Tom's Guide Verdict

Striving for a balance between protection, price and ease of use, IDShield does the basics well but lacks annual plans, full credit reports and its top plan monitors all three credit bureaus but only shows the scores for one. Still, it’s efficient and provides a lot for a little.

Pros

- +

Inexpensive

- +

Fast connections

- +

Reputation Manager

- +

Monitors three credit bureaus

- +

Includes Trend Micro antivirus, VPN and password manager

Cons

- -

No credit simulator

- -

Shows single agency score

- -

Doesn’t track home title changes

- -

Lacks access to full credit reports

Why you can trust Tom's Guide

Monthly cost: $15

Yearly cost: No annual plans available

Family plan: $40/month

No. of bureau scores: 1

No. of bureaus monitored: 3

Frequency of credit reports: None

Type of credit score: VantageScore 3.0

Credit-improvement simulator: No

Credit-lock/freeze button: No

Security software: AV, PW manager, VPN, parental controls

Investment account monitoring: Yes

Max. ID-theft coverage: $3 million

Data Breach Alerts: Yes

Medical Records/Payday Loan Monitoring: Yes/Yes

Online Predator/Cyberbullying Alert: Yes/No

Title Change Alert: No

Two Factor Authentication (2FA): Yes

Extras: Reputation Manager

With the ability to monitor the totality of your credit, limit rogue transactions and keep an eye on your investments, IDShield gets off to a great start for protecting your identity. It’s among the least expensive of the best identity theft protection services of its kind and provides the basics, including up to $3 million in identity insurance, and a slew of security software from Trend Micro. The top plan, however, not only lacks access to your full credit reports but only shows scores from Experian, although it monitors the action at all three credit agencies.

The product can help surface data broker accounts with your personal identifiers and scrub them while the company’s Reputation Manager breaks new ground in this genre by scanning your social media accounts looking for inappropriate activities, like college partying. Yes, it can help sanitize your online persona.

On the other hand, IDShield has neither credit simulators to see how paying off all your bills at once might help your scores nor a credit lock for identity emergencies. Plus, none of the company’s plans have home title monitoring.

IDShield could be for those on a tight budget who want essential protection and a few well-chosen extras.

IDShield review: Costs and what’s covered

| Row 0 - Cell 0 | Individual | Family |

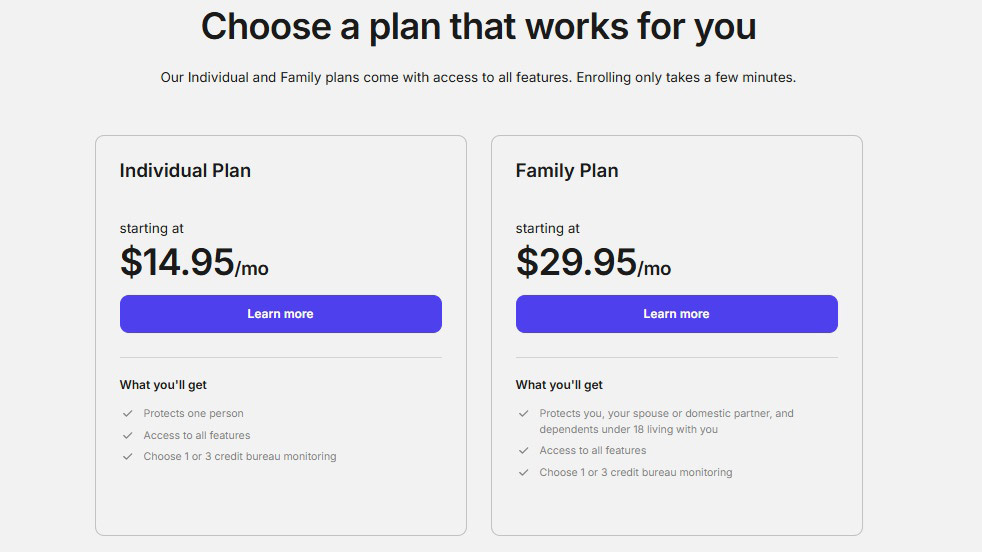

Pricing | $14.95 per month | $29.95 per month |

Users | 1 adult | 1 adult, 1 spouse/partner, all dependent children |

Devices | 3 devices | 3 devices |

IDShield has four main products that can cover an individual or family digital presence with $3 million in identity insurance. To start, the Individual plan costs $14.95 a month for single bureau scores and monitoring from Experian and $19.95 a month for monitoring from Equifax and TransUnion as well.

There’s no annual discount, however, and IDShield has an honest approach to pricing without an initial sign up discount. It costs a little more upfront but there’s no increase after your first year.

Getting the family plan covers two adults and up to eight children until they are 26 years old. Single bureau monitoring costs $29.95 a month while upping that the three bureau access costs $34.95 a month.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

While all the plans include Trend Micro security software, identity insurance, extensive monitoring options and dark Web and social media scanning, none of the IDShield plans include access to annual credit reports. Others do this on a weekly, monthly or daily basis but they are available for free annually from annualcreditreport.com.

Part of LegalShield, IDShield is owned by PPLSI that offers a variety of subscriptions for identity protection and legal services. The Better Business Bureau gave it a well-regarded A+ rating.

IDShield review: How we tested

In the Spring of 2025, I signed up for six of the top identity protection services, including IDShield. I entered my personal information and loaded the Android mobile app on my Samsung Galaxy S25 phone. Over three months I checked in frequently to look at my credit score and online warnings and alerts. When I was done, I cancelled the service and got on with my life in the real world.

