Tom's Guide Verdict

With the ability to keep an eye on your credit and identity insurance, PrivacyGuard Total Protection is a good way to safeguard your identity but can be expensive and lacks individual credit reports.

Pros

- +

Monthly credit scores

- +

Excellent credit simulator

- +

Password manager, secure browser extension and antivirus included

Cons

- -

Expensive

- -

Slow responses

- -

Merged credit report

Why you can trust Tom's Guide

Monthly cost: $25

Yearly cost: No annual plan

Family plan: No

No. of bureau scores: 3

No. of bureaus monitored: 3

Frequency of credit reports: Monthly

Type of credit score: VantageScore 3.0

Credit-improvement simulator: Yes

Credit-lock/freeze button: No

Security software: Secure browser and encrypted keyboard, Norton Security

Investment account monitoring: No

Max. ID-theft coverage: $1 million

Data Breach Alerts: Yes

Medical Records Monitoring: No

Payday loan monitoring: No

Sex Offender Alert: Yes

Title Change Alert: No

Two Factor Authentication (2FA): No

With the ability to monitor all three major U.S. credit bureaus and create a merged credit report that hits all the highlights, PrivacyGuard has a different approach to ID protection.

It offers up to $1 million in insurance as well as some helpful utilities, Norton security software and a password manager. However, it falls short by not backing it all up with two-factor authentication and a VPN like others provide.

On the downside, it is expensive and its online response was slow. Our PrivacyGuard review will help you decide if this is the best identity theft protection with the features you need at the right price.

PrivacyGuard Total Protection review: Costs and what’s covered

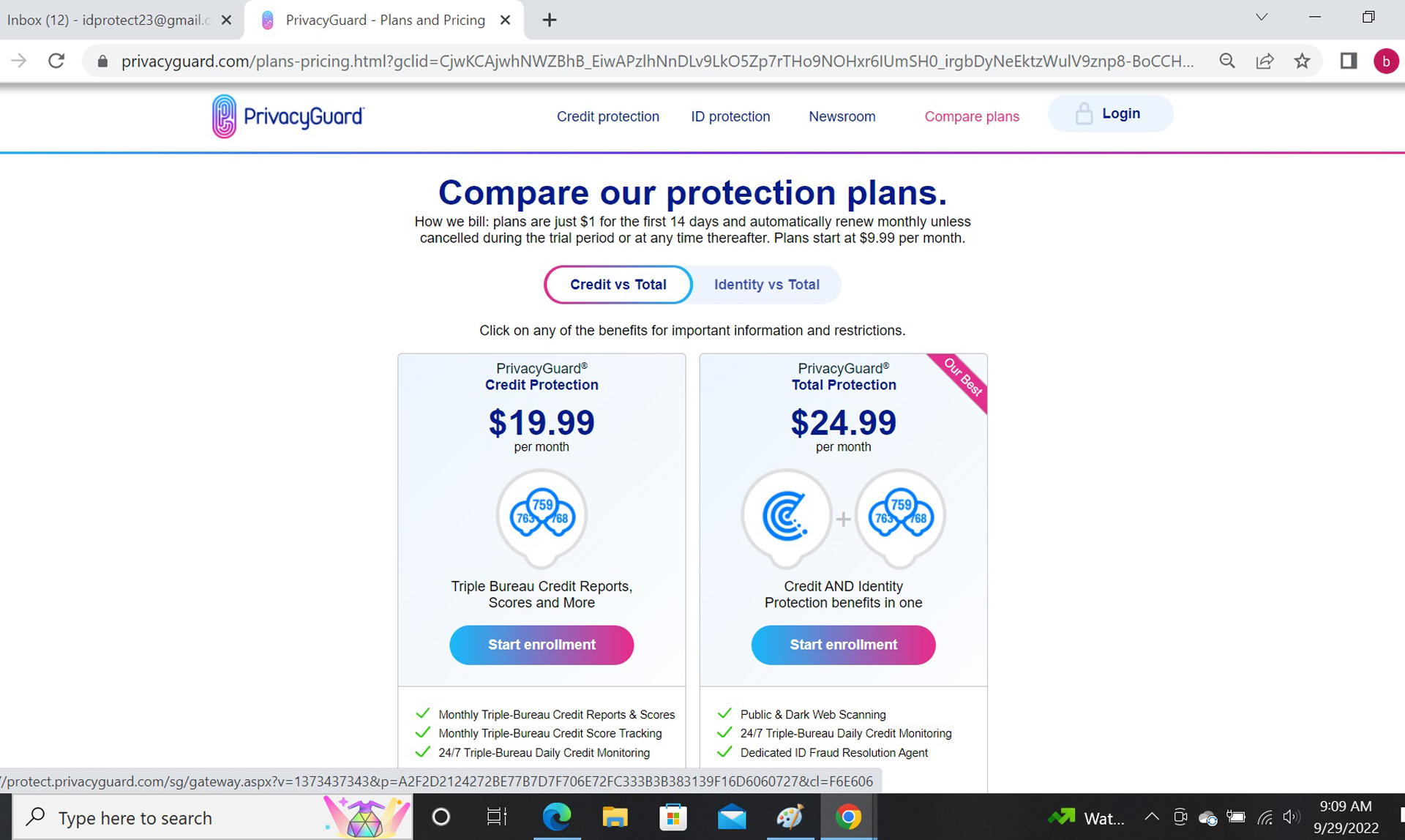

There are three PrivacyGuard plans that differ in terms of identity and credit monitoring as well as cost. There’s a two-week trial period for all the plans that costs just $1, after which the service charges full price.

All three service levels are available monthly but there are no annual plans. They all come with a secure browser, an encrypted keyboard and Norton Security Online.

The Individual Protection subscription costs $10 a month, making it inexpensive but not the cheapest ID plan around. Forget about getting credit scores or monitoring, but the plan includes $1 million of insurance to cover stolen funds as well as an army of lawyers, consultants and accountants. It monitors your personal information, like driver’s license, credit cards and bank accounts, email addresses, phone numbers as well as the expected Social Security number and date of birth. The Individual Protection plan watches for address changes and scans the dark web for instances of your personal identifiers online. On the other hand, it lacks payday loan protection as well as watching for home title changes and doesn’t have two-factor authentication.

PrivacyGuard’s Credit Protection trades the insurance for credit scores and monitoring at $20 a month. It includes credit monitoring, scores and tracking for all three bureaus as well as VantageScore 3.0 ratings for each. Its monthly merged credit report includes aspects from each service as well as credit simulators and financial calculators but lacks some of the details of the individual agency reports.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

The Total Protection plan costs $25 a month, puts it all together and was the plan I used. It’s a nice balance with PrivacyGuard’s $1 million in identity insurance and credit monitoring. Total Protection comes with Norton Internet Security malware scanning and defenses to protect a single Windows computer. By contrast, others can protect five or 10 systems or McAfee’s unlimited number of computers.

There are no family plans available, but the individual plans can be used by up to 10 children for Social Security number abuse. The company is not rated by the Better Business Bureau.

