Apple Pay Later in iOS 16 — everything you need to know

Apple's ready to take on PayPal in the Buy Now, Pay Later business

Update: Apple Pay Later could finally arrive by April of 2023.

Apple's constantly looking for ways to extend the reach of its Apple Pay payment offerings, whether it's in stores, online or anywhere where money gets exchanged for goods and services. So it's not that surprising that the launch of iOS 16 and a revamped Wallet app will signal Apple's entry into the Buy Now Pay Latter (BNPL) space with Apple Pay Later.

It's a crowded space to be in, with services like Klarna, Afterpay and Affirm among the more popular options, and fintech giant PayPal offering its own PayPal Pay in 4 payment plan. So Apple figures to have some tough competition when Apple Pay later launches in the fall.

Here's what we know so far about Apple Pay Later and how it will fit into the Wallet app.

What is Buy Now Pay Later

BNPL is a simple concept: instead of paying for a purchase all at once, you pay over installments. Typically, these installments will be offered interest-free, which is why they can be so appealing to consumers. Some, like My Chase Plan, charge fees, but Apple has said that Apple Pay Later won't feature any fees.

How does Apple Pay Later work

Based on what Apple has said when it unveiled its BNPL service at WWDC 2022, you do not need an Apple Card to use Apple Pay Later, but you need to be using Apple Pay. Apple does warn “A user’s card-issuing bank may charge a fee if the user’s debit card account contains insufficient funds,” but aside from that, there are no restrictions that we know about.

Even though it is not required, you may still wish to sign up for an Apple Card account anyway. Both Apple Card and Apple Pay Later are technically offered through Goldman Sachs, though users see everything as Apple-branded.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

