Online Security

Latest about Online Security

-

-

This new Android banking trojan can automatically transfer money off your phone to hackers

By Anthony Spadafora Last updated

-

The best password managers in 2025

By Anthony Spadafora Last updated

-

Plex users need to change their passwords — there’s been another breach

By Amber Bouman Published

-

Macs under attack from ‘cracked’ apps spreading dangerous info-stealing malware — don’t fall for this

By Anthony Spadafora Last updated

-

7 steps to stay safe after receiving a data breach notification letter

By Amber Bouman Published

-

These iCloud Calendar invites look legitimate but are tricky phishing attacks — here’s how to tell

By Amber Bouman Published

-

ESET review

By John Brandon Published

-

Explore Online Security

Antivirus

-

-

ESET review

By John Brandon Published

-

The best Mac antivirus software in 2025: our top five picks

By James Rivington Published

-

The best Android antivirus apps in 2025: our top five picks

By James Rivington Published

-

The best antivirus software 2025: our top five picks

By James Rivington Published

-

I’m a security editor, and this is the antivirus I would buy with my own money

By Amber Bouman Published

-

Hurry to get the best Prime Day antivirus deals: 9 heavily discounted security suites to keep you safe online

By Amber Bouman Last updated

-

The best antivirus software 2025: Tested and reviewed

By Amber Bouman Last updated

-

Norton 360 Deluxe antivirus review

By John Brandon Published

-

The best Android antivirus apps in 2025

By Amber Bouman Last updated

-

Identity Theft Protection

-

-

The best identity theft protection services in 2025

By Anthony Spadafora Last updated

-

Over half a million people impacted by major data breach — full names, SSNs, financial data and more exposed

By Anthony Spadafora Published

-

What to do if you’ve been gift card scammed

By Amber Bouman Published

-

1.6 million hit in massive insurance data breach — full names, addresses, SSNs and more exposed

By Anthony Spadafora Published

-

Aura identity theft protection review

By Brian Nadel Last updated

-

AI-powered tax scams are here - how to stay safe from deepfakes, phishing and more this tax season

By Amber Bouman Published

-

Your Social Security number is a literal gold mine for scammers and identity thieves — here’s how to keep it safe

By John Brandon Published

-

Half a million teachers hit in major data breach with SSNs, financial data and more exposed — what to do now

By Anthony Spadafora Published

-

What is ExpressVPN's Identity Defender?

By Aleksandar Stevanović Published

-

Malware & Adware

-

-

This new Android banking trojan can automatically transfer money off your phone to hackers

By Anthony Spadafora Last updated

-

Macs under attack from ‘cracked’ apps spreading dangerous info-stealing malware — don’t fall for this

By Anthony Spadafora Last updated

-

Google wants to fight Android malware by making sideloading more difficult — here's how

By Amber Bouman Published

-

Dangerous Android banking trojan found lurking in malicious apps with 19 million installs — don’t fall for this

By Anthony Spadafora Published

-

Booking.com phishing scam is infecting users with malware by using lookalike URLs — don't fall for this

By Amber Bouman Published

-

This Android spyware is posing as an antivirus app to steal your photos and passwords — how to stay safe

By Scott Younker Published

-

200,000 passwords, credit card data and more stolen by this dangerous new malware — how to stay safe

By Anthony Spadafora Published

-

More than 250 malicious apps are spreading info-stealing malware on Android and iOS — delete these right now

By Anthony Spadafora Published

-

12 signs your phone has been hacked — and what to do next

By Amber Bouman Published

-

Parental Controls

-

-

How to track your kids screen time — and the best tools to do it

By Kaycee Hill Published

-

Apple just announced 5 big upgrades to protect your kids online — here's what's coming