PrivacyGuard Total Protection review: How we tested

During the summer 2022, I signed up for and paid for PrivacyGuard’s Total Protection coverage with a credit card. Later, Tom’s Guide reimbursed me. Several times a week, I checked in with PrivacyGuard to see my credit scores using a variety of computers. I looked for alerts and saw if there were any new articles to read. After three months I canceled the service.

PrivacyGuard Total Protection review: Credit scores and monitoring

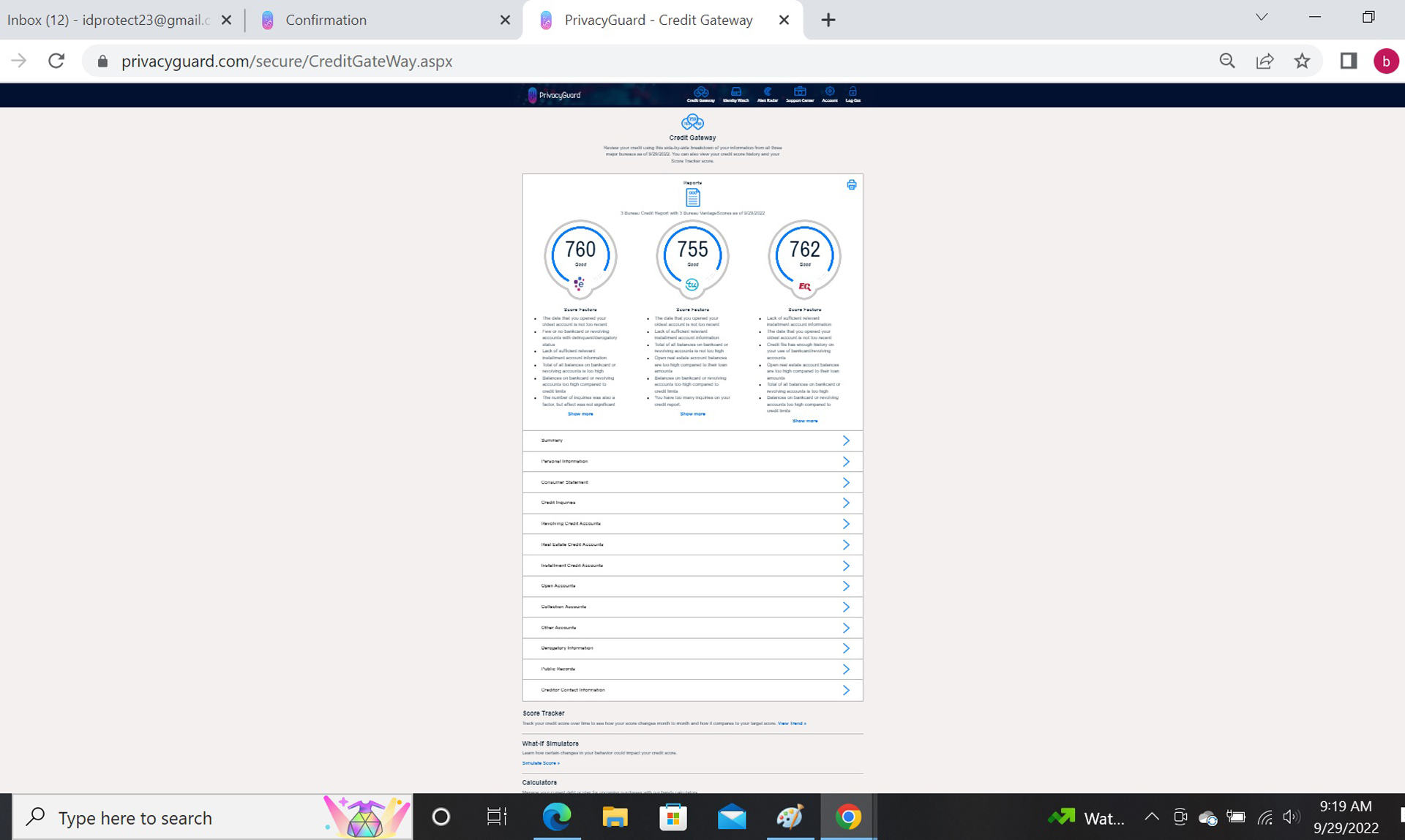

The Total Protection plan includes access to VantageScore 3.0 ratings based on data from all three credit bureaus. It’s not as good for predicting credit worthiness as FICO scores but can be an acceptable substitute to pretest your ability to get a loan.

It uses the familiar open circle visual metaphor for the scoring but added items relevant to my actual credit history and rating, like derogatory or delinquent accounts and high real estate balances. The Summary section is chock full of useful details, with the three credit bureau data side by side for comparison. It shows things like current balance, credit card accounts and accounts under collection. PrivacyGuard is a great way to evaluate the bureau’s data and look for errors.