IDShield review: Setup

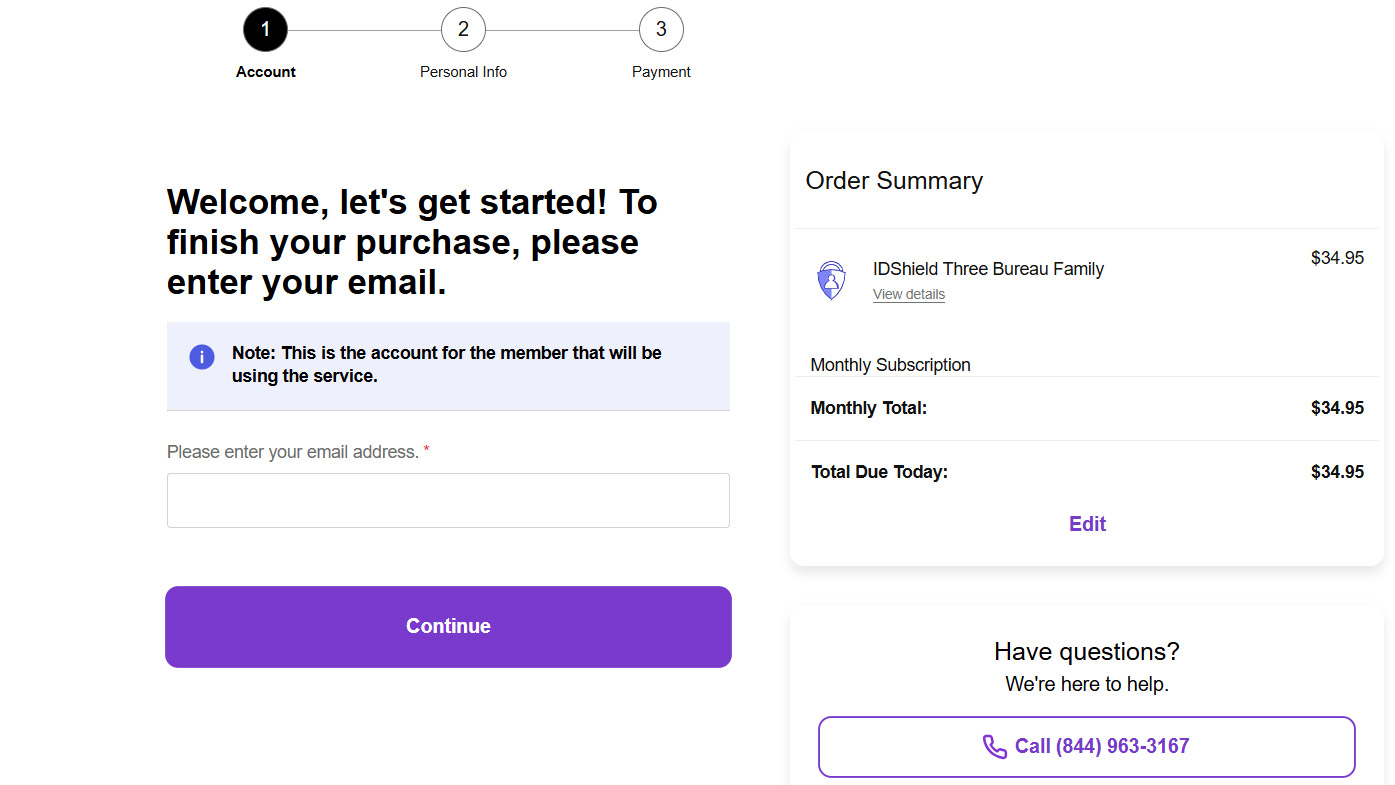

The setting up of IDShield coverage was easy to accomplish. It started at the company’s web site where I picked Family coverage, followed by viewing the two plans and picking the three bureau approach. Interestingly, unlike the competition, the $34.95 price is what I’ll pay for the foreseeable future because there’s no first year discount.

After I looked over the possible plans, I clicked on Get Started and entered my email address.

Next, I typed in a username, followed by my personal information, including the last digits of my social security number. The service was “unable to authenticate me, and I finished up proving I was in fact me over the phone with IDShield’s tech support people. During anxious moments, IDShield’s call desk person was a calming influence.

All told, it took about half an hour and I was able to see my credit score and enter the data concerning my passport, driver’s license, credit cards and bank accounts.

I added a few extra email addresses and phone numbers I use and the data for my LinkedIn account.

The support crew are there from 7 a.m. to 7 p.m. (Central Time) on weekdays but IDShield has restoration experts who are on call 24/7 to help with a question or an identity crisis. They were courteous, knowledgeable and, above all, reassuring.

