Tom's Guide Verdict

FreeTaxUSA lacks the niceties of more expensive services, but it’s a viable choice for federal taxes if you don’t mind an archaic interface, limited guidance and manual data entry.

Pros

- +

Free tier covers investments, cryptocurrency and self-employed filings

- +

Works on mobile and desktop browser

- +

Can handle multiple state returns

Cons

- -

Dated interface lacks visual design

- -

No clear info on tax expert review

- -

Must complete return in specified order

Why you can trust Tom's Guide

Mobile app: No; mobile web only

Online support: Email (free), live chat (deluxe)

Phone support: Weekdays and Saturday 9 a.m. to 11 p.m. ET

Tax pro assistance: With Pro support, $49.95 upgrade from free, includes live chat, screen share, and phone support

FreeTaxUSA is blunt about its primary attribute: This tax filing service is free for federal e-file, even for more complicated taxes like those who are self-employed. FreeTaxUSA 2022 Edition has some add-on charges, including for state filing, but as far as a free tax service goes, FreeTaxUSA offers far more than most competitors. Only Cash App Taxes might be an alternative to FreeTaxUSA, and even then, FreeTaxUSA has the advantage of having some level of both chat and phone support–and it can handle mutli-state returns.

Utah-based TaxHawk runs FreeTaxUSA, as well as an identical-looking web tax service under the TaxHawk moniker. While the underlying software is identical, and both share the same fee structures, clearly a name like FreeTaxUSA encapsulates the service’s aesthetic. Nothing fancy here. No onboarding questions, minimalist design, little help or guidance. Even the investment support is slim (you have to manually enter transaction information). But if you’re looking to save some money and don’t need a lot of hand-holding, FreeTaxUSA can get the job done. Among the best tax software, FreeTaxUSA is the best option if you don’t want to pay for the service.

Editor’s note: This is a review of FreeTaxUSA 2022, which covers the 2022 tax filing year.

FreeTaxUSA 2022 review: Cost

All three tiers — Basic, Premium and Self-Employed — are free for federal e-file. That’s it. What’s jarring is that the service lists tiers at all. Clearly, FreeTaxUSA does so as a marketing play to show how its free products stack up to competing services’ offerings.

Unlike Cash App Taxes, FreeTaxUSA has step-up pricing that adds additional features and support levels.

The Deluxe package at $7.99 gets you Priority Support to jump to the head of the chat queue for information on how to use the service, and for basic tax information (but not tax assistance). Deluxe includes unlimited amended returns and audit assistance should you need it. Unlimited amended returns are an extra $14.99 otherwise, making the Deluxe add-on a reasonable jump, even with the $1 price increase. A new Pro Support tier costs $49.99 to add live tax pro help with screen sharing and all features of Deluxe to the free version.

Other uncommon extras: $15.99 for a professionally bound tax return. You can also prepare prior year federal returns for free, or pay $17.99 for prior year State returns. If you want Audit Defense, that’s an extra $19.99 regardless of which package you have; a third-party (unnamed) handles the defense for FreeTaxUSA.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

FreeTaxUSA 2022 review: State filing

Like other services, FreeTaxUSA charges to file a state return (only Cash App is free to file a state return). Unlike competitors, FreeTaxUSA’s price is a bargain, just $14.99. FreeTaxUSA supports non-resident returns, so if you have a multi-state tax situation, you’re covered.

FreeTaxUSA 2022 review: Features

Unlike other tax software with stated tiers of service, it doesn’t matter the amount you spend — aside from the service and live help features. Your federal return is free at FreeTaxUSA.

You get a wide variety of forms as part of the service, supporting typical scenarios that will be faced by families, individuals, students, investors, sole proprietors and small businesses. Deluxe customers who spend the $7.99 extra also get unlimited amendments to returns.

