Tom's Guide Verdict

EveryDollar’s free version has limited use for budget planners, but the paid tier offers strong tools for zero-dollar budgeting and financial education.

Pros

- +

Easy to read visuals

- +

Clear workflow

- +

Paid tier includes access to other Ramsey+ services

Cons

- -

Free version very limited, and paid version pricier than most

- -

Confusing interface between EveryDollar and Ramsey+

Why you can trust Tom's Guide

EveryDollar from Ramsey Solutions is an online zero-dollar budgeting tool that follows a similar vein to YNAB. Available in free and paid tiers, the service stands out for its use of friendly, everyday language for guiding you through the process of setting up a budget.

The free version of EveryDollar sacrifices functionality and limits you to manual data input, which makes it less useful for tracking your cash flow. Stepping up to the premium paid version fixes that, and positions your budget as one pillar of a larger financial education. That’s because the upgraded paid version is one part of the Ramsey+ membership service that includes Ramsey’s Financial Peace University, EveryDollar, Baby Steps program, SmartTax, group coaching, and more.

The paid version of EveryDollar has a lot to like, but among the best budgeting apps, it’s only worth it if you plan to maximize your use of the full Ramsey membership.

EveryDollar: Cost

EveryDollar’s free version is useful for setting up a basic budget with manual inputs. It’s more useful for getting a picture of your money flow than, say, Personal Capital, which is also free and has a budgeting feature. However, every few steps of the way in the interface we were hit by an ad to upgrade since the feature we were trying needed the full paid version of EveryDollar.

The paid version of EveryDollar means upgrading to the Ramsey+ membership. Not only do you get a more functional budgeting solution, but you also unlock access to a slew of other financial education services and features from Dave Ramsey’s library of digital offerings.

Ramsey+ membership starts at $59.99 for three months ($19.99 per month), and it costs $129.99 for a year ($10.83 a month, billed annually).

EveryDollar: Features

The free tier of EveryDollar is minimalism at its best — or worst. You can set a customized budget, create virtual savings funds that you’re allocating funds to from that budget, and track your debt payments. This is more than you get with some competing packages like Personal Capital, but it lacks the automation and real-time element found in the services from YNAB, Simplifi, and Mint.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

The premium version of EveryDollar adds syncing with bank accounts, generating custom budget reports, the ability to download transactions as a spreadsheet, and get tracking recommendations and reminders (iOS only).

The premium EveryDollar is just one part of the bigger whole that is Ramsey+. You also get access to Financial Peace University, which includes nine lessons — four dedicated to outlining Ramsey’s seven Baby Steps, and five more with insights into spending, building wealth, real estate, insurance, and giving. Each lesson runs about an hour (some more, some less), and includes activities and worksheets intended to help you better understand financial concepts. You can also join a virtual nine-week class led by a coach that walks through the content in the videos.

A separate on-demand course is titled “Budgeting That Actually Works,”a nine lesson, 50-minute mini-course that explains the zero-based budgeting approach of EveryDollar and gives tips on how to approach budgeting. The videos are hosted by author Rachel Cruze, who also hosts a series of lessons around understanding your relationship with money.

Ramsey+ members also get a complimentary 1:1 coaching session with a Ramsey Preferred Coach, who’s trained and certified by Ramsey’s own coaching team of financial experts.

Another course titled “The Legacy Journey” gives Ramsey’s perspective on the intersection of biblical Christian scripture with wealth building and giving. (Note: This is one of several areas where Ramsey’s evangelical Christianity and biblical emphasis is very clear in the service. The EveryDollar budgeting component is not heavy-handed in its religious connections, but the Ramsey+ membership does have religious precepts scattered throughout. If you prefer your budgeting and financial advice served straight up without a dose of biblical scripture, we recommend looking at YNAB, which is also a zero-based budgeting app.)

EveryDollar: Available Help

EveryDollar free users can reach the chat widget and bot via the EveryDollar help center, which includes articles covering frequent questions and how to get started.

EveryDollar Premium/Ramsey+ users have access to a live chat agent. At the bottom of the page sits a question mark for accessing the virtual bot. Ask the bot a question to get served up related links; or leave a message or request a live chat (available Monday to Friday, from 9:30 am to 5pm CT (from 8am on Tuesdays, Thursdays, and Fridays)).

EveryDollar: Ease of use

We set up our account by entering our email and choosing a password, verifying our email, then entering our name. One thing we noticed from the outset: EveryDollar uses clear, large type and distinct color design to facilitate visual engagement — including the proclamation that the service will change our life! The page design is centered, to make page layout responsive for mobile and desktop use.

