RAM crisis continues to worsen — Micron kills Crucial consumer memory in favor of AI data centers

Micron will no longer offer Crucial-branded memory to consumers in favor of enterprise clients

Here at Tom’s Guide our expert editors are committed to bringing you the best news, reviews and guides to help you stay informed and ahead of the curve!

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Join the club

Get full access to premium articles, exclusive features and a growing list of member rewards.

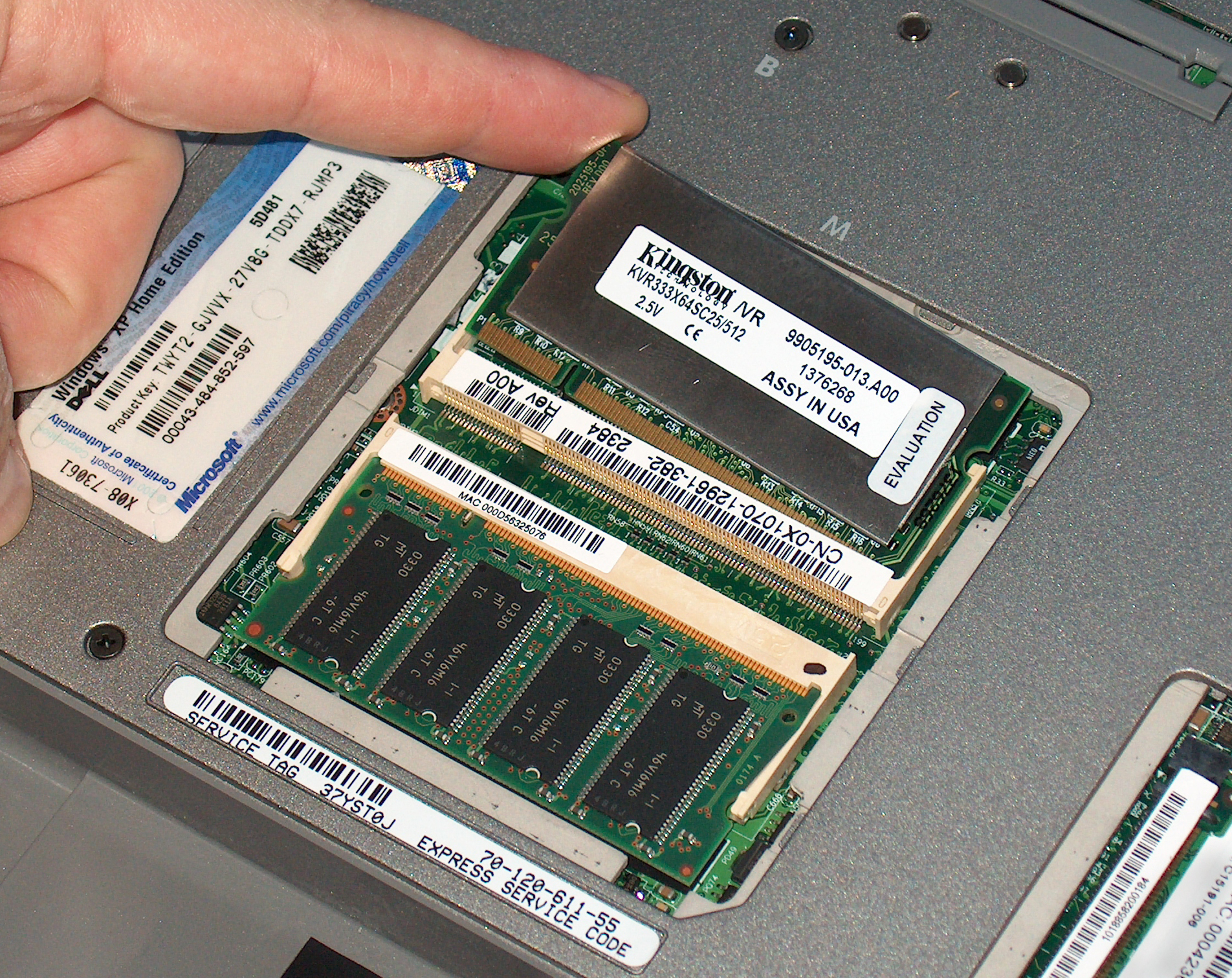

An impending RAM crisis is only just beginning to disrupt the world of tech. This week, the first real casualty was revealed when Micron announced that it will stop selling its Crucial-branded memory and storage in 2026 and “exit the Crucial consumer business in order to improve supply and support for [its] larger, strategic customers in faster-growing segments.”