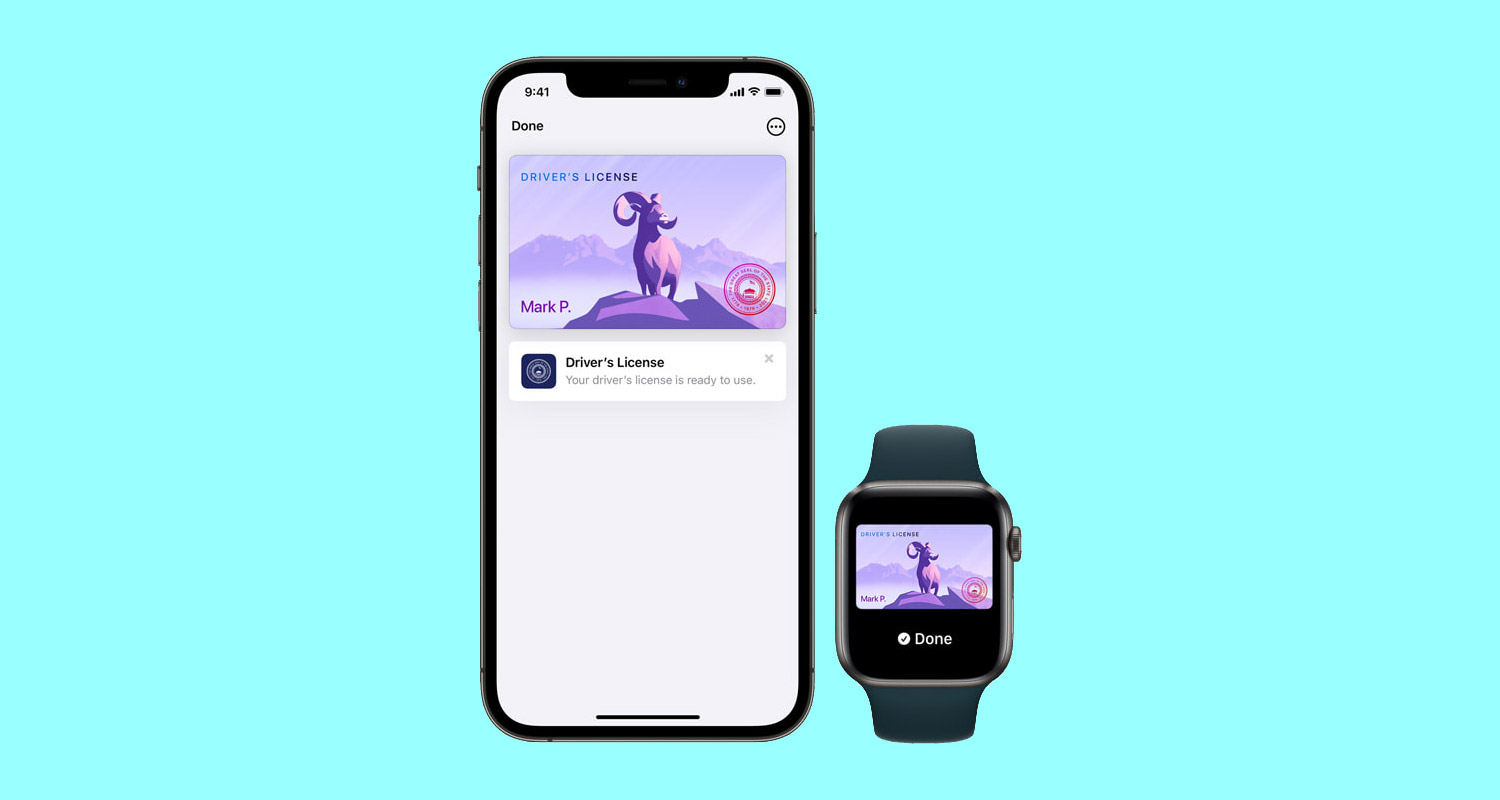

Once you are using Apple Pay, it seems that all you need to do next is simply make a purchase with Apple Pay. There may be some purchases that are ineligible for Apple Pay Later, but details on those restrictions will likely emerge closer to launch. This feature should also work for contactless payments made with an iPhone or an Apple Watch.

