Tom's Guide Verdict

TurboTax Deluxe is the most expensive tax software, but it also continues to have the most extensive intake from financial institutions, the best crypto handling and the widest expert help options, including an improved full-service tier that takes the guesswork out of filing.

Pros

- +

Easy to navigate around return

- +

Wider help options than most, including full service option for end-to-end tax filing assistance

- +

Excellent automated data input

- +

Direct import from cryptocurrency exchanges

- +

Only tax package with Spanish language option

Cons

- -

Pricier than other tax software

Why you can trust Tom's Guide

Mobile app: iOS, Android

Online support: Email, live chat, screen share

Phone support: 7 days a week, 5 a.m. to 9 p.m. PT

Tax pro assistance: Yes, paid upgrade to Live Assisted ($129 for Deluxe tier) or Live Full Service ($259 for Deluxe tier) (price varies depending upon tax service)

Intuit TurboTax Deluxe 2022 is a perennial mainstay for the best tax software crown, and this year is no different. Now in its 39th year, the TurboTax family (which covers the 2022 tax year) has a wide swath of options for assistance from a tax expert, and it has the smoothest all-virtual full-service upgrade that lets a tax professional do the heavy lifting. However, these features cost more than they ever have. If you’re trading in investments and cryptocurrency, this tier continues to provide one of the best integrated intake processes of any of the competitors.

The service’s user interface provides guided detailed questions in plain English, and minimizes your exposure to actual tax forms. TurboTax Live’s expert assistance remains a well-integrated experience. For 2023, TurboTax makes tweaks to its fully virtual Live Full Service, through which you can have a tax pro complete and file your taxes for you. If your tax needs are uncomplicated, TurboTax has a phenomenal free limited-time deal for those who qualify for Basic Live Assisted.

Read the rest of our TurboTax Deluxe 2022 review (which covers the 2022 tax year) to find out what else we liked about the software.

If you purchased TurboTax from 2016 to 2018, but because of your income, were eligible to use its free offering, you may be entitled to a refund, due to a settlement between Intuit and the states' Attorneys General offices.

Intuit TurboTax Deluxe 2022 review: Cost

TurboTax now offers three types of online federal tax products. At the baseline, there’s the do-it-yourself TurboTax. The step-up from that is TurboTax Live Assisted; the name now adds “Assisted,” presumably for clarity that you do get live help via video chats and tax return review with tax experts. The third line is TurboTax Live Full Service, where you give your documents to a tax expert and they do the rest. While we considered the availability and ease of using the live components, we evaluated the standard TurboTax online product, focusing on the Deluxe tier — one of four product tiers based on your return’s complexity.

All four do-it-yourself tiers remain the same price as last year, but the Live Assisted versions went up $10 across the board and the Live Full Service versions went up dramatically. For example, the Deluxe tier Live Full Service went up by $60, while the more complex Premier and Self-Employed versions each increased by a whopping $110.

• Basic (free; $89 for Live Assisted version after March 31, 2021; $209 Full Service after March 31, 2021) *For simple tax returns only. Not all taxpayers qualify.

• Deluxe ($59; $129 Live Assisted; $259 Full Service)

• Premier ($89; $179 Live Assisted; $369 Full Service)

• Self-Employed ($119; $209 Live Assisted; $399 Full Service). (See here for a matrix of various TurboTax options).

| Row 0 - Cell 0 | Basic | Deluxe | Premier | Self-Employed |

| TurboTax | Free | $59 | $89 | $119 |

| TurboTax Live Assisted | Free ($89 after 3/31) | $129 | $179 | $209 |

| TurboTax Live Full Service | $209 (after 3/31) | $259 | $369 | $399 |

TurboTax Live Full Service’s prices are a more significant step up from Live Assisted (new name, same as last year’s “Live” tier), but still a fairly reasonable expense when you consider you’re getting a fully virtual service tax pro handling your taxes — and they now handle your taxes live on the call with you. If you qualify for the Basic Live Assisted Service, you can get this service free if you file before March 31. We like TurboTax’s price transparency for its Live Full Service product. Also, you can see up front what Live Full Service costs before you start; H&R Block’s interface still obscures the pricing for its full virtual tax prep option online.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

If you prefer to keep your tax data local instead of using an online service, Intuit continues to offer four varieties of download-to-own TurboTax, at the same prices as last year (Basic, $50; Deluxe, $80; Premier, $110; and Home & Business, $120). The downloadable product lets you electronically file, or you can print out and mail your return. (Live services are not an option with the downloaded versions.)

Active duty and reserve military users can file federal and state taxes for free, using a link via the website’s menu. TurboTax’s software dynamically adjusts for its military product, as opposed to having a separate “product” (as TaxAct does for its military tax service).

Small businesses get a boost with the new TurboTax Live Full Service Business Tax, which handles LLCs, S-corps and partnerships. Pricing starts at $999.

Intuit TurboTax Deluxe 2022 review: State filing

State tax filing costs $59 per state on all standard do-it-yourself TurboTax online products, also up $10 from last year (a free state return comes with TurboTax Free online). That's pricier than H&R Block, which charges $37 per do-it-yourself state return. TurboTax Live Assisted Basic, which includes live support, includes one state filing. All other TurboTax Live Assisted and Live Full Service options cost $64 to file a state return, up $15 from last year.

