Home

Latest about Home

-

-

The best coffee maker in 2025

By Millie Fender Last updated

-

As good as the Breville Bambino Plus espresso machine is, I wouldn’t recommend it for everyone — here’s why

By Erin Bashford Published

-

Le Creuset dropped a new outdoor collection, and it's ideal for grilling season

By Camilla Sharman Published

-

Fans are obsessed with Nespresso’s Nomad iced coffee cup – and it’s finally back in stock

By Cynthia Lawrence Published

-

7 car cleaning tips to make yours look brand new

By Kaycee Hill Published

-

I can't wait to try the Fellow Espresso Series 1, but this design feature has me concerned

By Millie Fender Published

-

How to revive a dying houseplant — 7 steps that actually work

By Kaycee Hill Published

-

Explore Home

Home Appliances

-

-

The best coffee maker in 2025

By Millie Fender Last updated

-

As good as the Breville Bambino Plus espresso machine is, I wouldn’t recommend it for everyone — here’s why

By Erin Bashford Published

-

Le Creuset dropped a new outdoor collection, and it's ideal for grilling season

By Camilla Sharman Published

-

I can't wait to try the Fellow Espresso Series 1, but this design feature has me concerned

By Millie Fender Published

-

Best Keurig coffee maker in 2025

By Kevin Cortez Last updated

-

I use my induction cooktop for every meal, but there's one thing it just can't do

By Grace Dean Published

-

Ninja just dropped a new espresso machine, and it's even smarter than the Luxe Café

By Millie Fender Published

-

Air purifier vs. humidifier: Which should you buy?

By Catherine Hiles Published

-

I made smoothies, shakes and pancake batter in Ninja's most powerful portable blender — here's my verdict

By Millie Fender Published

-

Home Office

-

-

I’ve been sitting in this ergonomic office chair for six months — and it’s done wonders for my posture

By Anthony Spadafora Published

-

I've spent the last 4 years testing the best standing desks — here's my top picks for your home office

By Anthony Spadafora Last updated

-

I tried an under-desk elliptical and it transformed my work day — here's how

By Anthony Spadafora Last updated

-

I’ve been testing this standing desk — and I can’t believe how sturdy and customizable it is

By Anthony Spadafora Last updated

-

I spent over 5,000 hours testing all the best office chairs — here are my top picks

By Anthony Spadafora Last updated

-

I thought the Steelcase Karman was perfect until I tried the high back version of this one-of-a-kind office chair

By Anthony Spadafora Published

-

Amazon Spring Sale — 9 last minute office chair and standing desk deals to build out your home office

By Anthony Spadafora Published

-

I tested this standing desk with touchscreen controls and built-in cable management for 2 months — and I’m in love

By Anthony Spadafora Last updated

-

This office chair strikes the perfect balance of form and function — and it's almost $200 off on Amazon

By Adam Schram Published

-

Home Security

-

-

The best smart locks in 2025

By Mike Prospero Last updated

-

Arlo's cheapest home security cameras just got a big upgrade for Apple users

By Mike Prospero Published

-

Wyze adds AI-powered filter to its security cameras to cut down on notifications that are “no big deal”

By Amber Bouman Published

-

I tried a physical panic button for 48 hours — and this tiny device already makes me feel safer