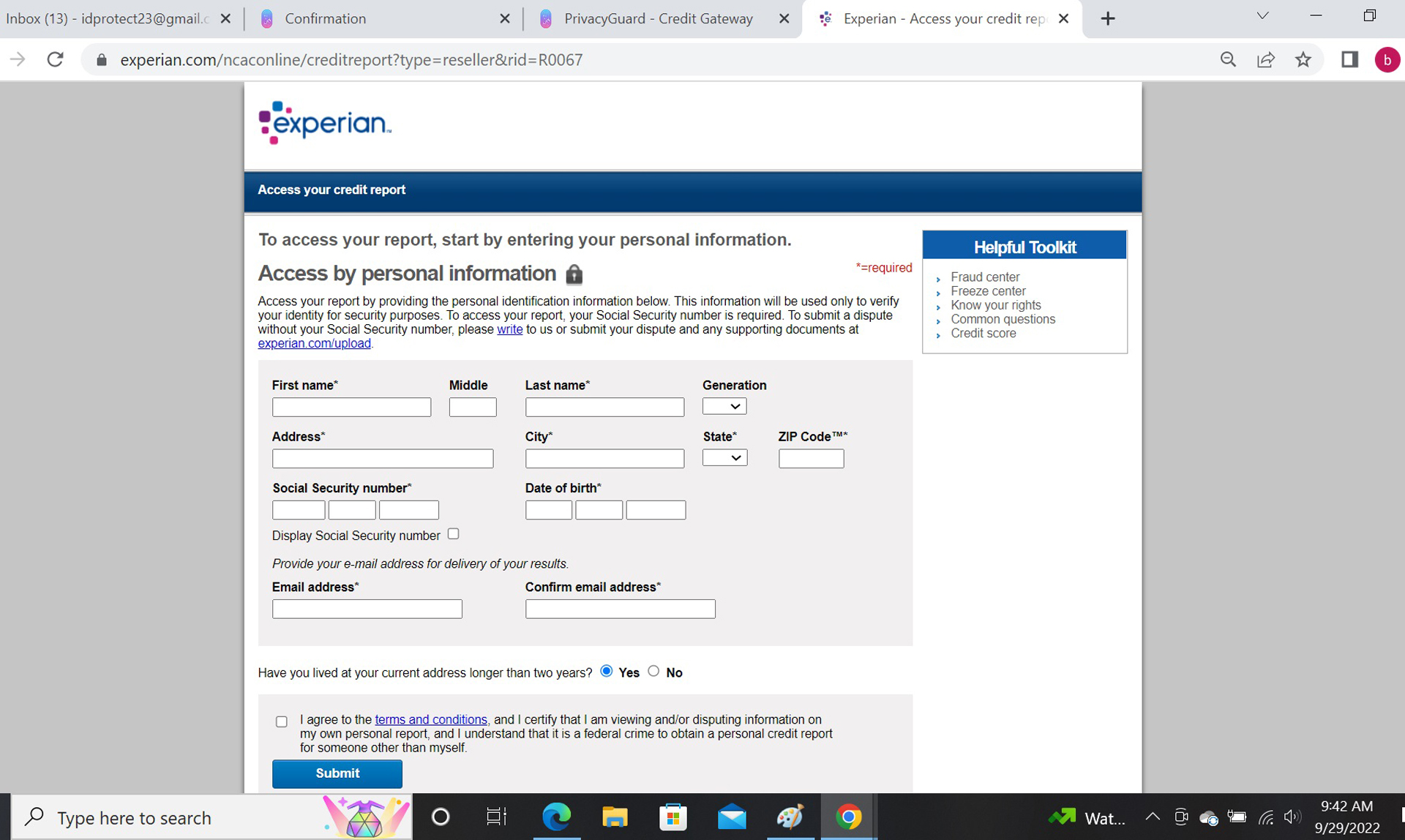

The bottom has links for disputing anything on the report. It’s a tease, however, because it leads to a form for getting the actual report.

Total Protection keeps an eye on the dark web for your financial dealings like bank accounts. On the downside, it can’t take in your investments, although the company is working on adding that. However, the number of accounts it can track is limited to 10 banks and 10 credit cards. It does look for your Social Security number in all the wrong places though.

PrivacyGuard Total Protection review: Insurance and services

The Total Protection plan includes $1 million in insurance in the event of an identity theft. The coverage is underwritten by the omnipresent AIG. It’s meant to cover lost funds as well as lawyers, consultants, investigators and getting new documents, like a driver’s license and passport.

Lost work and travel are covered and you can recover up to $7,500 in lost wages and $1,000 for travel. They also promise to have a single person follow your case from start to finish.

PrivacyGuard Total Protection review: Notifications and alerts

There’s a variety of credit-based alerts that can just as easily be an indication of overspending as an identity hack. It has a different way of showing alerts. Its Alert Radar is one of six main tabs and if you click on it, your Credit and Identity Alerts are shown. Click on any for the details.

The alerts can be personalized to how big a change triggers the notification as well as if the risk level changes. My favorite is the ability to select a target score and get a gratifying signal when you’ve reached it. Nothing like positive reinforcement.

The service monitors public and court records as well as new accounts opened in your name. However, it lacks home title checking as well as payday loan monitoring.

Over my three month evaluation of PrivacyGuard, it sent me two alerts that concerned information I hadn’t filled out in the online forms.

PrivacyGuard Total Protection review: Setup

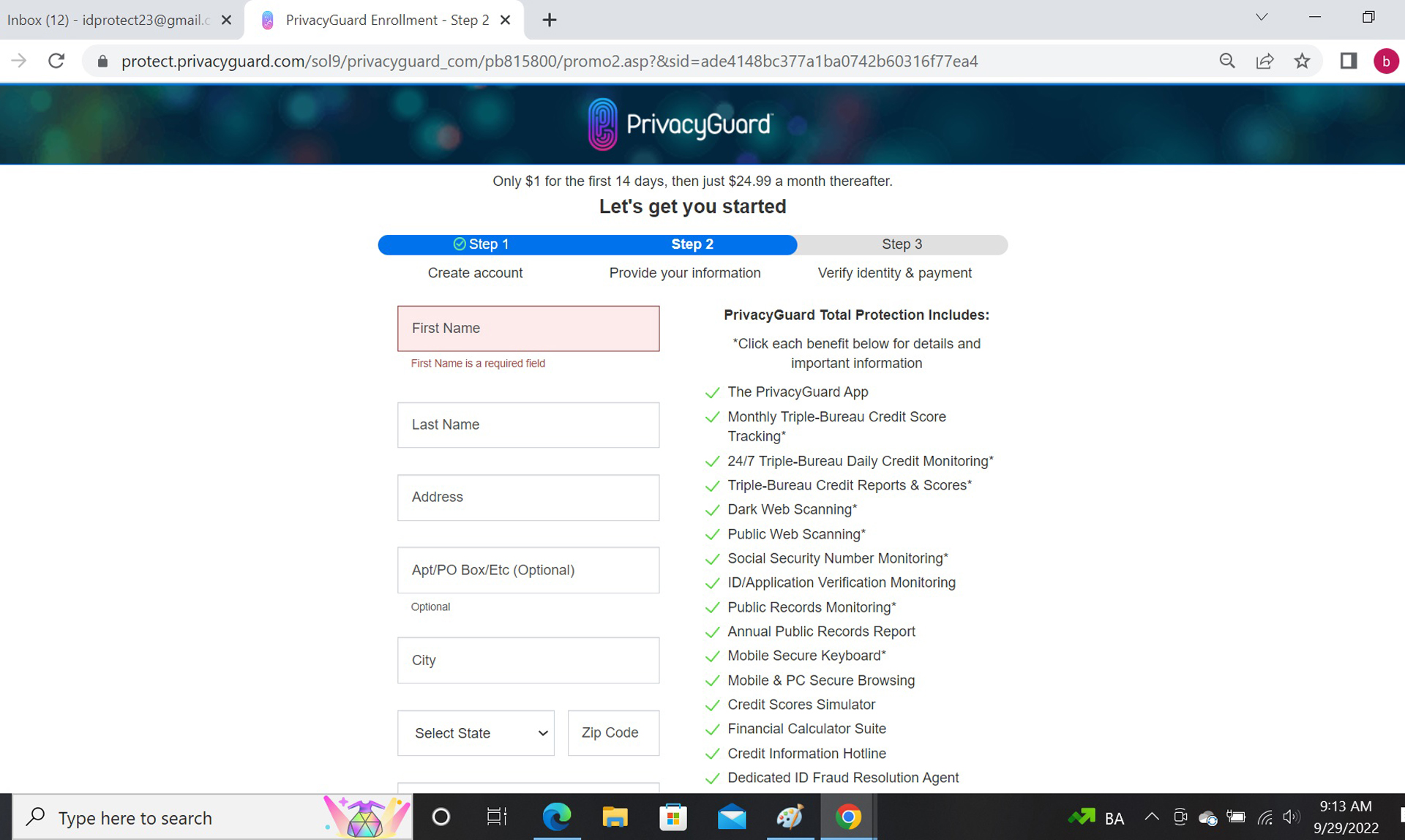

Privacy Guard’s on-boarding process was a snap. After finding the right plan on the company’s website, I clicked on “Start enrollment”.

