Tom's Guide Verdict

Cash App Taxes has better integration with Cash App, but it remains the best free option for filing both federal and state taxes (in 40 states plus D.C.). It can handle a surprising variety of tax situations — including self-employment — but H&R Block and TurboTax offer vastly more support.

Pros

- +

Mobile-friendly filing

- +

Simplified, clean interface

- +

Free to file both federal and state taxes, even for self-employed

- +

Supports investments and cryptocurrency transactions

Cons

- -

No tax expert option

- -

Minimal online support and guidance

- -

Interface lacks refinement

Why you can trust Tom's Guide

Mobile app: Via Cash App

Online support: 9 a.m to 10 p.m. CST

Phone support: None

Tax pro assistance: None

Cash App Taxes is Credit Karma Tax reincarnate. Now in its second year as part of Cash App, Cash App Taxes gets a few new features, it looks and feels largely the same as compared with previous years. It remains free, and a contender for best tax software. However, it still falls short of paid competitors, some of which charge nominal fees to get a greater breadth of support.

Last tax season, Cash App Taxes was too new to the Cash App (owned by Block) family to reflect integration with Cash App or Block’s Square services. That changes this year, with Cash App integrations for crypto transactions and receiving refunds, as well as direct W-2 imports from Square Payroll. The service still has its long-time minimalist, mobile-friendly design — plus now, you can use Cash App itself to do your taxes on your phone. Read the rest of our Cash App Taxes review to see if this free service is enough, or if it’s worth paying a little extra for more assistance.

Editor’s note: This is a review of Cash App Taxes 2022, which covers the 2022 tax filing year.

Cash App Taxes 2022 review: Cost

Cash App Taxes is free to use, and free to file most any federal return. Not every scenario is covered (for example, the service targets single-state residency returns and lacks support for several scenarios), but it is completely free.

Cash App Taxes 2022 review: State filing

As with your federal return, state tax e-file is free for one state with Cash App Taxes, but the service doesn’t support multiple states, and it doesn’t support part-year or non resident state returns. State filing is available in 40 states plus Washington, D.C. You can only file a state return with Cash App Taxes if you file the federal return with the service. Most competitors charge between $35 and $60 per state at the Deluxe or higher tiers.