Intuit TurboTax Deluxe 2022 review: Features

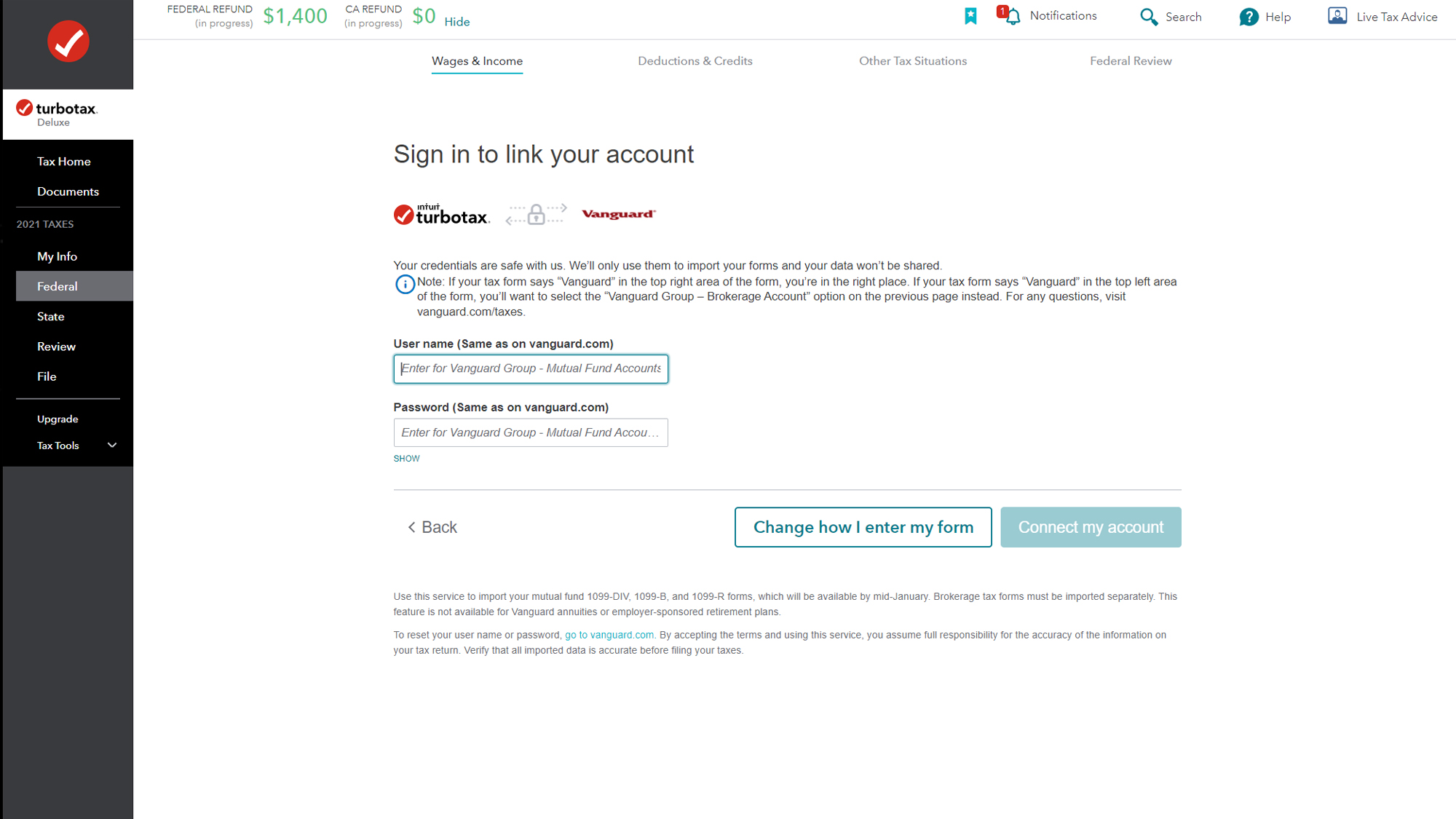

TurboTax has long let you import data from financial institutions and from Intuit QuickBooks, but not its consumer-centric Mint (TurboTax desktop handles Quicken imports as well). If you’re using the Live Full Service tier, you can use TurboTax’s MyDocs cloud service, through which you can share relevant tax documents for review (you can also add your docs there to collect them in one secure place, even if not using a tax pro to do your taxes for you).

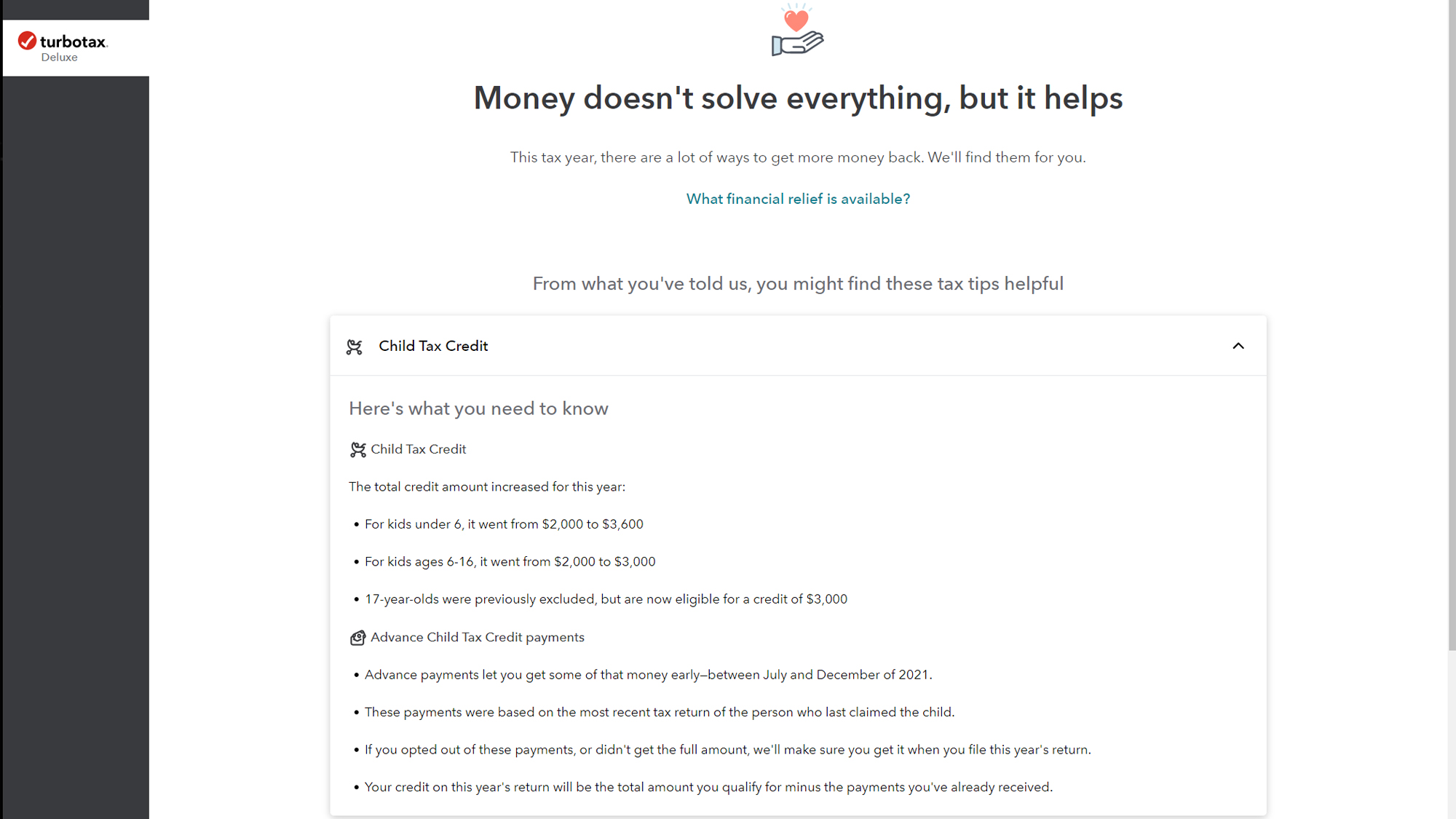

The free tier handles simple Form 1040 tax situations like the earned income tax credit, the standard deduction, the Child Tax Credit, basic interest and dividend income, and unemployment income. It also handles student loan forms. For anything more complex, you need to graduate to a higher tier.