IDShield review: Credit scores and monitoring

| Row 0 - Cell 0 | Individual | Family |

Credit scores | Yes (1 bureau) | Yes (1 bureau) |

Credit monitoring | Yes | Yes |

Social Security monitoring | Yes | Yes |

Dark web monitoring | Yes | Yes |

Social media monitoring | Yes | Yes |

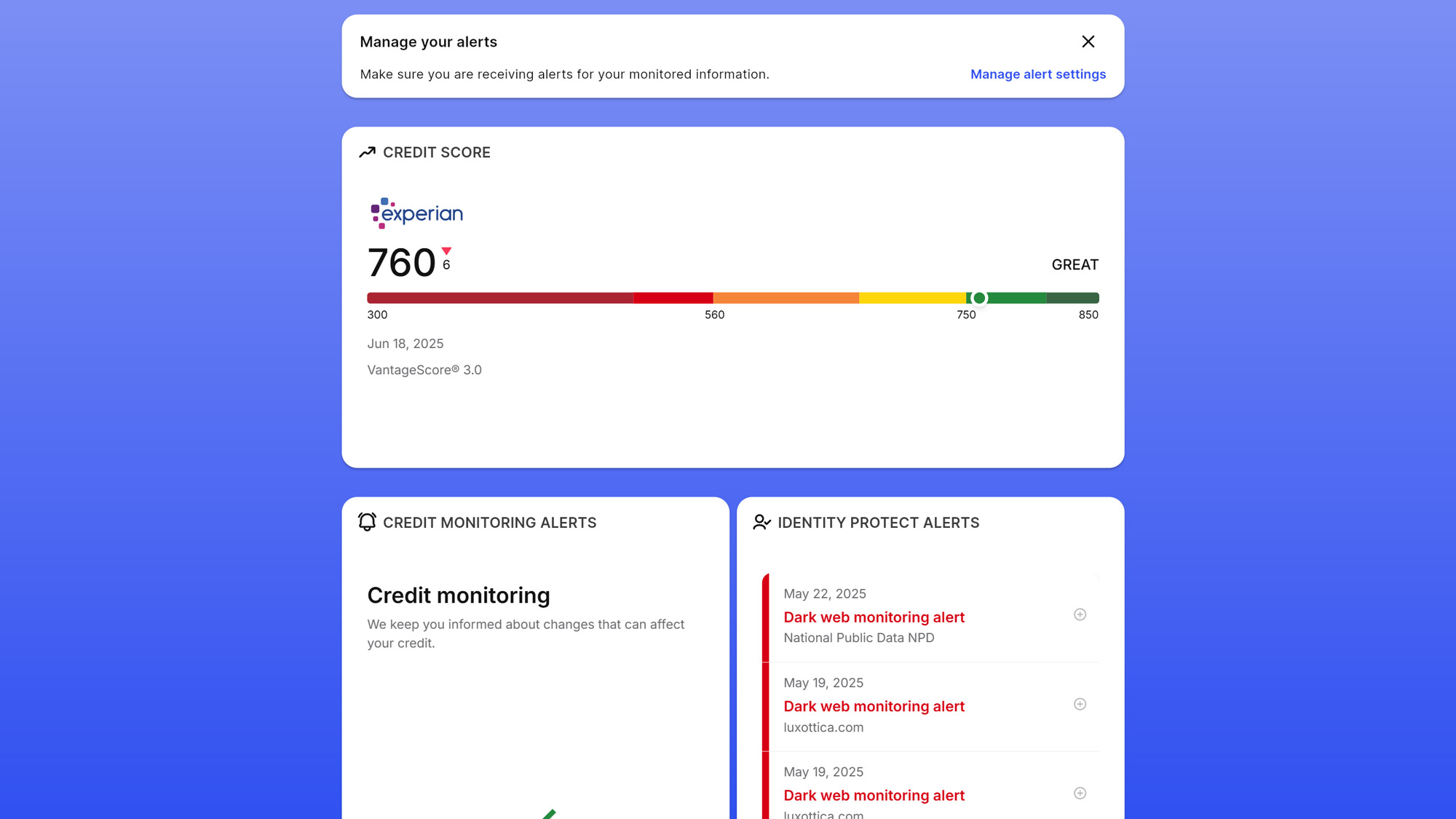

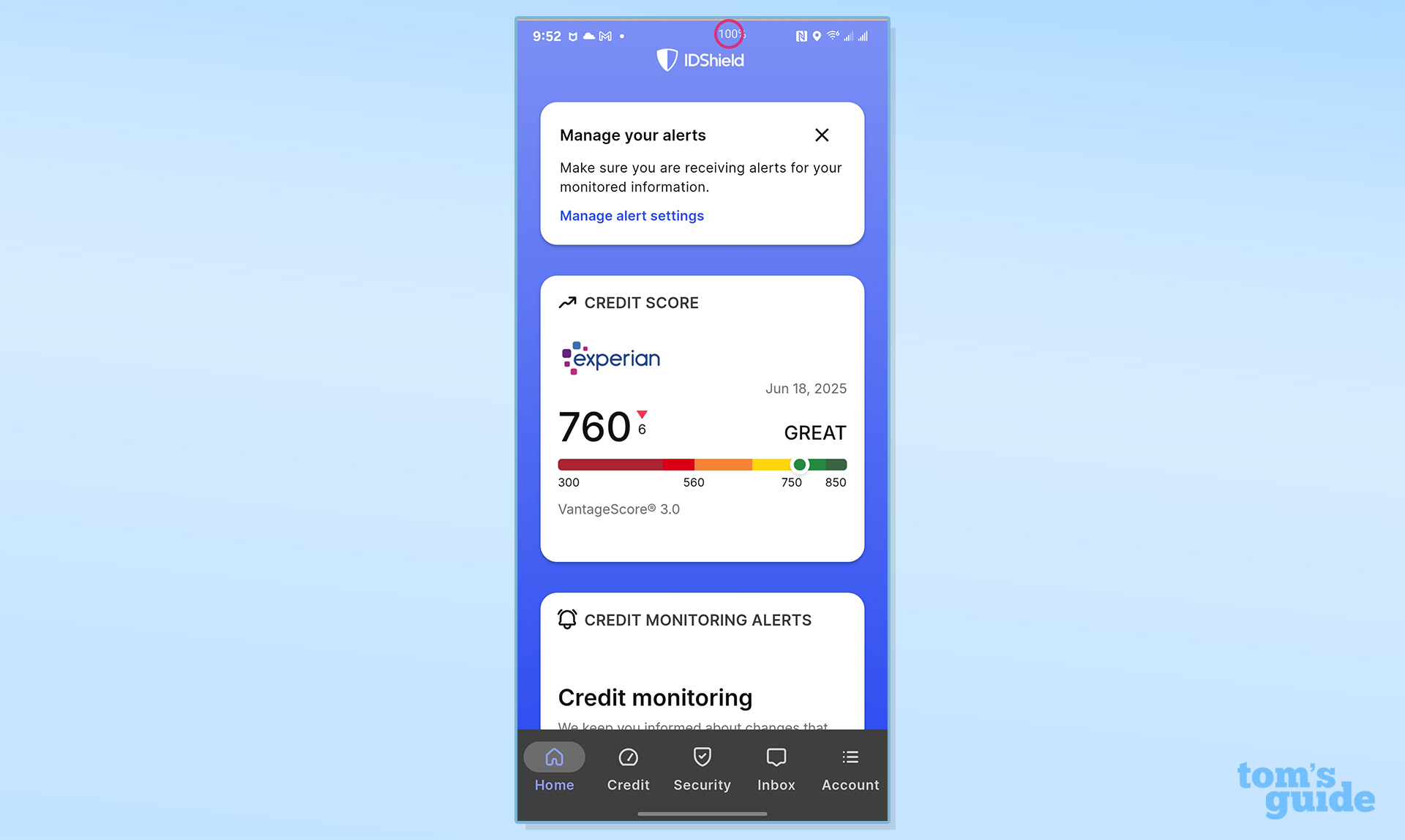

Regardless of which service you sign up for, IDShield does a good job of monitoring and delivering your Experian credit score. The plan does monitor your credit at TransUnion and Equifax as well for large transactions and attempted fraud.

Regardless, you’ll get a Vantage 3.0 score that is the functional equivalent of the well-known FICO score. A weakness is the lack of full credit reports. This is something that others provide daily, monthly, quarterly or annually. You can get your credit report from annualcreditreport.com for free every year and IDShield provides a direct link.

Up to 10 Social Security numbers are monitored, including those under 18 years old for the Family plan. The alerts also include if a child’s Social Security number is used to start an account, credit application or loan.

IDShield continually scans the dark web for instances of your personal identifiers as well as keeping an eye on access to your medical records and action at payday loan establishments. The service lacks a mainstay of identity protection: tracking of your home’s title to alert you of any changes that might be an indication that someone is trying to steal your property through fraudulent paperwork.

The company operates a white glove restoration service to help financially and psychologically in the event of an identity takeover. A single representative will be your case officer and see you through the hard times.

IDShield review: Insurance and services

With insurance underwritten by AIG, all IDShield plans cover up to $3 million, although stolen funds have a $1 million limit. It, however, does without the extra $25,000 of coverage that others, including McAfee, provide to cope with a ransomware incident.

There’re no deductibles and the coverage includes theft and fraud as well as the cost of restarting your life. It can be used for getting a new driver’s license, passport and other key documents.

The best part is that the company can marshal an army of experts to dissect the attack, clean up after it and make your life whole again. This includes lawyers, accountants and private investigators. They often advise and work with law enforcement and collection agencies to help with the restoration.

In addition to lost wages and travel costs, the plan can cover child or elder care if you need to attend meetings or hearings. There’s also lost wallet protection, and the service can help cover your paycheck, up to $7,500 if you have to miss work