Cash App Taxes 2022 review: Features

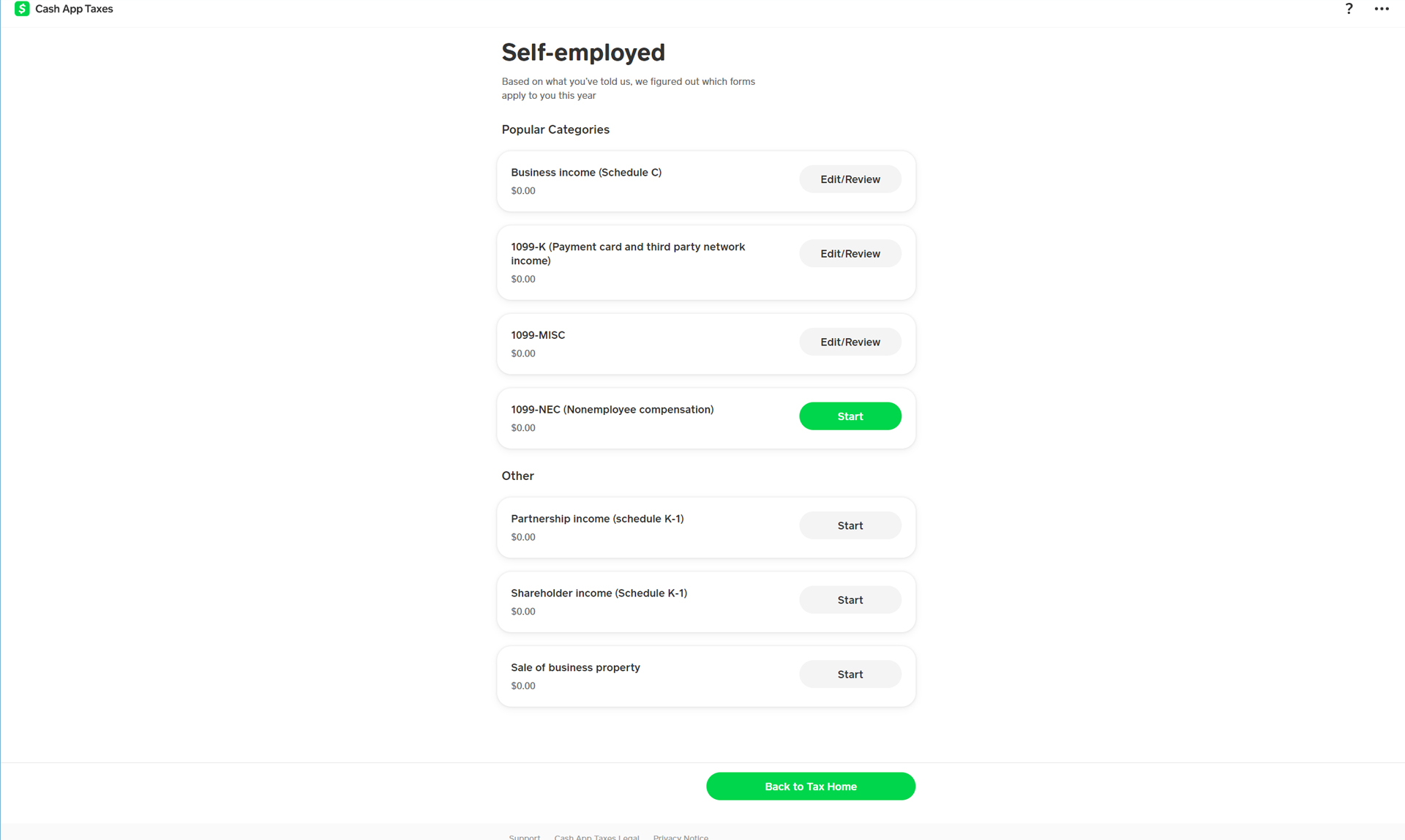

No upgrades, no upsells, no hidden costs here. Even gig workers with Schedule C deductions and self-employed or freelance income can file without paying extra. So too can S-corporations and partnerships. And crypto investors. However, the service can't handle estates and trusts, and it can't handle part-year or nonresident state returns (but it can handle multiple W-2s).

When you’re done with your return, you can export a PDF copy of your taxes for your offline records.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

Cash App integration remains minimal, but is a bit stronger now . You can have your refund redeposited into your Cash App account, without requiring a Cash Card first. And if you use Cash App for your crypto transactions, you can use Cash App’s partnership with TaxBit to generate the necessary tax documents (more on that later).

Cash App Taxes 2022 review: Available help

Cash App Taxes still lacks the detailed original tax code content of its competitors. Click the ? and the help pane comes out, with a separate tab on top for chat. Cash App lacks phone support. The chat support runs from 9 a.m to 10 p.m. CST. Help is via a form on Cash App’s support page. With no upgrades available, that means no upsells — and also no avenue for help from tax experts, as found in the four paid services and one competing free service in our best tax software buying guide.