Simply put: Micron is abandoning the consumer market (PC builders, PC gamers) in favor of AI data centers that have been gobbling up memory and storage at a staggering rate.

If you’re familiar with gaming PCs or building computers, you’re more likely to be familiar with the Crucial brand over Micron. Crucial is Micron’s consumer-focused brand that sold RAM, SSDs, SD cards and other storage for years, though according to the company’s announcement it will stop bringing new Crucial products to store shelves in February 2026

Despite continuing claims that we are in an AI bubbles, it’s clear that Micron believes the AI-generated memory shortage won’t end anytime soon. If it did, it’s likely Crucial would survive in some form, even if products were delayed.

What is happening with memory?

Despite what you may have heard about AI bubbles, major tech companies from OpenAI and Google to Apple and Microsoft are moving full steam ahead in pursuit of an AI future. This has coalesced in a tidal wave of demand for new data centers and the silicon needed to run those server farms.

As chatbots like ChatGPT and Gemini have become more capable, they’ve equally demanded more computing power and more memory and storage. It’s part of the reason Nvidia is currently a behemoth astride the world of tech.

The critical pieces running these centers include the sort of memory hardware that is also used to produce RAM and SSD storage. As demand for these chips skyrockets, companies like Micron have deprioritized NAND flash chips and cheaper, older memory chips in favor of chips meant for AI companies. It’s caused drastic silicon shortages and absurd prices not just for consumers but PC and smartphone manufacturers.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

Price comparison

Less than six months ago, a Crucial Pro 64GB DDR RAM kit could be purchased for around $75 new, $90 on the high end. Amazon’s own price tracking tool shows that number started creeping up in August before plateauing around $250 in October.

As of this writing, that same kit costs $469 on Amazon. A version on Best Buy is priced at $687.

The cheapest one we could find was via Microcenter where you can get the most barebones variant for $291, a $168 discount off the listed $459 price. It’s only available for in-store pickup and limited to two per person (I’m sure to avoid selling to scalpers). The closest Microcenter to me is in Tustin, California, a nearly three-hour drive and I’m in one of the few states that has this retailer.

This isn’t an isolated issue, either. Before Thanksgiving, CyberpowerPC and Maingear released statements saying that their prices would have to go up as RAM prices have surged 500% while SSD prices went up 100%.

PC parts are just the beginning

This problem isn’t going away anytime soon. PC Gamer reported this week that “sky-high DRAM prices could run past 2028.” That report was in response to Samsung and SK Hynix (makers of 70% of the DRAM market) announcing that neither company has the current capacity to sufficiently expand memory production. In some cases, new production or facilities won’t come online until 2028, but whatever additional production they provide is already spoken for.

On Tuesday, Reuters reported that several Chinese phone companies, including Xiaomi and Realme, are already warning customers that price hikes between 20% and 30% are likely to occur by June of 2026.

And just as Black Friday was kicking into gear, a report from the Korean publication SEDaily claimed that even Samsung’s own internal divisions are unable to lock down long-term contracts with one another.

Samsung’s Electronics Device Solutions (DS) division apparently rejected a request from the Mobile eXperience (MX) division, the company’s smartphone producer, to sign a long-term memory supply contract. Instead, the MX division is facing a sudden profitability concern for next year’s S26 series and had to negotiate a quarterly deal with the DS division just to get through the end of 2025.

Samsung is reportedly favoring profitability in this “memory super cycle” over supporting a different arm of the same company.

Micron’s Crucial brand is the first real casualty in this memory boom but we doubt it will be the only company to pull out of selling consumer-grade RAM and SSDs in favor of AI.

Follow Tom's Guide on Google News and add us as a preferred source to get our up-to-date news, analysis, and reviews in your feeds.

More from Tom's Guide

- Russia blocks Roblox – and demand for VPNs skyrockets

- Google just fixed 107 security flaws including two zero-days — update your Android phone right now

- How to get Xbox Full Screen Experience on any Windows 11 PC — even if you don't have the option in settings

Scott Younker is the West Coast Reporter at Tom’s Guide. He covers all the lastest tech news. He’s been involved in tech since 2011 at various outlets and is on an ongoing hunt to build the easiest to use home media system. When not writing about the latest devices, you are more than welcome to discuss board games or disc golf with him. He also handles all the Connections coverage on Tom's Guide and has been playing the addictive NYT game since it released.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.

Club Benefits

Club Benefits