IDShield review: Notifications and alerts

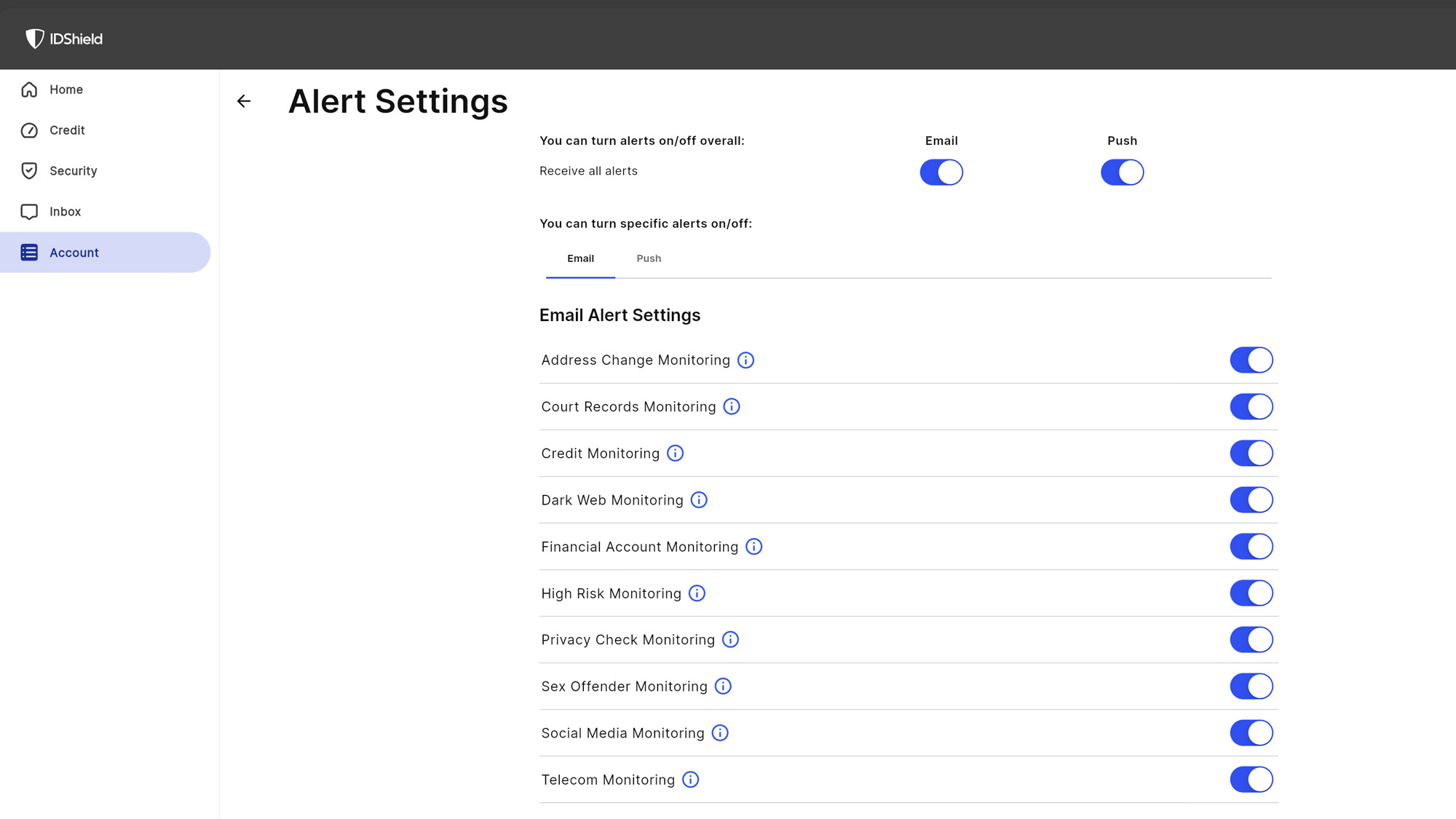

With the choice of seeing and reading alerts via the app or browser, IDShield will also send them via email. Starting later this year, IDShield will send out a monthly summary of all alerts to its subscribers. The alerts are all adjustable and if they prove to be too distracting, there’s an Unsubscribe All button.

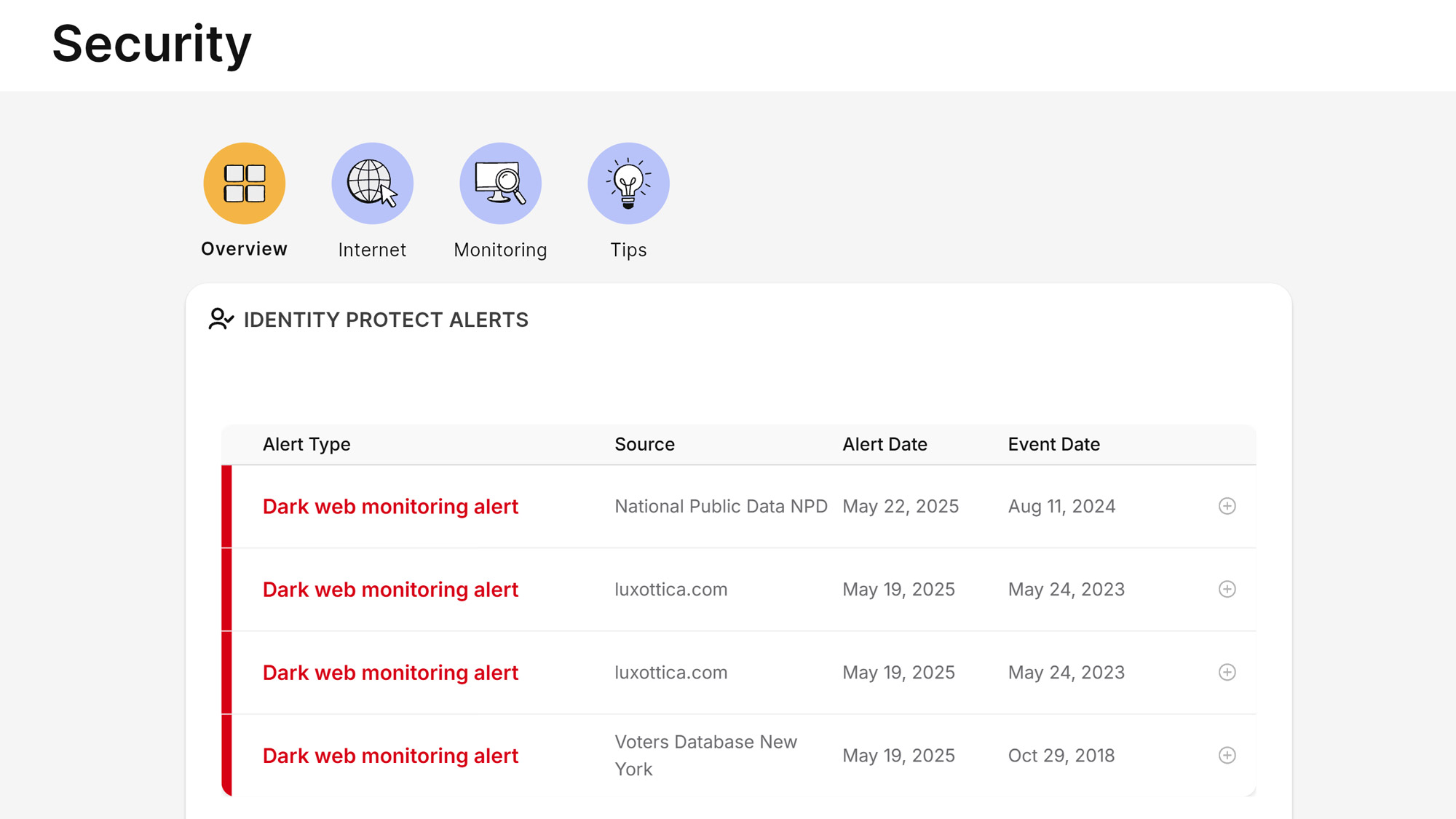

The dark web monitoring is a must-see. It lists places where your personal identifiers (or partial matches) have shown up online. I had four hits immediately, and a couple after using the service for a month or two.