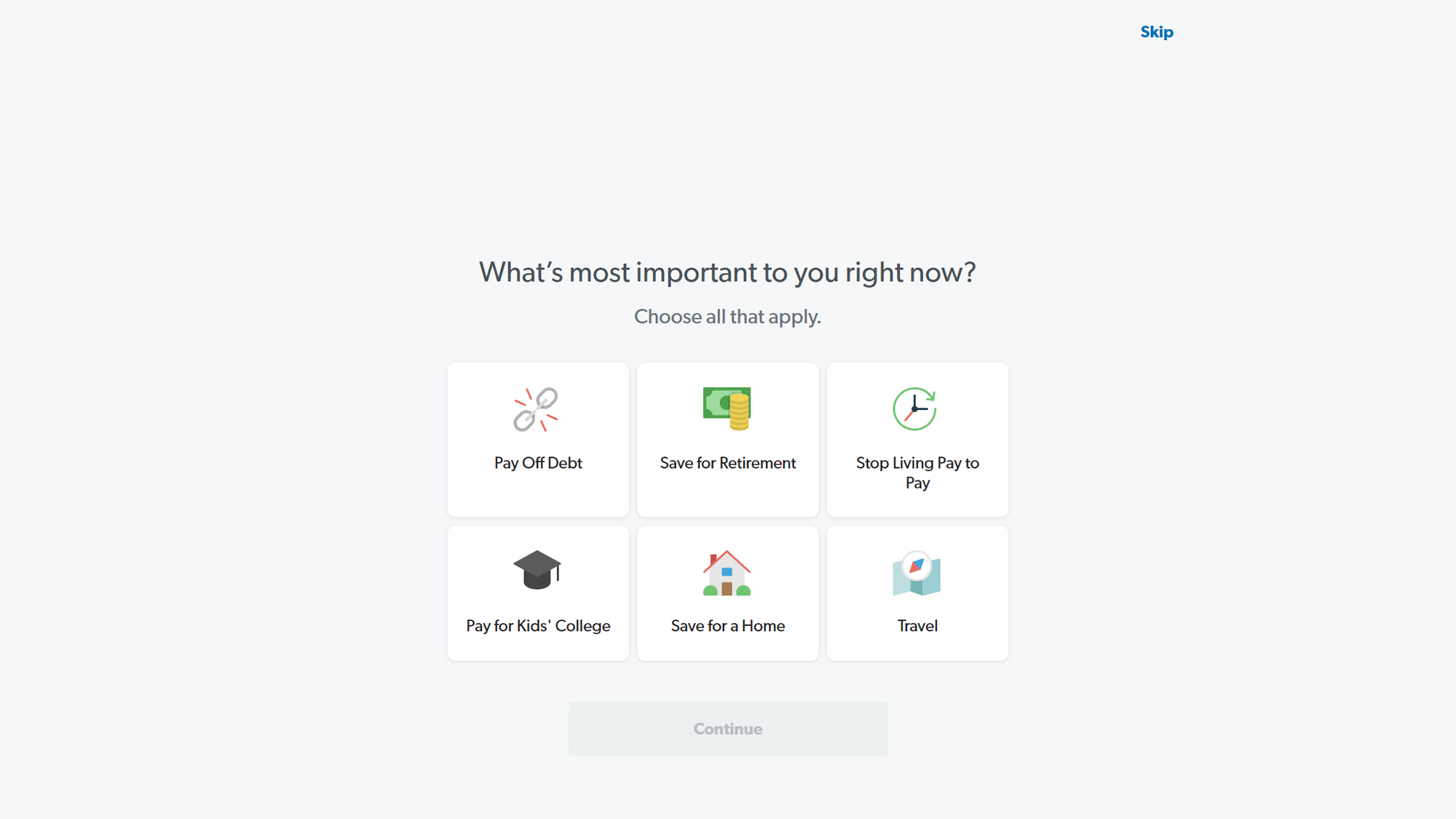

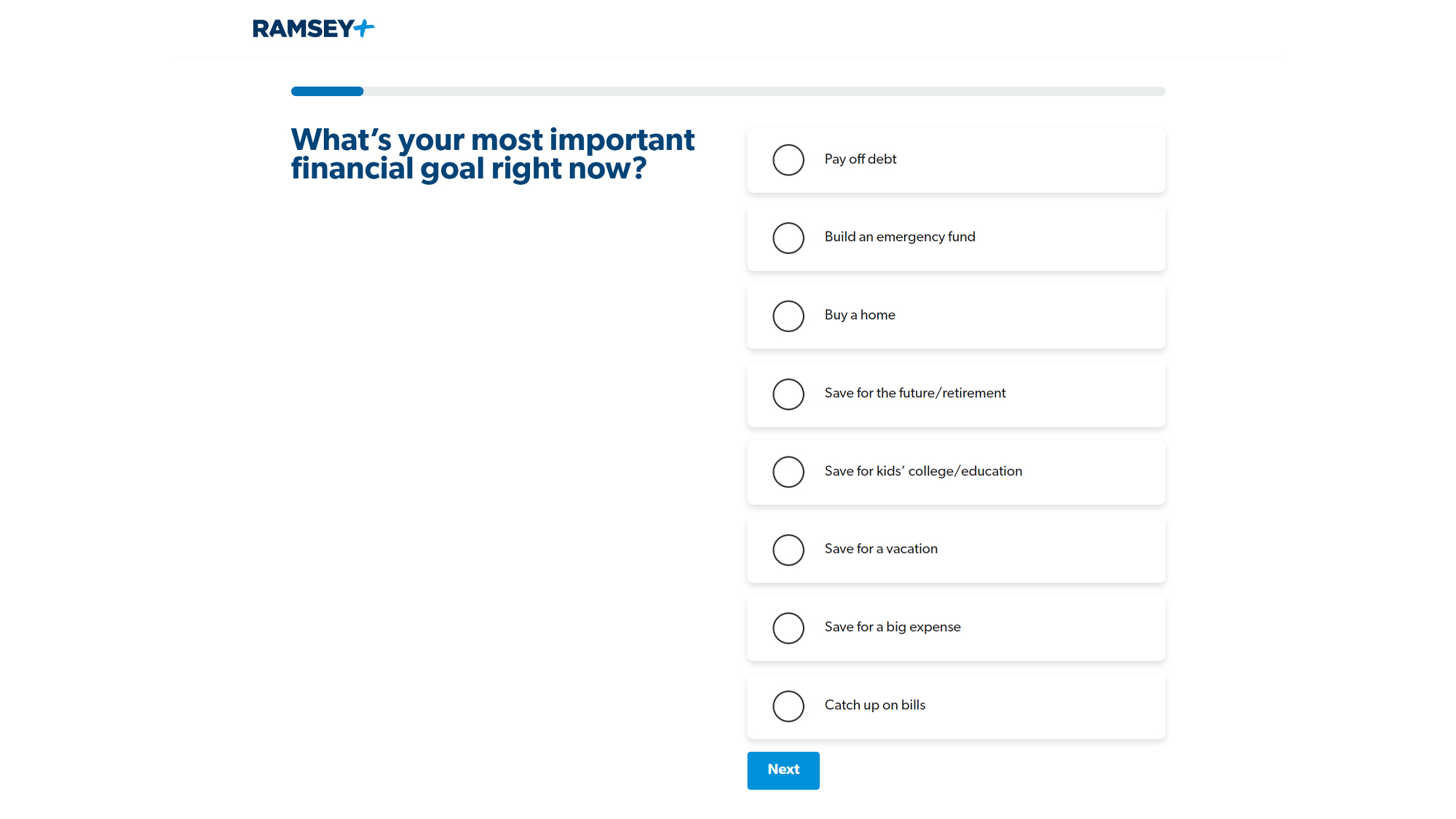

The next steps delve into money goals so we could build a budget that’s aligned with those goals. We liked that it asked us what our priorities were, plural, up front, and allowed us to choose more than one: pay off debt, save for retirement, stop living pay to pay, pay for kids’ college, save for a home, travel.

