Tom's Guide Verdict

With an excellent variety of plans — from cheap to comprehensive — Identity Guard has something for everyone. Too bad, the credit reports are limited to arrive annually and it lacks basic malware protection that others provide.

Pros

- +

Inexpensive

- +

Social media monitoring

- +

Includes password manager

- +

Has two factor authentication

Cons

- -

Annual credit reports

- -

No malware protection or VPN

Why you can trust Tom's Guide

Monthly cost: $30

Yearly cost: $300

Family plan: $40/month

No. of bureau scores: 3

No. of bureaus monitored: 3

Frequency of credit reports: Annual

Type of credit score: VantageScore 3.0

Credit-improvement simulator: No

Credit-lock/freeze button: Yes

Security software: PW manager, Safe Browsing extension

Investment account monitoring: Yes

Max. ID-theft coverage: $1 million

Data Breach Alerts: Yes

Medical Records Monitoring: No

Payday loan monitoring: No

Sex Offender Alert: Yes

Title Change Alert: Yes

Two Factor Authentication (2FA): Yes

With thorough social media monitoring and identity insurance, Identity Guard is an inexpensive alternative to other ID protection services that are all-encompassing, and can be a little stifling. Its plans are reasonably priced and include security goodies, like two-factor authentication and a password manager.

On the downside, the entry level subscriptions don’t include credit monitoring for early detection of fraud and none of the plans come with malware protection or access to a VPN. Finally, the best they do is annual delivery of credit reports.

If all you care about is the basics of ID protection and insurance, Identity Guard can be economical protection that does just enough. Our Identity Guard Ultra review will help you decide if this is the best identity theft protection service for your needs.

Identity Guard Ultra: Costs and what’s covered

There are three Identity Guard plans that offer a variety of ID protection services, from basic to advanced. The Value plan is among the cheapest ID protection services at around $9.00 per month (or $54 per year) and includes the essentials. In addition to the Identity Guard Web browser extension for Chrome, data breach notifications, high-risk transaction monitoring and dark web monitoring, the plan includes a pot of $1 million of identity insurance. Identity Guard Value plan has a password manager, but doesn’t show any of your credit scores.

The $20 Total plan (or $120 annually) adds single bureau credit scores that are updated monthly from Equifax but also has monitoring of all three major credit agencies for the early signs of abuse. By contrast, the Ultra plan I subscribed to tops out at $30 per month (or $180 yearly) and shows scores for all three credit agencies but also includes credit reports but the annual frequency is a disappointment. The protection includes monitoring of bank accounts, credit and debit cards as well as sex offender checking, address changes and home title alerts. It also includes an Experian credit lock button.

While Identity Guard is not rated by the Better Business Bureau, its parent, Aura, got an A+, showing that it is highly regarded as an identity protection service.

Identity Guard Ultra: How we tested

In the late summer of 2022, I signed up for the Identity Guard Ultra identity protection service. I went through the installation process and paid for it with a credit card; later, Tom’s Guide reimbursed me. I checked in with the service several times a week using a variety of computers to monitor my credit scores, respond to alerts, look into the transaction monitors.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