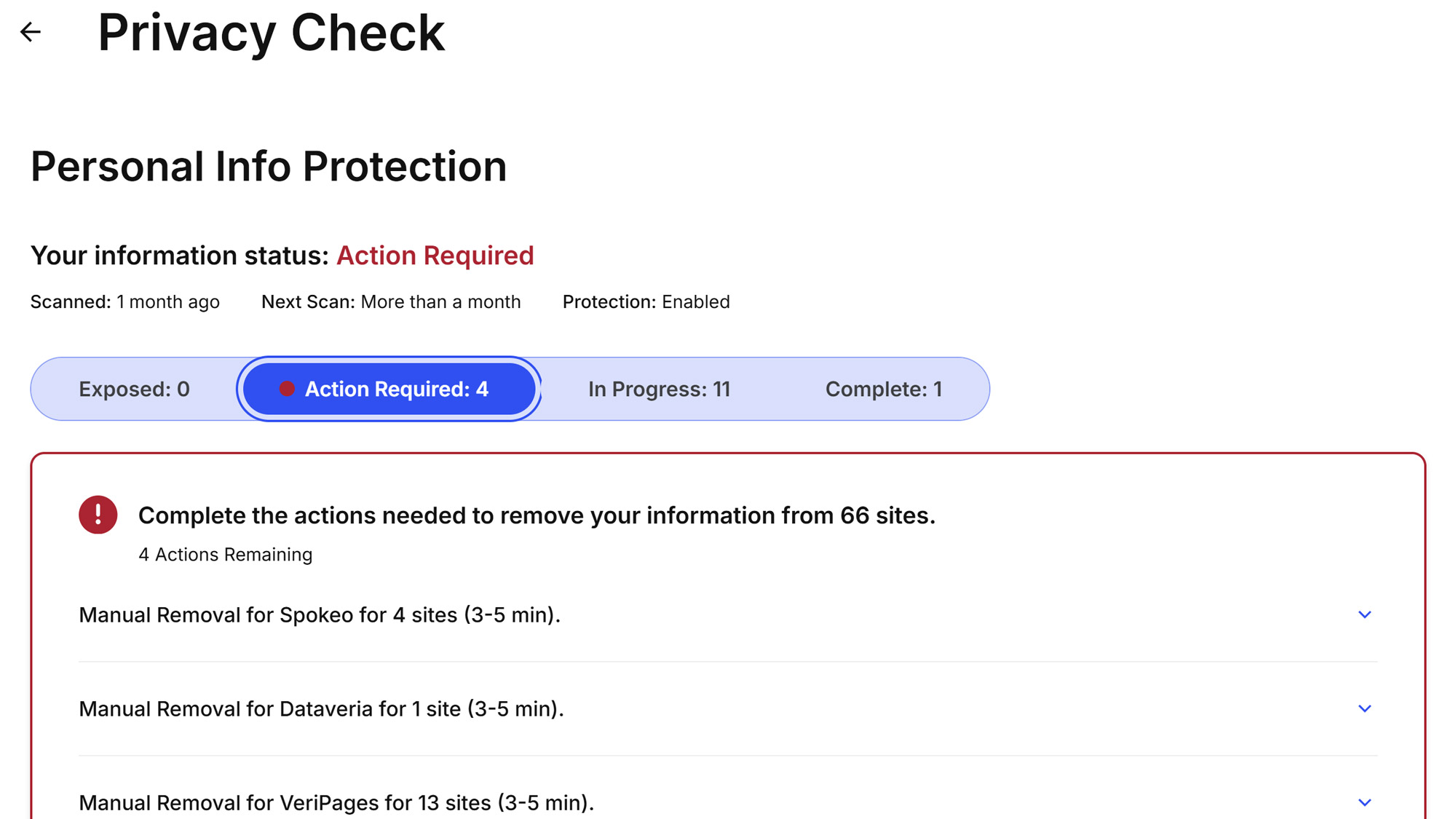

Along these lines, my favorite IDShield service is the company’s Privacy Check, which works with data brokers to find instances of your information that have already leaked out. The service can try to remove them as well. It found a dozen instances of me and my family’s data being out in the open. On the other hand, four required follow up action on my part to remove the data.

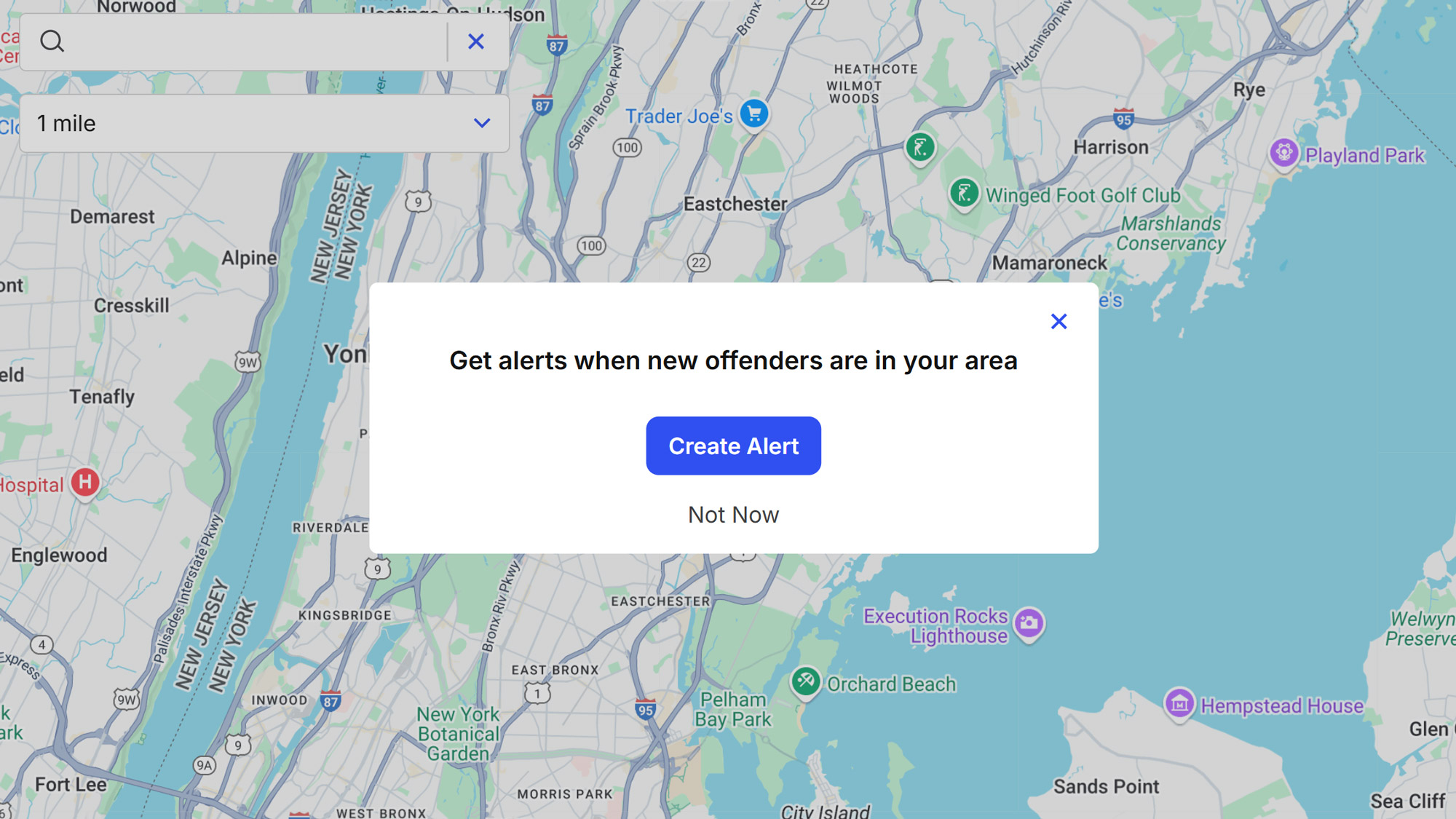

There’s also the Sex Offender alert for any matches with the locality’s offender list living in your area. It has a nice map with the ability to set a radius, show the actual location and send an alert if someone new moves in. Unfortunately, IDShield lacks any monitoring for indications of cyberbullying of your children.