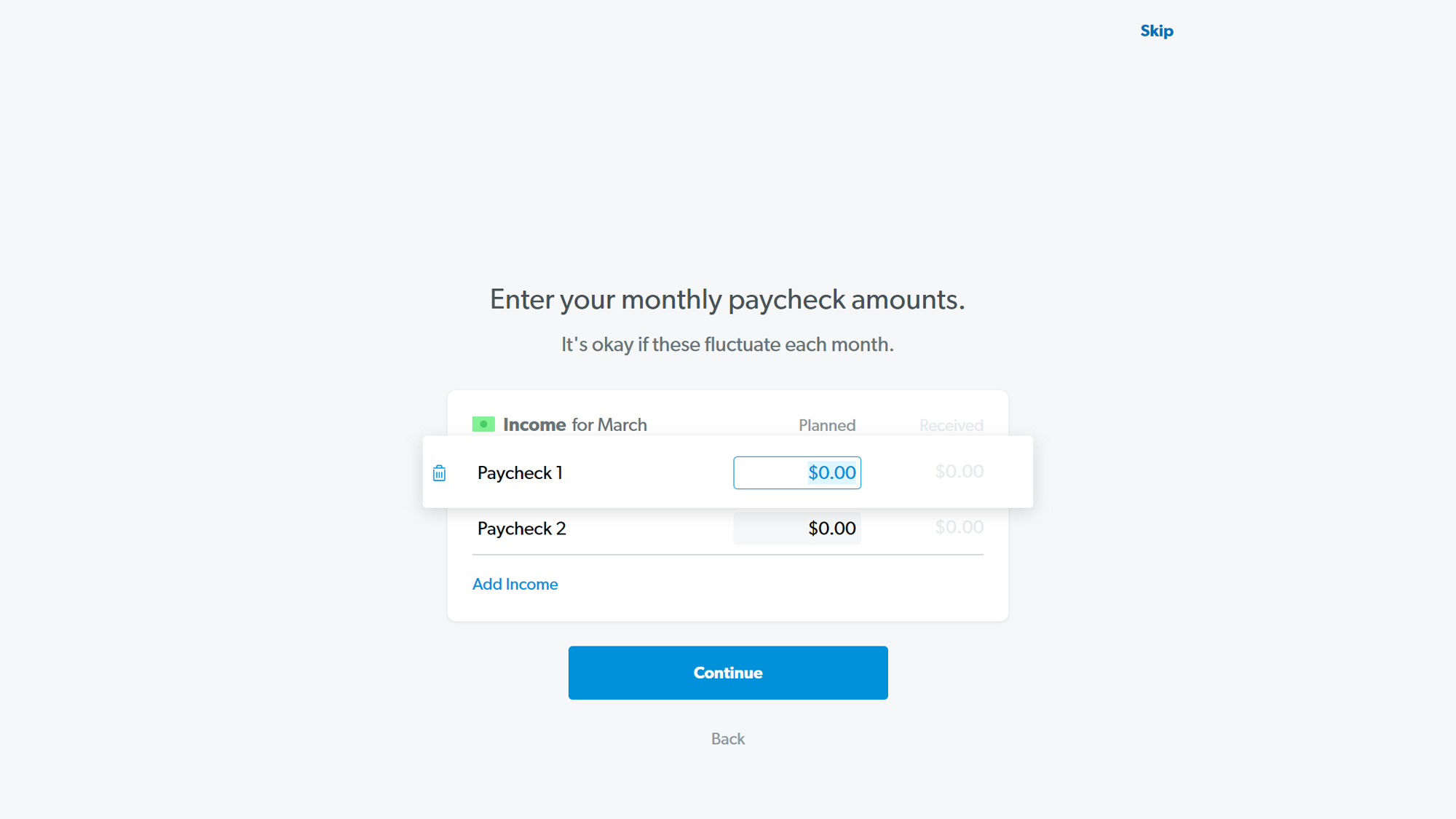

The second of five onboarding steps covers your income sources. You can enter your income, both planned and received, and add additional sources (labeled by default as “Paycheck”).

Of note here is the lack of differentiation of types of income (such as investment income). Next, you’ll encounter the first prompt to upgrade to Ramsey+ if you want to automate expense tracking by connecting a bank account. We started with the manual option to play through how EveryDollar works as a free app.