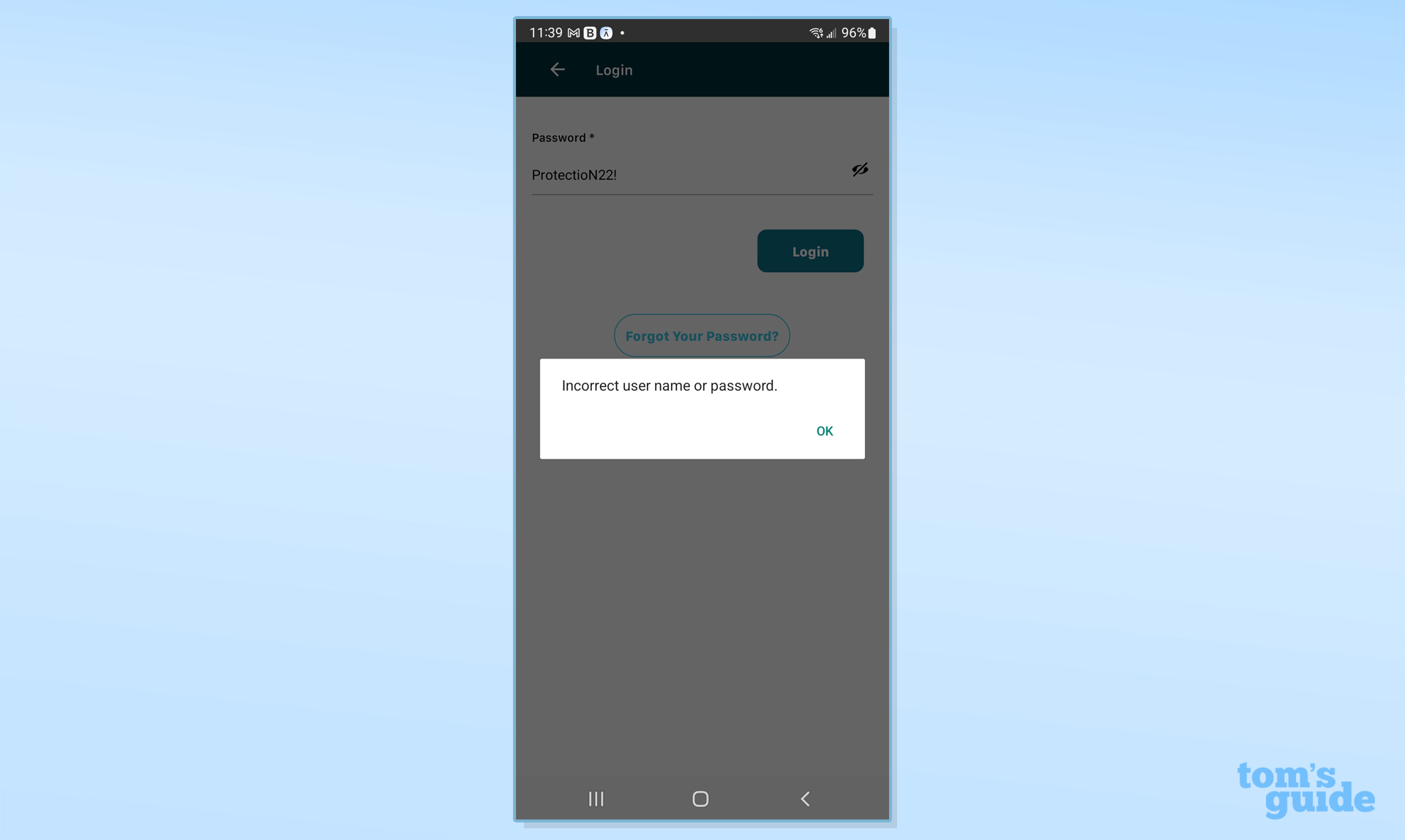

I had some startup problems with the Identity Guard app but after some tech support help it worked well. I cancelled the service after three months of use.