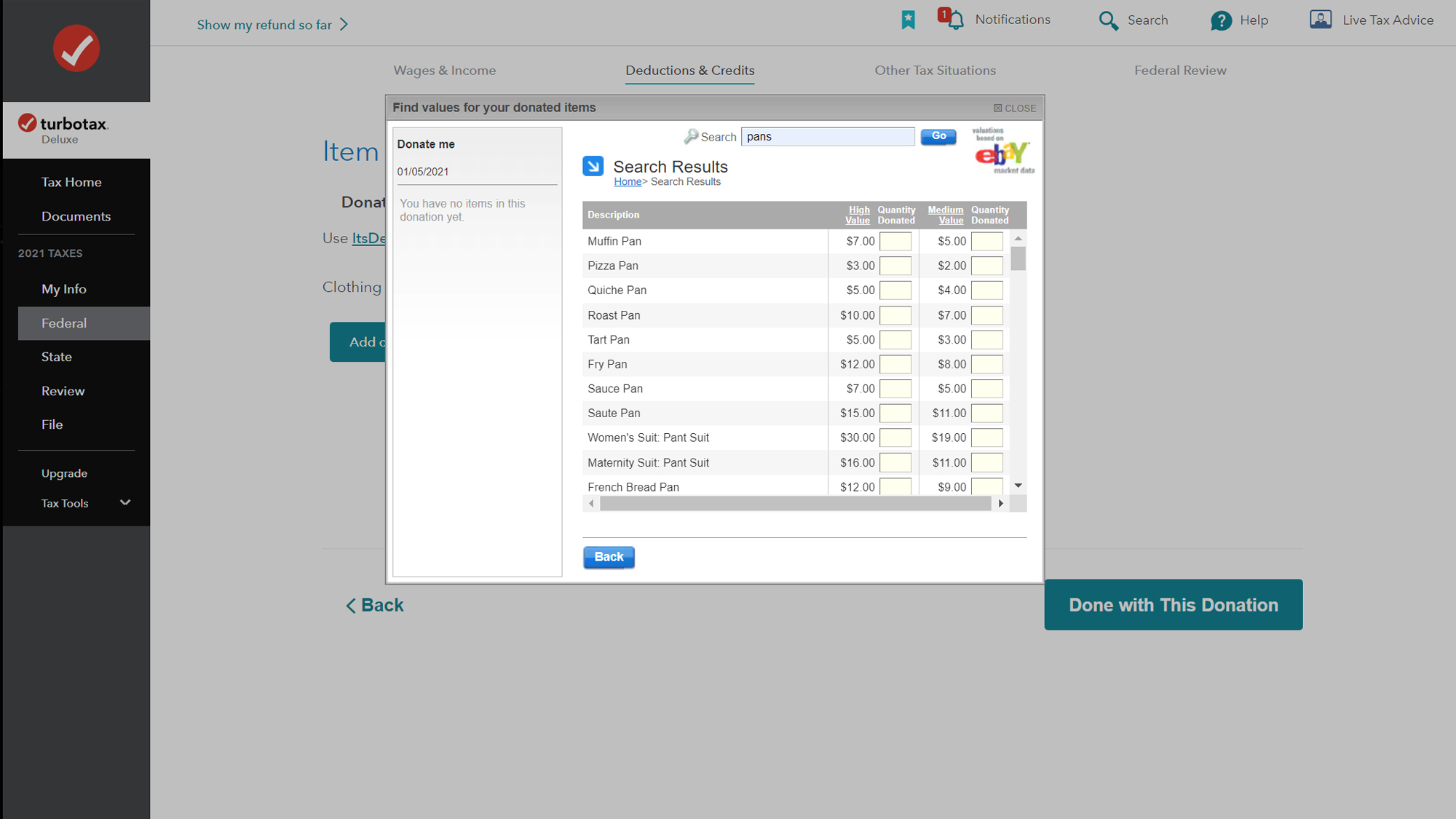

TurboTax's Deluxe product covers charitable donations and Schedule A (real-estate taxes and mortgage) deductions, and searches for more than 350 possible tax deductions.