I needed to add my email, a username and password for the service. I unchecked the box that would have allowed Privacy Guard to send me marketing information. Next, I typed my name, address and date of birth.

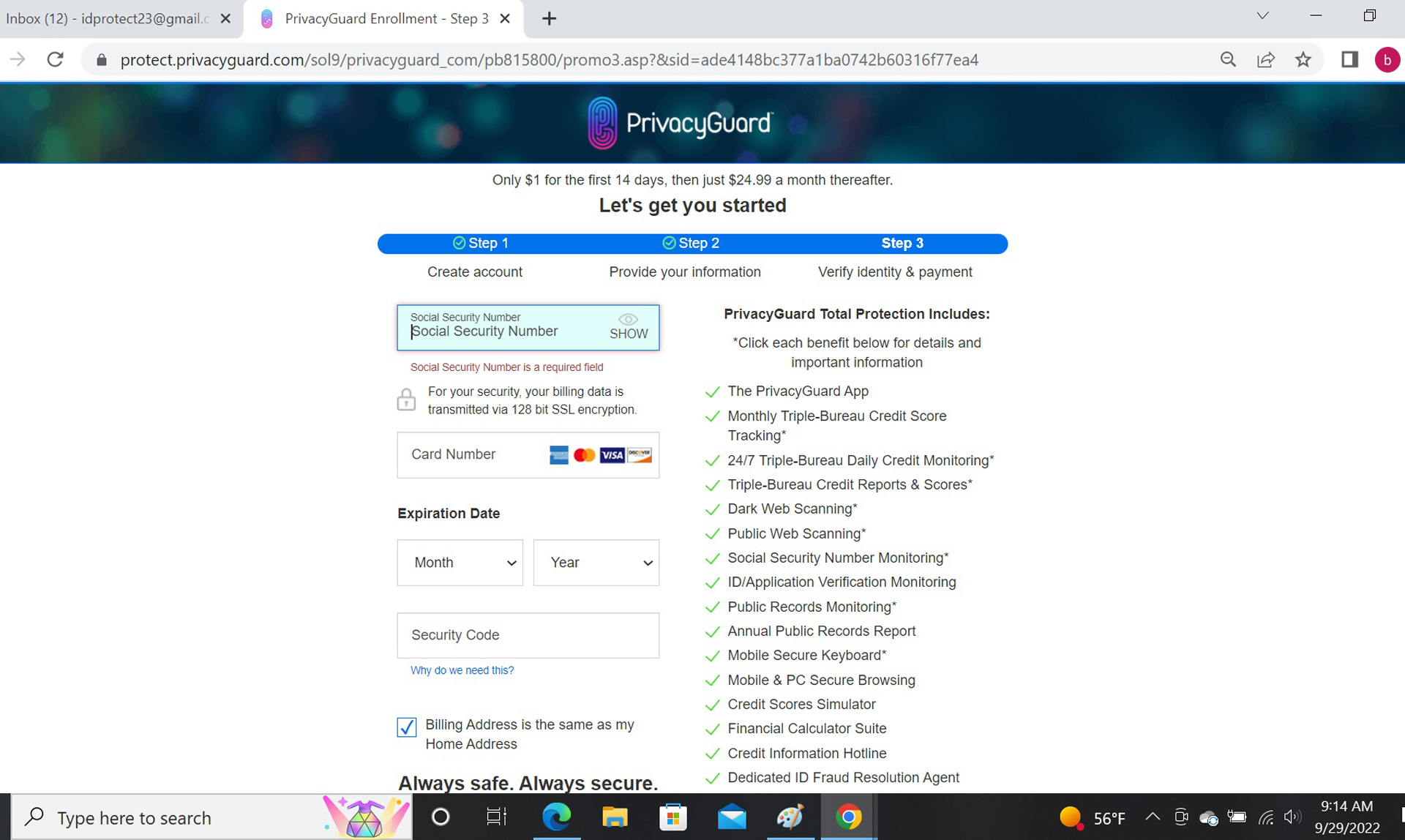

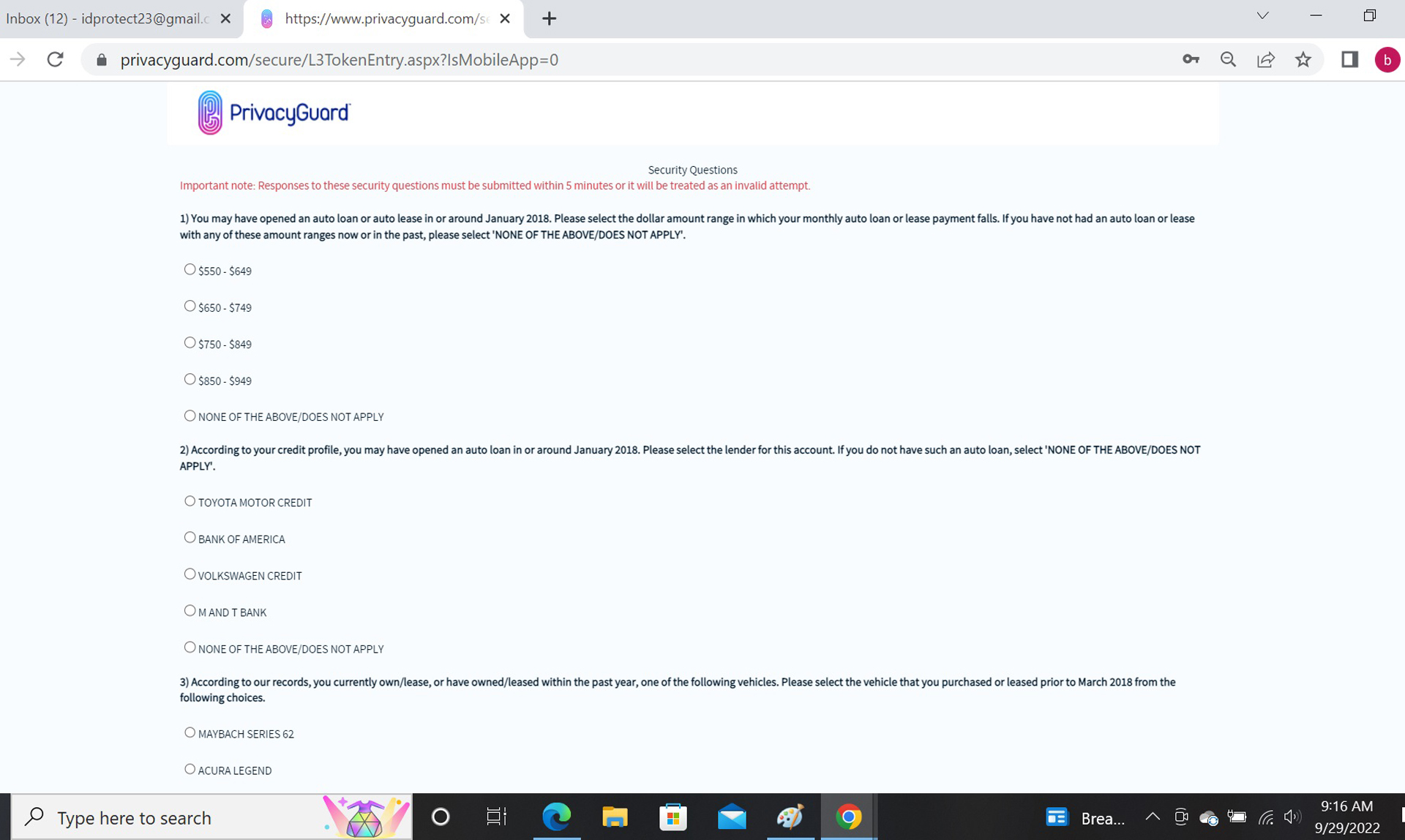

This was followed up with me clicking on “Yes, sign me up”. After answering five challenge questions about cars, loans and the year of my birth, I was done and received a summary page with a membership number.