Identity Guard Ultra: Credit scores and identity monitoring

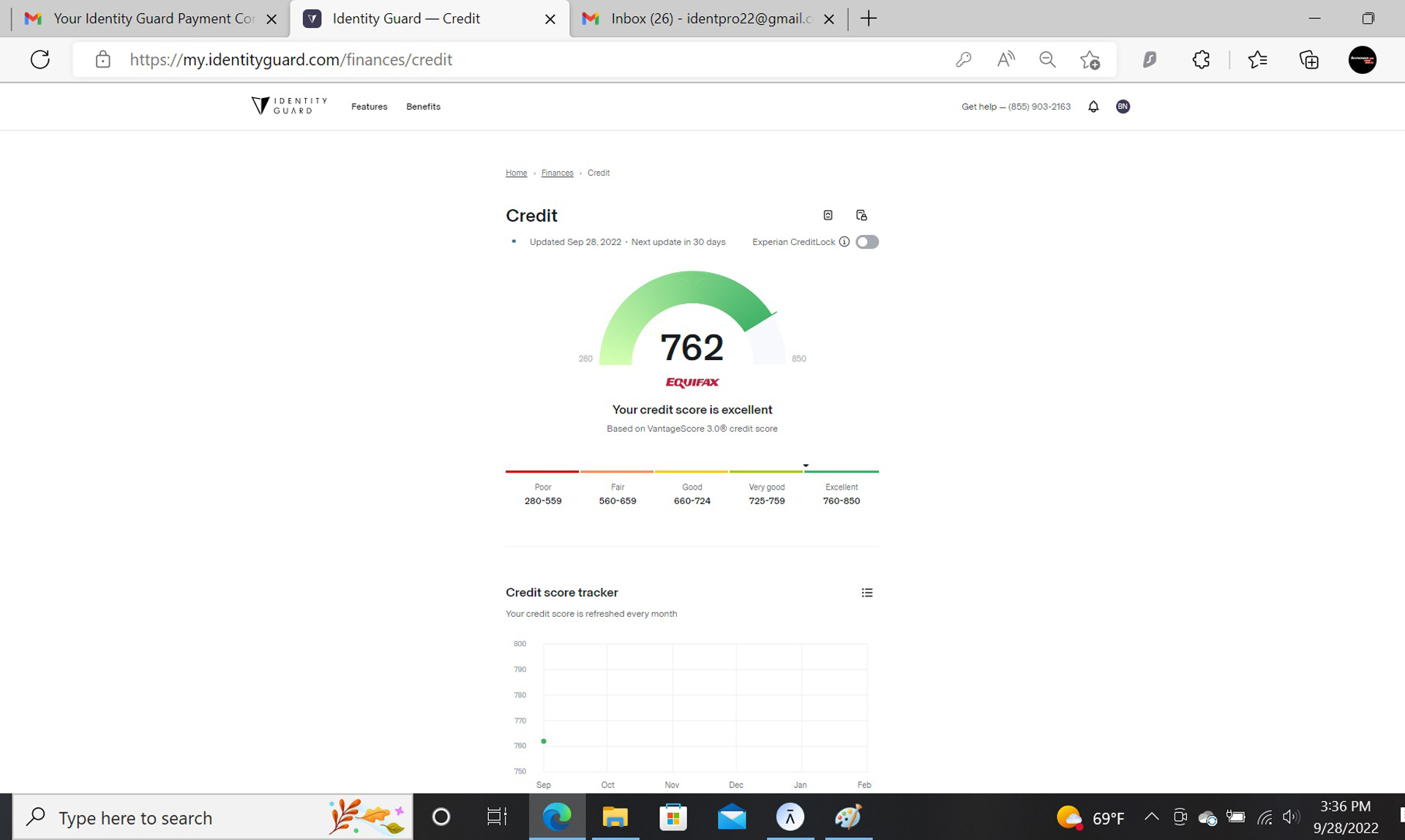

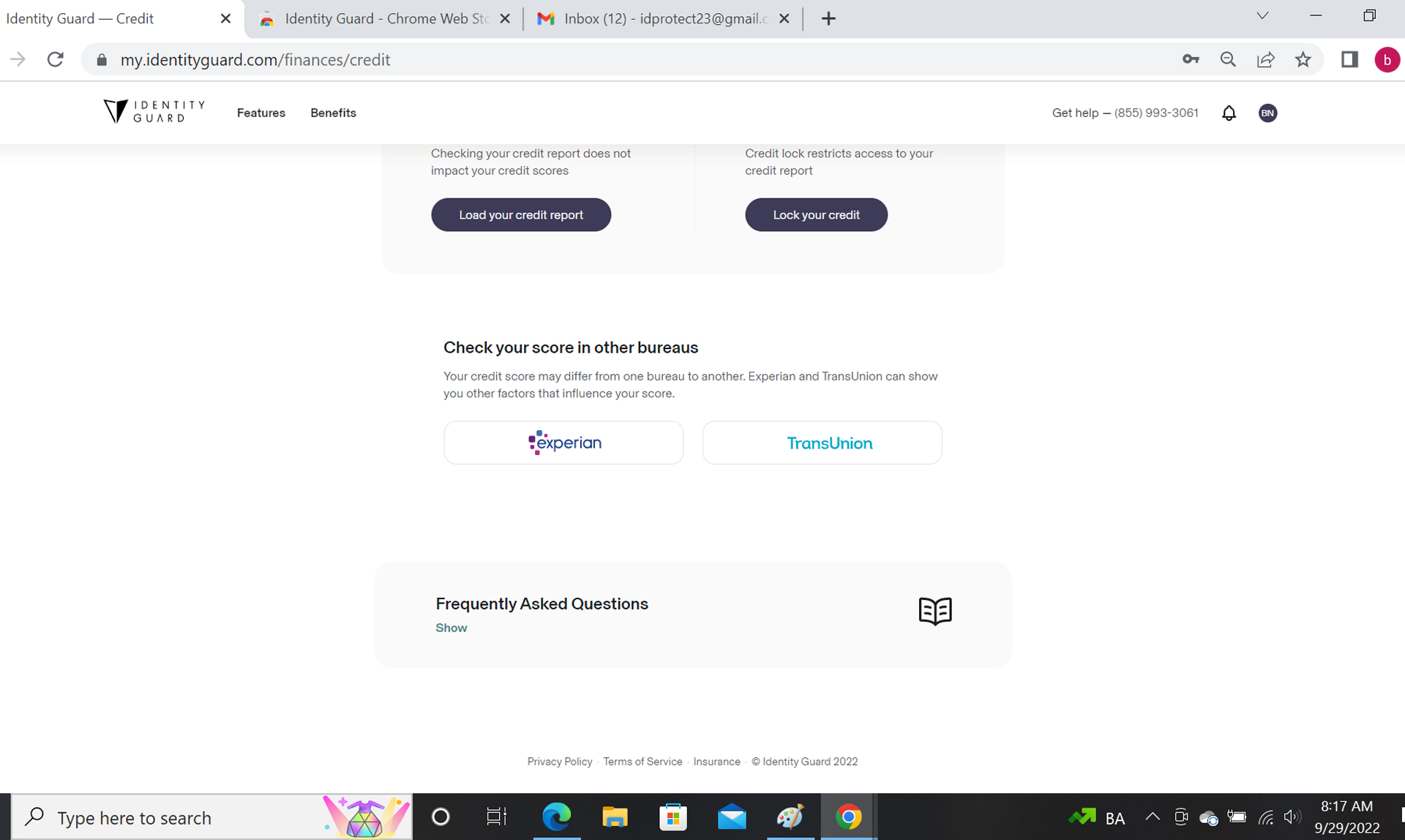

While the Identity Guard Value plan lacks any credit agency scoring, the Ultra plan has scores from the three bureaus, Equifax, Experian and TransUnion. If you get the Ultra plan, you do need to scroll to the bottom of the Credit page to see them, but it’s worth the effort.

On the downside, all are VantageScore 3.0 ratings based on each bureau’s data. They are not the more popular FICO ratings that banks and loan providers actually use to assess creditworthiness.

Identity Guard provides monitoring for all three agencies as well as the full credit reports. I was able to see my reports from Equifax, Experian and TransUnion but they are provided annually, something they are obligated by law to provide for free. There isn’t a way to buy an instant report for any of the credit bureaus in an identity emergency.

While the Ultra service keeps an eye on court records, bankruptcy proceedings and home title changes, it also has transaction monitoring for credit card, bank account as well as retirement and investment savings. It lacks the ability to monitor investments, like retirement accounts, however. The service can alert you if a new account has been opened in your name but not if someone has absconded with your identity to take out a payday loan.

