Wellness

Explore Wellness

Latest about Wellness

35 best running shoe deals for spring — save up to 50% on Hoka, Asics, Nike and more

By Olivia Halevy last updated

In the market for a new pair of running shoes? Top brands like Hoka, Asics and Nike are hosting huge sales ahead of spring.

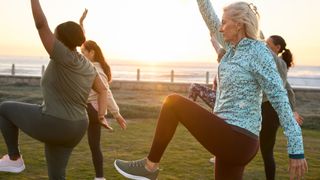

I'm a personal trainer: These are the 3 moves you need for better stability and balance after 60

By Sam Hopes last updated

Add these three balance exercises to your exercise routine for strength and stability.

The 7 coolest wellness gadgets and wearables I saw at MWC 2026

By Dan Bracaglia published

From desktop robot companions to smart contact lenses, these are the coolest gadgets I checked out during Europe's largest tech show of 2026.

I logged 37 miles at MWC 2026 on my Garmin Instinct 3 — here are 5 things I learned

By Dan Bracaglia published

I walked 67,000 steps over five days at Europe's biggest tech show and climbed 3.5 times the height of the Sagrada Familia. Here's what it taught me.

I spent two weeks testing the brand-new Amazfit Active 3 Premium — and I don’t know why anyone would spend $400 on an Apple Watch again

By Erin Bashford published

Editor's ChoiceThe Amazfit Active 3 Premium is a fantastic budget fitness tracker capable of going head-to-head with industry leaders like Oura, Fitbit, and Apple.

Icebug Järv RB9X review: Takes the crown for most sustainable running shoe

By Erin Bashford published

RecommendedThe Icebug Järv RB9X are a pair of well-made, environmentally friendly trail shoes, with responsive soles that let you feel the ground underfoot.

This 10-minute standing workout is perfect for improving your balance and stability, and you just need a light dumbbell to do it

By Nick Harris-Fry last updated

Working on your balance and stability is important for all ages, and this 10-minute standing workout can be done at home using just one dumbbell.

I’m a personal trainer: I've been adding frog pose into my routine to help fix my low back pain and build hip stability

By Sam Hopes last updated

Frog pose releases tight hips and can ease symptoms of sciatica when performed properly; here's how to do it, and the benefits.

Yes, teens need more sleep than adults — experts share how much and why

By Sarah Finley published

Teens are natural night owls and late risers, and they might need up to three hours more sleep than you a night. Sleep experts explain why and how to help them get it.

The Brooks Glycerin Max is one of the most comfortable running shoes I’ve tested, and it’s reduced by 25% right now

By Nick Harris-Fry published

The Brooks Glycerin Max is an exceptionally comfortable shoe and actually better than the Glycerin Max 2 in my opinion, so this deal is worth looking at.

Here at Tom’s Guide our expert editors are committed to bringing you the best news, reviews and guides to help you stay informed and ahead of the curve!

Club Benefits

Club Benefits