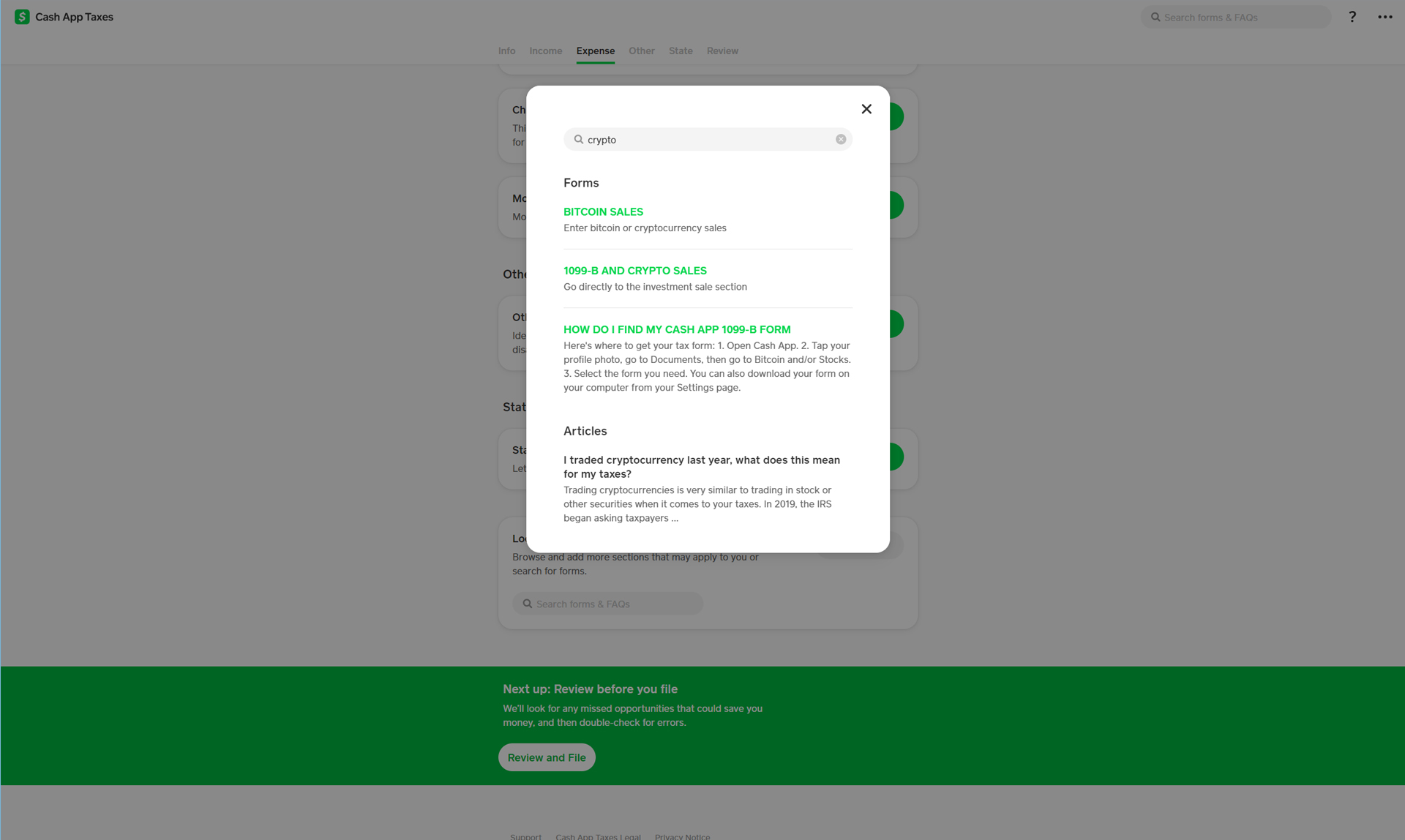

Cash App Taxes’ help interface remains a fractured affair. The help offered via the pop-up pane at right remains basic. When you click on help within the service, you get a pop-up box that has to be dismissed to resume working on the page. Many entries refer to IRS documents, and lack depth. In another example, a search for crypto yielded instructions on how to enter the data, but those instructions disappear as soon as you follow the link — which is actually for the Cash App on your phone, not on your computer.

Cash App Taxes 2022 review: Ease of use

One year on, and all mention of Credit Karma Tax is gone. Not surprising, though it’s possible someone might return this year. The visual interface is largely the same as before, with some subtle wording tweaks.