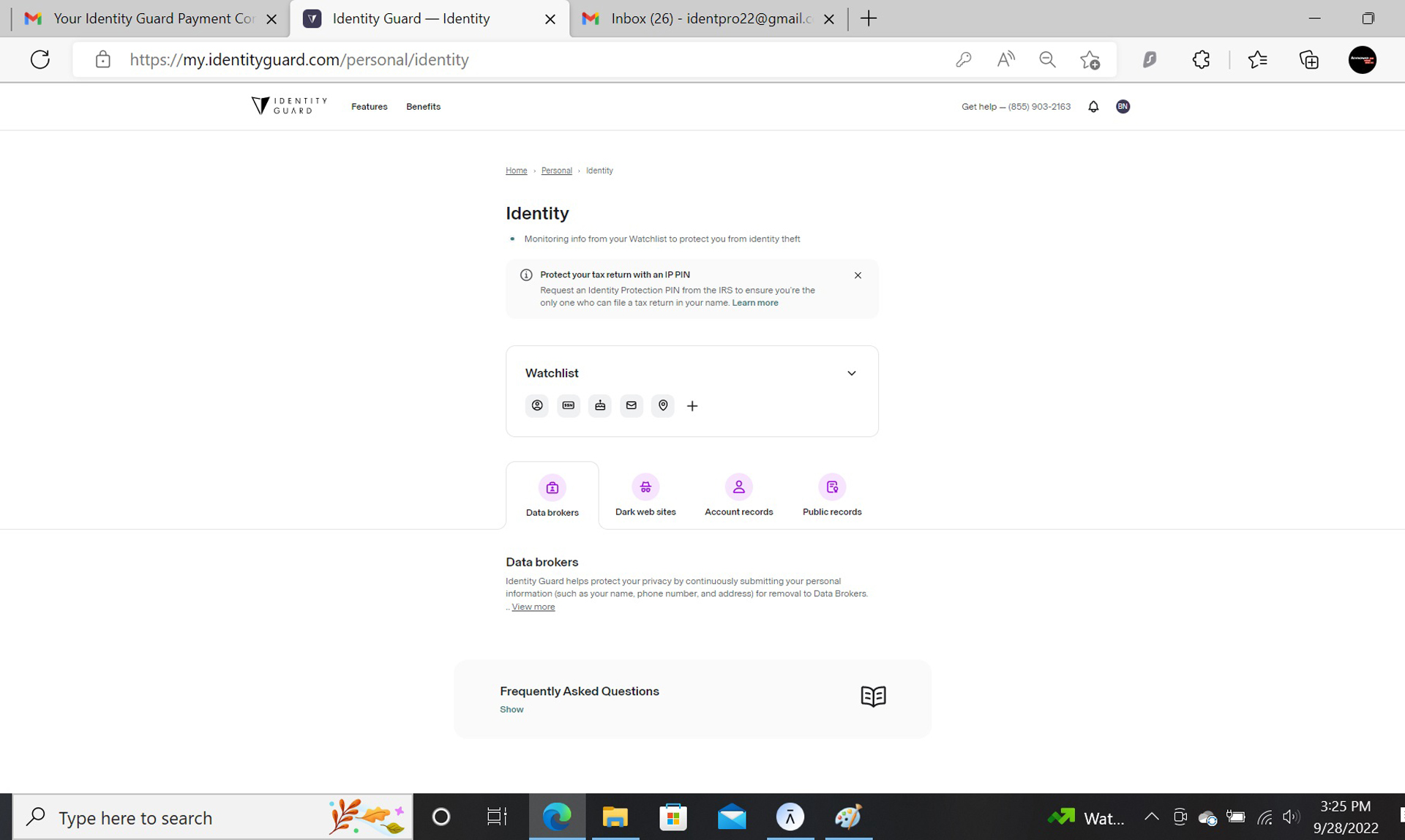

Meanwhile, Identity Guard Ultra scans the dark web for instances of your personal data and goes the extra online mile by looking into chat rooms to see if your name is showing up too often. It can also let you know if a registered sex offender moves in near you but lacks a map to show their location.

In addition to monitoring your social media presence online, the Identity Guard service looks for potential vulnerabilities that might lead to an identity crisis. They include evaluating your ID theft risks moment by moment.

Identity Guard Ultra: Insurance and services

As is the case with many of its ID theft competitors, Identity Guard includes $1 million in insurance. The policy is underwritten by the ever-present AIG.

The insurance covers the basics for things like monetary theft and fraud due to an identity take-over as well as incidentals that might come up like travel or lost work. The plan pays for getting new documents, such as a driver’s license, a passport as well as a new Social Security card and number. More to the point, the insurance can help pay for specialists, like accountants, lawyers and investigators to get to the bottom of the breach and fix it.

The company promises to have a single agent available day or night to handle your claim, from start to finish. It features an Experian CreditLock up front with the current score, making it one of the easiest ways to freeze your credit in an emergency.

