A new Apple is emerging from the coronavirus pandemic

The struggling economy is hurting demand for ultra-premium products, but Apple is adapting to the challenge

Here at Tom’s Guide our expert editors are committed to bringing you the best news, reviews and guides to help you stay informed and ahead of the curve!

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Daily (Mon-Sun)

Tom's Guide Daily

Sign up to get the latest updates on all of your favorite content! From cutting-edge tech news and the hottest streaming buzz to unbeatable deals on the best products and in-depth reviews, we’ve got you covered.

Weekly on Thursday

Tom's AI Guide

Be AI savvy with your weekly newsletter summing up all the biggest AI news you need to know. Plus, analysis from our AI editor and tips on how to use the latest AI tools!

Weekly on Friday

Tom's iGuide

Unlock the vast world of Apple news straight to your inbox. With coverage on everything from exciting product launches to essential software updates, this is your go-to source for the latest updates on all the best Apple content.

Weekly on Monday

Tom's Streaming Guide

Our weekly newsletter is expertly crafted to immerse you in the world of streaming. Stay updated on the latest releases and our top recommendations across your favorite streaming platforms.

Join the club

Get full access to premium articles, exclusive features and a growing list of member rewards.

Apple looks like a company that's dealing with every challenge that the coronavirus can throw at it, even emerging from its most recent quarter with a slight bump in revenue. But it also sounds like more challenges are ahead.

Certainly, Apple's March quarter could have been much worse, as shutdowns due to the COVID-19 outbreak began hitting Apple's business in China in early February and spread to the rest of the world throughout March. But Apple finished the three months that ended on March 28 with $58.3 billion in quarterly sales, an increase of 1% over the March 2019 quarter.

- iPhone 12: What to expect from this fall's new phones

- What's the best iPhone you can buy right now

- Plus: iPhone 12 prices and key specs leak for all four models

That was nowhere near what Apple was expecting at the start of 2020 and even through the first few weeks of the year, CEO Tim Cook told Wall Street analysts during a conference call today (April 30).

In February, as supply chain interruptions began to impact Apple's iPhone supply and Apple Store closures in China cut into demand in that country, the company warned it wouldn't meet its revenue targets during the quarter. Even so, Apple finished ahead of analysts' revised estimates of $54.4 billion in revenue.

"This may not have been the quarter it could have been absent this pandemic, but I don't think I can recall a quarter where I've been prouder of what we do, or how we do it," Cook told analysts.