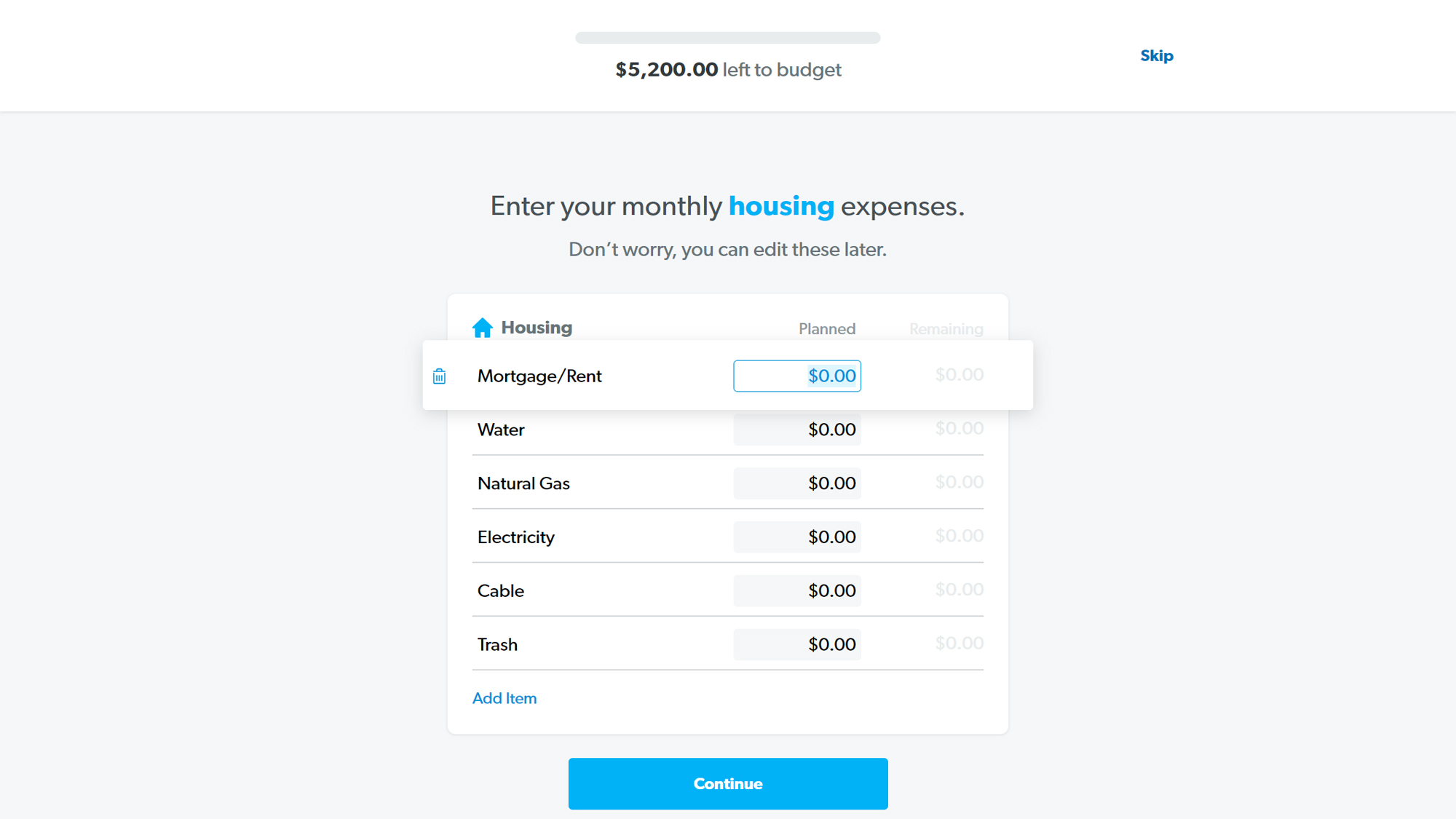

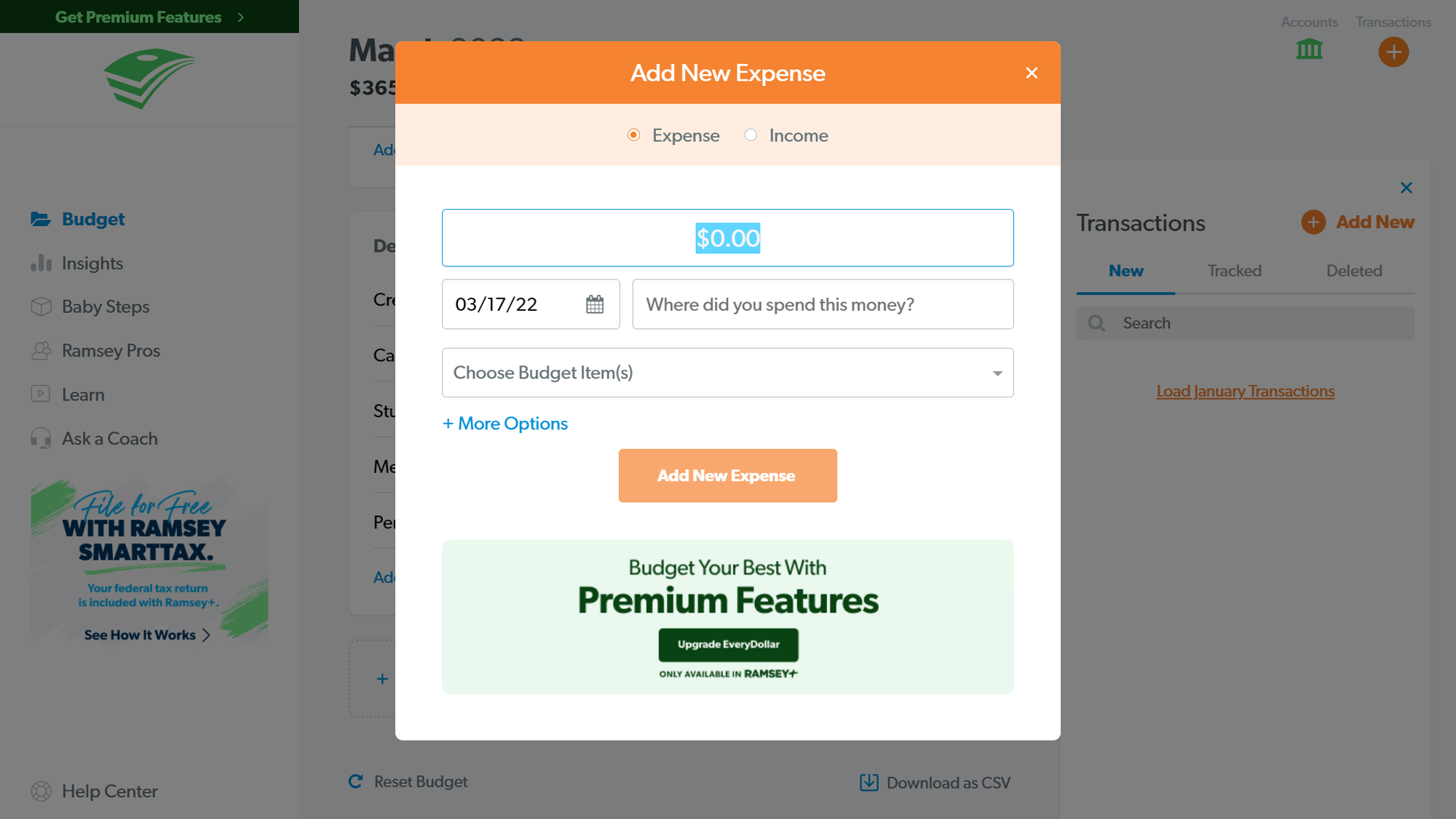

We generally liked the logical flow of expense tracking. You can enter your planned expenses with high-level categories like mortgage/rent, water, natural gas, electricity, cable, and trash.