The first online form asked for my username and a password; oddly, the password creation field rejected punctuation marks, which could potentially have made the password stronger; PrivacyGuard is working on updating this. The next forms wanted my name, address, date of birth, Social Security number and a credit card for payment; PrivacyGuard doesn’t accept PayPal.

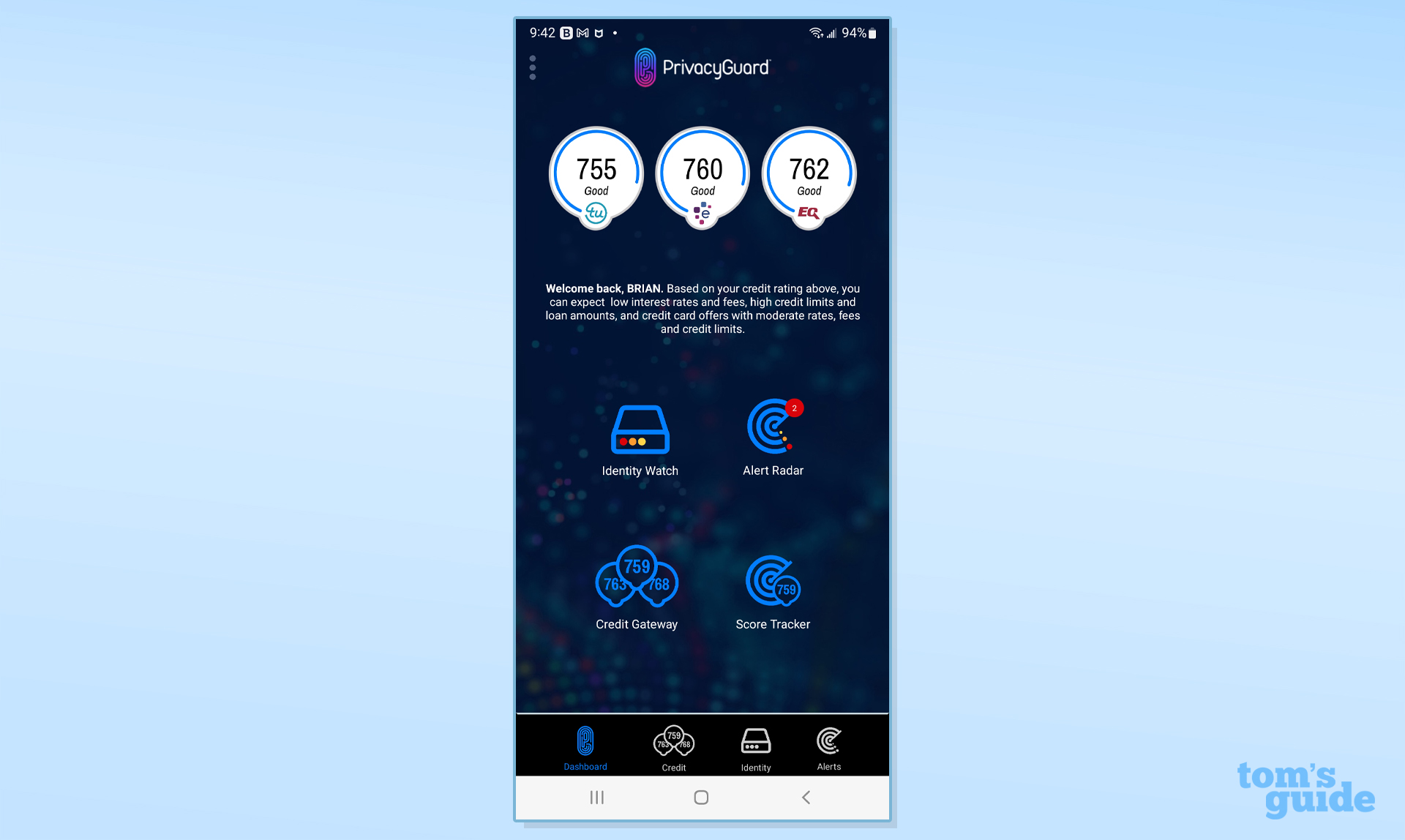

Last item: I needed to install the PrivacyGuard app on my Samsung Galaxy Note 20 phone. This took less than a minute and I was ready. My scores were on screen a moment later. All told, it took less than 7 minutes.

The company’s tech support technicians are available only from 9 a.m. to 8 p.m. ET on weekdays as well as 9 a.m. to 5 p.m. on Saturdays. On the other hand, if you’re in the throes of an identity theft, they’re there for you with 24/7 service. If you have any credit anxieties, the Credit Information Hotline can help with answers to key credit report questions.

There are PrivacyGuard support links and phone numbers at the bottom of most pages of the web interface. My emailed request for information on how to use the interface was responded to in a few hours with a suggestion to call the tech-support number instead.

