVS Pharmacies and elsewhere with a QR code. You can cash a check at home and even buy and sell crypto, all using the Venmo app.

Despite all the new ways that Venmo has made it easier to access and manage your money the past year or two, the app is still super simple to use. It’s still social — Venmo features a stream showing everyone’s transactions — and still fun, with the use of emojis to indicate what a payment is for.

From how to open a Venmo account to how to use the app to how the Venmo Credit Card compares to others to how Venmo is different from its sister PayPal, here’s everything you need to know if you’ve ever wondered what is Venmo.

- Best budgeting apps to get your finances in shape

- See the best tax software

What is Venmo?

Venmo is a mobile payment service that provides a way to pay friends and others when you don’t want to deal with cash. Venmo account holders can transfer funds to other Venmo account holders quickly and easily through a mobile app.

Venmo is also a way to pay for things online at authorized websites or in person with a Venmo Debit Card or new Venmo Credit Card.

How does Venmo work?

To use Venmo, you must first set up an account, which you can do by downloading the Venmo mobile app (available for iOS and Android) or at venmo.com. In addition to the usual name, address, and phone info, you will be asked to enter your bank account information. You must link a bank account to your Venmo account in order to use Venmo. (Note: Venmo is only available in the United States and only compatible with U.S.-based banks.)

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

Once you are signed up, it’s fast and easy to pay someone or request money from someone: Using the app (you can’t pay or request money through the website), find the Pay or Request button on the home screen—it will either say “Pay or Request,” or it will look like a pencil and a square. You then enter as many people — by username, phone number, or email — as you’d like to pay or charge, the amount, and a note. Emojis will pop up as you type certain words in your note, and you can choose to use them or not.

For more detailed instructions, please see our guide on how to use Venmo.

All Venmo users are also assigned a personal QR code, and you can scan someone else’s to find them or show yours to a person or merchant to be scanned. However you’ve entered the info, once you’re ready to make the transaction, tap “Request” or “Pay” depending on the action you want to take. If you are paying someone, they will receive an email to click on to accept the payment, and then you will receive an email confirmation.

If you are requesting money, the other person will receive an email for the request, and you’ll receive an email notifying you that you’ve been paid. If you are making a payment and don’t have enough money in your Venmo account, Venmo will automatically take the difference from your linked bank account. On the other hand, if you have a lot of money in your Venmo account and want to transfer it to your bank account, on the app, simply go to the menu and click on “Transfer balance.” On venmo.com, click on “Transfer money” on the homepage.

What are the fees for using Venmo?

Venmo costs nothing to set up, nothing to send or receive money, and there are no monthly fees. So how does Venmo make money, you ask? Well, it didn’t for a long time. But Venmo is facilitating more and more transactions between its users and businesses, and when it does that, it charges the business a small percentage of the sale, similar to a credit card company. This is how Venmo makes most of its money.

There is also a lot of potential money to be made using the data Venmo collects, though that has yet to be sorted out. Note that there are, in fact, some fees, but they are easily avoidable. For example, there’s a 3% fee for sending money using a linked credit card and a 1% (max $10) fee for moving money between your bank account and your Venmo account instantly (it normally takes one to three days).

How do you reach Venmo customer service?

Accidentally pay the wrong person and they kept the money, or need help with something else? Venmo does not have a general customer service phone number, but there are a few ways to reach them. Which route to go depends in part on the topic of your question.

- You can send a message about anything to support@venmo.com or by filling out this contact form, which can be found on the app by opening the menu and clicking Get Help and then Contact Us. To get to the form on venmo.com, click on Help and then click on Contact Us at the bottom of the page.

- You can chat about any topic in the Venmo mobile app (M-F, 7:00am-1:00am EST; and Sat-Sun, 9:00am-11:00pm EST). To start a chat, from the menu, click on Get Help → Contact Us. Note there is no chat function on venmo.com.

- For questions related to the Venmo Mastercard Debit Card, send a message through this contact form, email debitcardsupport@venmo.com, chat in the mobile app, or call the phone number on the back of your card.

- For questions related to the Venmo Credit Card (powered by Visa), call Synchrony Bank at the phone number listed on the back of your card. If you lose your card, call Synchrony Bank at 855-878-6462

If you don't want to use the service anymore, here are instructions on how to delete your Venmo account.

