Tech

Latest about Tech

Best key finder in 2025: AirTag vs. Tile vs. SmartTag vs. Chipolo

By Philip Michaels last updated

These are the best key finders and Bluetooth trackers for finding lost keys, wallets, phones or anything else that is easily misplaced.

I lose my TV remote all the time — and this sticker tracker has come to my rescue

By Philip Michaels published

The right tracker for certain types of jobs

I tried this wallet-sized tracker for a month — and I wouldn't recommend it

By Philip Michaels published

The Tile Slim is perfectly designed for a wallet or purse to make sure you don't lose track of your valuables. But the range is too limited to depend on this tracker.

Tile Pro 2024 review: Still a good key finder, but a backward step

By Philip Michaels published

The updated version of Tile's top-of-the-line key finder isn't as polished as past versions. Our Tile Pro 2024 review looks at what the key finder does well and where it falls short.

I've been testing key finders for a decade — and this is my new top pick

By Philip Michaels published

The Tile Mate may not be the most expensive of the Tile trackers, but it's the best.

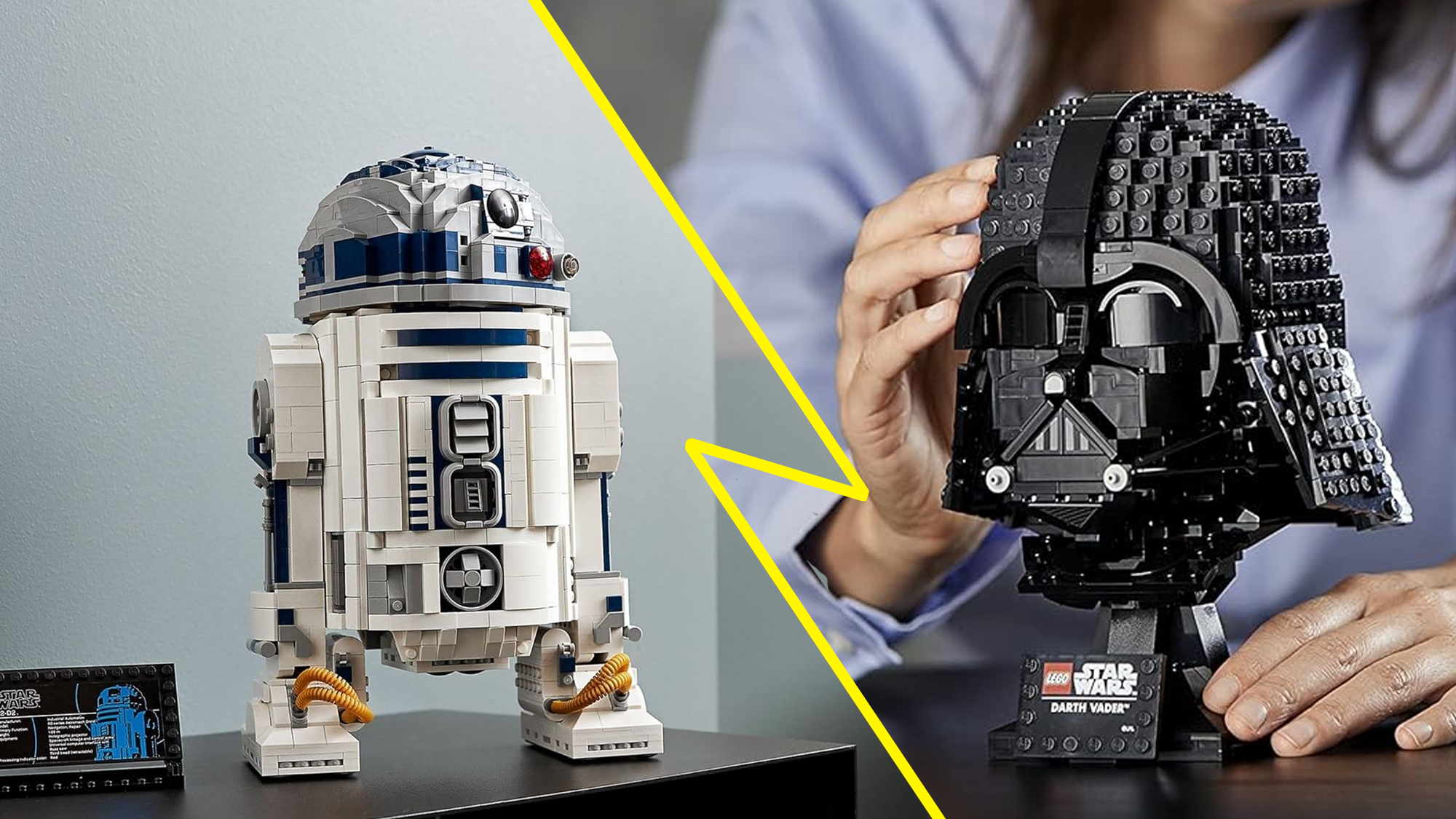

LEGO Star Wars Day deals 2025 — sets I'd buy starting at $6

By Kate Kozuch published

Here are the best LEGO Star Wars Day deals 2025 you can get now, including new sets, free gifts with purchase and exclusive LEGO Insider savings for Star Wars Day.

How to get a Dell student discount

By Rory Mellon last updated

Here's how to get a Dell student discount and save up to 10% on a range of high-quality laptops, monitors, PCs and more.

How to recycle electronics and old tech — tips for properly disposing used phones, TVs, and computers

By Kate Kozuch, Jason England, Philip Michaels, Michael Desjardin published

When it comes time to get rid of your used electronics, here's what to know about how to recycle them properly.

Sign up to get the BEST of Tom's Guide direct to your inbox.

Here at Tom’s Guide our expert editors are committed to bringing you the best news, reviews and guides to help you stay informed and ahead of the curve!