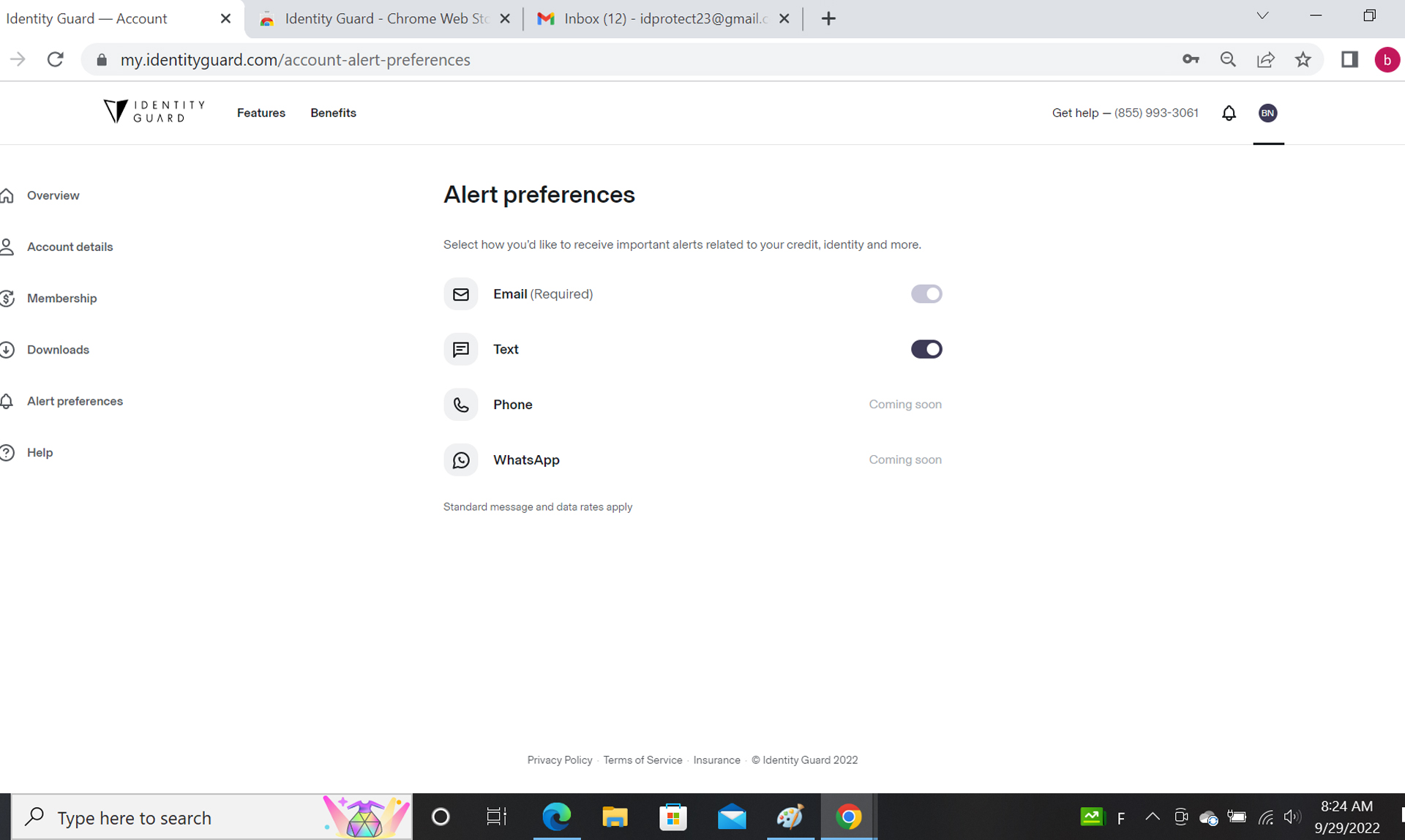

Identity Guard Ultra: Notifications and alerts

The Identity Guard Ultra plan has a good assortment of alerts available, though they are balanced so as not to overwhelm you with loads of minor notifications. They can be received via the Alerts section of the browser interface or through the mobile app as well as by email or text message, although you’ll have to manually set up that last option. The company is working on adding WhatsApp and phone call notifications to the alert mix.

The service can warn about someone making an address change for you as well as if anyone has used your health insurance policy. As far as the financial monitoring goes, thresholds can be set so you’re not alerted to every transaction. It can also alert you if a duplicate transaction has been logged.

During the three month evaluation, Identity Guard delivered four alerts that concerned a couple large payments and an IRS identity verification of my identity that others missed.