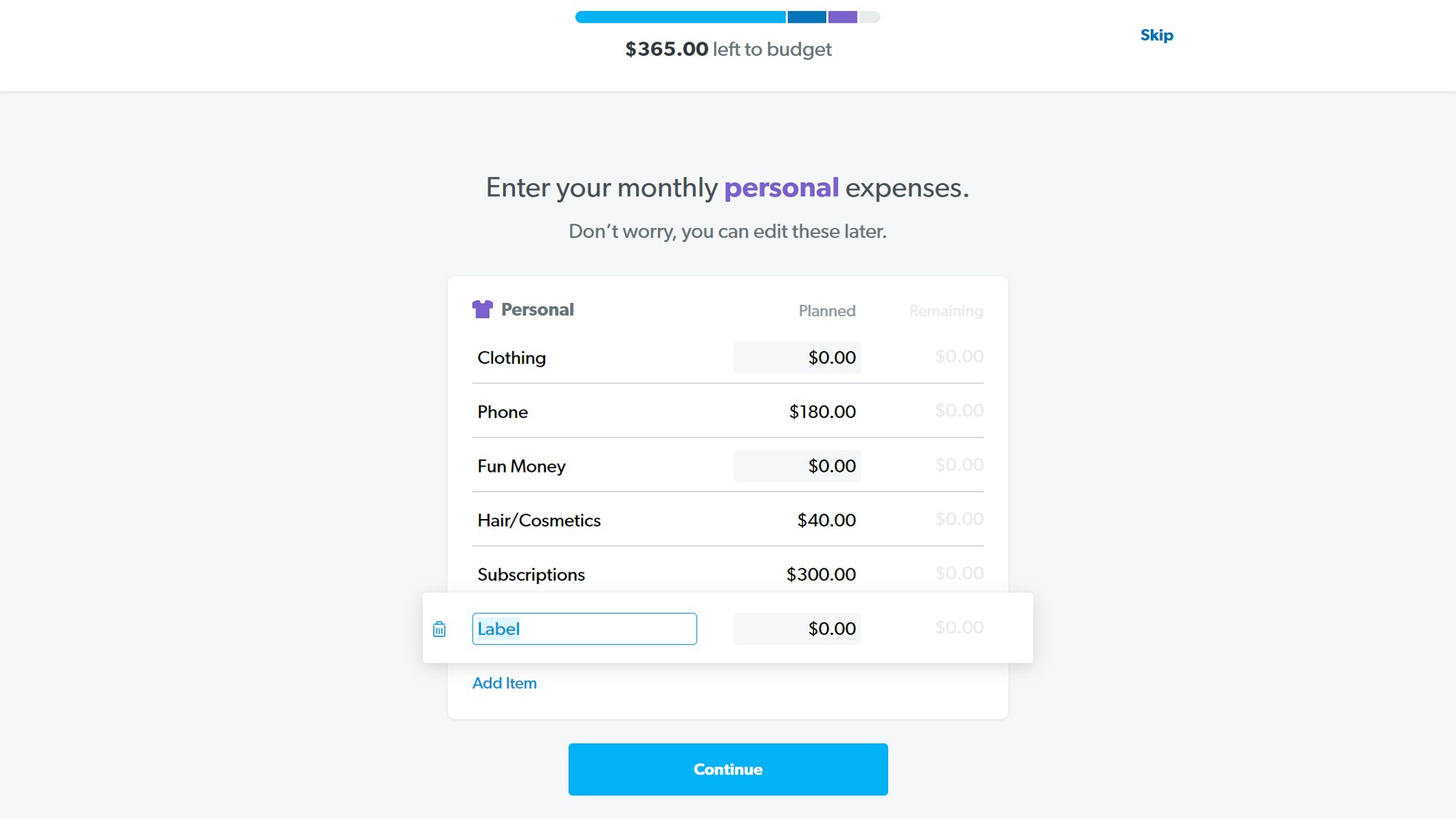

Editing labels, adding items, and entering data is a simple click away, and the interface was consistent as we moved through the next data points like monthly transportation expenses, food expenses, and personal expenses. We again liked the methodical thought process, and the ease with which we could tweak and customize the labels.