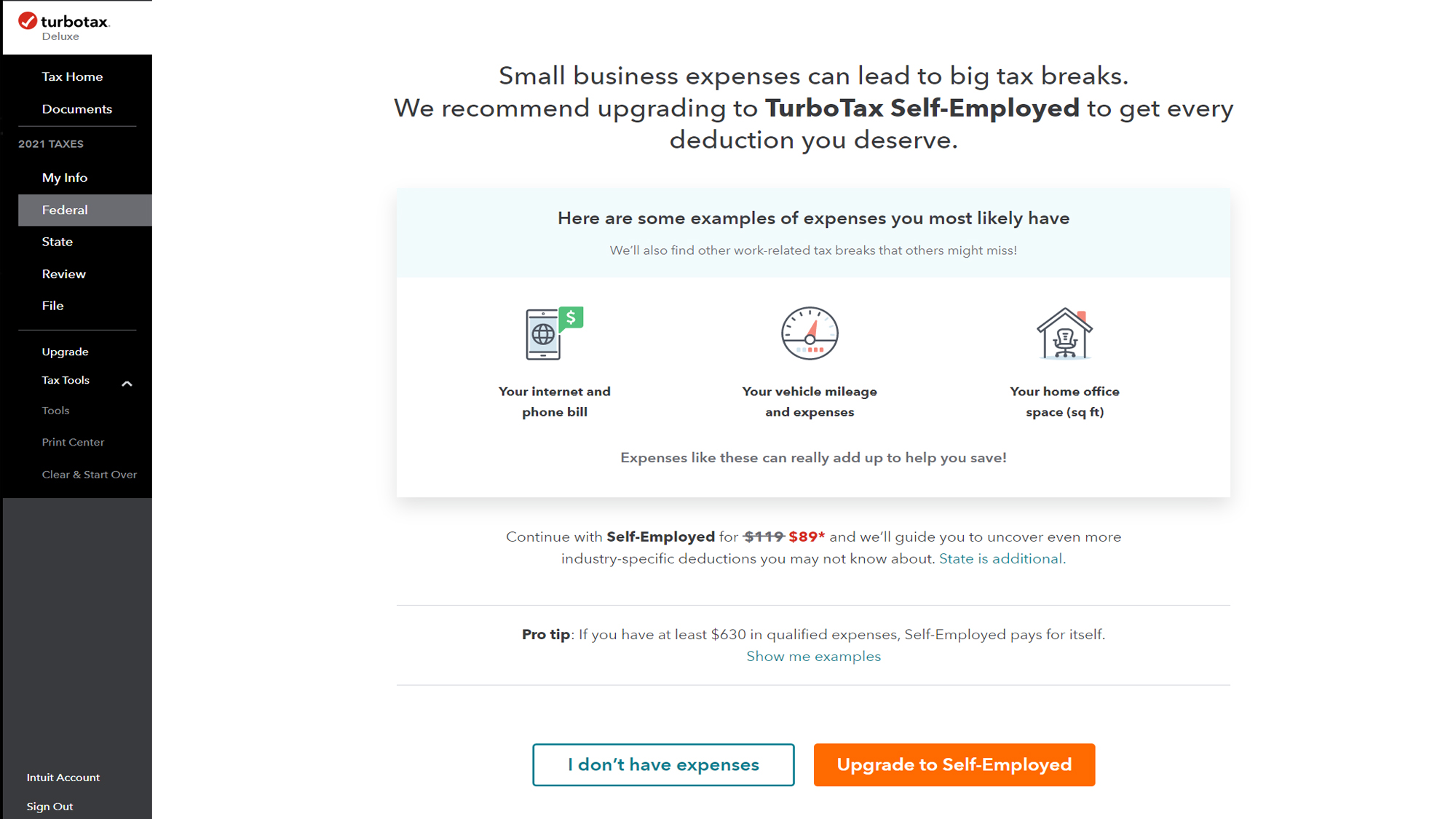

If you have a 1099-K from selling personal items or as a hobby, you can use Deluxe, but not if you have self-employed income. If you have a 1099-NEC form (the new independent contractor income form) or investments, you may be able to use Deluxe. But Schedules D (investments) and E (rentals and royalties) — including rental income, roboinvesting, and cryptocurrency transactions — require the Premier tier (although oddly, the Deluxe version allowed us to enter crypto transactions without prompting us to upgrade, as it did for stock investments). And if you have a business with associated deductions, that’s covered in the Self-Employed product, which now looks for over 500 possible credits and deductions and uses machine learning and AI (according to TurboTax) to uncover deductions for your industry.

TurboTax Self-Employed adds photo import for 1099-K forms (but we saw only the opportunity to import using a digital file). It also adds a handy year-round expense monitor that can simplify the tax process when the time comes, a deductions checklist, and a streamlined Schedule C intake intended to better tailor the screen prompts for your tax situation.

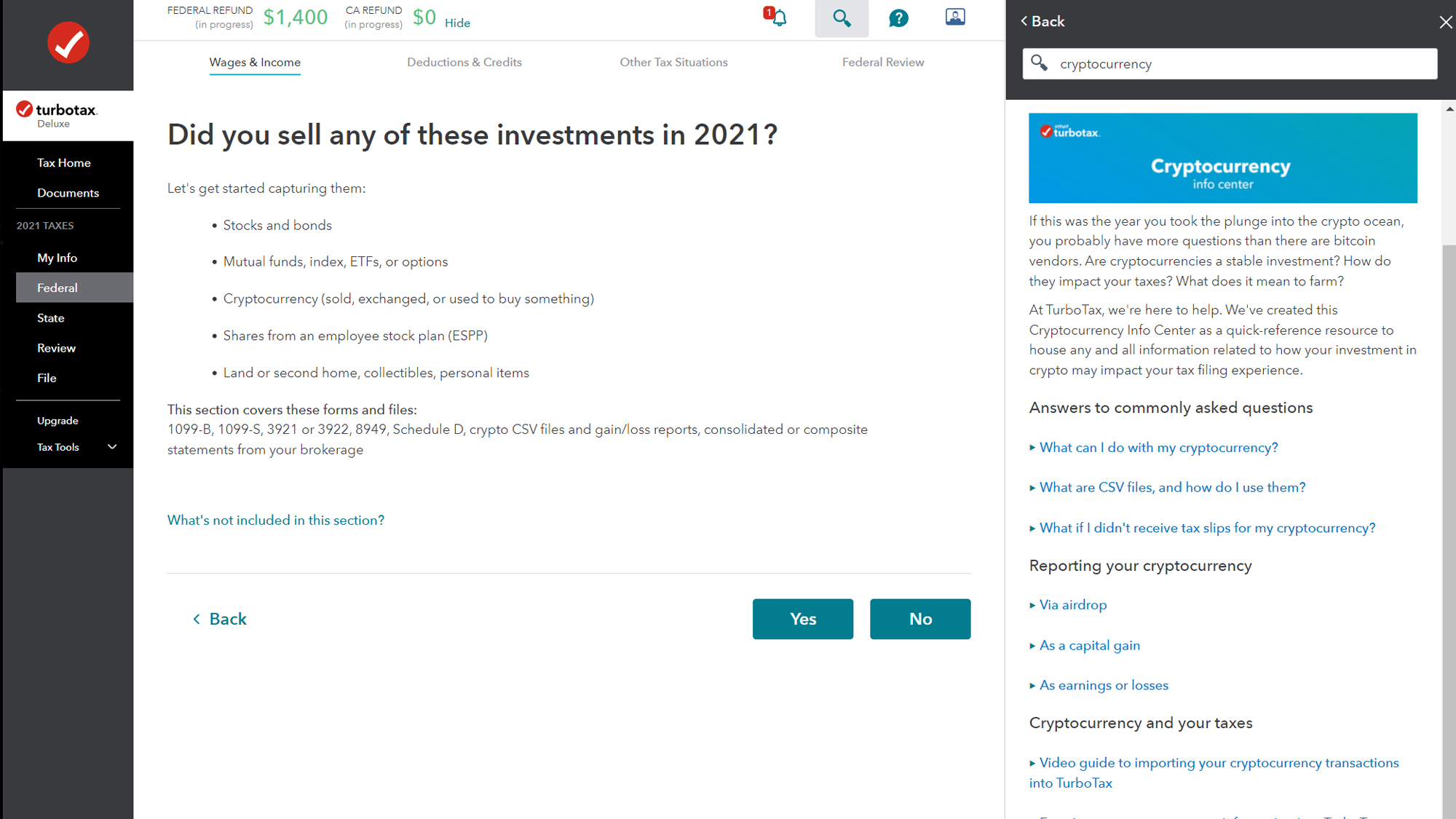

Meanwhile, investments and cryptocurrency gain big support this year with additional updates to the import process. Investors get a holistic view of their portfolio with the new Investor Hub, which pulls together all investments and their related taxes. You can import up to 10,000 stock transactions directly from financial institution import partners, and the software now performs an analysis on your investments’ cost basis based on your data imports. And for cryptocurrency transactions, TurboTax supports up to 20,000 transactions, five times the last year’s number.

TurboTax provides improved guidance on crypto investments, and it partners with more than 30crypto exchanges — up from 15, and including Coinbase, Robinhood, and Binance — to directly import cryptocurrency transactions. This is a direct import, versus using a manual process and importing a CSV file, as before. Competitors have different ways of handling crypto: H&R Block supports direct import from a limited number of exchanges; TaxAct uses Koinly; and Cash App Taxes uses TaxBit.