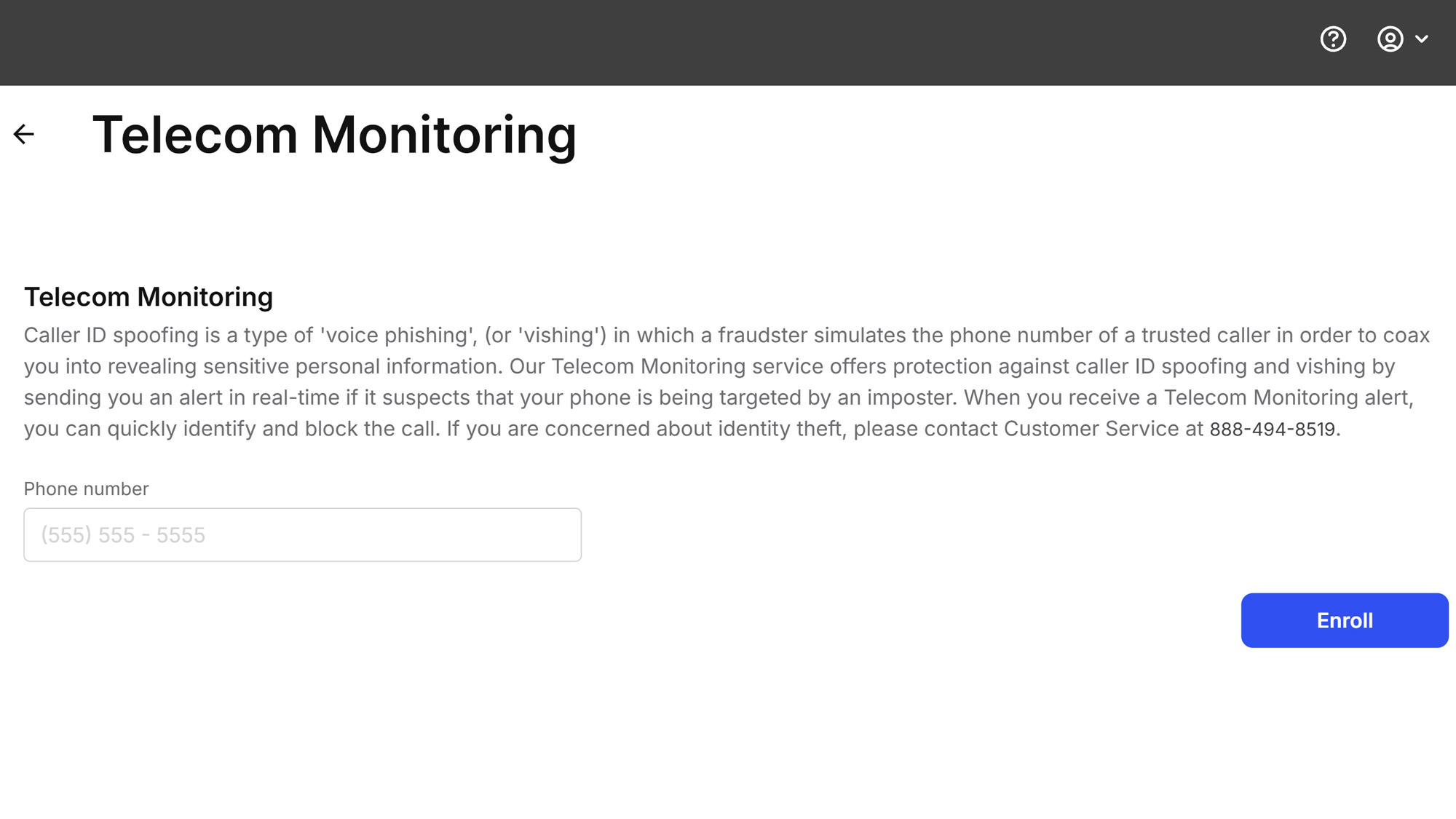

In addition to registering a mobile phone number to get alerted if someone tries to spoof it, the IDShield plan includes Social Media monitoring and notifications if a hacker has compromised your credentials. It works with FaceBook, X (nee’ Twitter), Linkedin and YouTube, although it no longer supports Instagram.

A level below the surface, the Financial Account Monitoring section keeps an eye on your bank and investment accounts. It can monitor an unlimited number of accounts, from checking to retirement.

The service showed me 6 alerts over the three months I used IDShield, mostly scan results.

IDShield review: Interface and extras

With the choice of a web-based interface and mobile apps for iOS and Android, IDShield has its interactions covered. Happily, they look similar and can both be used at once.

Starting with the browser user interface, IDShield was fast on the online draw, taking just 2.9 seconds to connect and show its stuff. The app was a little slower at 7.5 seconds.

IDShield presents a bland but functional look dominated by white, gray and pink. Unlike previous efforts keeping the zoom level at 67 or 75% is fine, although some pages do require some scrolling up and down.

The Home page has a wealth of information, including the current credit score, ability to change the alert settings and a look at your alerts. The tabs on the left lead to Credit, Security, Inbox and Account info.

The all-important Credit page shows any outstanding alerts followed by the current credit score and a fever chart of recent movement. At the bottom are ways to set up payday loan monitoring and include your investments in the coverage. There’re also some useful articles on your credit score and what affects it.