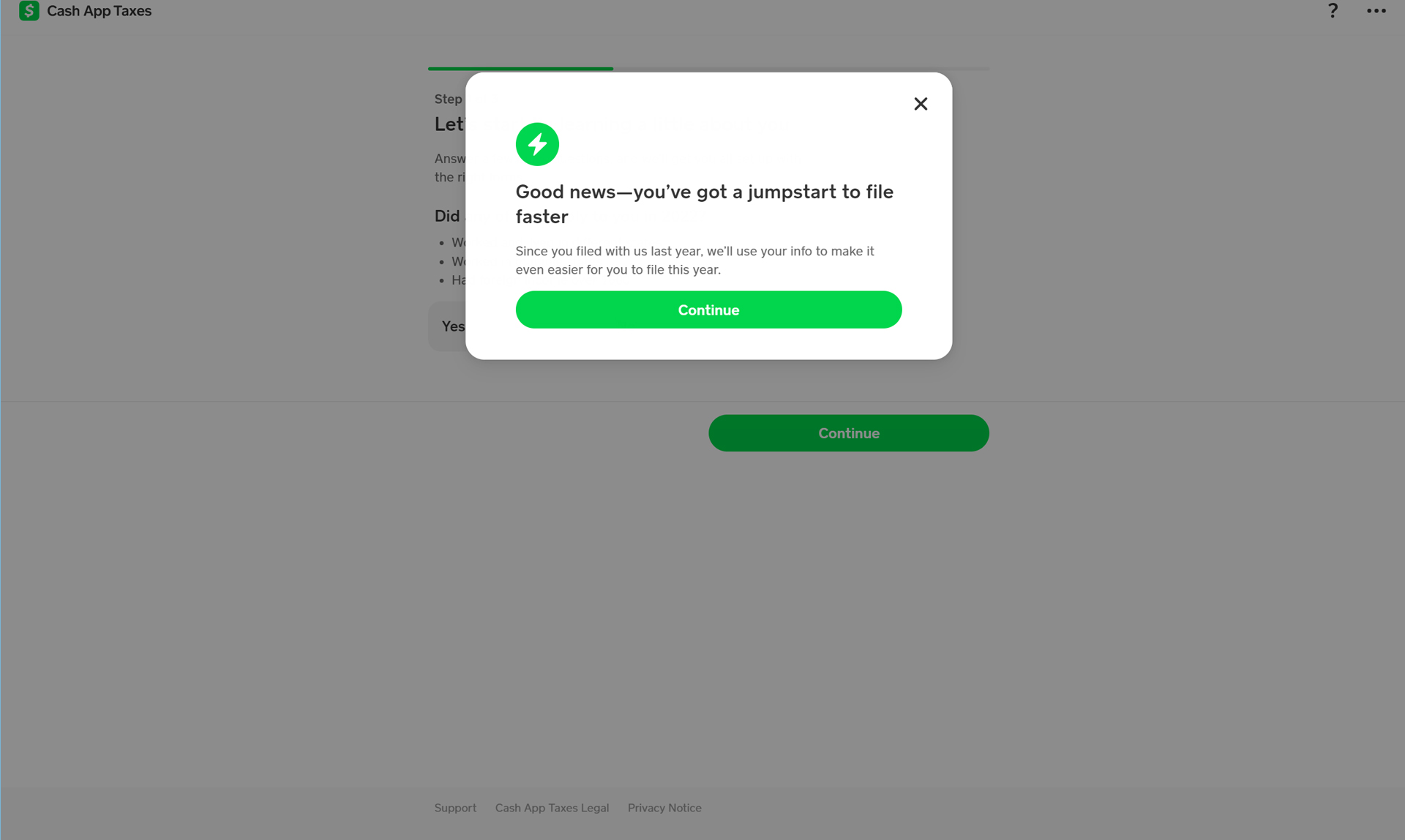

If you’re a returning user, Cash App Taxes now recognizes you from last tax season, and it jumpstarts the process of filling out data for 2022. It even keeps some of the selected on-boarding settings, but it wasn’t always clear where to go if your situation changed and this meant you might see options in the tax dashboard for forms that are no longer relevant.

Logging in on a computer is a two-step approach. Go to Cash.App/taxes on your computer, then it prompts you to log in to the Cash App on your phone. Once you’re verified on the phone, the web page on your computer jumps into the Cash App Taxes onboarding screens. If you don’t already have a Cash App account, you don’t need to add a debit card in order to use Cash App Taxes. That said, the need for a Cash App account by default means that you have to have an iOS or Android phone with Cash App installed in order to use Cash App Taxes.

Cash App Taxes’ sign in was much smoother than last year, which required a QR code.

If you’re new, you get three intake screens asking about your tax filing situation. In my case, as a returning user, the service had information already populated, and asked me to update my tax filing situation.

From there, it was straight to the dashboard. Everything runs down the center of the screen; at top sits a question mark for pulling up a help pane, and three dots for a menu with few options (including a link to the support center page, and a link to share the app with your friends). The initial intake screen asked for filing status, dependents, whether you received advance Child Tax Credit payments, and where. If you worked in more than one state, Cash App notifies you immediately that you can only use the service to file a federal return. And you can’t use the service if you made more than $600 in foreign income.