Is there a Venmo card?

As noted above, there are two Venmo cards, one debit and one credit. The Venmo Debit Card, powered by Mastercard, is connected to your Venmo account and allows you to shop at participating merchants. Like other debit cards, you can also use it at an ATM to get cash from your Venmo account. (Withdrawals are limited to the funds in your Venmo balance up to $400 daily, and there is a $2.50 fee for using an out-of-network ATM.)

The Venmo Credit Card is a Visa issued by Synchrony Bank that allows you to make contactless payments, split your credit card purchases with friends on Venmo, request new virtual card numbers and earn cash back on your purchases that goes straight into your Venmo account (3% cash back on your top spend category, 2% on the next, and 1% on everything else). The Venmo Credit Card has no annual fee. Note: Not all Venmo account holders are currently eligible to apply for the Venmo Credit Card — if you are eligible, you’ll see a Venmo Credit Card section at the top of the main menu of your Venmo app.)

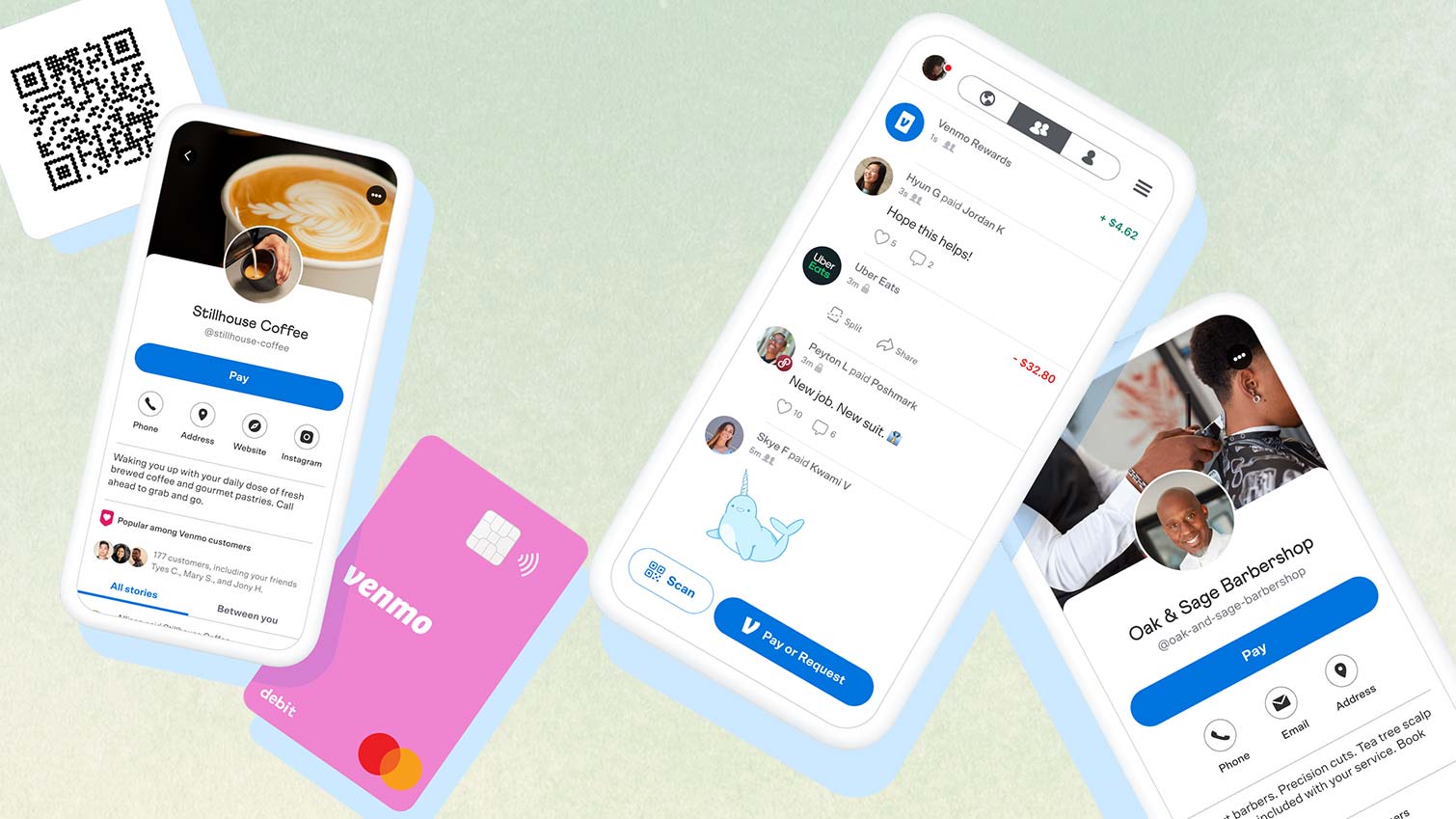

What is Venmo for Business and how does it work?