By Philip Michaels Published

-

How to set up parental controls on Nintendo Switch 2

By Kaycee Hill Published

-

The best parental control apps for Android and iPhone 2025

By Anthony Spadafora Last updated

-

Get the most out of your new Xbox with a gaming VPN

By Olivia Powell Last updated

-

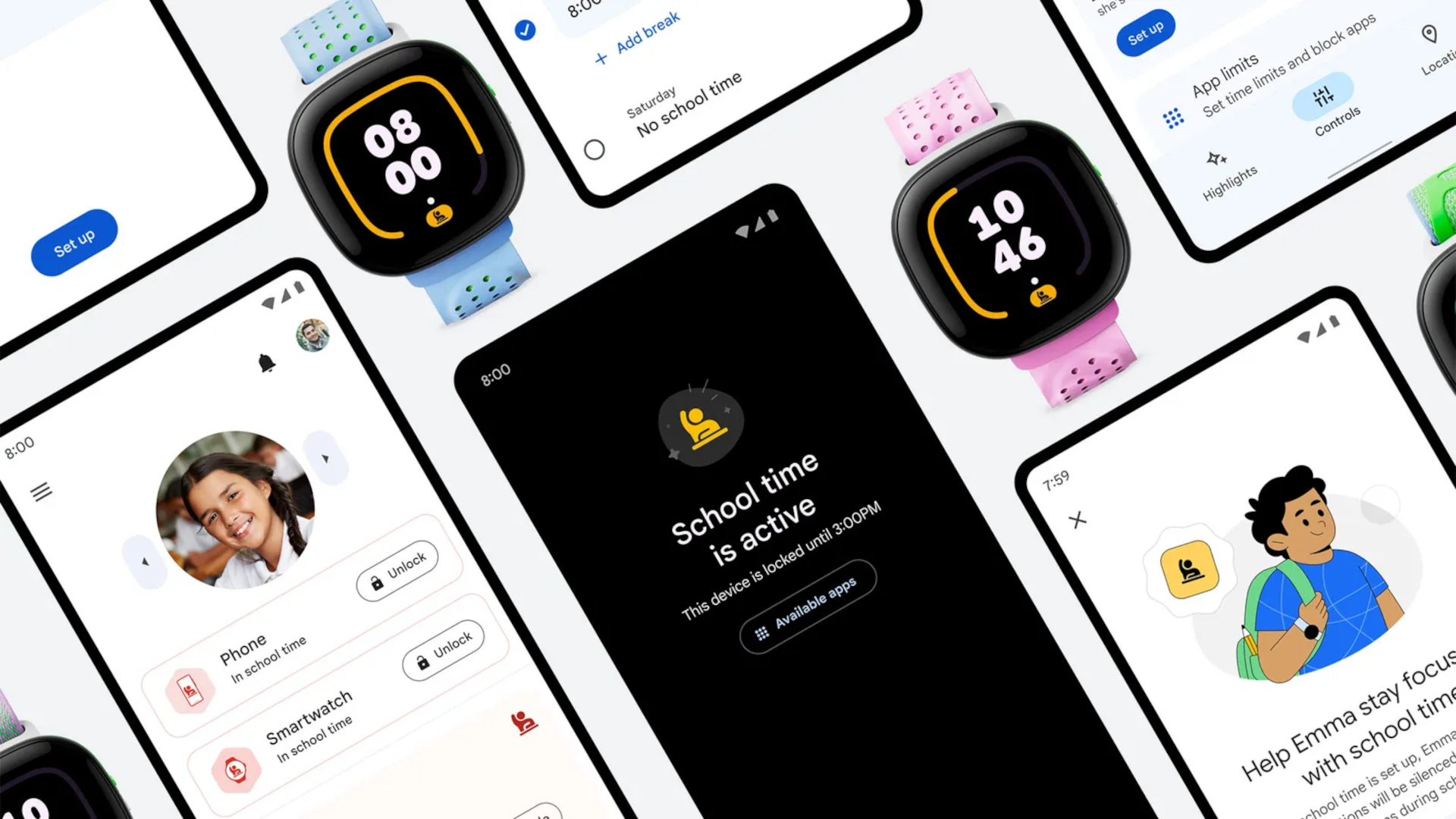

Google's School Time feature expanding to more devices — parents need to know about this

By Josh Render Published

-

Android phones are getting a powerful parental control upgrade

By Alan Martin Published

-

How to set up Google Family Link on iPhone

By Tom Pritchard Published

-

How to set up parental controls on a Windows 11 PC

By Alex Wawro Published

-

Password Managers

-

-

The best password managers in 2025

By Anthony Spadafora Last updated

-

Dropbox Passwords is shutting down — what you need to do

By Amber Bouman Published

-

Microsoft Authenticator will shut off the password autofill feature in July — here’s how to save them