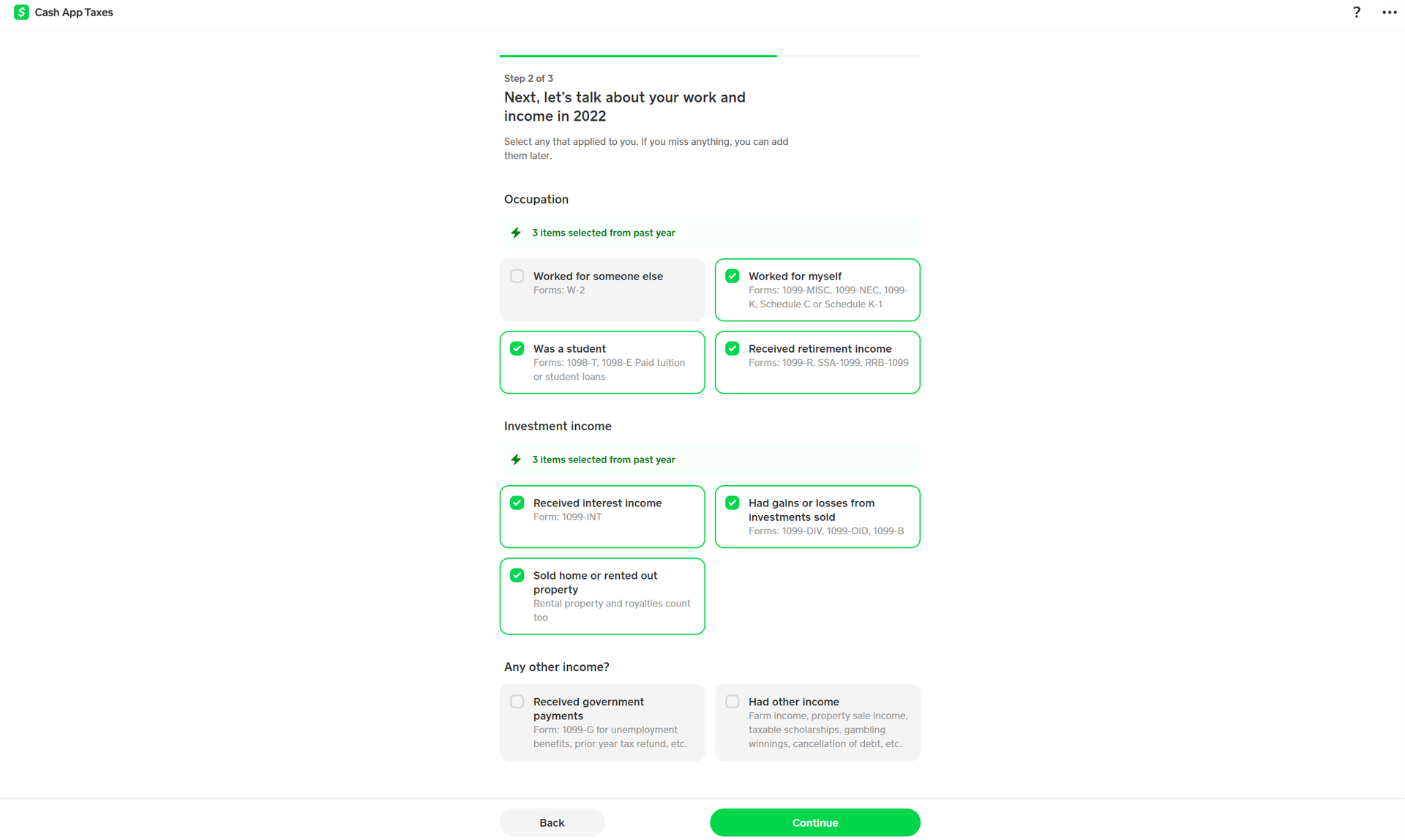

The next screen asks about your types of income, including self-employed and investment income, rental properties, and more. Finally, it asks some very clear questions around your personal expenses, medical expenses, and other expenses.