FreeTaxUSA 2022 review: Available help

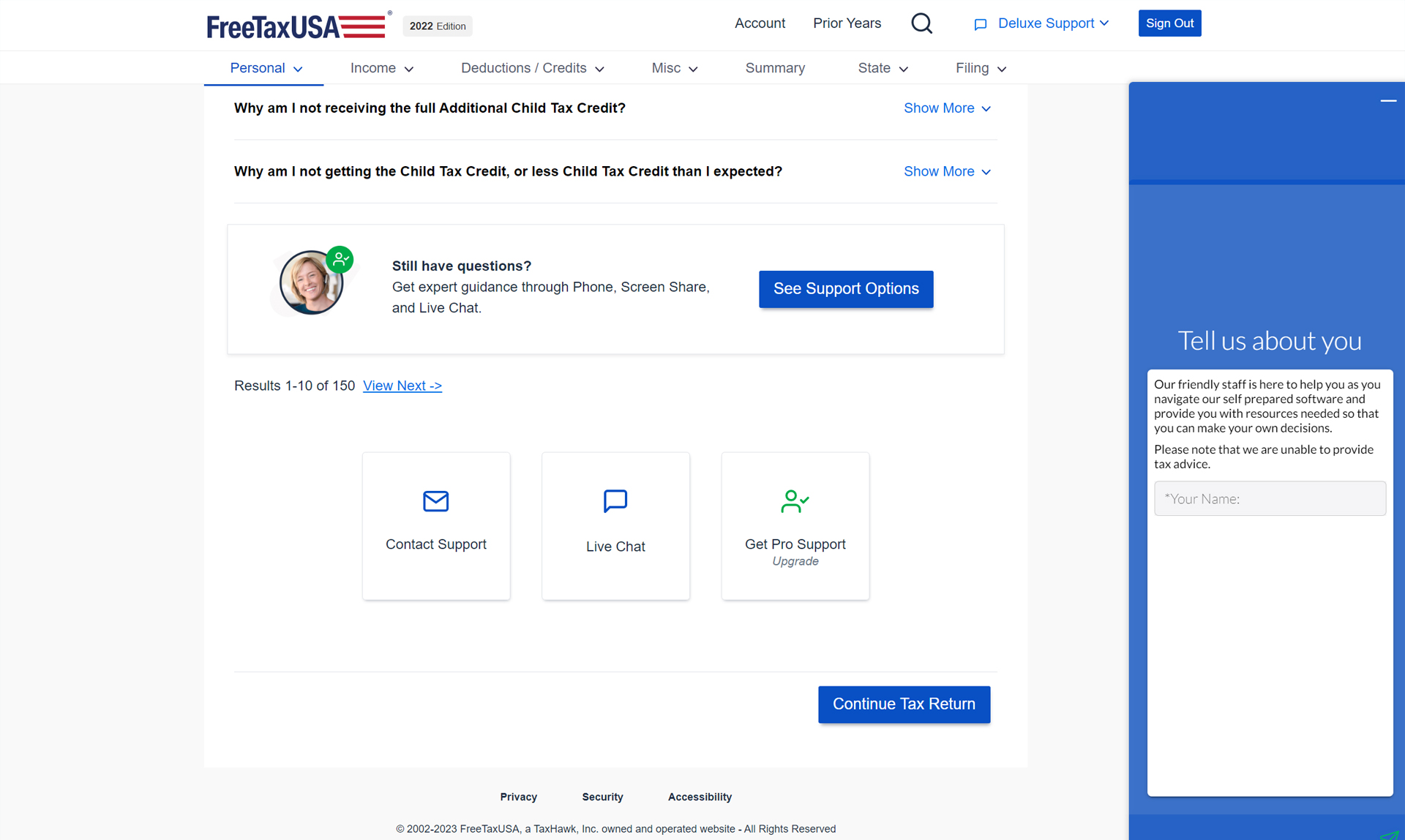

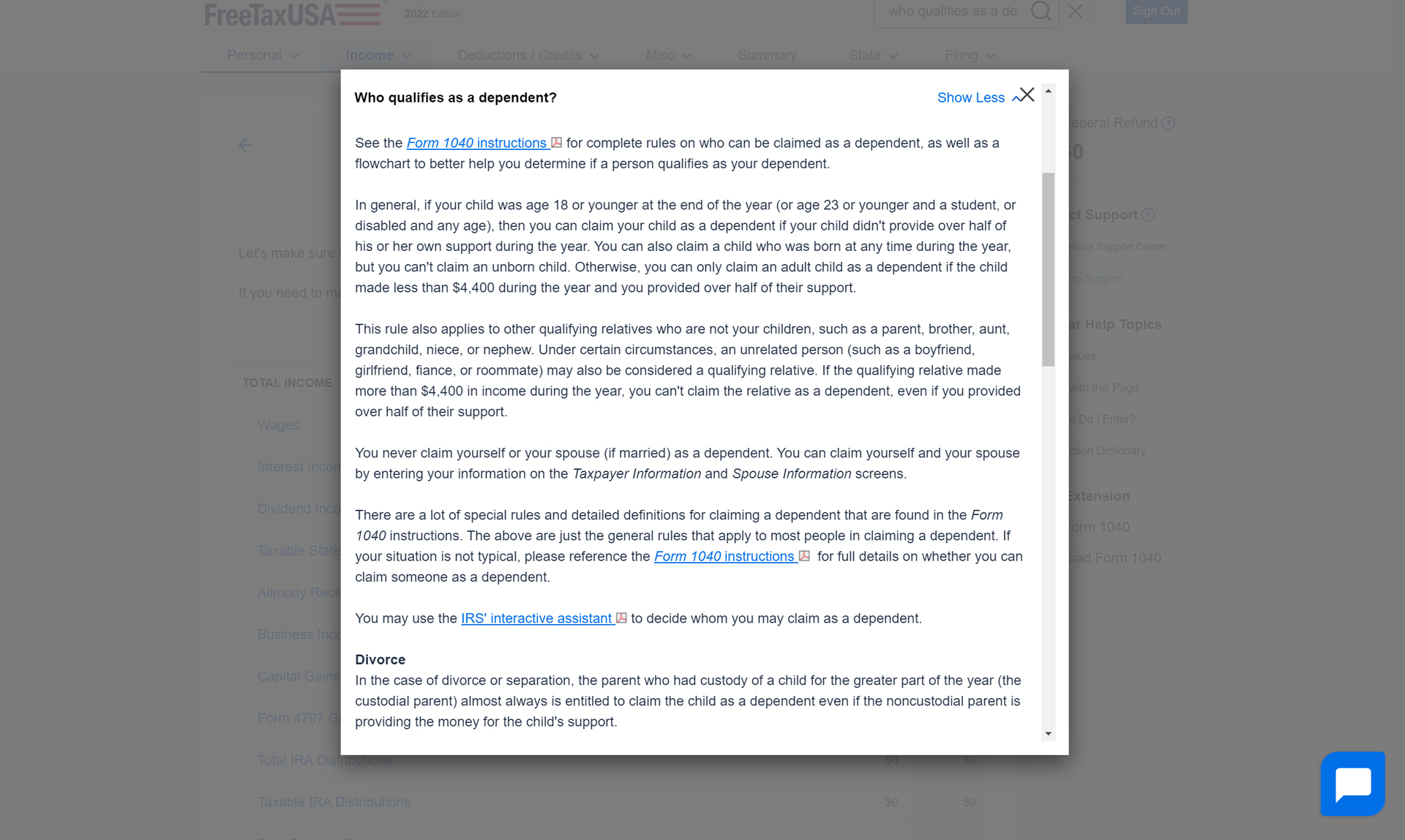

FreeTaxUSA’s online help is very basic, almost crude, in its design. For example, click on the Help with this Page or Deduction Dictionary links in the right-hand support pane, and you’ll get a pop-up of basic HTML hyperlink lists of supporting definitions. The content lacks the depth and original reporting of competing services, like TurboTax. For example, the service has minimal resources explaining the Child Tax Credit.

Last year, live chat assistance was available to everyone. Now, it’s an upgrade that requires signing up for the Deluxe tier. You can access live chat from the Support Center only by clicking a button that says Live Chat. The chat window is an overlay at right, and you can’t navigate back to another screen while that overlay is active. In the standard form, the help pane is underutilized, with too much unused prime real estate. At least the search tool at the top of the site does search for relevant help entries. And, the site does have several entries discussing cryptocurrency investments.

If you pay the $7.99 for the Deluxe package, you get to go to the head of the chat queue and get additional hours, Monday to Saturday, from 9 a.m. to 11 p.m. ET (the chat window conflicts with information elsewhere on the site, saying chat is available 8 a.m. to 7 p.m. MT Monday to Friday).

