CEO of ID Protection Firm Has ID Stolen 13 Times

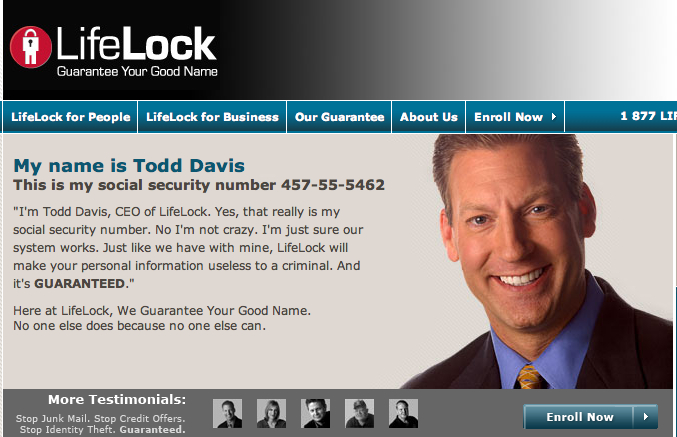

You're the CEO of LifeLock, a company that promises to protect the identities of your customers against identity theft. Your service is guaranteed to work, so what better way to advertise than to post your name and social security on your Wesbite and on billboards across the country? That's just what LifeLock chief Todd Davis did. Surprise, surprise, he's had his identity stolen a total of 13 times.

Phoenix New Times reports that Davis has been the victim of identity theft no fewer than 13 times. This, in addition to the fact that LifeLock was recently ordered to pay $12 million for deceptive advertising, will do little to convince potential customers of the validity of the service.

In 2007, it was widely reported that Davis' publication of his social security number had resulted in a $500 loan being taken out in his name. Not only did Davis' company not protect him from this fraudulent activity, he didn't even find out about it until the unpaid account went to a collection agency. A year later, Davis said that this was the only time anything like that had ever happened to him. However, it seems that that is not necessarily true.

In October, just a few months after news of the first incident hit, someone opened up an AT&T account in Albany. In the fall of 2008, AT&T enlisted a debt collection agency to try and recover a debt of $2,390.

Over time, more fraudulent accounts were opened in Davis' name. These include a Verizon account in New York (at least $186), a Centerpoint Energy account (at least $122), Swiss Colony, a gift basket company ($312) and $573 to Credit One Bank. There also accounts in his name for a Gap credit card (balance zero) and one for a USA Savings Bank, also with a balance of zero. Phoenix New Times reports that collection agencies are pursuing Davis for the following payments: Bay Area Credit, $265; Associated Credit Services (x2), $207 and $213; and Enhanced Recovery Corporation (x2), $250 and $381.

Davis refused to comment on all of the incidents of identity theft and so did LifeLock.

Davis' methods of advertising echo a move by Top Gear's Jeremy Clarkson that saw the popular presenter print his bank details in the newspaper. In 2007 the UK government lost two discs of data containing the details of millions of citizens. Naturally, everyone was quite upset about the whole thing but Jeremy couldn't understand why, dubbing the media frenzy a 'storm in a teacup.' Clarkson insisted that everyone's data was perfectly safe and in an attempt to prove his point, he published his bank details in his weekly newspaper column. He also printed his home address and what kind of car he drives. Unsurprisingly, Clarkson opened his bank statement to find that in an effort to set him straight, some kind soul had set up a direct debit of £500 to the British Diabetes Association. Soon after, the Top Gear personality admitted he had been wrong and that he had been punished for his mistake.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

Read more on the LifeLock situation here.

Jane McEntegart works in marketing communications at Intel and was previously Manager of Content Marketing at ASUS North America. Before that, she worked for more than seven years at Tom's Guide and Tom's Hardware, holding such roles as Contributing Editor and Senior News Editor and writing about everything from smartphones to tablets and games consoles.

-

duk3 I figured that someone would steal his identification.Reply

However, I also figured that he wouldn't be stupid enough to leave the number up there after it happened once or twice.

13 times is pushing it. -

ta152h When you consider the amount of people that were convinced because of him being so bold, compared against the small debts, it probably still worked in his favor.Reply -

zoemayne No one company can stop ID theft the gov is gonna have to step in one day to end this.Reply -

hellswaters Well at least the people stealing his ID are being nice about it. Only 1 collection required of above a grand. What are those people buying, just a pair of jeans?Reply -

bogcotton hellswatersWell at least the people stealing his ID are being nice about it. Only 1 collection required of above a grand. What are those people buying, just a pair of jeans?Reply

Identity thieves tend to take many small transactions from many bank accounts, so the victims dont notice it in their statements. -

Kelavarus This could be one of those times that "Any press is good press" doesn't work out so much. On the other hand, it's surprising no one opened a ton of porn accounts in his name for shits and giggles.Reply -

stopthe_bomb KelavarusThis could be one of those times that "Any press is good press" doesn't work out so much. On the other hand, it's surprising no one opened a ton of porn accounts in his name for shits and giggles.Reply

On top of that, If they make one huge withdraw the bank itself might get involved right away and they just risk getting caught a lot more if they do huge transactions.