Identity Guard Ultra: Setup

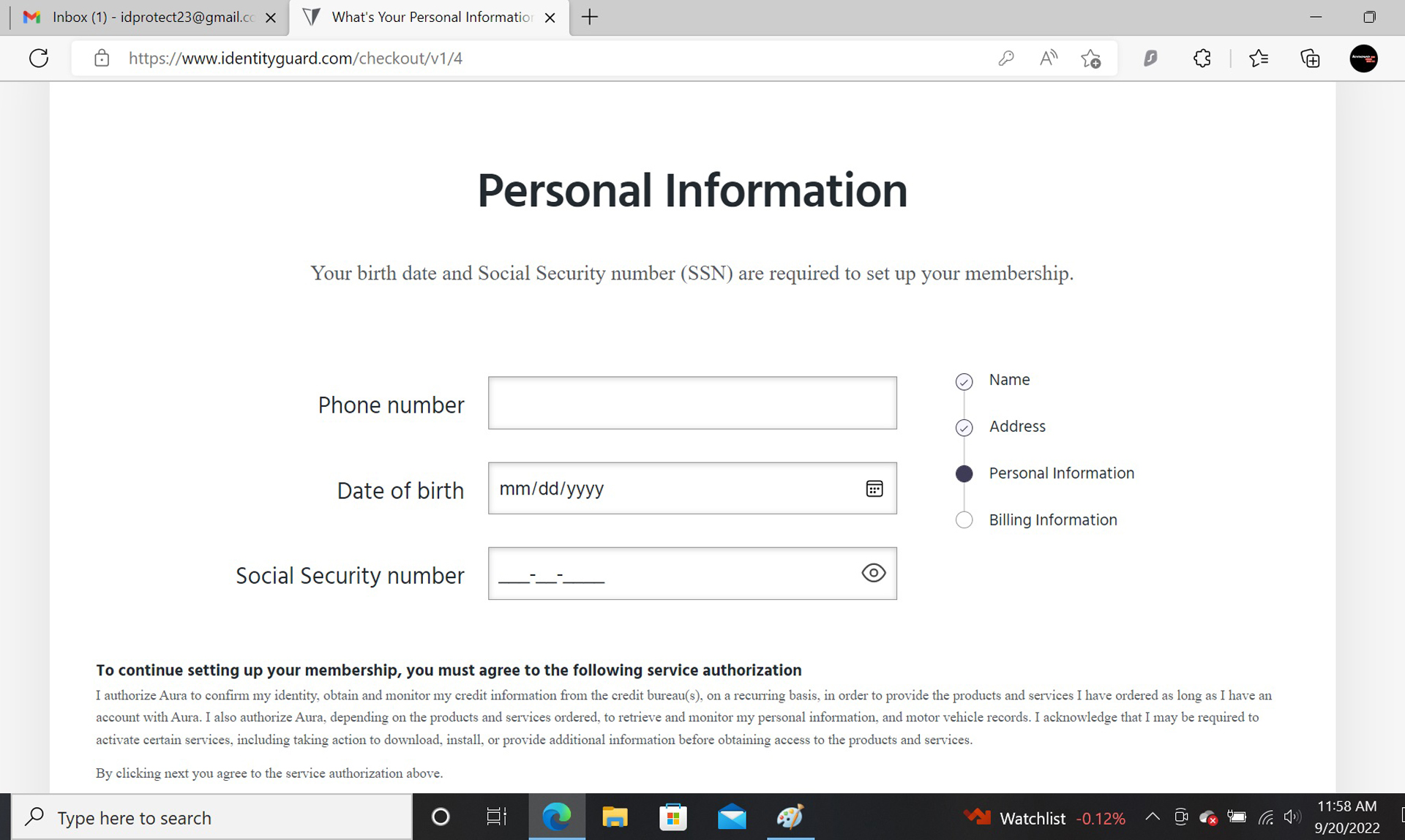

Setting up Identity Guard coverage started at the company’s web site. I clicked on “Start My Membership,” and picked the Ultra plan for individuals. After entering my email account, password, name and address, I typed in my personal information: phone number, date of birth and my Social Security number.

Next, I paid with a credit card; that’s the only choice because the service doesn’t accept PayPal. Then, I clicked “Complete Order” and the account was set up. I logged in but my work wasn’t done. At the Dashboard, I needed to verify my information with six challenge questions about loans and addresses to open the Alerts and Credit. It worked for the Alerts section, but my scores and credit report weren’t working.

After talking with an Identity Guard technician, I was told to wait and see if the scores showed up. A week later she called back to tell me that the servers had the wrong Social Security number. She quickly canceled the account and I re-enrolled. Now, I was set, or so I thought.

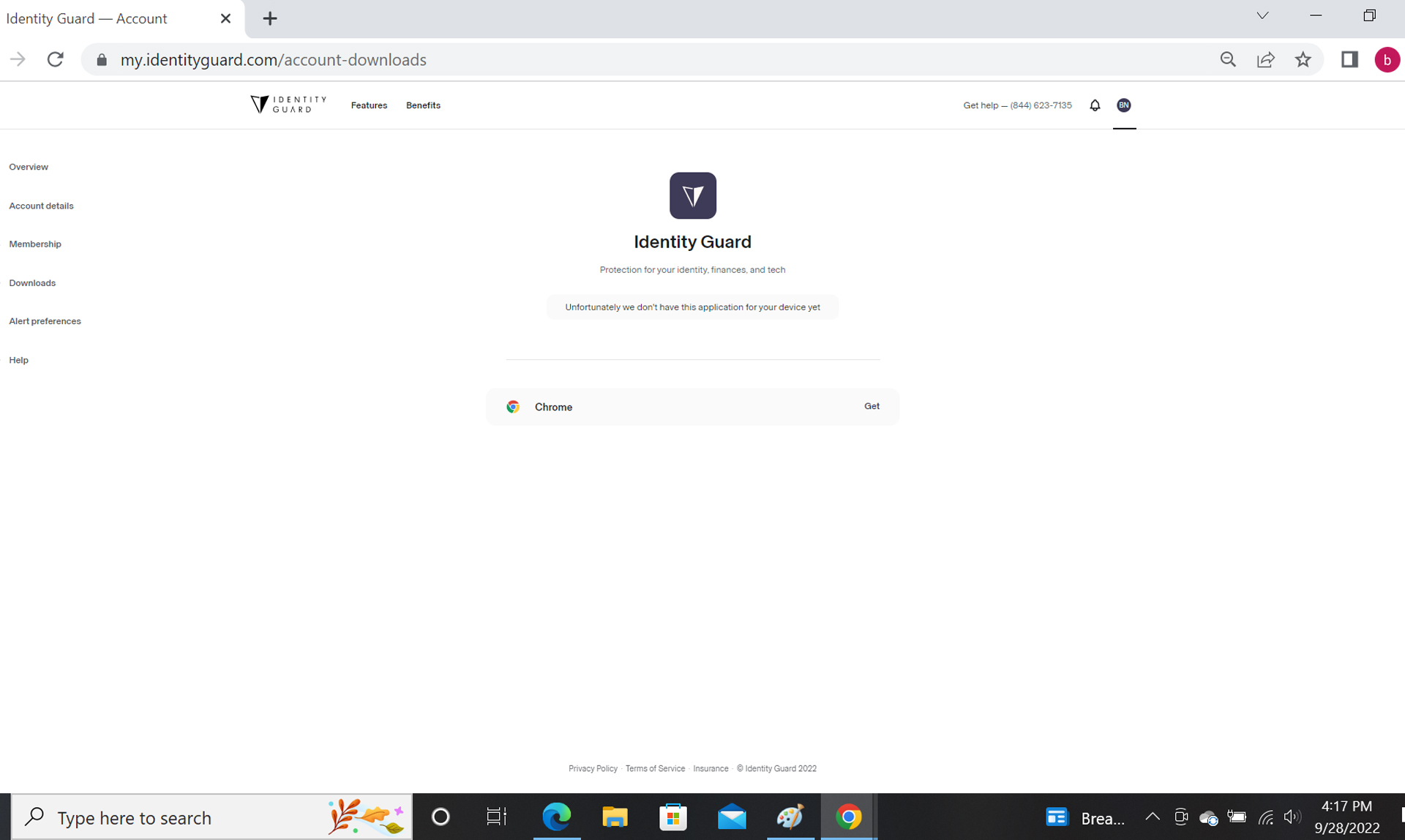

At first, I couldn’t log into the Identity Guard app, but later everything started working with Identity Guard’s new app. All the data travels over the internet in an encrypted format and is also encrypted on the company’s servers.