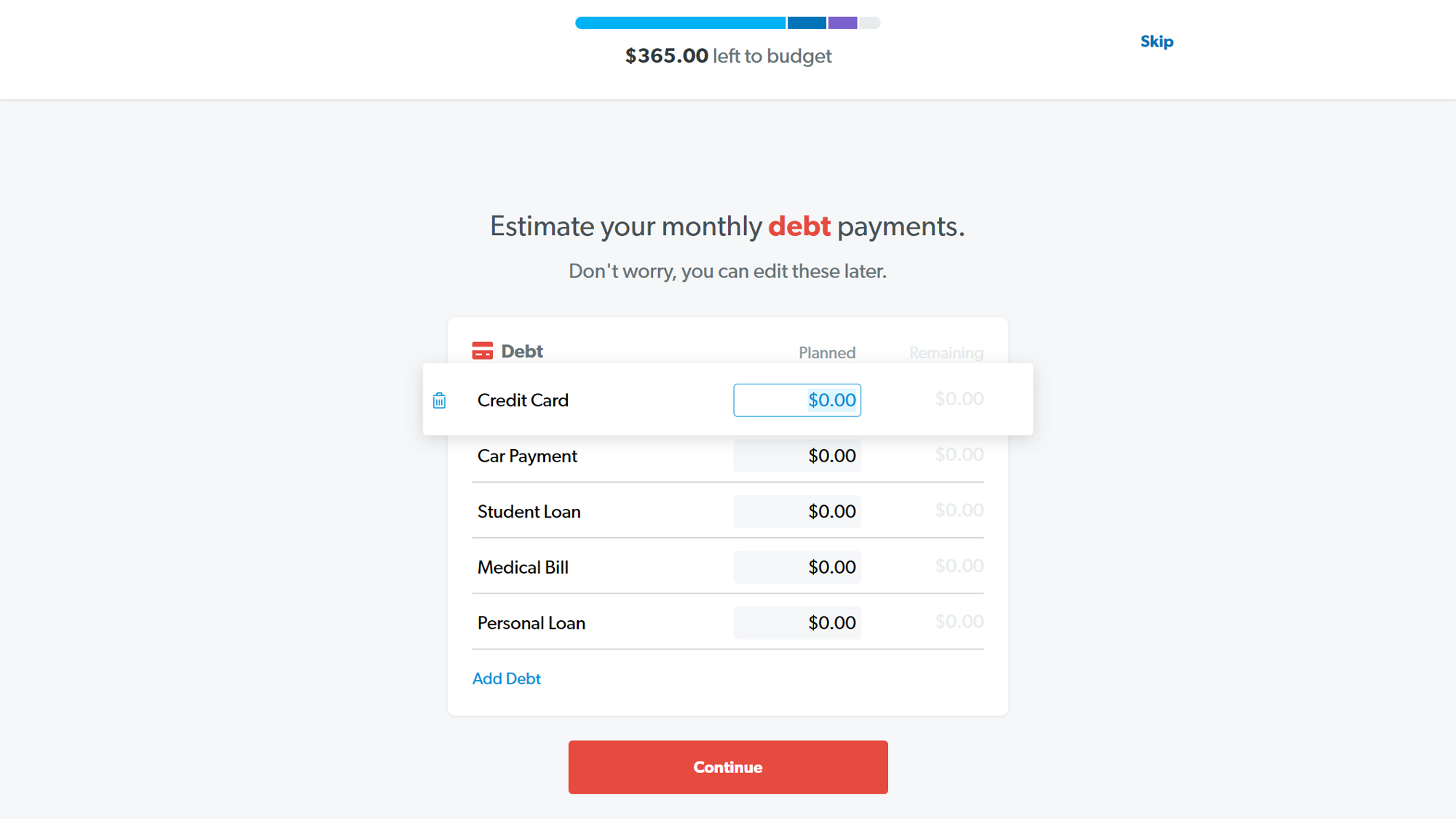

Many of the default labels are universal and work well for everyone (including an allowance for “fun money”). In the next section, Giving, the default label of “Church” is a rare reminder of EveryDollar’s religious influences. Up next is tracking your debt, by outlining what’s owed on your credit card, car payment, student loan, medical bills, and personal loans.

If you’re using the free version, you’re then subjected to an advertisement to join Ramsey+, before you can view the holistic outline of the financial information entered manually. And even then, the main screen shows an advert to upgrade, a reflection of EveryDollar’s heavy-handed push to join the Ramsey+ membership.

The main EveryDollar screen has a left navigation pane for moving among your budget, insights, Baby Steps, Ramsey Pros, but many of those are simply lead-ins to tempt you into additional services.

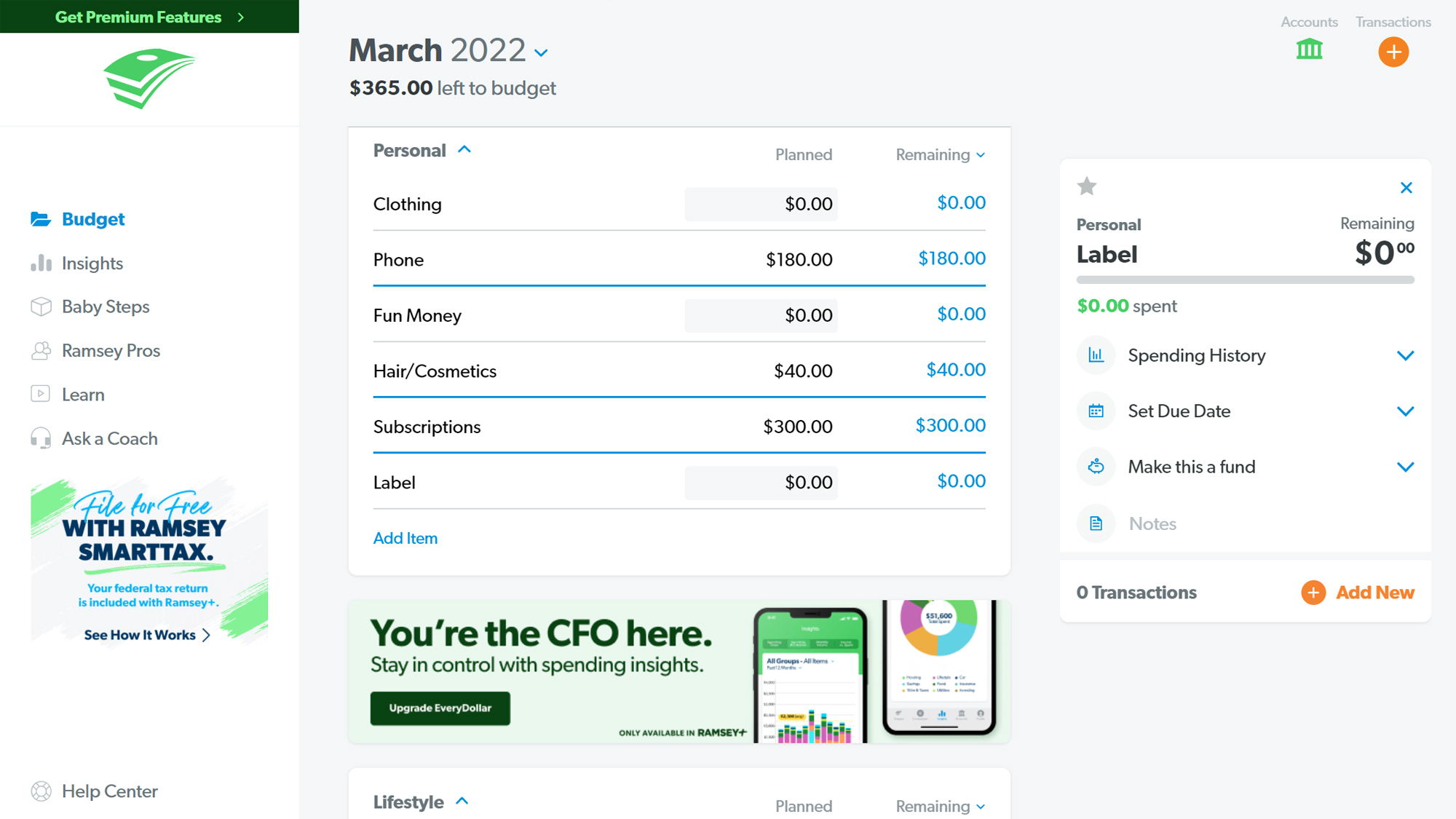

The main Budget section is broken down into two columns of cards. The center column has cards outlining your income and your expenses grouped by name. The income card remains fixed at the top, and you can reorder the cards beneath as you prefer.