Plus, you need to be at the Deluxe level to sign up for the $49.99 “Pro Support,” which gives access to chat, screen sharing and phone calls with tax pros (CPAs and EAs).That’s more than twice its price last year, but it’s far less than the costs of adding live help at competitors like TurboTax. And, with this service tier, you can file unlimited amended returns, in the event you need to correct something down the road. Last year, Pro Support was new, with limited information and availability. Now, you can easily access the service via a link under the Support options on every page.

If you pay the $6.99 for the Deluxe package, you get to go to the head of the chat queue and get additional hours, Monday to Friday, from 8 a.m. to 11 p.m. ET. Plus, you’ll need to be at the Deluxe level to sign up for this year’s new “Pro Support,” which gives access to chat, screen sharing and phone calls with tax pros (CPAs and EAs).

FreeTaxUSA’s website lacked details about this feature when we tested the service, but according to a support chat only a “limited number” of customers will be able to upgrade. The service’s bargain price of $17.99 sounds good — maybe even too good — if you can get it, but the lack of information makes it impossible to draw any conclusions. We found one reference to this in the help, but never saw any mention of it beyond being told about it by a chat representative.

FreeTaxUSA 2022 review: Ease of use

Even though FreeTaxUSA lists multiple products by name under its menus, ultimately each gives you just one button — Start Free Return — to get going, and all lead to the same underlying service. Setting up an account is mostly standard fare, where you enter name, email address, username and password, then get an account verification code sent to your phone. The username part deviates from the norm, though, due to the company’s guidelines which don’t let you use your name or email as a username. The service is simple and straightforward, best for users who know what they’re doing. Presumably since FreeTaxUSA is free at all tiers, it lacks on-boarding questions of competitors like TurboTax and H&R Block.

