This type of scam cost Australians billions in 2022

Over AU$3 billion was lost to online scams in 2022, an 80% increase over 2021, and investment scams were most effective

Here at Tom’s Guide our expert editors are committed to bringing you the best news, reviews and guides to help you stay informed and ahead of the curve!

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Daily (Mon-Sun)

Tom's Guide Daily

Sign up to get the latest updates on all of your favorite content! From cutting-edge tech news and the hottest streaming buzz to unbeatable deals on the best products and in-depth reviews, we’ve got you covered.

Weekly on Thursday

Tom's AI Guide

Be AI savvy with your weekly newsletter summing up all the biggest AI news you need to know. Plus, analysis from our AI editor and tips on how to use the latest AI tools!

Weekly on Friday

Tom's iGuide

Unlock the vast world of Apple news straight to your inbox. With coverage on everything from exciting product launches to essential software updates, this is your go-to source for the latest updates on all the best Apple content.

Weekly on Monday

Tom's Streaming Guide

Our weekly newsletter is expertly crafted to immerse you in the world of streaming. Stay updated on the latest releases and our top recommendations across your favorite streaming platforms.

Join the club

Get full access to premium articles, exclusive features and a growing list of member rewards.

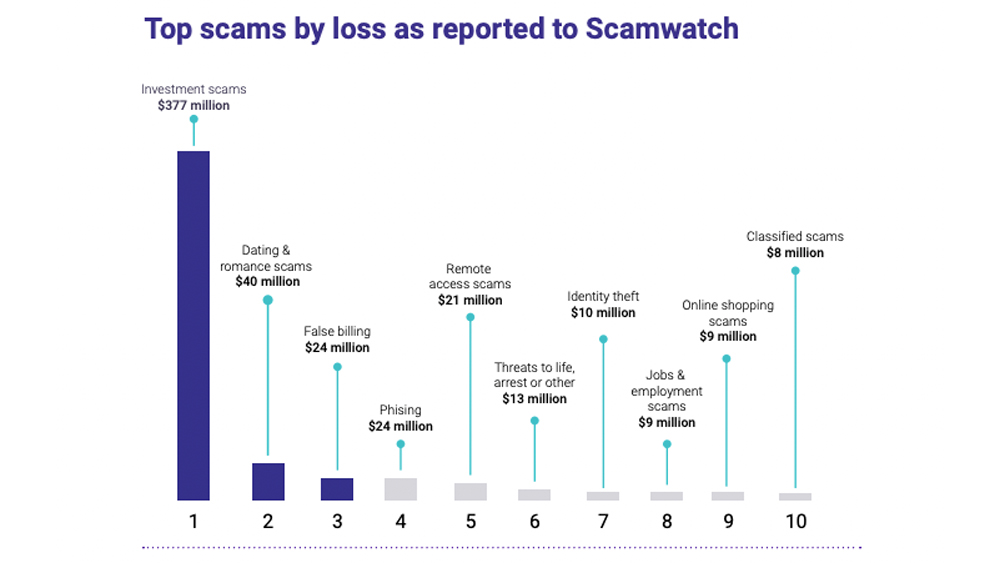

Australians lost a staggering AU$3.1 billion to scams in 2022, according to the Australian Competition and Consumer Commission (ACCC), an increase of a huge 80% compared to losses in 2021. The ACCC’s Targeting Scams report — which sources data from its own Scamwatch, ReportCyber, the Australian Financial Crimes Exchange, IDCARE, and other government agencies — found investment scams contributed the highest losses at AU$1.5 billion.

While there are a number of government initiatives and support channels (such as those that contributed to the Targeting Scams report), all aiming to minimise and prevent Australians falling foul to scams, scammers themselves are becoming increasingly clever, employing new tactics to deceive people out of life-changing sums of money.

These include scammers being able to impersonate legitimate phone numbers, email addresses and websites, and they’re also now able to send text messages that appear in the same thread as previous messages from a legitimate organisation.

Investment scams costing Australians billions

As mentioned earlier, the investment scams category was responsible for the highest losses in 2022, and the ACCC’s Scamwatch has identified a number of trends that proved particularly effective. They include:

Imposter bond scam

Imposter bond scams see a scammer impersonating financial service companies or banks claiming to provide low risk investment products such as bonds and fixed term loans. Their seemingly sophisticated nature — appearing to be legitimate even when a potential victim does their own research — is a major cause of their effectiveness.

The ACCC provided an example of one such successful imposter bond scam

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

The scammer demonstrated expert financial knowledge and even after the woman did her own research on the firm the scammer said he was from, it all appeared to be legitimate. Even her bank confirmed the account she was asked to send money to was registered with them.

After the woman sent AU$50,000, the company she paid disappeared and she wasn’t able to retrieve her money.

IPO scams

Initial public offering scams see scammers impersonating Australian companies to promote offers related to company listings, with some identified companies scammers posed as including Porsche, Stripe and SpaceX.

One victim identified by Scamwatch purchased what he believed to be real shares in Porsche, after a scammer, 'Richard', sent the victim a link to a company website with account details to send money to. Because the documentation he received seemed real, he decided to make a second purchase, with money this time being sent to a different bank account, which was blocked. He was told it was a scam account, so that money was safe, but the initial AU$26,000 he'd sent to the first account was lost.