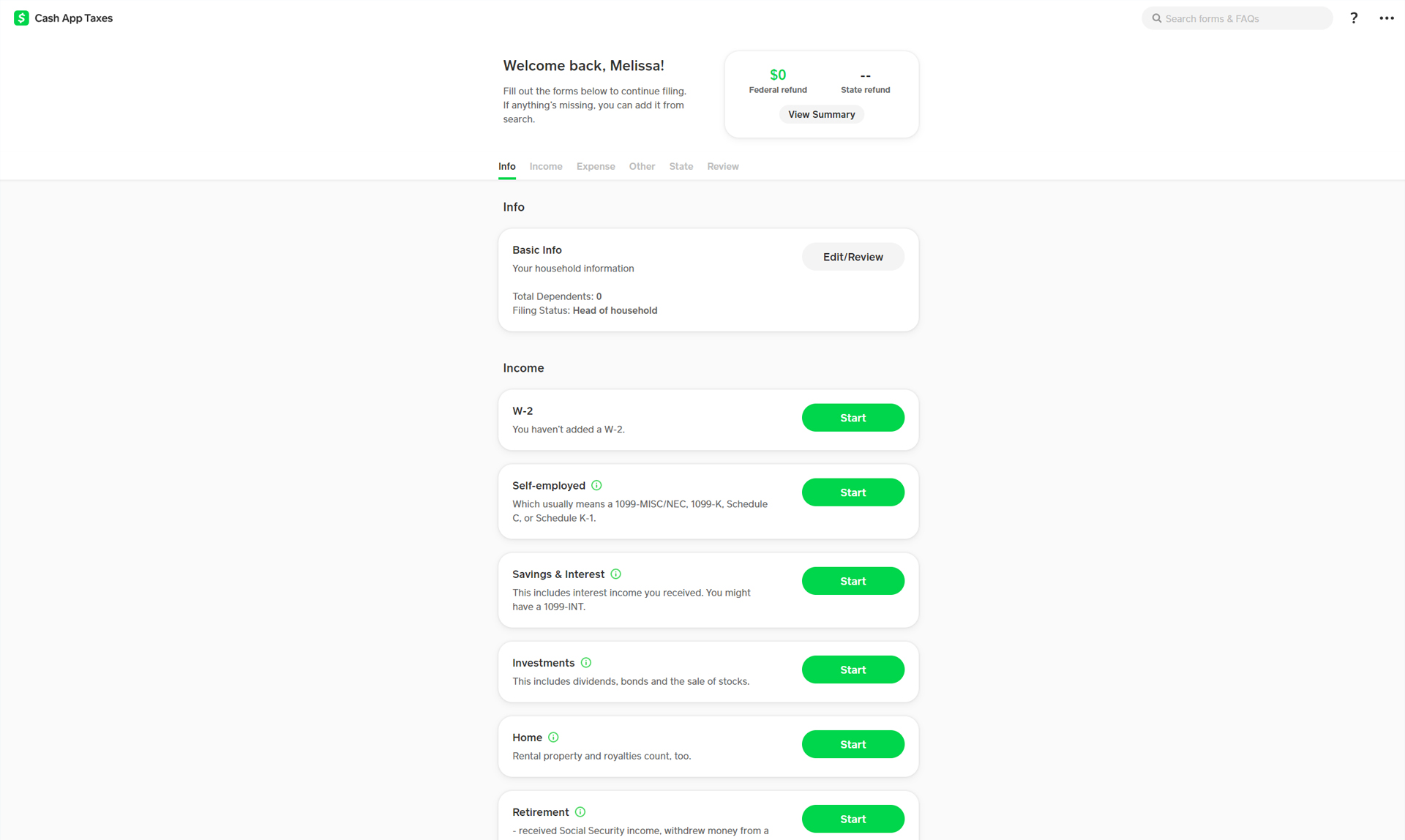

Cash App Taxes’ interface is built around a tax home page dashboard, with a center-weighted design and separate card-style modules that work well whether on a desktop or in a mobile environment. The interface’s design is responsive and minimalist, and well-suited for use on touchscreens, with finger-friendly, oblong buttons and differentiated text that is easy to read.

You’ll start the tax return process by reviewing the terms of service and authorizing Cash App Taxes to share information with parent company Block. Want to opt out? A tick box at the lower vaguely says Change Sync Settings; once there, you’ll find a way to skip sharing info and jump straight into the personal info screens of the return. The wording here could be clearer and more transparent. (As a returning user, this time the service didn’t prompt me to authorize Cash App Taxes to share my info with the government).