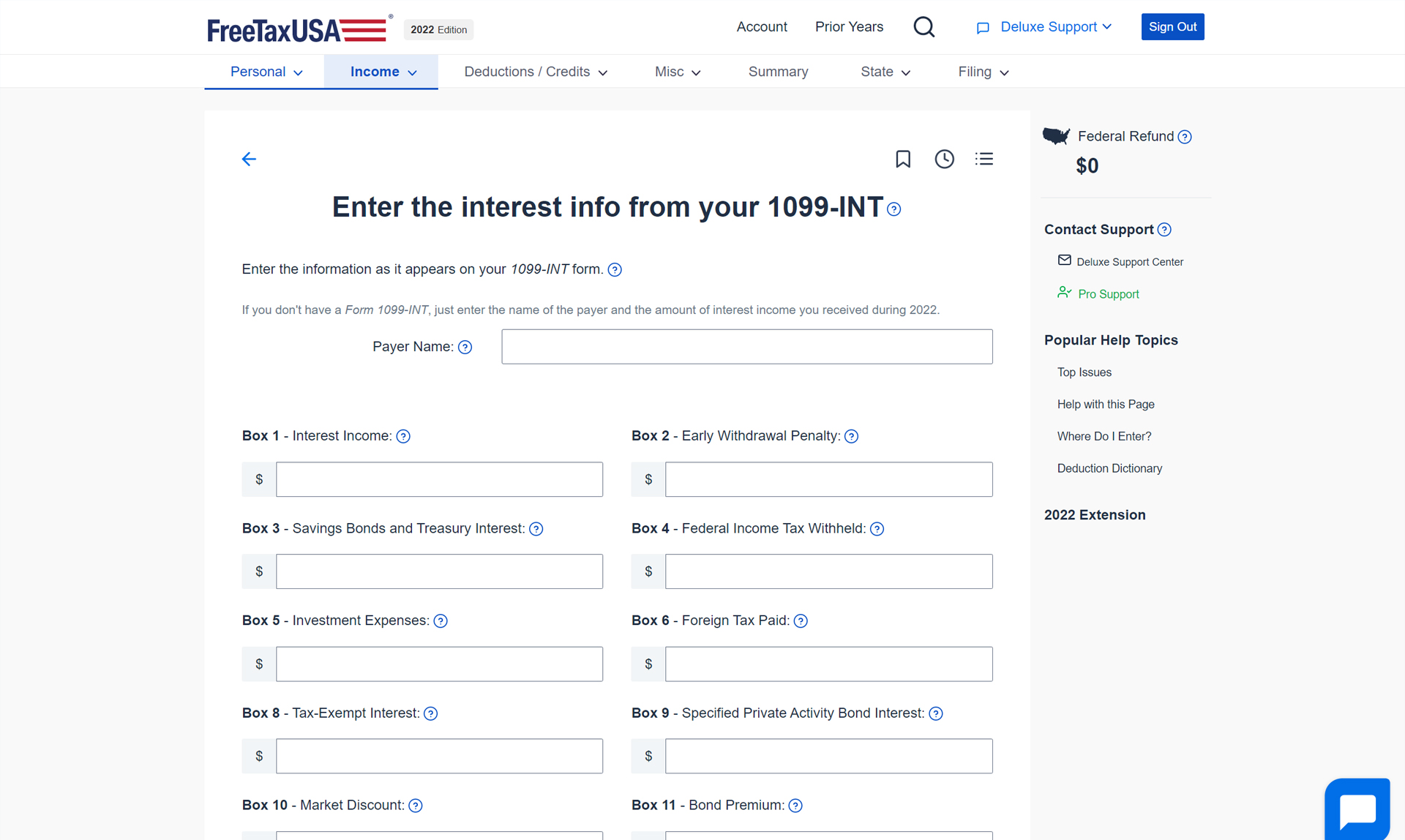

Once we entered our account, it was clear that this is a no-frills service, from a visual perspective. The screen’s layout is about as old-school as it gets, with the biggest variances being bold text and text size, but so much being … text. Even the color scheme is minimal, with a white center main panel to work in, a slightly gray surrounding, the occasional graphic and colored button, and menu tabs (so it’s clear which section you’re in). The page has responsive design, and is more visually appealing on mobile web, which is the only way to use the service on mobile since it lacks a dedicated app.