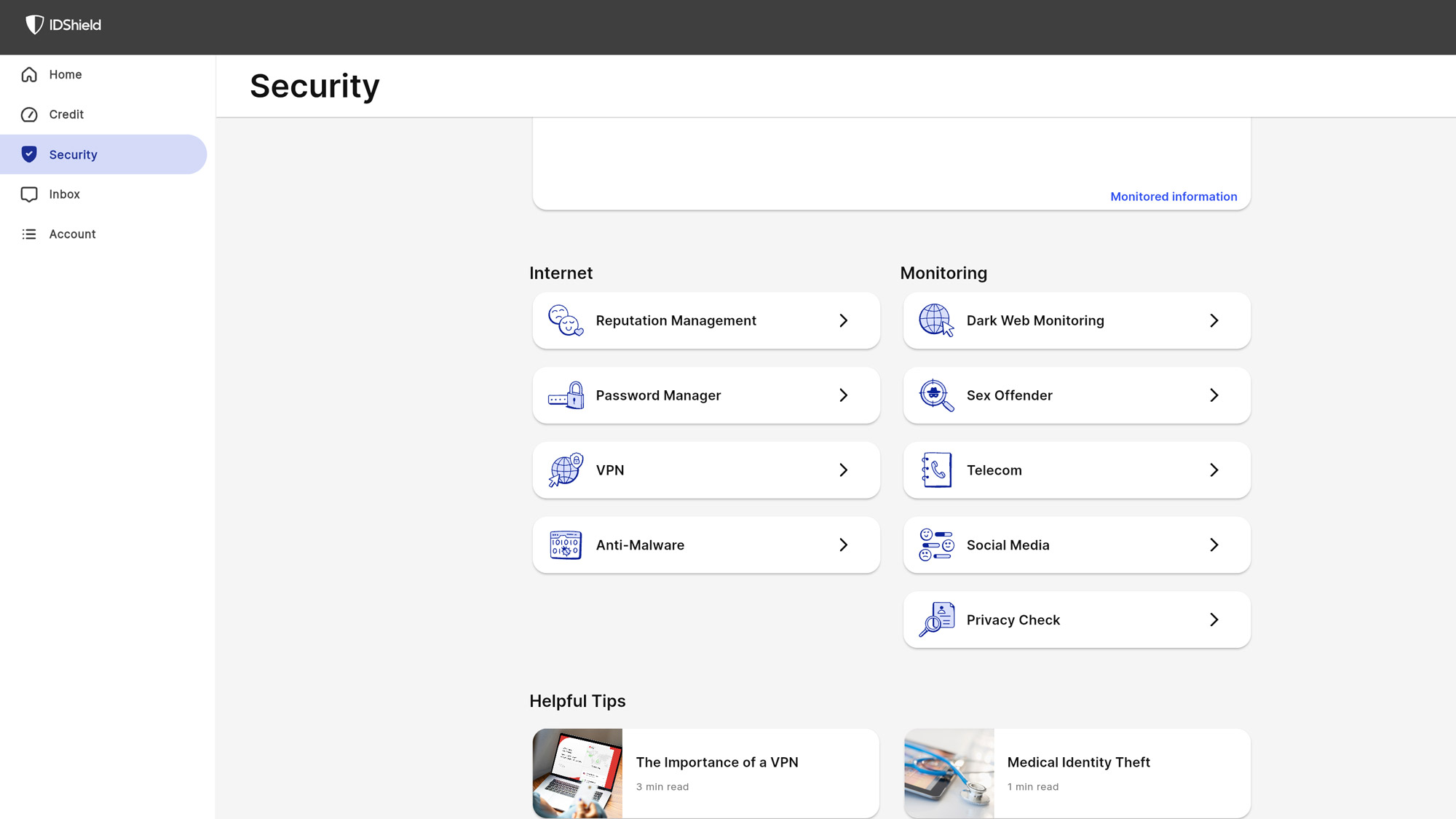

Meanwhile, the Security tab’s Overview has recent dark web monitoring alerts as well as what identity elements have been scanned for and the results. The bottom has links for all security-related aspects of IDShield and more helpful articles.

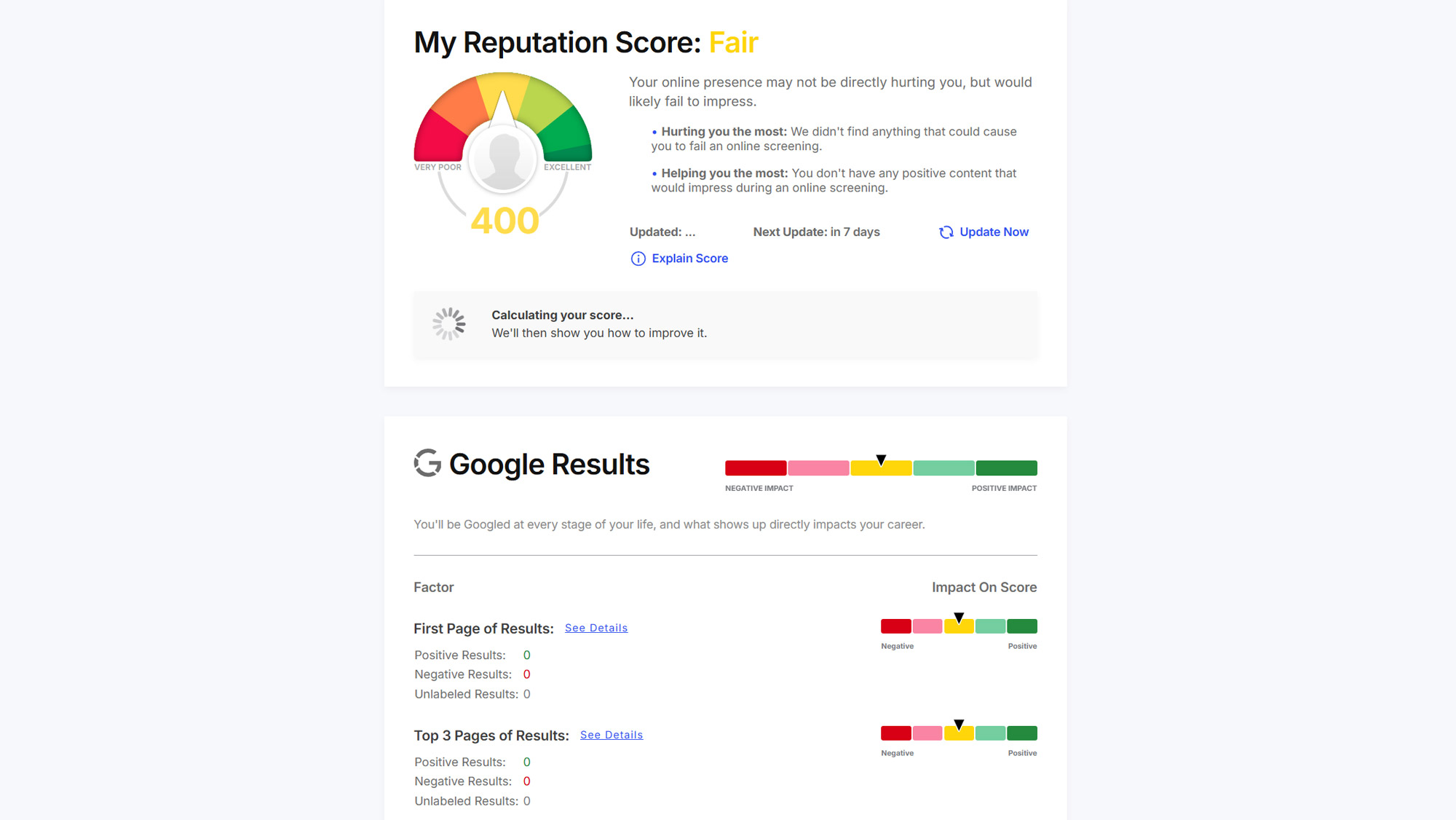

IDShield’s Internet section has its innovative Reputation Management that can save embarrassment and maybe your career by tracking your presence online and providing a score of what’s out there that might be damaging. It can’t change history but might make the past disappear, including photos from frat parties, social media posts about conspiracy theories and uploaded content on a variety of weird topics.

I rated a mid-range 400 score, which hopefully relates to an under the radar boring online persona. The service offered an explanation of the score as well as some helpful advice on being a more rounded individual online. It even offered to scrub my social media presence.