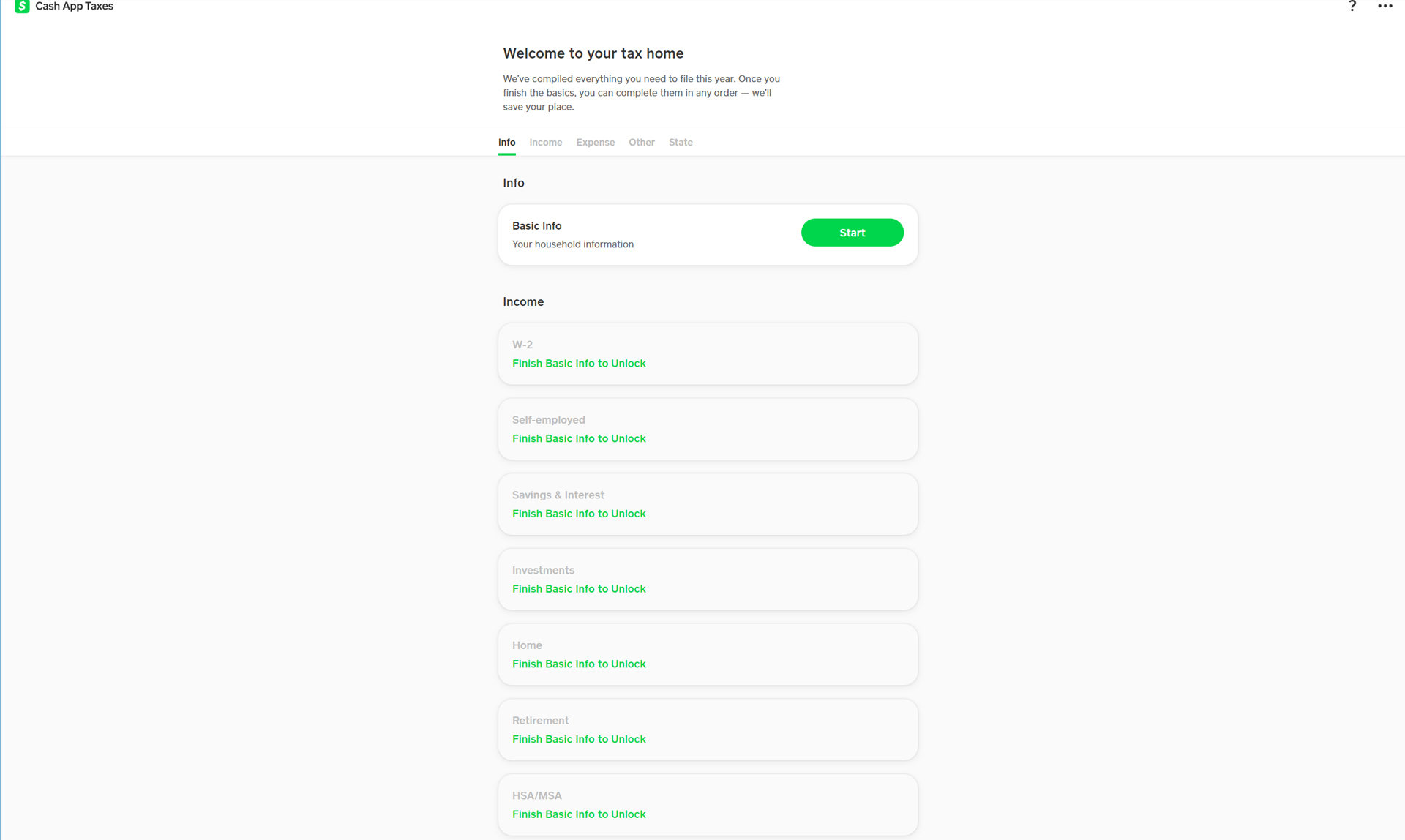

For new users, the service continues to offer a simple onboarding, in which you fill in the standard personal information fields: Name, birthday, address, phone number, social security number (required to proceed further). This information auto-populated from my Cash App account. basic info is confirmed, you can unlock the other modules and enter data in any order you wish.

From here, the overall interface is largely the same as last year. Along the top, Cash App Taxes groups data entry by five core tabs that are much more clear than previous versions: Info, Income, Expense, State and Review. These tabs merely jump to those sections lower in the page, but they provide at-a-glance clarity.

Cash App Taxes populates the cards representing various tax return topics based on what information you shared during the first three intake pages. A search bar at the bottom lets you look for something specific, and go back to cards you didn’t select to re-evaluate and it to your return. When you finish entering data in a given card, you return to the main dashboard, and you’ll see your progress towards refund for federal or state at the top of the screen. Some cards have the option of single-page or multi-page view, where the former puts all of the fields for that card on what page.

Some aspects of the interface remain woefully dated. For example, when entering a business description, Cash App Taxes still lacks numerous business category options in the drop-down, and the drop-down is the only way to complete the field. “Writer” became “Publishing Industries (except Internet)” — an oddity in the year 2023.

The super-simple, minimalist interface is helpful in some ways, and frustrating in others — same as in the previous iteration. For example, entering Schedule C business expenses is buried under business income, and is accessible through multiple clicks (with no single-page view). You can add aggregate expenses to a Schedule C form, although other expenses still require a lot of manual input.