Charitable deductions are improved as well. Intuit’s nifty but imperfect integration of donations tracking app Its Deductible into TurboTax simplifies estimating and adding the value of goods donated to your return. Previously, you could only import data from your account on this Intuit-owned app.

New in 2023, TurboTax Live Full Service adds a “personal welcome call” to get you started, and can get your taxes done fully in one session with an expert. Also, the Live Full Service adds bi-lingual services for Spanish speakers, from start to finish. This is in addition to the full Spanish language service for the do-it-yourself and Live Assisted products as well. A simple click in the left nav bar switches the interface from English to Spanish.

Intuit TurboTax Deluxe 2022 review: Available help

Add in about Live Help button showing how long for an expert, also note expert review, and can submit questions for response outside

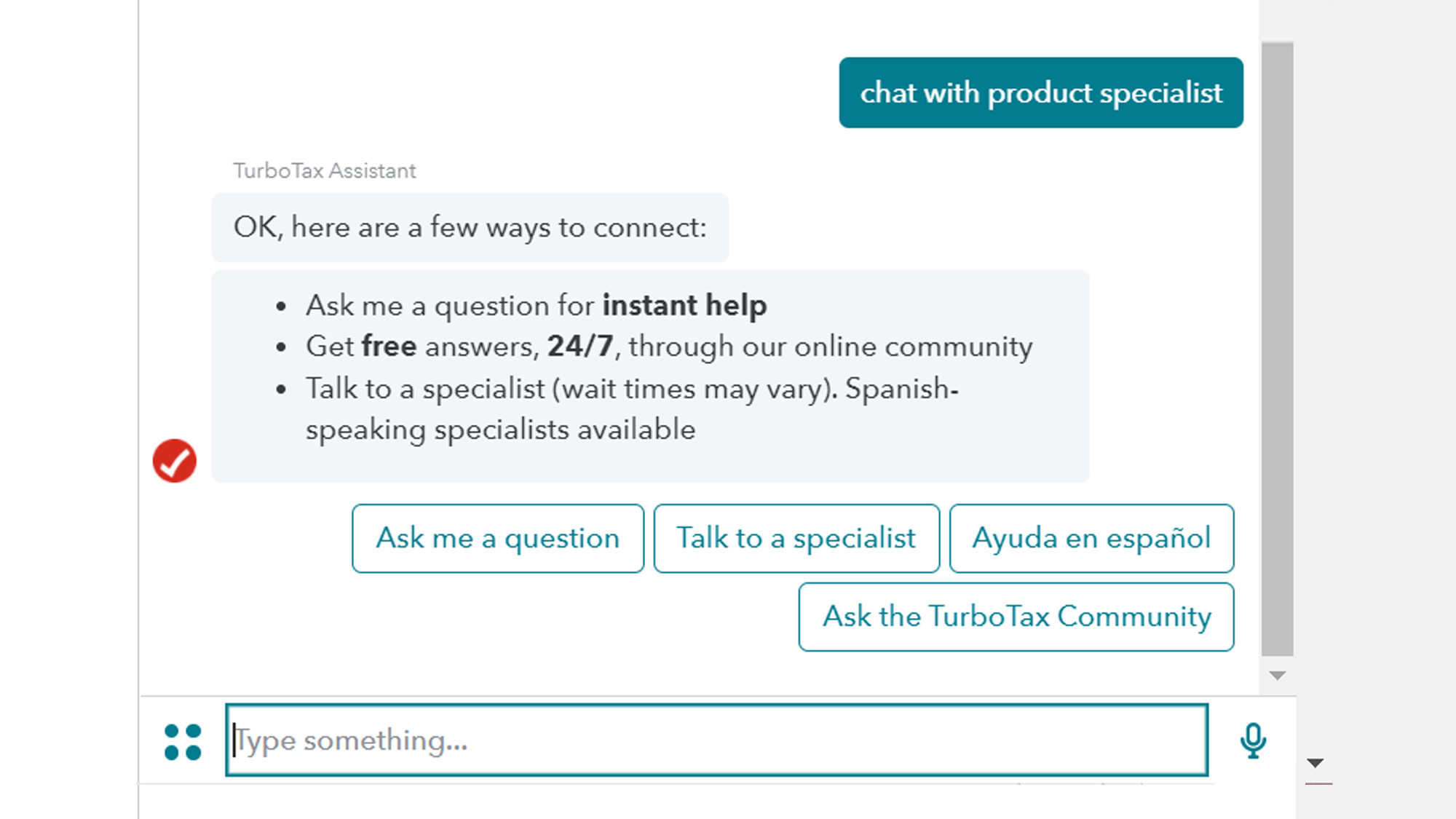

TurboTax improves available assistance for 2022 taxes, starting with a smoother experience for Live Full Assisted and Live Full Service. For the former, the live help is more targeted, and context sensitive to wherever you are in the service. For example, if you’re in the self-employed expenses or investments sections, the expert you connect to will be well-versed in that topic and ready to help you with your questions. And if you need more help, Coach mode helps you get started, letting you connect with an expert to describe your tax situation verbally and let them set up your TurboTax screens to make your view customized and easier to navigate. In Live Assisted, an expert can also now take control of your screen and navigate you to the feature you need (they can even leave to-do notes for you to follow up on).

In TurboTax Live, the process is now simplified and synchronous. Before, it was an asynchronous process: You’d connect to a tax pro assistant, who then routed you to an expert who’d handle things by going back and forth with you. Now, you are either connected immediately with an expert, or you can immediately make an appointment with an expert — and the expert does your taxes synchronously, with you on the call.