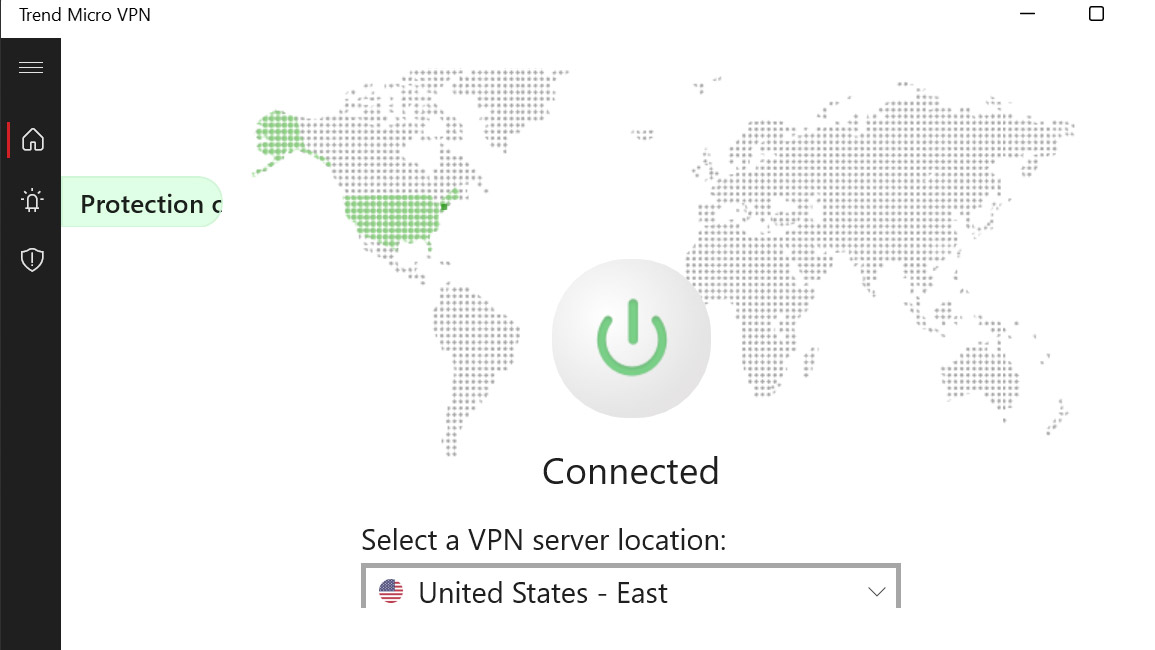

There’s also a place to get the included malware protection, password manager and VPN. These come from Trend Micro and they all require separate downloads, activations and have different interfaces.

The VPN is a step or two behind the others with connection points in only 15 countries. There are three in the U.S. for east, central and west. It can be set to always be on.

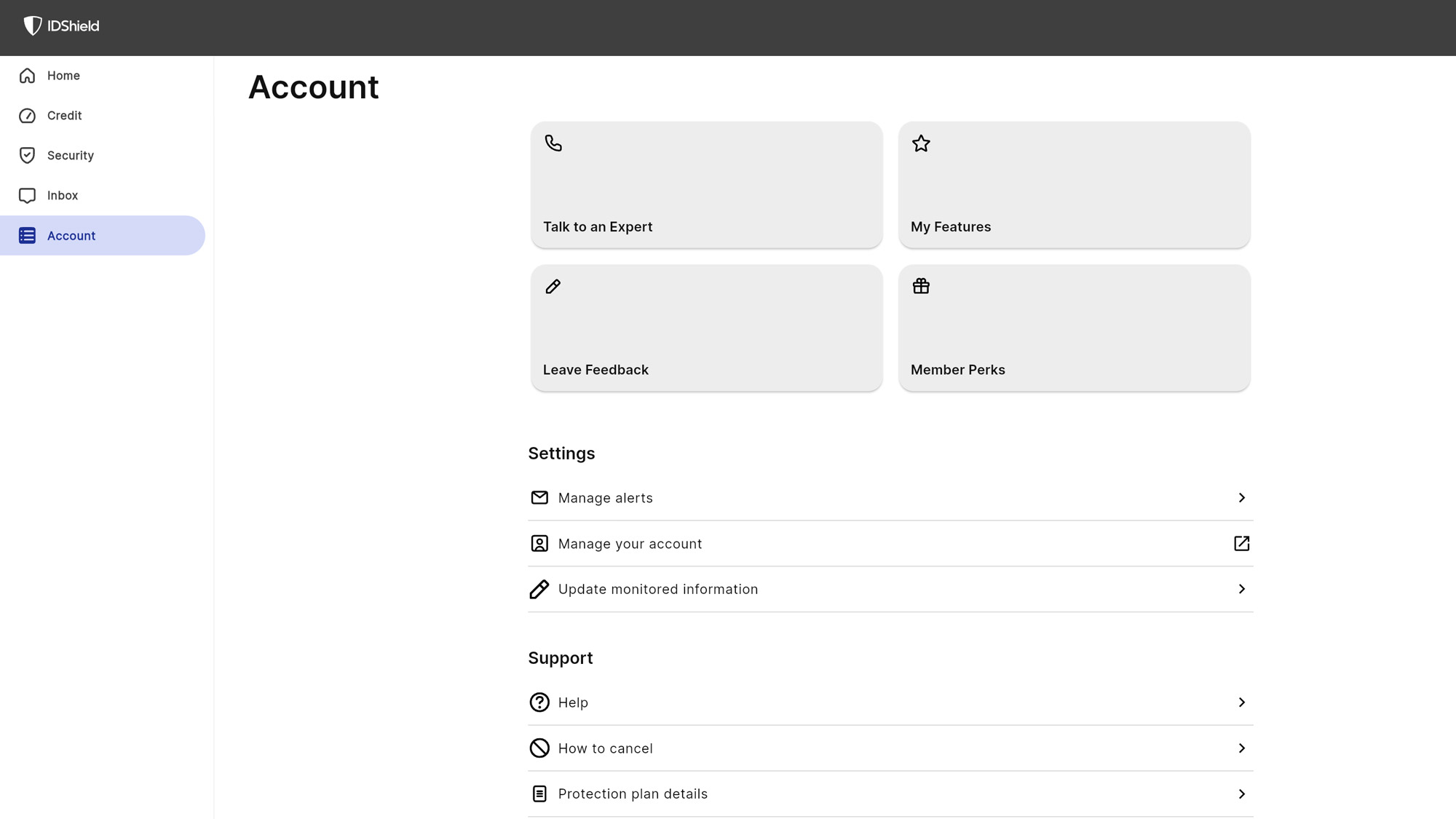

The Inbox is for alerts while the Account tab leads to details about your subscription. A big bonus is a direct link to the tech support people at IDShield. For those who need a discount to buy anything, the Member Perks section has deals with companies like Samsung, Verizon and Disney.

Brighter with more color, the app interface squeezes a lot into a small screen. It only works in portrait mode and each area mimics the browser’s approach, with the Home page showing alerts and credit scores.

It has the same tabs, but they are along the bottom of the screen.

IDShield review: Verdict

Offering a lot for a little, IDShield comes close to being the best compromise when it comes to securing your identity and home computers on a tight budget. It monitors all three credit bureaus and provides Experian credit scores but flags on delivering full credit reports.

Its access and action is fast and the package is a bargain at $35 a month for a family, including malware protection, a password manager and access to a worldwide VPN. The company could stand to expand its choices by offering a discounted annual plan, but that’s up to them.

The standouts include a reputation manager to find and delete embarrassing material online but the service doesn’t track a home’s title and there’re no credit simulators. It’s clearly for those who value every dollar and need to squeeze each and every one of them.

Brian Nadel is a freelance writer and editor who specializes in technology reporting and reviewing. He works out of the suburban New York City area and has covered topics from nuclear power plants and Wi-Fi routers to cars and tablets. The former editor-in-chief of Mobile Computing and Communications, Nadel is the recipient of the TransPacific Writing Award.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.