PrivacyGuard Total Protection review: Interface and utilities

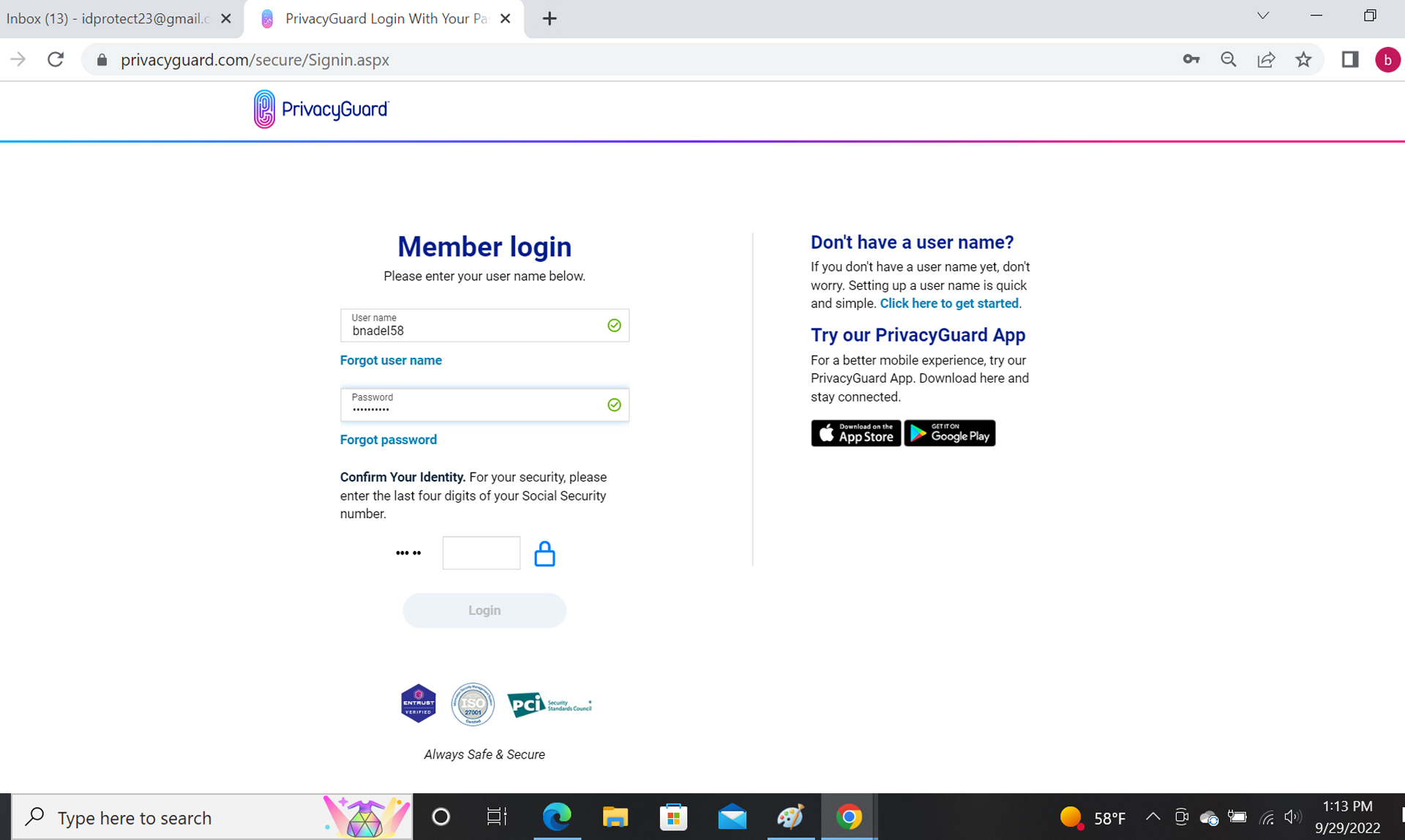

To get connected to PrivacyGuard’s online services, I needed to enter the last four digits of my Social Security number for the page to load. It’s not as secure as two-factor authentication but is better than nothing.

It can be one of the more frustrating identity protection services to use day-in and day-out. That’s because it can take 15 seconds or more to actually log in and double that for some pages to load. This can seem like an eternity if you fear something is amiss with your credit or online identity.

PrivacyGuard’s web-based browser presents a lot of data in a long strip and requires some judicious zooming. Setting the browser on my HD system to 33% takes nearly everything in while 50- or 67% makes it all readable but with some scrolling up and down. Happily, most of the pages have contact information for easy access in an emergency.

The meat of the interface is the Credit Gateway that shows all three bureau VantageScore 3.0 ratings above the major factors that went into the scores. It has a print command in the upper right that will produce a combined set of credit reports with everything from personal information and credit inquiries to derogatory information and public records. It’s all below but this one-click print option is an unexpected bonus.

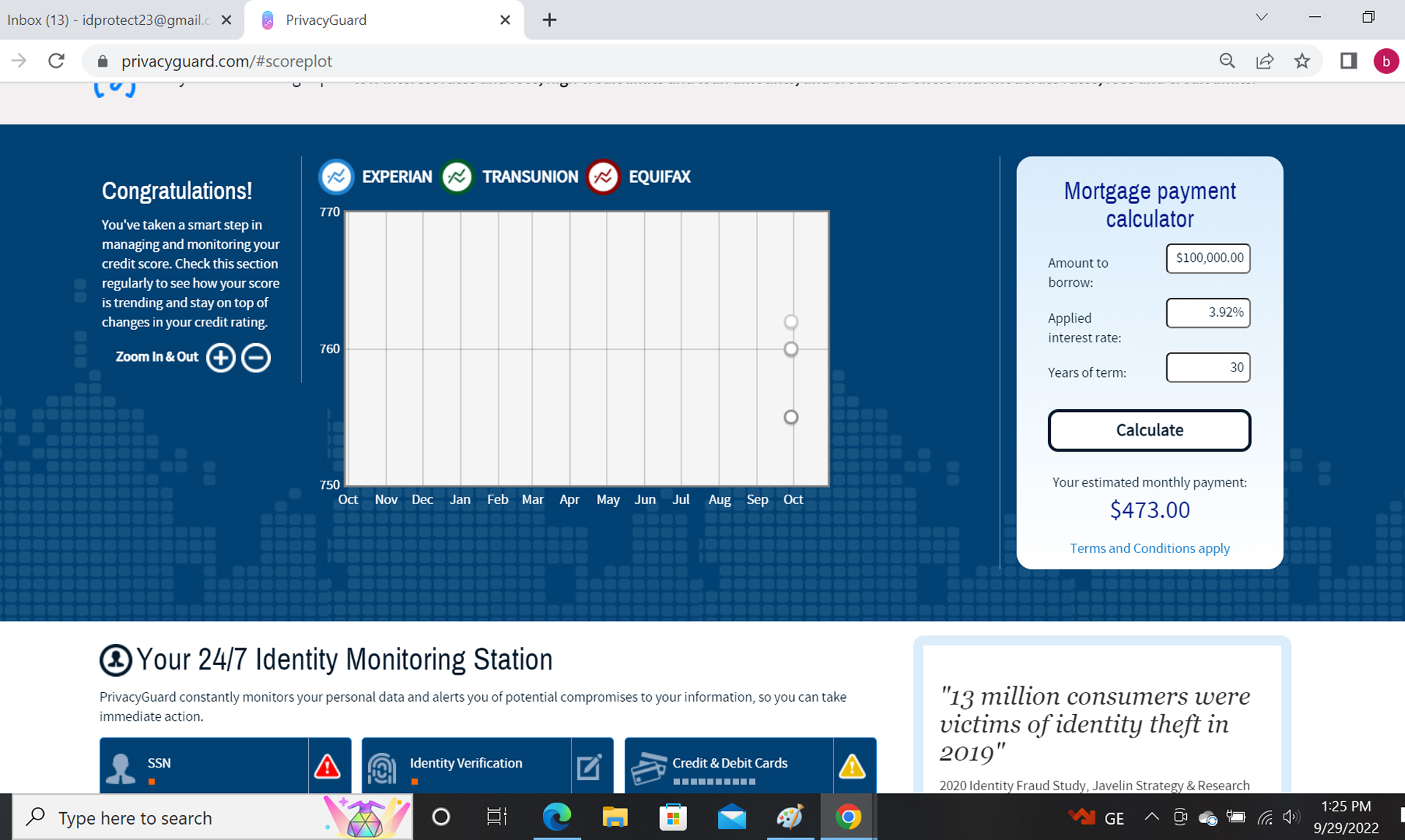

There’s also a score tracker for watching the three VantageScore ratings change over time. Oddly, it’s next to a mortgage calculator. The service has some of the best financial simulators available anywhere.