A colorful breakdown of your expenses is visible at right when you have no line item selected. When you click on a specific line item in a card, you’ll see an expanded view at right to show the details like your spending history, the due date, or if the expense is actually a fund that carries over month-to-month to save towards a goal.

We liked that you could download the information entered as a .CSV file, which makes it easier to export your information if you’d like. If you haven’t connected accounts that will reflect all of this expense data, you’ll need to manually enter the data, which will quickly become tiresome. Regardless, if you stay with the free EveryDollar, at the least you will gain an easy way to eyeball your top-level expenses and how they balance with your income.

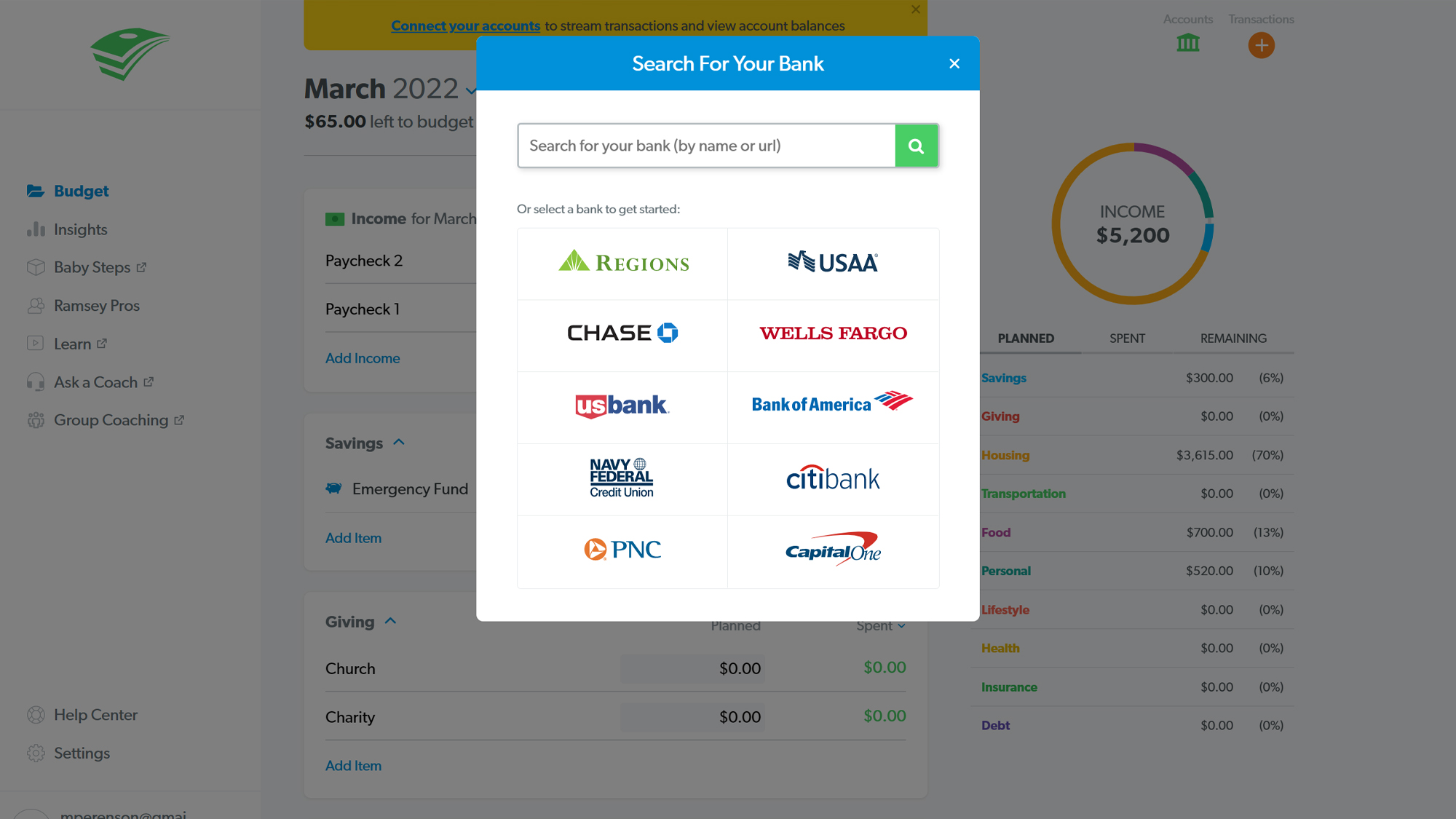

But to get the most of EveryDollar, you have to upgrade to the full Ramsey+ service and connect accounts (EveryDollar uses Mastercards’ Finicity service to bridge that secure connection).

To upgrade, you have to connect a checking account, because Dave Ramsey espouses not using credit cards. Once you’re in, EveryDollar runs through a fresh series of questions about your financial goals and current situation, going into deeper detail than on the free version.