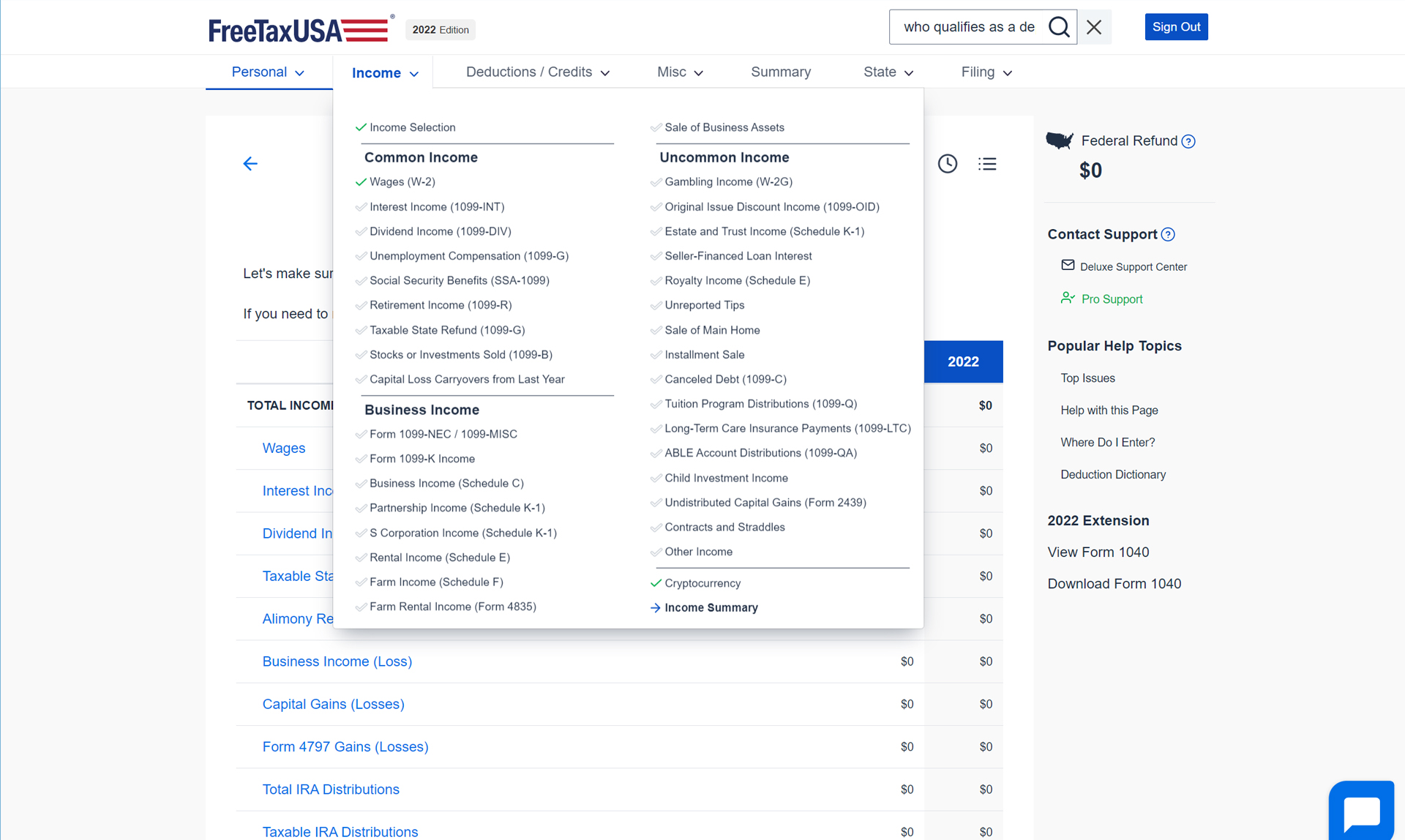

Along the top of the page are seven drop-down menus for navigating the different components of the return, but you can’t move among different areas of the return until you’ve filled out the screens in the order prescribed. This can get annoying if you’re trying to test out the product before committing your info, or trying to fill in what you have without having all of your documents on hand.

As a new person, to begin our 2022 tax return, we clicked on the option to import 2021 tax returns. We liked that, up front, FreeTaxUSA gave an option to file an extension, too. Many other services don’t list or offer extensions at all, or wait until it’s closer to the tax deadline to let you file an extension.

FreeTaxUSA lets you import PDF files from TurboTax, H&R Block Online, H&R Block Tax Software (self-prepared) — their wording, not what we see at H&R Block — and TaxAct. Anything else and you have to start from scratch.

We then entered personal information, including taxpayer specifics, filing status, and dependents. At this screen, FreeTaxUSA prompted for information related to the Child Tax Credit payments from 2022, although there is minimal help info surrounding what this all means.

As a returning user, much of the information above was populated already, and all we had to do was walk through the personal information to confirm the information already carried over from last year remains accurate.

In the summary screen you can add your IRS Identity Protection PIN, if you have one, and add an additional phone number to your account with FreeTaxUSA.

The next prompts are for income. Everything has to be entered manually; there’s no way to take a photo and have the info imported into the FreeTaxUSA system. Same for interest income and 1099 income, which can get tiresome fast if you have lots of accounts or clients.