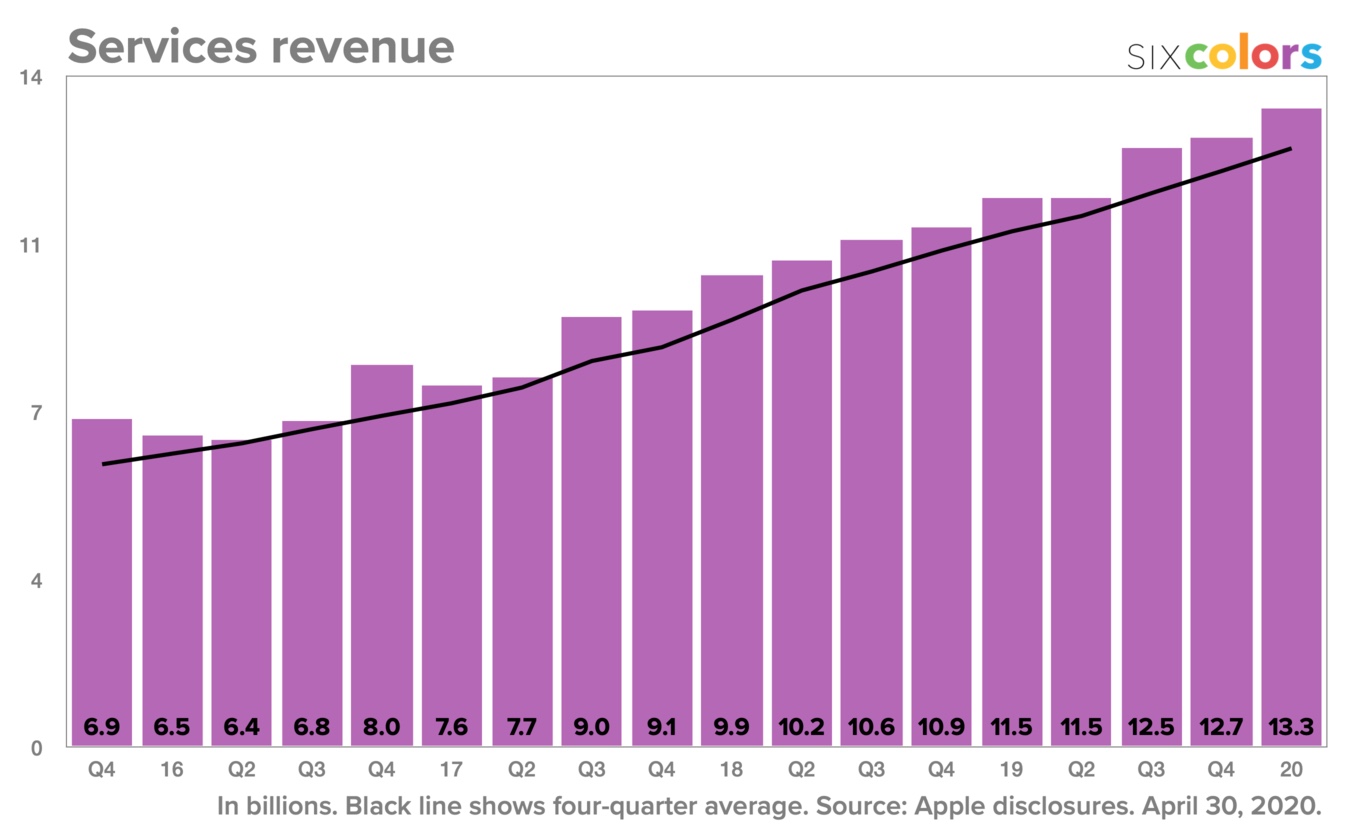

Credit Apple's ongoing gains in services and wearables for keeping Apple from seeing a quarterly decline. Services hit an all-time high of $13.3 billion for the quarter, an increase of 16% over last year, as the App Store, Apple Music and cloud services all set records. Wearables grew by 23% to just under $6.3 billion in sales, with Apple pointing to lots of new customers for the Apple Watch.

Those numbers helped make up for lost iPhone business during the quarter, as Apple's smartphone still accounts for half of the company's revenue. iPhone sales fell 7% to just under $29 billion during the quarter. Those figures don't account for the iPhone SE 2020, which launched after the March quarter ended.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

The question for Apple is, what happens next? The company doesn't seem to have a definitive answer, as it declined to give specific guidance for the current June quarter. iPhone and wearable revenues are expected to worsen year over year in the quarter, while Mac and iPad revenues are forecast to improve as people sheltering in place snap up computers and tablets that help them work at home.

Longer-term, Cook took a more confident tone about where Apple was headed. "Our global supply chain is profoundly durable and resilient. We have shown the consistent ability to meet and manage temporary supply challenges like those caused by COVID-19. We have continued to deliver innovative new products across multiple categories that appeal to a broad-cross section of customers," he said.

Apple's outlook is helped by the fact that the company's global supply chain is up and running again, according to chief financial officer Luca Maestri. Cook added that production levels were back to typical levels by the end of March.

The road ahead for Apple

Apple doesn't discuss upcoming products during these earnings calls with analysts, but comments about the supply chain are likely to fuel optimism that the iPhone 12 is still on track despite disruptions during the first three months of the year. Earlier this week, reports circulated that the iPhone 12 launch could be pushed back by up to a month.

Last year, the iPhone 11 was unveiled during the second week of September, and pre-outbreak, many Apple watchers were expecting a similar schedule this time around.

"Apple typically announces new iPhones in the second week of September, but product availability varies from late September to early November," said Avi Greengart, president and lead analyst for Techsponential. "I would expect the timing to be pushed out closer to the end of that range, but it does sound like Apple’s product development plans are largely back on track."

Apple has plenty of other products in the works for later this year. Besides the iPhone 12, Apple is likely working on the Apple Watch 6, new versions of the iPad Air and MacBook Pro, exercise-focused earbuds called the AirPods X and a new tracking device called AirTags, among other rumored products. And getting its supply chain back on line is only one piece of the puzzle for successfully launching, with several other conditions being out of Apple's control.

For one thing, Apple stores outside of China remain closed, as shelter-in-place orders remain in effect in most places. Some states and countries are beginning to ease up on those restrictions, but it's unclear when Apple's stores will re-open which could limit its ability to sell any new products it has in the works. In an interview with Bloomberg, Cook said that Apple would start to slowly open "just a few" of its U.S. retail outlets in May.

"Apple’s stores play a large role in discovery — exposing consumers to new products – and support. Long term, Apple definitely needs stores open," Greengart said. "However, in the short term, Apple’s products are so well known and well regarded that consumers are willing to purchase them online."

Then there's the prospect of a recession, which would limit shoppers' ability to buy new phones, tablets and other gear. Cook noted that the company started seeing upticks in demand as March gave way to April, partly due to the new iPhone SE and iPad Pro it released but also because of government-backed stimulus programs taking effect. It's unclear if those programs will continue throughout 2020.

The right product mix for an economic crisis

Greengart sees Apple facing a couple of challenges as the company looks to get operations back on track. For starters, the U.S. trade war with China seems to be heating up again, as the two countries trade accusations over the pandemic. That's a potential trouble spot for Apple, which relies on partners in China for parts and assembly of the products it designs. There's also the economic landscape where consumers might balk at paying for pricier electronics.

"It is unclear how the economic impact of the global shutdown will play out over time, but super-premium phones above $1,000 will likely be out of reach to many people who might have purchased them in previous upgrade cycles," Greengart said. "Still, Apple has a lot of the right products for a pandemic that is forcing people to work and learn from home: premium and professional computers, a rich line of tablets at multiple price points, health-monitoring watches, and noise cancelling earbuds."

For his part, Cook sounded optimistic about Apple's prospects during his prepared remarks for today's earnings news.

"We've always managed through difficult moments by doubling down and investing in the next generation of innovation, and that's our strategy today," Cook said. "So while we can't say for sure how many chapters are in this book, we can have confidence the ending will be a good one."

Philip Michaels is a Managing Editor at Tom's Guide. He's been covering personal technology since 1999 and was in the building when Steve Jobs showed off the iPhone for the first time. He's been evaluating smartphones since that first iPhone debuted in 2007, and he's been following phone carriers and smartphone plans since 2015. He has strong opinions about Apple, the Oakland Athletics, old movies and proper butchery techniques. Follow him at @PhilipMichaels.

Club Benefits

Club Benefits