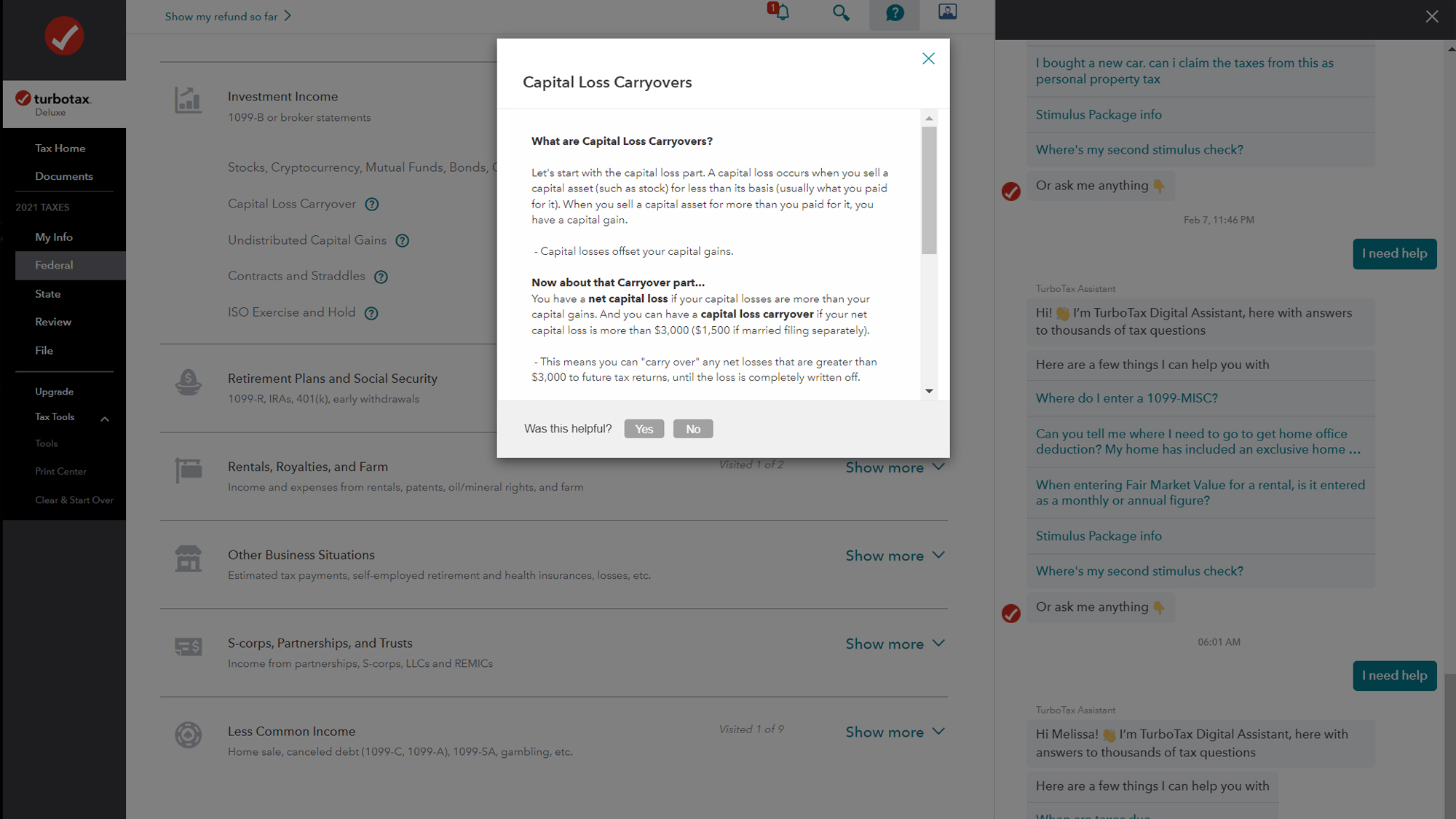

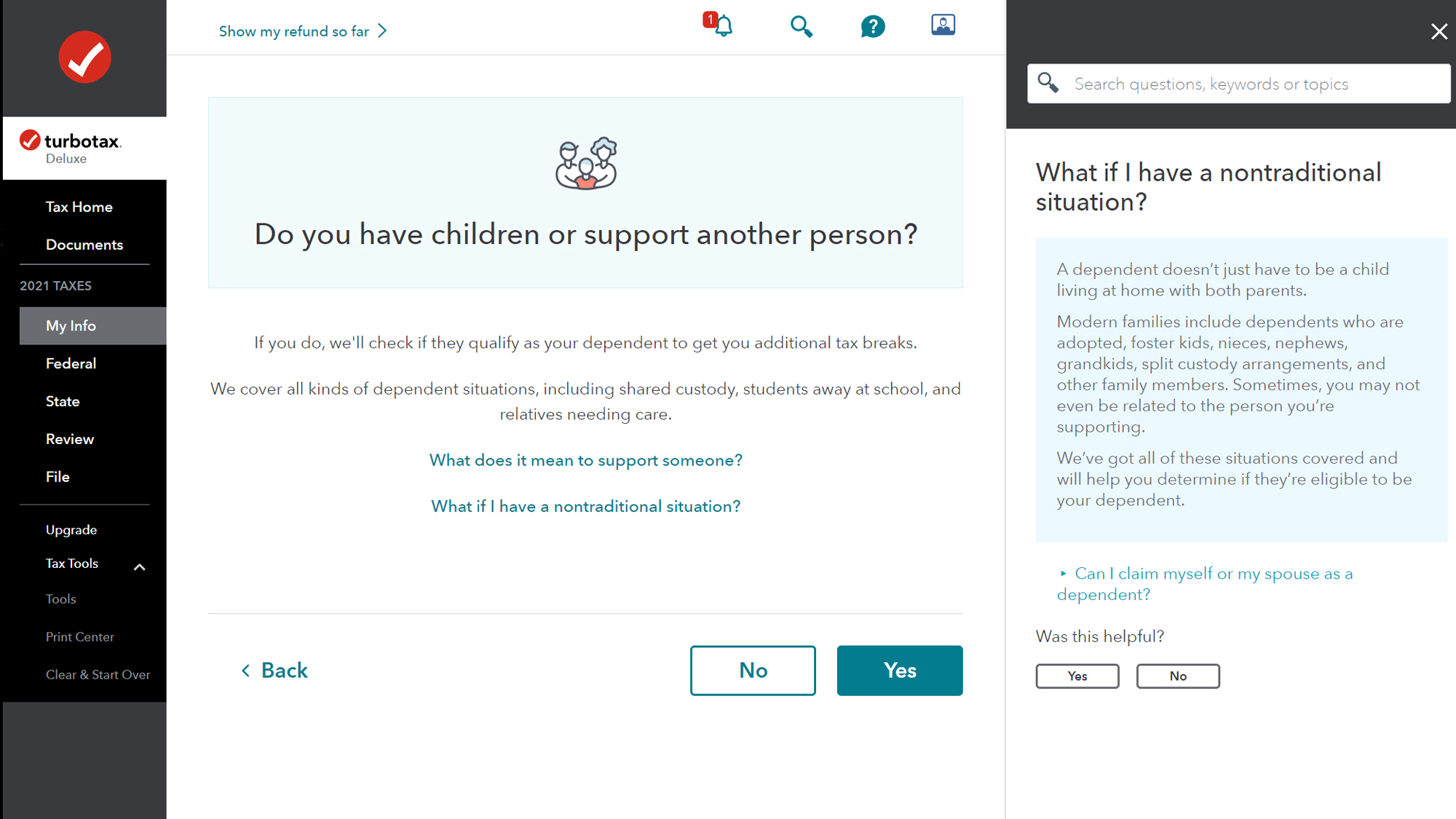

I encountered the legacy help pop-ups less frequently than before, but they’re still there — even though most help screens activate a dedicated slide-out panel on the right side of the screen. This year, the chat head for accessing live assistance is a permanent fixture on-screen.