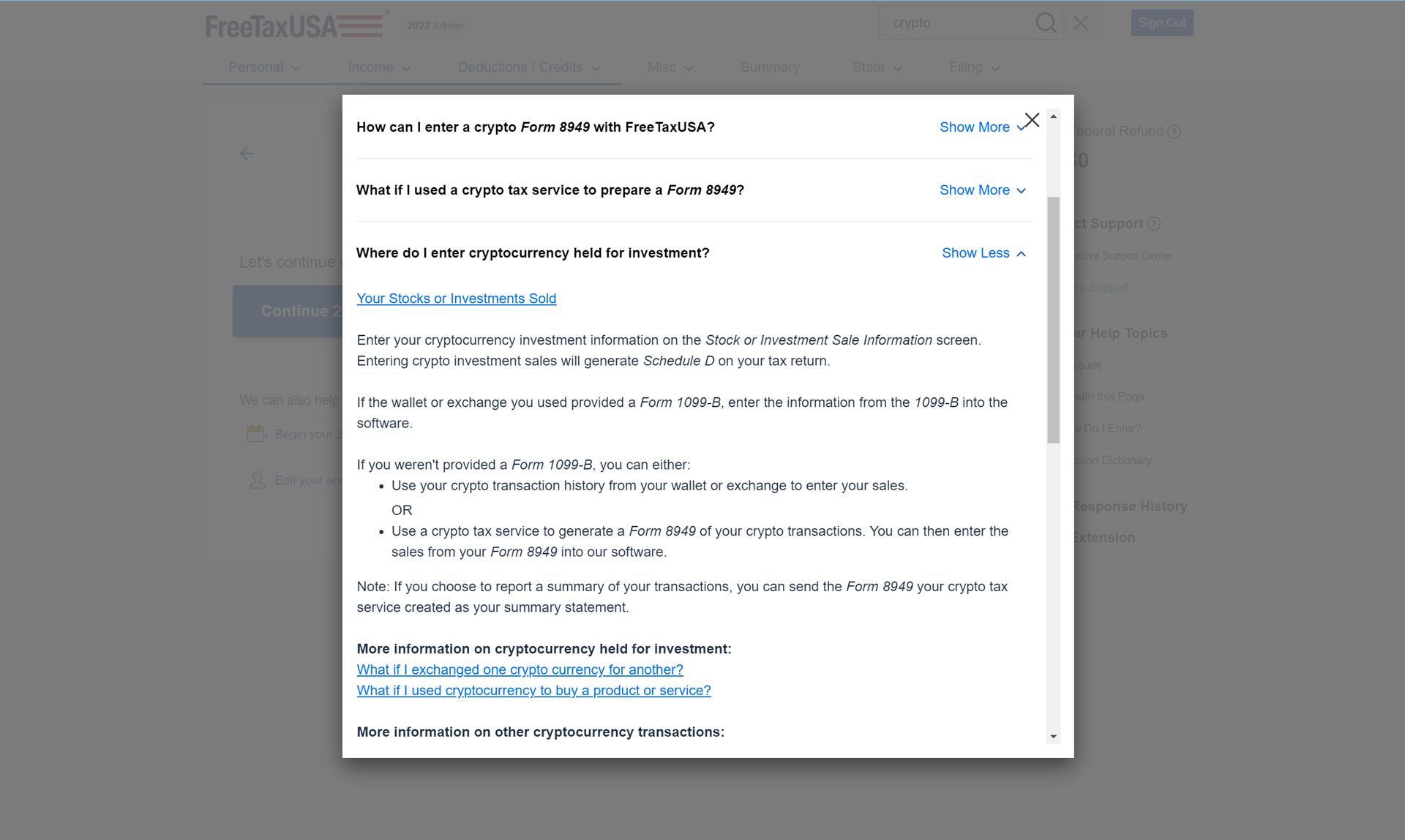

While there is no clear reference in the main income screen to cryptocurrency, FreeTaxUSA does have some help topics available, and the service reminds you after the main income entry screen to include cryptocurrency on your tax return. But that’s the extent of crypto guidance.

Elsewhere on the site, FreeTaxUSA guides you to use a crypto tax service to prepare a Form 8949, which you can then enter as a summary for your total long-term sales and short-term sales in the service, and then send your form separately to the IRS. Or, you can enter each row of crypto sales as a separate sale.

After income, this year you get an upsell splash screen to the $49.99 Pro service. A simple click moves you along if you’re not interested.

For all entries, you can download a PDF preview of the actual form, but this preview is watermarked and can’t be used for the IRS. Also, all pages have three navigation elements in the upper right corner: bookmark, history and topic list, each of which is a pop-up on the page. As with everything about FreeTaxUSA’s interface, the presentation is very OG web design, with basic HTML links and zero visual presentation. The topic list is the best way to navigate among what you’ve already done, even though the drop-down menus do show surprising detail, too.