By Amber Bouman Published

-

Apple Passwords password manager review

By Emily Long Published

-

Millions stolen from LastPass users in massive attack — what you need to know

By Anthony Spadafora Last updated

-

Proton Pass password manager review

By Emily Long Published

-

Google just made a huge step in killing off passwords for good

By Tom Pritchard Published

-

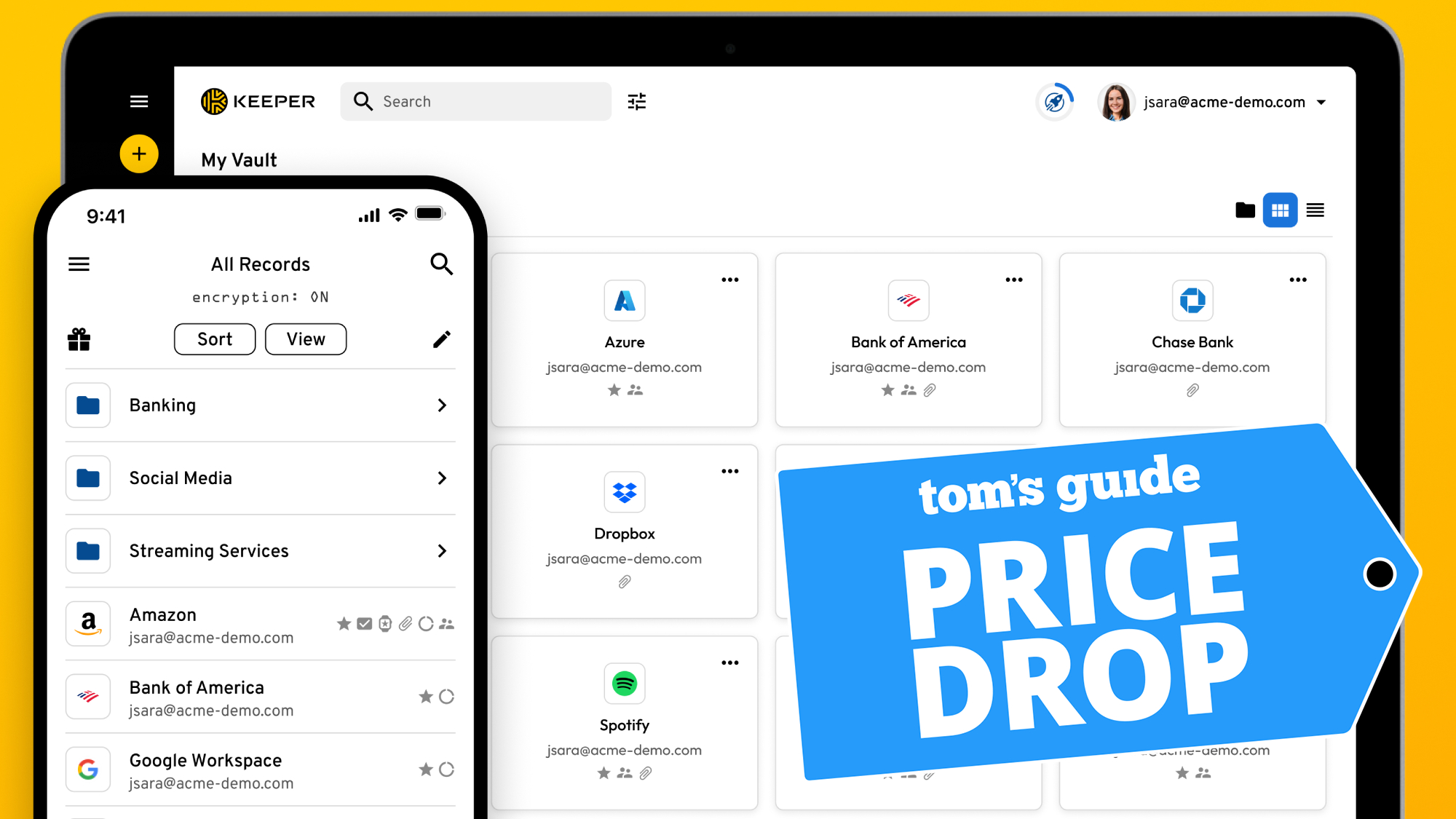

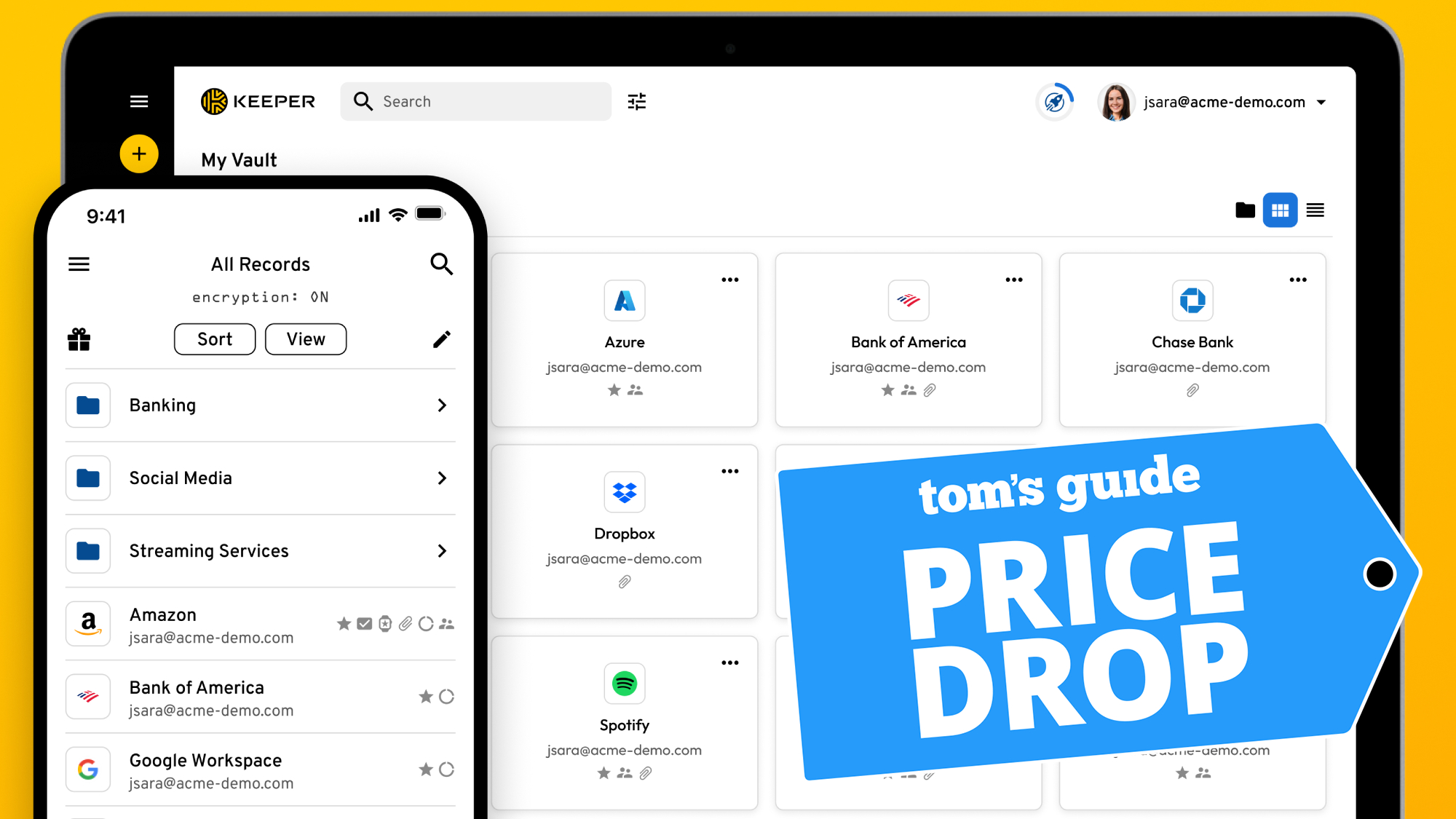

Hurry! Save 50% on this top-rated password manager

By Louis Ramirez Published

-

Hurry! One of our top password managers is 50% off right now

By Louis Ramirez Published

-