Older Australians the worst affected

There has also been a sharp increase in the number of scams occurring on social media websites such as Facebook Marketplace, with many seemingly keen buyers asking for sellers to transfer them money via PayID. The buyer often says they’re sending money from a business account, and so needs to send more than necessary in order for it to go through. The buyer will then ask the seller to send them money back.

Remote access scams reported AU$229 million and the payment redirection scams category was the third-highest, with losses of AU$224 million. The ACCC adds that it’s not just the financial loss that takes a toll on victims, but the emotional stress too, with “the process of recovery from a high loss scam [being] long and difficult.”

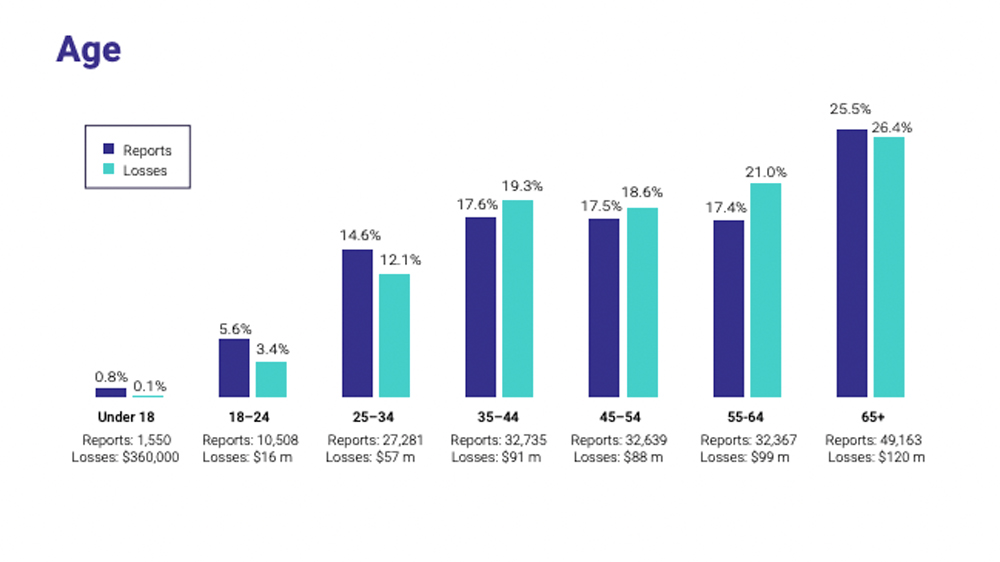

One of the most concerning statistics in the ACCC’s Targeting Scams 2022 report, is that just over a quarter of all scams reported (25.5%) to Scamwatch were from the 65 years and over age group, suggesting the scammers are relying on the older generation to be less technologically-savvy and so being easier to deceive. The 65+ category reported the highest total losses too, of AU$120 million.

Australia’s indigenous community was also preyed upon heavily in 2022, with total financial losses reported to Scamwatch reaching AU$5.1 million. Culturally and Linguistically Diverse Communities reported losses of AU$56.6 million and people with disabilities reported AU$33.7 million in losses.

Other scams to look out for

Money recovery services

Some scammers prey upon those who have already fallen foul to financial scams. One example provider told of an elderly woman who had already lost her retirement fund of over AU$3 million. She found a business online that claimed it would be able to help her retrieve her money.

The scam business asked for a 5% retainer fee of the total lost, and after selling assets, the elderly woman managed to raise and pay AU$70,000. But the recovery service asked for AU$80,000 and threatened with legal action if she didn’t pay it. The woman asked her daughter to take out a loan so she could pay the full amount, but the daughter determined it was a scam and reported the fraudulent business.

Phishing

Phishing was the most reported category of scam to Scamwatch in 2022, with losses totalling AU$24.6 million, a 496% increase over the AU$4.3 million lost in 2021.

Phishing scams were mostly sent as text messages, impersonating a bank, a child or a road toll company, such as Linkt. These phishing texts will usually contain a link to either pay money or provide personal information.

These phishing scams are becoming far more sophisticated, and are now able to cleverly mirror the usual communications one would receive from the legitimate company the scam is impersonating. They will also either be sent from a spoof version of the legitimate company’s phone number, or they can even display the same sender ID as the legitimate company.

What's being done to combat scammers?

The ACCC and the Australian Securities and Investment Commission (ASIC) worked in collaboration in July 2022 to track down malicious websites. Over a period of 21 days, 1,757 web addresses were analysed and 381 were indeed found to be malicious, and these have since been removed.

The Australian Federal Police has also been working with overseas police forces to target and track down online fraudsters, many of which have been successful and scammers in Australia — working on their own or being involved in international syndicates — were taken to court and charged.

For more information on scams, including what to look out for, to report a scam or for help with what to do if you think you’ve been a victim, you can head to the Scamwatch website

More from Tom's Guide

Max is a digital content writer for Tom’s Guide in Australia, where he covers all things internet-related, including NBN and the emerging alternatives, along with audio and visual products such as headphones and TVs. Max started his career in his homeland of England, where he spent time working for What Hi-Fi? and Pocket-lint, before moving to Australia in 2018.

Club Benefits

Club Benefits