As is the case with many of its competitors, Identity Guard has two levels of support. In the event of an identity crisis, there are agents waiting 24/7 to help freeze your credit and start the identity restoration process.

All other items, including questions about the products and how to use the interface, are covered from 8 a.m. to 11 p.m. (Eastern time) from Monday through Friday or between 9 a.m. to 6 p.m. on Saturdays. There’s a page that has the phone number and a place to send an email to them.

There’re lots of explanatory FAQs and do-it-yourself articles on Identity Guard’s support site. Happily, the tech support line is listed at the top of the browser-based interface.

Identity Guard Ultra: Interface and utilities

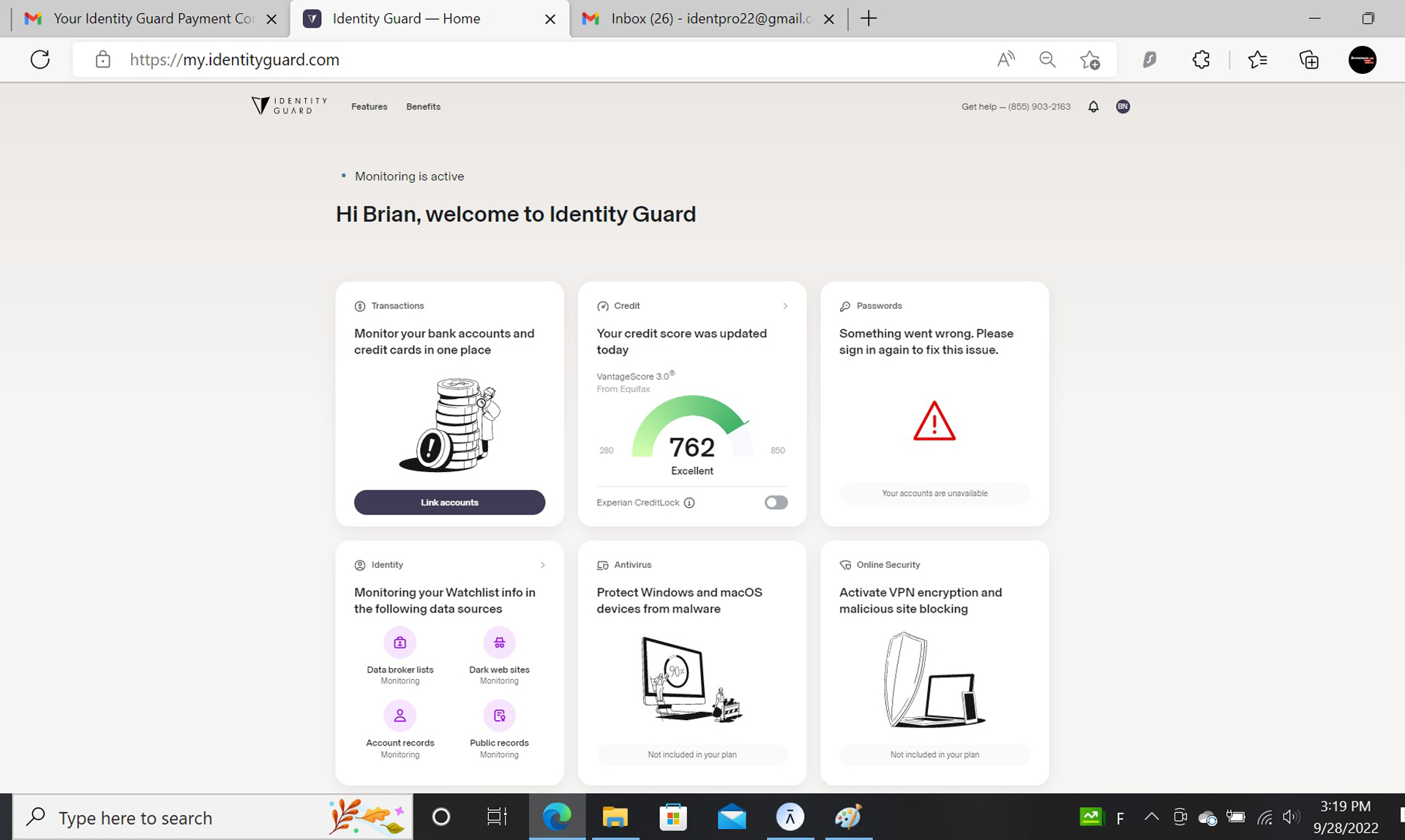

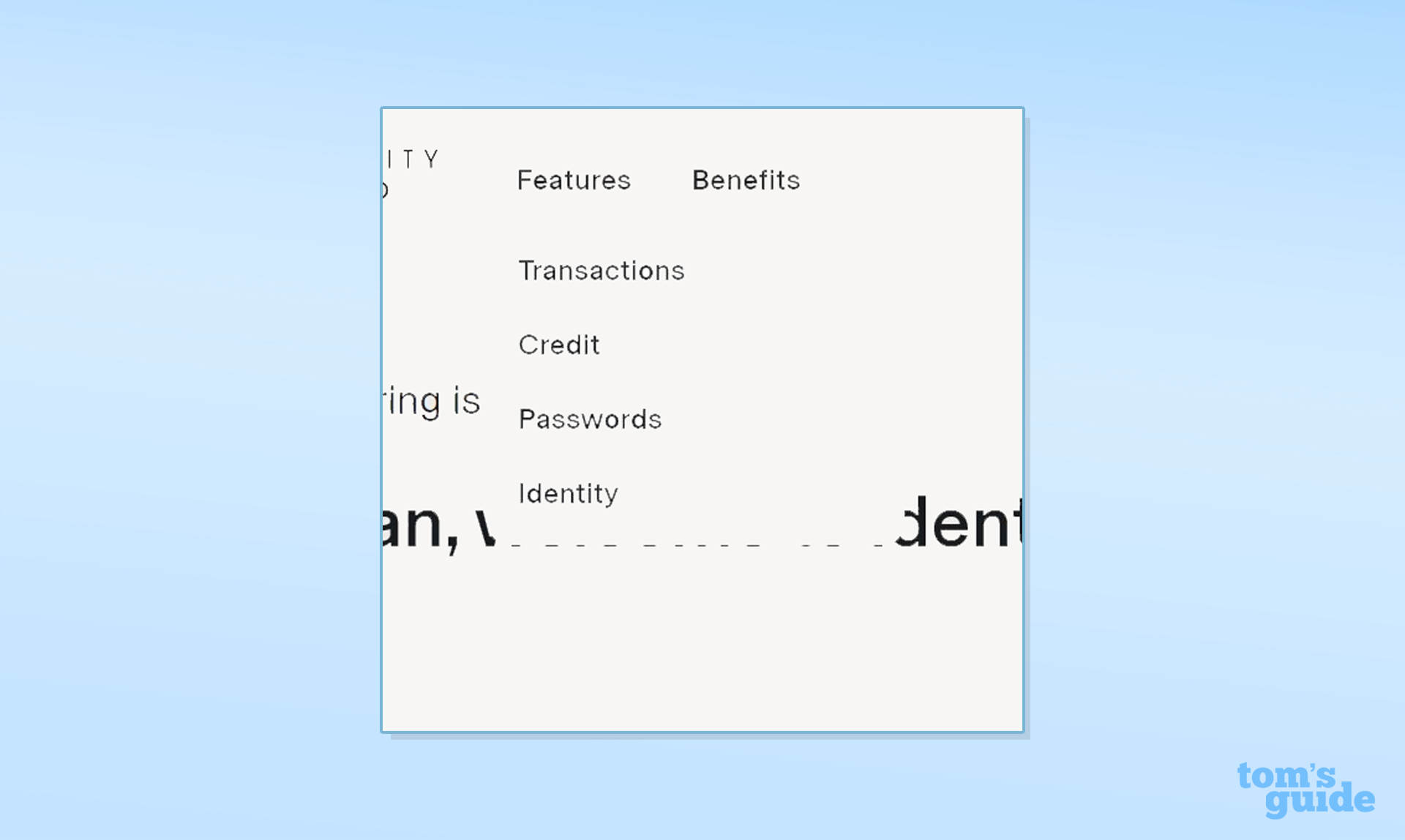

Identity Guard covers the bases well with an interface that loads quickly and is one of the most recently redesigned of the bunch. Less crowded and more visually appealing with larger elements, it’s sprinkled with helpful illustrations. The Dashboard from the last generation has been replaced by the Overview page, which worked well with an HD screen, but the browser needed to be zoomed to 50% to take in all of the components.

Above the welcome message, Identity Guard reassures with “Monitoring is active,” while the seven boxes below have the plan’s active elements. The Transactions portion keeps an eye on your bank, credit card and investment accounts. At the same time, Credit has the current Equifax VantageScore 3.0 rating along with a monthly score tracker. A level below offers access to credit report data.

If you scroll to the bottom of the Credit page, you’ll be rewarded with access to your scores from Experian and TransUnion. It’s well hidden but worthwhile.

Not surprisingly, the Passwords section has access to the included password manager that works with the Identity Guard Web browser extension to help protect your online personna. All your favorite websites can be included for quick and secure log-ins. On the downside, it only works with the Chrome browser.