TurboTax’s help is the most comprehensive of any service. The content is largely well-written, original, and useful. It mines questions from other users, which might help you figure out your own situation without asking an expert.

You can get technical help using any tier of the service, and even share your screen with a support person. You can add TurboTax Live Assisted (the new name for the Live product) at any time by clicking on the Live Expert Help badge at the top right of the screen. Once you have Live Assisted, you can add Live Full Service; or you can opt for Live Full Service when you sign-up.

For Live Assisted, the support call starts by phone, and then you can initiate one-way live video or screen sharing. TurboTax Live Assisted is available year-round to ask tax pros questions. If you upgrade to Live Full Service, you get matched with a tax pro based on the complexity of your return, and you can continue with that same pro if you’d like once your return is done.

If you don’t go the Full Service route, TurboTax Live does let you have a tax pro review your return before you file.

The call starts by phone, and then you can initiate one-way live video or screen sharing. TurboTax Live is available year-round to ask tax pros questions. If you upgrade to Live Full Service, you get matched with a tax pro based on the complexity of your return, and this year going forward you will be able to interface with that same pro if you’d like.

If you don’t go the Full Service route, TurboTax Live does let you have a tax pro review your return before you file.

Intuit TurboTax Deluxe 2022 review: Ease of use

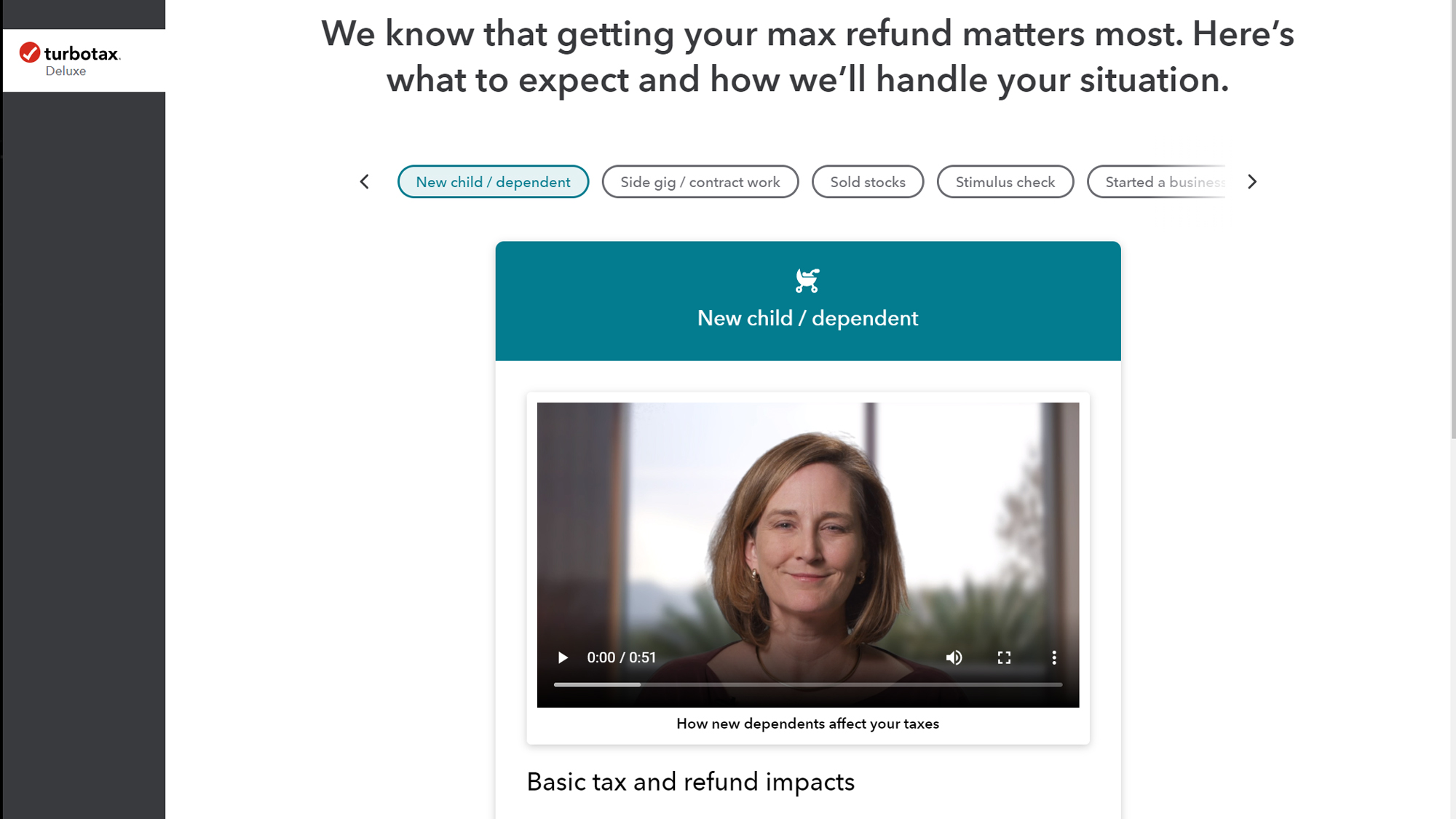

TurboTax’s onboarding process remains similar, with updated tile selections representing aspects of your tax situation. Selecting tiles — which come up again later as questions — produces a recommendation on which product tier is appropriate. Or you can select the product to start with directly from their product page, and upgrade along the way if you prefer.

Onboarding continued even before I logged in, asking how I filed taxes last year; the answer will customize your experience once you log in. Prior users of TurboTax or other Intuit online products (QuickBooks, Mint) log into the service with their Intuit credentials; new customers have to create an account. The service sends a code to verify you (it sent me codes to my phone, then my email).

As a returning user, I returned into the same product version (Live Assisted Self-Employed) I’d used last year. If your tax situation has changed and you want to use a lower tier product (for example, you went from self-employed to a W-2 employee again), it is possible to start fresh, but TurboTax doesn’t prompt for this; instead, the option to start fresh hides in the left nav bar, under tax tools.

I liked how, from the start, TurboTax’s intake is in friendly, plain language. It first prompted me to enter any life changes in the past year. The service next showed a summary of what I could expect to deal with in my taxes, and it also gave more reading info

Finally, the service prompts you to agree to share tax info with Intuit to get personalized strategies. You can opt out if you’d prefer. That ends the onboarding process and you can finally begin working on the return itself.