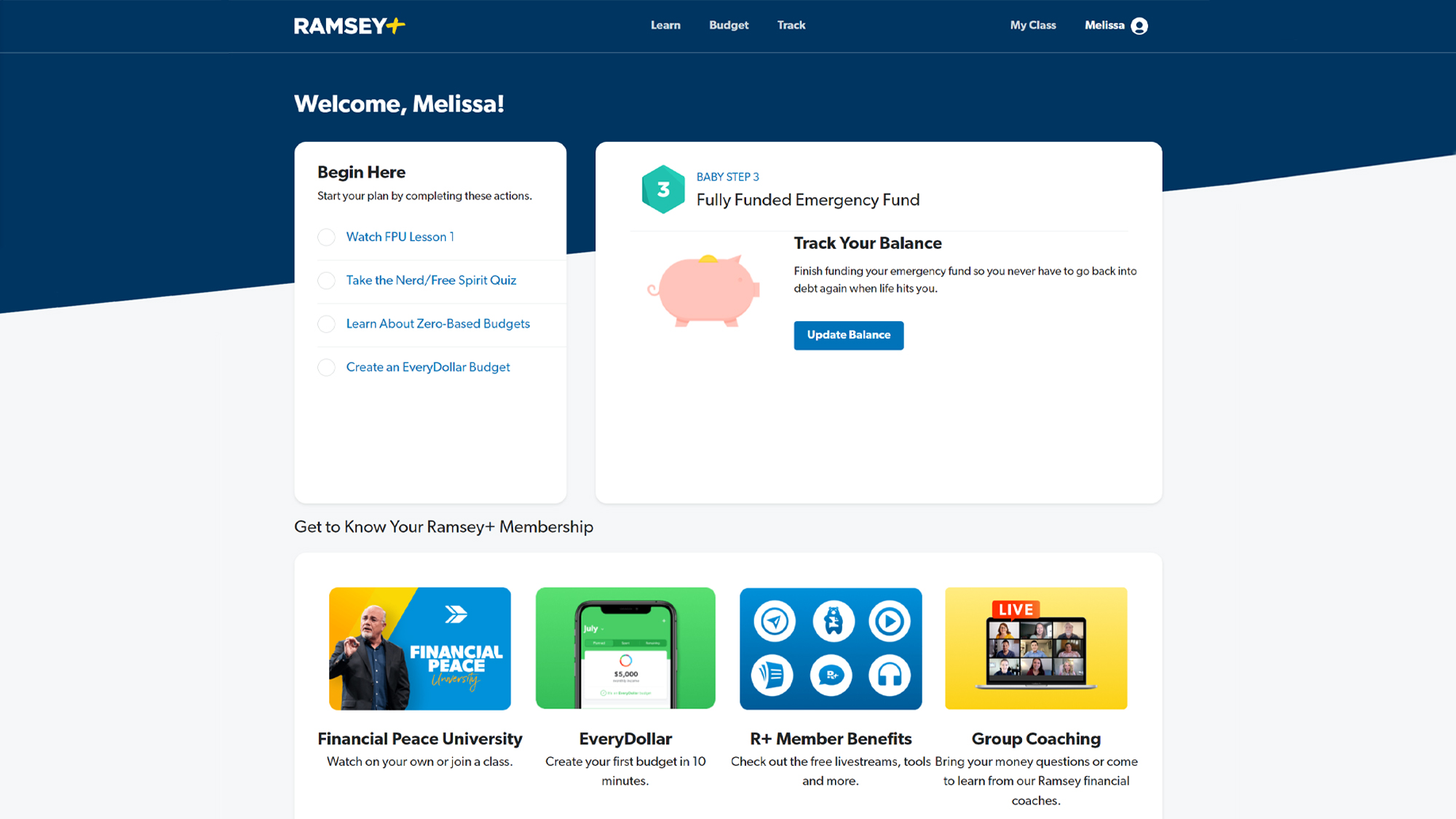

Your answers determine where you are in the 7 Baby Steps series (we randomly plugged in $10,000 of savings and it put us at step 3). And then the you open up into the Ramsey+ landing page. The page is structured a bit inconsistently, with a top nav bar for Learn, Budget, Track, but then below you see tiles for Financial Peace University (which is part of the Learn tab), EveryDollar (the same as the Budget tab), and Track (which takes you to where you are in the 7 Baby Steps). In spite of the label confusion, we liked that the page starts with a tile that walks you through getting started in the membership. It starts with the first lesson in the Financial Peace University, and a useful explainer about zero-based budgets, and sends you off to create an EveryDollar budget … on a separately branded page that lives on everydollar.com.

The structure and lack of cohesive visual aesthetic gives the Ramsey+/premium EveryDollar experience one of being cobbled together. Because once in EveryDollar, you can’t clearly navigate back to Ramsey+ (four of the tabs do lead back to Ramsey+, but the interface lacks a design element that points you there). You can enter EveryDollar from the everydollar.com page or from Ramsey+.

EveryDollar review: Mobile

EveryDollar’s mobile app has a clean and functional visual aesthetic that tracks with the web-based service. The app lacks any branding or links back to Ramsey+ when you’re signed in, another sign of the cobbled-together effect of EveryDollar’s premium version falling under the Ramsey+ umbrella.

EveryDollar review: Verdict

Functionally, EveryDollar has a strong visual aesthetic and logical workflow for achieving zero-dollar budgets. The free version is limited in its abilities, since you have to manually enter all information. But that also makes it attractive if you want to get a more rough idea of where you stand with your cash flow, but don’t intend to maintain the budget daily.

The premium EveryDollar, which is part of the larger Ramsey+ service, lets you link bank and credit cards. You’ll still have to do some manual upkeep of the data, but the automation brought by the premium version helps make a smoother experience. And with Ramsey+, you gain access to group coaching and education on financial principles as presented from Dave Ramsey’s perspective. We found EveryDollar easier to use with a clearer flow than YNAB, but we recommend YNAB for zero-based budgets since it costs $31 less (billed annually) and has broader customization. EveryDollar could be a good starting point for those who want some additional financial literacy tools; Ramsey’s personality can be an acquired taste, and his advice is often one-size-fits-all, but you can still find a lot of value in the Ramsey+ option.

Melissa Perenson is a freelance writer. She has reviewed the best tax software for Tom's Guide for several years, and has also tested out fax software, among other things. She spent more than a decade at PC World and TechHive, and she has freelanced for numerous publications including Computer Shopper, TechRadar and Consumers Digest.