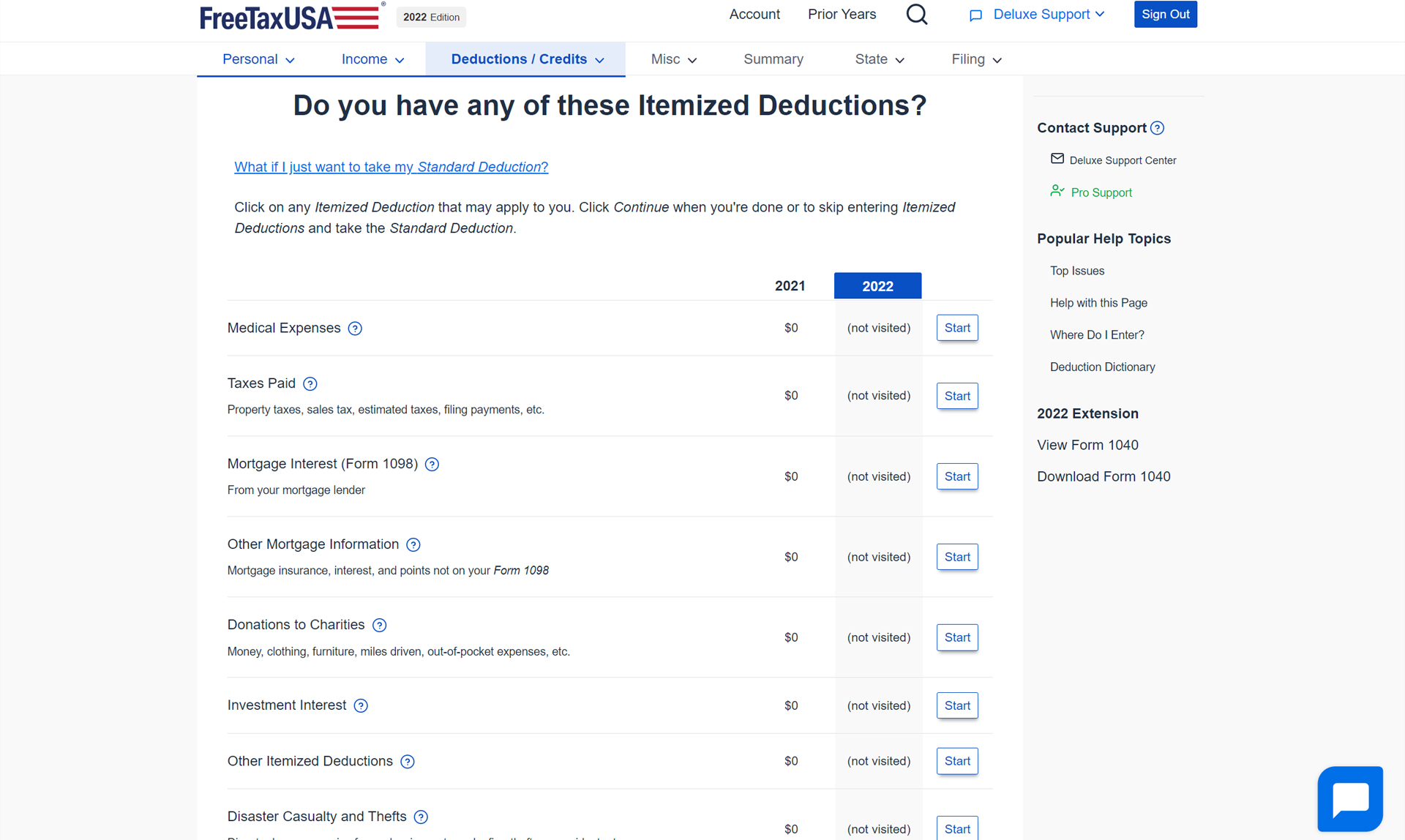

The deductions screens seem straightforward, and walk through many common, and uncommon, scenarios. Then you get to Miscellaneous Forms and Topics, for additional information, and finally a summary to review everything before moving on to your state taxes.

FreeTaxUSA has a certain simplicity about it, but it’s too simplified to the point of being annoying. Jumping around gets frustrating, and explanations lack the detail and guidance of competitors. If you need help with something in the free version, you have to first go to the support screen to get the chat overlay; and you can’t go back to where you were having problems while on the chat.

FreeTaxUSA 2022 review: Verdict

FreeTaxUSA 2022 Edition is free, and fairly comprehensive in what it covers. The simplified interface lacks the visual distinctions and details of competing products, including the free Cash App Taxes. And it lacks any photo imports, again something that Cash App Taxes has.

However FreeTaxUSA might be worth a look if you know you don't need much hand-holding with your taxes, and don’t mind the barebones interface. Intuit’s TurboTax Deluxe 2022 costs more, but we like it for its friendly interface and more robust data import tools and its direct handling of cryptocurrency and investment transactions.

Melissa Perenson is a freelance writer. She has reviewed the best tax software for Tom's Guide for several years, and has also tested out fax software, among other things. She spent more than a decade at PC World and TechHive, and she has freelanced for numerous publications including Computer Shopper, TechRadar and Consumers Digest.