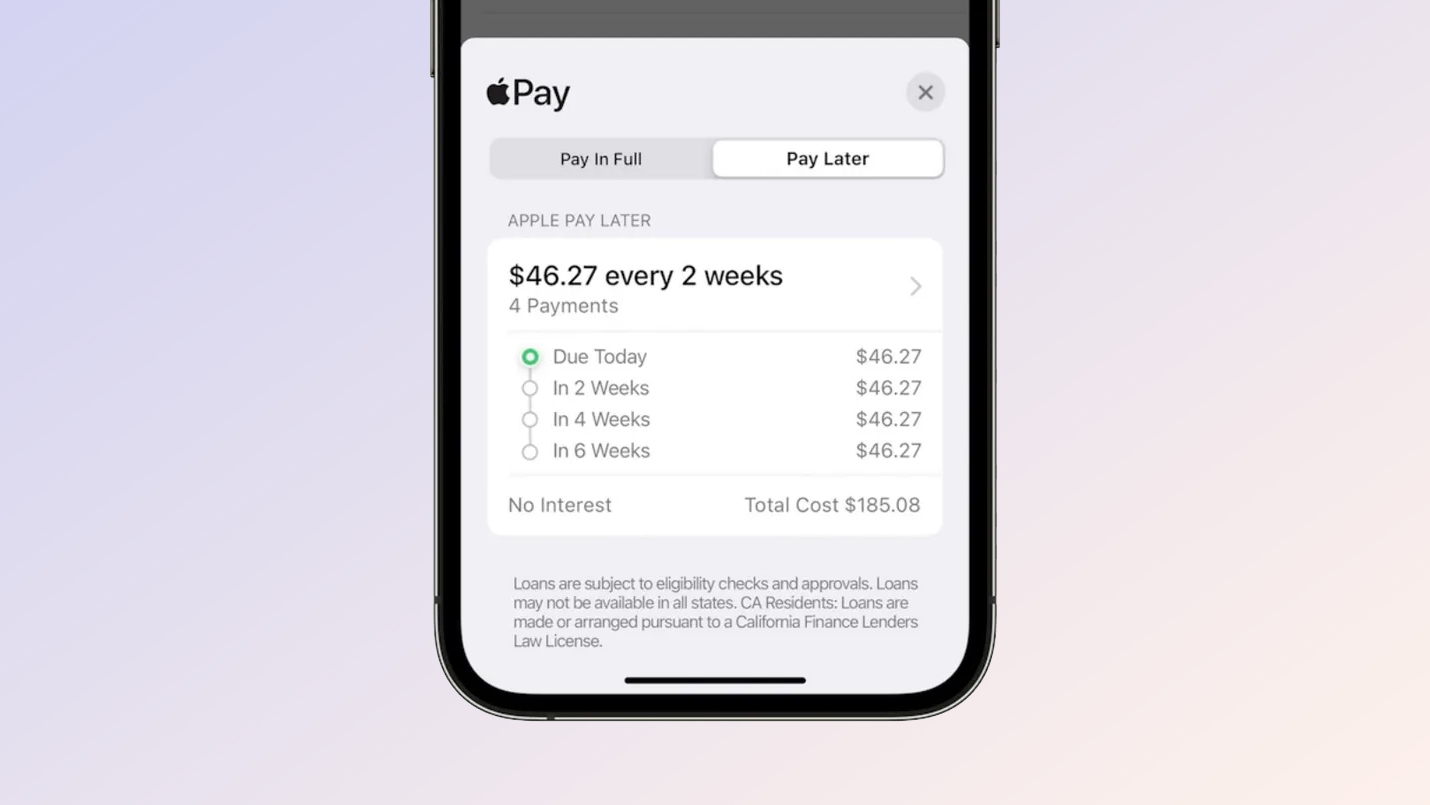

Once you have made a purchase with your Apple Card, you can select either “Pay In Full” or “Pay Later.” If you select “Pay Later,” you will be given a scheduled payment plan showing a breakdown of your four payments.

Every Apple Pay Later purchase is split into four equal payments over the course of six weeks. The first payment is made once “Pay Later” is selected, and the subsequent payments are scheduled at two-week intervals. The payments are all handled through the Wallet app.

Where can I use Apple Pay Later

According to Apple, Apple Pay Later will work anywhere Apple is accepted online or within an app. That would seem to exclude physical stores from BNPL purchases.

Who can sign up for Apple Pay Later

Apple Pay Later is currently slated for users in the United States. Additionally, users must apply to use the feature and can only use it once their application is approved.

It's unclear when other regions will gain access to Apple Pay Later, but Apple typically tests out payment features in the U.S. before bringing them to other countries.

When can I sign up for Apple Pay Later

The feature is expected to launch with iOS 16. That software update is currently in beta, with developers getting first crack at it. A public beta is coming in July, but we'd guess that Apple Pay Later won't launch until after iOS 16 gets a full release in the fall.

What else do I need to know about Apple Pay Later

Apple Pay Later is technically a line of credit. However, the application process should only require a soft credit check, and therefore does not affect an applicant’s credit score. While there are no fees with Apple Pay Later, defaulting on a payment is likely to come with a penalty of some kind. Therefore, you should only use Apple Pay Later if you know you can make each of the four payments on time. This rule applies to any BNPL service.

Apple has also just made a huge change to Apple Pay in iOS 16 beta. Apple Pay will now be support third-party browsers for in-browser payments on iOS 16.

Stay tuned to Tom’s Guides for the latest updates on iOS 16 features coming to your phone later this year.

Malcolm has been with Tom's Guide since 2022, and has been covering the latest in streaming shows and movies since 2023. He's not one to shy away from a hot take, including that "John Wick" is one of the four greatest films ever made.

Club Benefits

Club Benefits