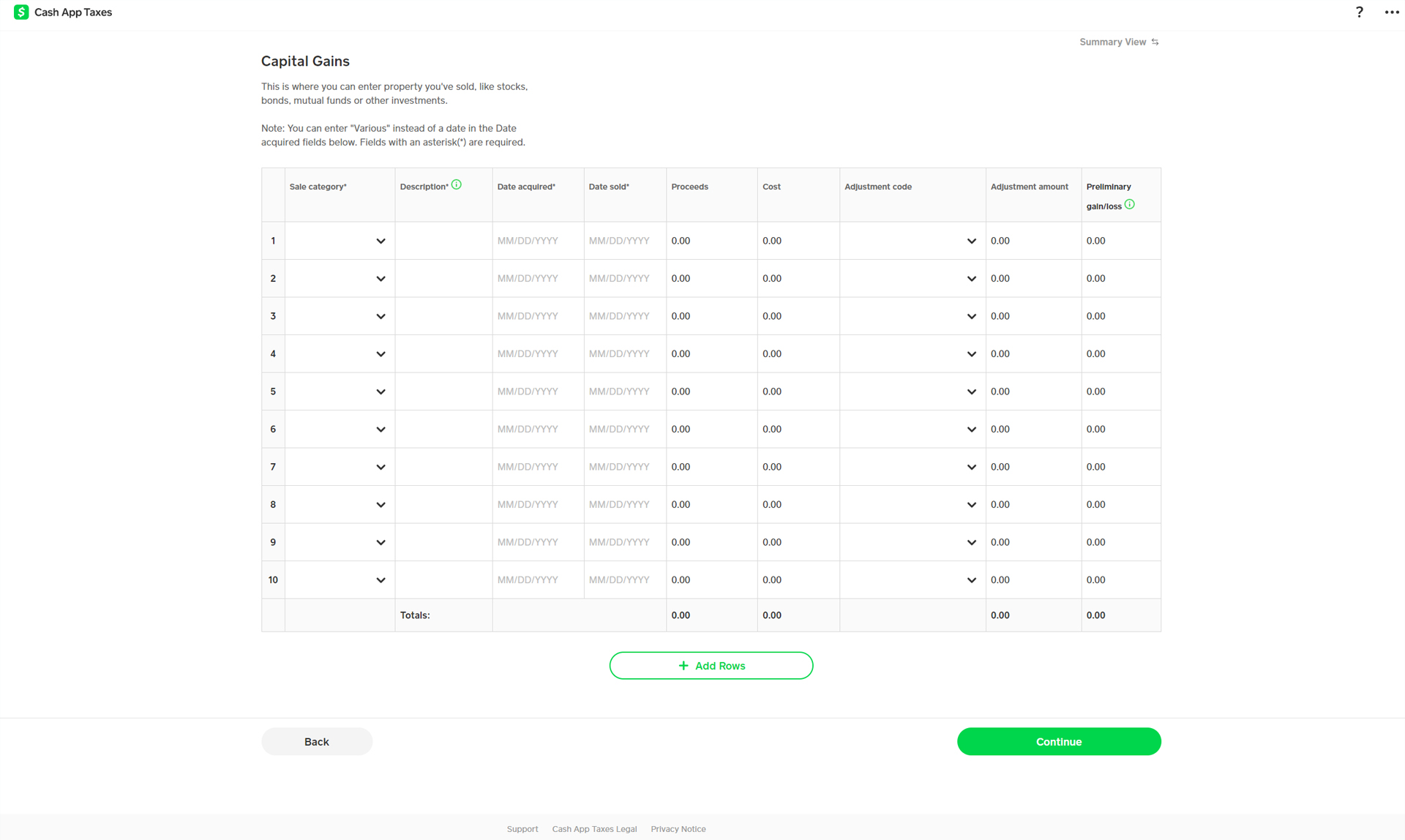

There are three ways to enter investments, including cryptocurrency. But even though you can enter data in spreadsheet style, you can’t import from a spreadsheet. You can also choose to enter a summary of transactions, to simplify data entry.

New this year is the ability to import data via TaxBit, but that process is convoluted. If you search under Cash App Taxes, you find more info about crypto than last year, but the instructions and implementation are convoluted, at best. For example, to find your Cash App 1099-B Form for Bitcoin or Stocks, you need to go to Cash App and find the forms by tapping your profile photo and then Documents. And the forms generated through TaxBit are only for Cash App transactions.

Bottom line: Expect little automation of any tasks within Cash App Taxes. The one exception: the ability to import a W-2 via photo (including automation of importing W-2s from Square Payroll).

One nice part of Cash App Taxes: Even though its design shields you from the actual tax forms themselves, you can view your tax return forms at any time during the process. The services from H&R Block and TurboTax don’t let you see the forms until after your return is submitted.

Cash App Taxes 2022 review: Verdict

Cash App Taxes is a reasonable free option for filing federal and state taxes. Its lack of finesse may not matter to you if you’re enticed by the word free. It can handle a surprising variety of tax situations, but when you run into tax questions, you’ll pay with your time to find answers elsewhere. And if you’re not a Cash App user, this service is less attractive since it requires a Cash App account.

If you’re likely to need assistance, or would like a tax pro to go over your documents, both H&R Block Deluxe and TurboTax Deluxe are better, if more expensive options. We also prefer their more intuitive menus. If free is your main criteria, FreeTaxUSA may provide a more full-featured experience with more options.

Melissa Perenson is a freelance writer. She has reviewed the best tax software for Tom's Guide for several years, and has also tested out fax software, among other things. She spent more than a decade at PC World and TechHive, and she has freelanced for numerous publications including Computer Shopper, TechRadar and Consumers Digest.