Meanwhile, the Identity category has everything from data broker records to dark web scanning to account and public records. Oddly, the next three boxes for antivirus, VPN and covering other family members are grayed out with the notation, “Not included in plan”. Think of them as areas for future growth for Identity Guard – a good sign.

Overall, the interface is easy to figure out and work with. Up top, the Features section has just the plan’s active elements. Next to it is Benefits, where the plan’s attributes are explained. Happily, the tech support box has a link to the tech crew as well as a phone number.

There’s an alert bell in the upper right for notifications but it doesn’t swing or make a chime when there’s something that needs your attention. To its right is your personal account information including alert preferences.

After the month-long kerfuffle over not being able to log into the app, it worked fine. The home page shows alerts and transactions followed by the credit score. Incidentally, using a phone or tablet’s browser worked well too.

Identity Guard Ultra: Cancellation

Ending my relationship with Identity Guard needed to be done over the phone with one of the company’s technicians. There’s no online way to do it. It took about six minutes with the operator trying to keep me as a customer. I received an email confirmation saying my account was canceled within minutes.

Identity Guard review: Verdict

With the approach of providing just enough protection at an attractive, reasonable price, Identity Guard includes the expected (credit monitoring, $1 million in ID insurance and data breach alerts) but reserves credit reports to annual events. There’s social media monitoring, a password manager and two-factor authentication but none of the Identity Guard plans include access to a VPN or malware scanning software. At $300 a year, it’s an alternative to more smothering plans.

Brian Nadel is a freelance writer and editor who specializes in technology reporting and reviewing. He works out of the suburban New York City area and has covered topics from nuclear power plants and Wi-Fi routers to cars and tablets. The former editor-in-chief of Mobile Computing and Communications, Nadel is the recipient of the TransPacific Writing Award.