Venmo for Business allows business owners to accept Venmo payments in their apps, online, or in person with a unique business QR code. When a business sets up a Venmo Business Profile (free of charge; there is a 1.9 percent plus $0.10 fee per transaction), customers can pay them the same way they pay their friends on Venmo. It’s easy to set up a business profile under your existing Venmo login and seamlessly switch from your personal profile to your business profile in just a tap.

Venmo also offers Purchase Protection for both buyers and sellers on any transaction identified as being for goods and services. (Payment Protection is also available for payments to strangers for things like concert tickets or a couch, as long as the transaction is identified as being for goods and services.)

Here’s how to set up a Venmo business profile:

- In the Venmo app, tap your profile picture in the top left corner, then tap “Create a business profile.”

- Customize your profile, adding details that make you special.

- Tap “Publish.”

How do I buy and sell crypto on Venmo?

Venmo is a great platform to get your feet wet in crypto investing. They have solid educational resources (articles and videos) and keep it simple by only offering four different types of crypto to invest in: Bitcoin, Ethereum, Litecoin and Bitcoin Cash. What’s more, you can invest as little as $1, get price alerts to track your investment, and share your crypto investments in your Venmo feed.

Here’s how to buy crypto on Venmo:

- Open Venmo and tap the crypto icon in the menu at the bottom of the screen.

- Tap on the coin you’d like to purchase.

- Tap “Buy” (You’ll need to tap Agree to terms and conditions the first time)

- Enter the amount of money you’d like to invest (as little as $1)

- Tap “Review”

- Tap “Buy”

Is Venmo safe?

Yes. But you need to be vigilant. The transactions themselves are super safe: Like it’s competitors, Venmo uses encryption to help protect your account information and monitor your account activity to help identify unauthorized transactions. For another layer of security, you can add a PIN code to the app. There have been some Venmo-related scams, but a little common sense can avoid them: Don’t send money to strangers or for things that look like pyramid schemes.

For more, check out our guide on how to cancel a Venmo payment and how to undo a Venmo payment to the wrong user.

There is, however, a privacy concern regarding Venmo’s social feed: A lot of people make a fuss about the fact that Venmo’s default setting is Public, meaning your transactions are visible to everyone on the internet in Venmo’s emoji-filled stream. So if you’re not comfortable having the world know who you had dinner with last night, you must elect to make your transactions either private or visible only to friends.

What are the Venmo limits?

When you sign up for Venmo, your person-to-person sending limit is $299.99. Once Venmo has confirmed your identity, your weekly rolling person-to-person spending limit is $4,999.99. The overall combined spending limit for person-to-person, authorized merchant payments, and Venmo Debit Card purchases is $6,999.99 per week. Click here for details.

Venmo vs. PayPal vs. Zelle: What's the difference?

PayPal started out as an e-commerce payment platform and added person-to-person payments; Venmo started out as a person-to-person payment platform and added e-commerce capabilities. So you might suspect that each platform is stronger in its original purpose — and you’d be correct.

PayPal works internationally, has a better security track record and higher spending limits, whereas Venmo makes it simpler, faster, and more fun--emojis!--to pay and request money. Zelle, meanwhile, is the big banks’ answer to Venmo and PayPal. The main differences are that Zelle is a function within your bank’s app rather than its own app, the money transfers instantly as opposed to one to three days, and its security is as solid as the steel vaults in the banks behind it.

Jonathan Lesser is a writer, editor and communications professional living in Pelham, N.Y. Jonathan writes about personal finance and cryptocurrencies for Tom's Guide. He has worked at two Fortune 100 financial services companies and has been published in Men’s Health, Men’s Journal, Vibe, Travel + Leisure Golf and other publications.

Club Benefits

Club Benefits