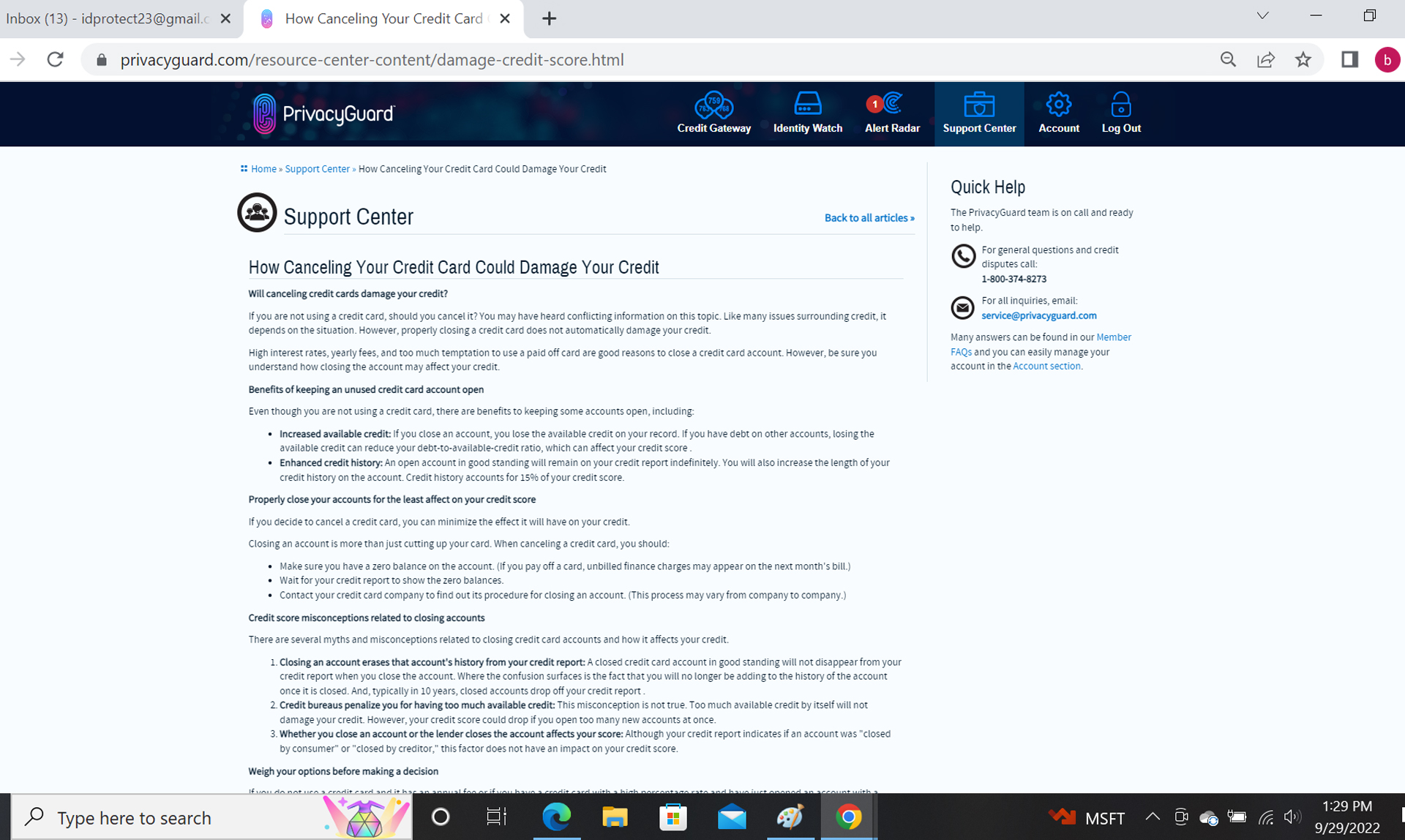

The support center has lots of useful, though, general, credit information, like how to pay off credit cards and lower your score. Unfortunately, none of the articles are dated.