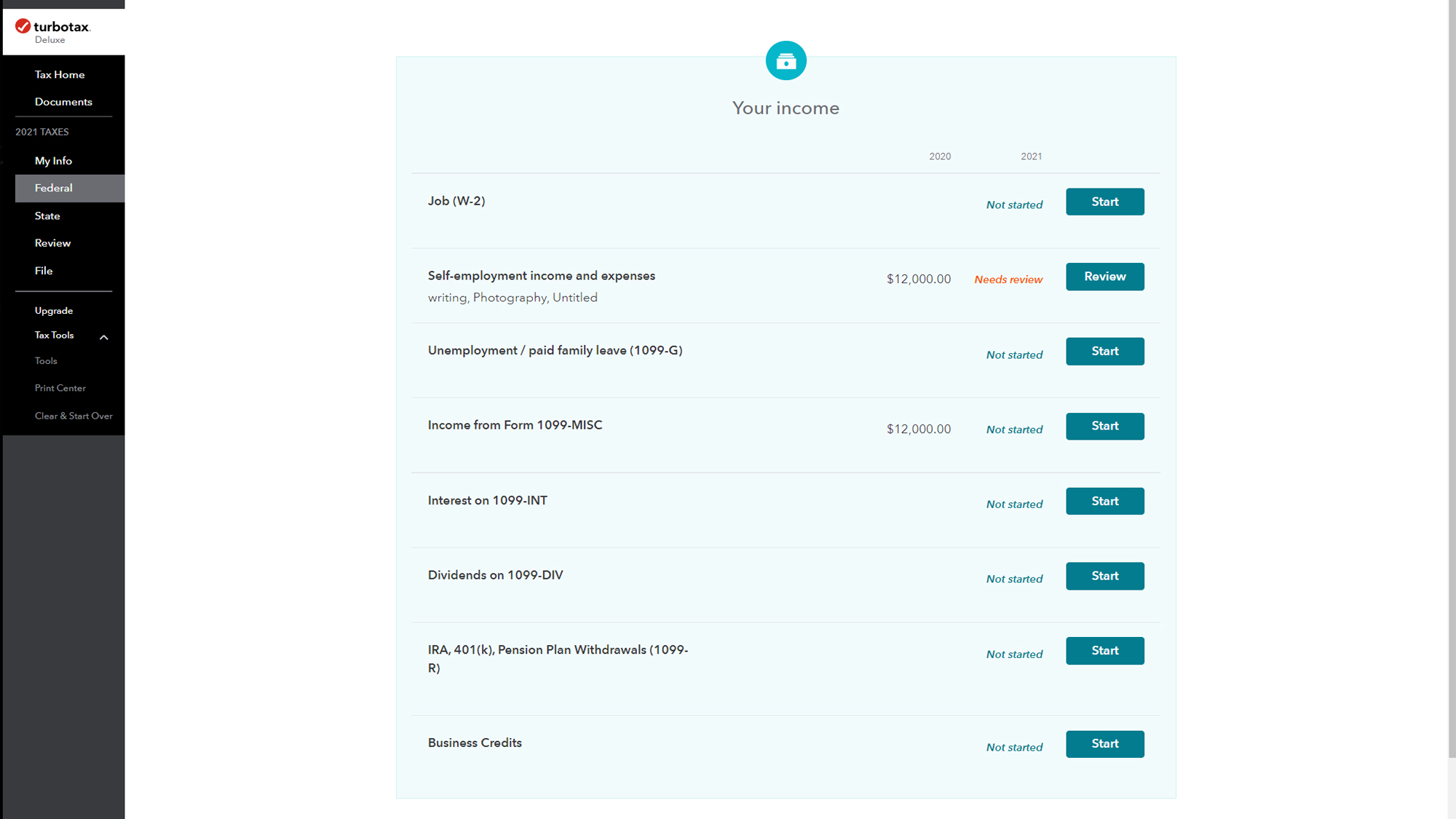

TurboTax’s overall online design remains the same. The service has a left-hand navigation pane for your tax home, Documents, and top-level navigation for the different components of your tax return (personal info, Federal, State, review, and file).

You’ll start with adding personal info (name, birthday, Social Security number, occupation, residency — including if you lived somewhere part-time – and military status), dependent info, and the like. After reviewing all of the personal info, TurboTax plugged an optional $49 upgrade for its theft-monitoring and audit-defense service. Once I declined this, we finally moved into the federal return.

Throughout the process of answering questions to complete your return, TurboTax uses clear language to walk you through adding your data. If you don’t want to see what looks like a representation of a tax form, you don’t have to. This hand-holding is in stark contrast to some competitors, like FreeTaxUSA and TaxAct, who just drop you right into walking through different tax forms with minimal questions and little natural language guidance.

TurboTax allows you to navigate your federal return via four floating tabs — Income & Expenses, Deductions & Credits, Other Tax Situations, and Federal Review. You can complete these in order, or jump around as you’d like. When you reach the end, TurboTax alerts you to missing information before you file, or you can choose to have a tax pro review your return. If you are expecting a refund, you can track the status of your refund at Intuit’s Credit Karma.

Atop the screen sits the global navigation bar, with buttons for accessing notifications, search, virtual assistant help, and live tax advice. The latter leads to the upgrade for TurboTax Live Assisted, or to the TurboTax Live expert if you’ve already upgraded. TurboTax also shows an update of your federal and state refunds in the top nav, but you can hide this info.

The onboarding questions can get repetitive, even though they serve different purposes in the process. If you miss something the first time, you have to find where it is again on your own. For example, I had to click the income button to expand on other income received, and found a highly detailed reference list that jogged my memory of what else to add. At least the language on the whole is friendly and accessible. And TurboTax covers more scenarios — and it does so more clearly — than some of the competing services. For example, TurboTax calls out if you have a nontraditional situation for a dependent or made money while living in a state other than your residence, and provides appropriate guidance in the slide-out help pane at right.

The TurboTax service has responsive design, making it easy to navigate across mobile apps, mobile browser, and desktop browser. While the text size is now larger in some places, overall it could still use work to become more differentiated on all screens. Often the text remains surprisingly small, with a low font weight,on a computer screen, making it harder to read. Overall, H&R Block still does a better job with its cohesive interface design and visual presentation.

If you use the Live Assisted version, one new feature this year: Race mode. Intuit gamifies completing your tax return by letting you know how long it will take to do your taxes (based on the info you provided), and starts the clock to show your progress as you move through the return.

Intuit TurboTax Deluxe 2022 review: Verdict

The experience of using TurboTax Deluxe 2021 is fundamentally the same as compared with recent years, but subtle interface tweaks, improved live and full-service support, and the software’s ongoing improvements in investment and crypto handling gives TurboTax the edge over H&R Block and other contenders as the best tax software.

Even though it’s the most expensive of the tax prep software we tested, the steps TurboTax takes to simplify the intimidating tax process places its services ahead of the competition.

Melissa Perenson is a freelance writer. She has reviewed the best tax software for Tom's Guide for several years, and has also tested out fax software, among other things. She spent more than a decade at PC World and TechHive, and she has freelanced for numerous publications including Computer Shopper, TechRadar and Consumers Digest.