By Amber Bouman Published

-

7 Ring video doorbell tips everyone needs to know

By Caroline Preece Last updated

-

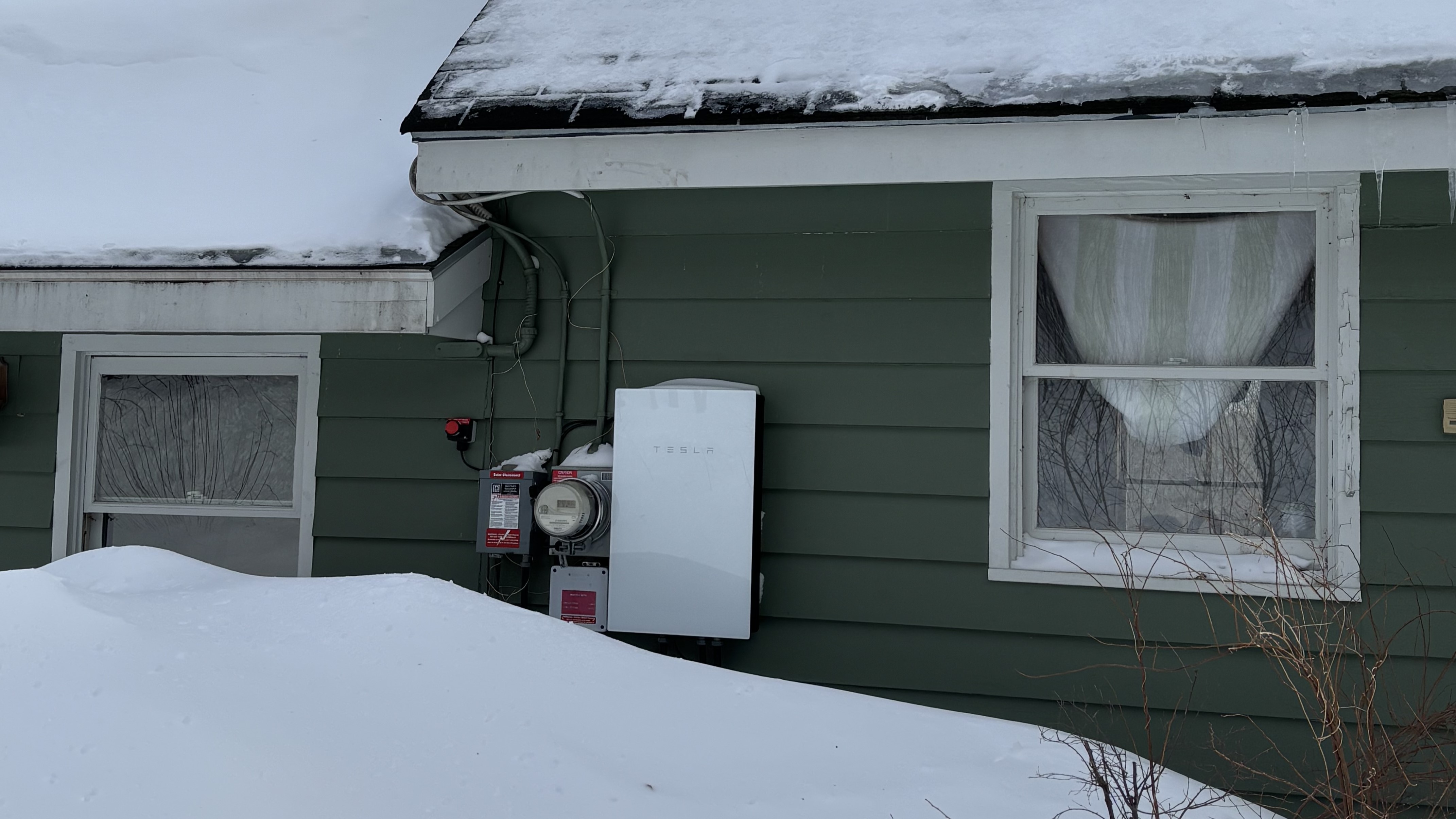

I deal with major snowstorms every winter and these Powerwall batteries are a game changer in my home

By Amber Bouman Published

-

EufyCam 2C Pro review

By Christian de Looper Published

-

Ring's new Outdoor Cam Plus security camera offers 2K video, better night vision

By Amber Bouman Published

-

Best outdoor security cameras in 2025

By Mike Prospero Last updated

-

Outdoors

-

-

I'm a mom who loves gardening — here are 3 gifts I'd like to receive on Mother's Day

By Camilla Sharman Published

-

I rode this electric bike 40 miles through every borough in New York City — 5 things I learned

By Mike Prospero Published

-

The 7 best plants for neat yet low-maintenance hedges

By Madeleine Streets Published

-

I just spent a week with Brompton's latest folding bike — here's what I like and what I don’t

By Jeff Parsons Published

-

5 vegetable crops to grow in May for a homegrown harvest

By Camilla Sharman Published

-

5 colorful flowers to plant in May for a beautiful summer garden

By Camilla Sharman Published

-

Recteq's latest release could replace your pellet and your gas grill in one

By Grace Dean Published

-

Rad Power is replacing its most popular electric bike — here's what's new

By Mike Prospero Published

-

Take a natural approach to pests: How to use diatomaceous earth to solve 7 garden problems

By Madeleine Streets Published

-

Smart Home

-

-

Best video doorbells in 2025: Ring, Nest, Arlo and more tested

By Mike Prospero Last updated

-

The best dehumidifiers in 2025

By Cynthia Lawrence Last updated

-

Best smart thermostats in 2025

By Mike Prospero Last updated

-

I’ve been using Google’s new Nest Learning Thermostat for 6 months — and these 3 features make the upgrade totally worth it

By Anthony Spadafora Last updated

-

Ecobee Smart Thermostat Essential review

By Christian de Looper Published

-

Chromecast with Google TV isn't dead yet — Google's older streaming dongle just got a massive upgrade

By Jeff Parsons Published

-

I just upgraded to a smart lock with built-in video doorbell camera — and it’s a game changer for my home

By Anthony Spadafora Last updated

-

Google is cutting off support for these older Nest Thermostats — what you need to know

By Scott Younker Published

-

Eufy FamiLock S3 Max review: A smart lock and video doorbell in one

By Christian de Looper Published

-