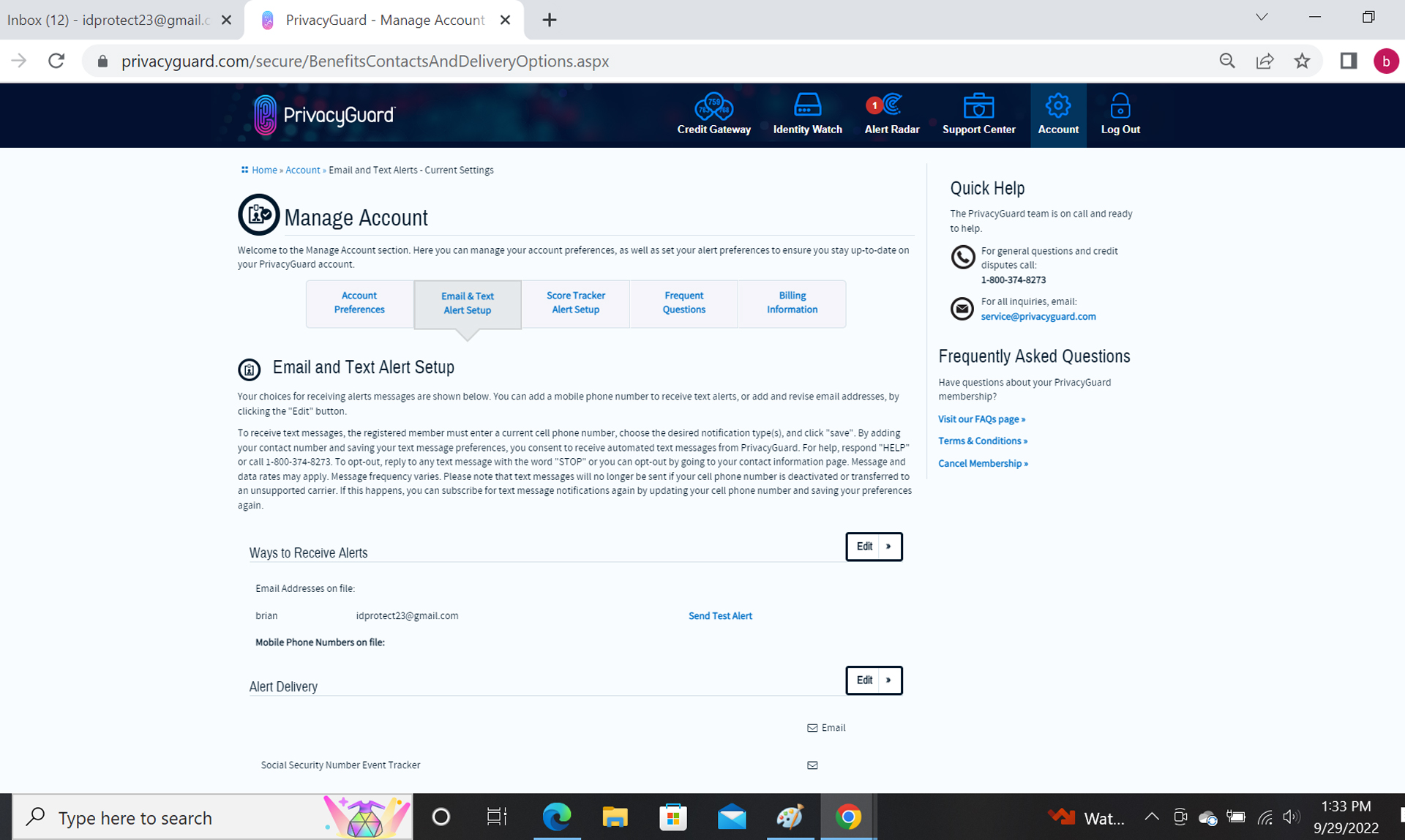

Next over is the Account section, which is the place to set preferences for emails and texts alerts as well as the Score Tracker alerts. There’s an excellent Q&A section about the plan with details listed. Over to the right, there is an icon for logging out.

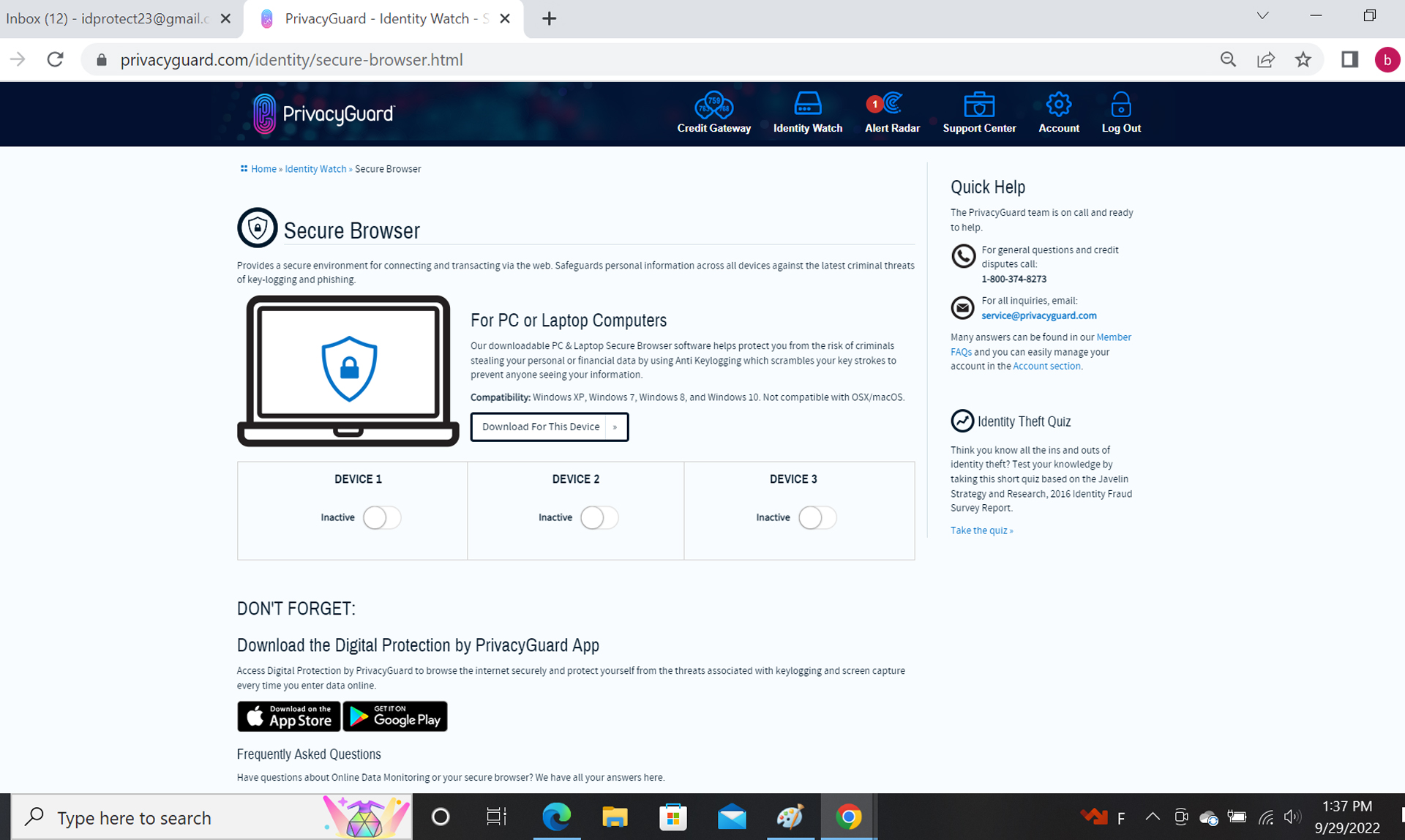

Its utilities are useful and deep, starting with Norton Internet Security for stopping malware. The plan included a secure browser extension that can be loaded onto three computers and works with iPhones and Android smartphones but not PCs or Macs. There’s also a secure keyboard that encrypts its traffic to thwart a hacker’s keylogger program from reading your character strokes. On the downside, there’s no VPN or password manager.

The app has a similar color scheme and design as the web version, making the transition easy. The scores are at the top with the four major functional activities – Identity Watch, Alert Radar, Credit Gateway and Score Tracker – below.

PrivacyGuard lacks two-factor-authentication to prove that you are actually you to see your vital data and make changes. The company is working on adding this vital piece of security software soon, but at the moment log-ins require the last four digits of your Social Security number.

It’s more secure than a password only log-in but it risks abusing the last part of your Social Security number.

PrivacyGuard Total Protection review: Cancellation

The service can be canceled by phone, email or on the website. Go to the Account section and on the right is a “Cancel Membership” link. The next page warns about losing coverage, but all I needed to do was to confirm the cancellation. I was also given a confirmation number for the cancellation.

PrivacyGuard Total Protection review: Bottom line

The Total Protection plan from PrivacyGuard combines three-bureau credit monitoring and scores but stops short of providing the actual reports behind the scores. Instead, the company creates a merged report with most of the highlights that can make comparisons easier. Its security software is good with Norton malware protection and an encrypted keyboard, but it lacks a VPN.

Its credit simulators can be a big help in figuring out what to pay first, but PrivacyGuard’s slow response can make it frustrating to use, particularly when your identity is on the line.

Brian Nadel is a freelance writer and editor who specializes in technology reporting and reviewing. He works out of the suburban New York City area and has covered topics from nuclear power plants and Wi-Fi routers to cars and tablets. The former editor-in-chief of Mobile Computing and Communications, Nadel is the recipient of the TransPacific Writing Award.