Mobile Wallets: Apple Pay vs Samsung Pay vs Google Pay

Learn who accepts Apple Pay, Samsung Pay and Google Pay; how these services work; and the pros and cons of each.

We are gradually closing in on the day when your phone or smartwatch will replace your wallet. Instead of scrambling to locate your credit or debit card to pay for a meal, shopping excursion or prescription, you will simply tap your device to a retail terminal and be on your way.

While card-free mobile payments facilitate and protect transactions for consumers, they are a potential gold mine for mobile vendors. According to a 2017 report by Allied Market Research, the global mobile payments market is estimated to reach nearly $3.4 billion by 2022, with a compound annual growth rate of 33.4 percent from 2016 to 2022.

Apple, Google and Samsung all want a piece of the action, and they have rolled out solutions like Apple Pay, Google Pay and Samsung Pay, which use near-field communication (NFC) technology to let users make everyday purchases with maximum speed and minimum fuss.

| Service | Supported Devices | How to Use | Number of Accepted Locations |

| Apple Pay | iPhone X, iPhone 8/8 Plus, 7/7 Plus, 6/6s, 6/6s Plus, SE, Apple Watch, iPad, iPad Air 2, iPad Pro, iPad Mini 3, 4, MacBook Pro with Touch Bar | Tap to pay with NFC at supported terminals | 4 million |

| Google Pay (formerly known as Android Pay) | All NFC-enabled Android phones, tablets, watches running KitKat (4.4) or higher | Tap to pay with NFC at supported terminals | > 1.5 million |

| Samsung Pay | Galaxy Note 8, S8/S8+, S7/S7 Edge; S6/S6 Edge/S6 Edge+; Galaxy Note 5; Gear S2, S3 watches | Tap to pay with NFC at supported terminals, supports MST, EMV readers | > 30 million |

Consumers are increasingly intrigued by the concept of digital wallets, but most have only minimal experience using them because of the limited availability of this payment option. A survey by JPMorgan Chase found that only 16 percent of U.S. consumers have completed a digital wallet transaction, probably because only 36 percent of U.S. merchants currently offer this payment option.

MORE: Best Budgeting and Personal Finance Apps

But changes are underway: Nearly 70 percent of merchants in that JPMorgan Chase survey anticipate accepting digital wallet payments within five years.

Apple takes the lead

Apple Pay seems to have taken an early lead, at least according to the numbers Apple’s disclosed in its quarterly earnings reports. In October 2017, Jennifer Bailey, Apple's vice president of Apple Pay, said the company's mobile payment service represents 90 percent of all contactless payments made in markets where it's available.

However, there have also been some shakeouts. CurrentC, the QR-code-based service created by the Merchant Customer Exchange (MCX) consortium as a rival to Apple Pay, shut down, and its technology was later sold to JPMorgan Chase for use in building out its own Chase Pay system.

Google Wallet, another early retail payment system, morphed into Android Pay before Google folded both services into one: Google Pay. The app allows you to transfer funds to friends or tap to pay for items in stores.

While mobile payments play in a new and hotly competitive field, replete with compatibility and security concerns, their popularity is accelerating. For instance, banks such as Wells Fargo and Bank of America are now starting to use NFC readers for ATM cash withdrawals.

Want more information about Apple Pay, Google Pay and Samsung Pay? Here’s what you need to know.

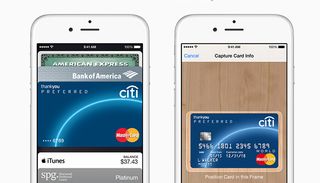

Apple Pay

What it is: Apple Pay, which launched Oct. 20, 2014, is a proprietary iOS mobile payment system that uses your device to make payments on NFC-enabled credit card terminals at the point of sale.

Devices: You can use the iPhone X, iPhone 8/8 Plus iPhone 7/7 Plus, 6/6 Plus, 6s/6s Plus and Apple Watch for retail purchases, as well as the MacBook Pro with Touch Bar, 2017 iPad, iPad Air 2, iPad Pro, and iPad Mini 3 and 4 for online purchases.

Who should use it: iPhone owners are the target market, and the technology can cover phones from the iPhone 5 series, if you have an Apple Watch. If not, you’ll need an iPhone 6 or later with Touch ID or an iPhone X with Face ID.

How it works: Enter or scan your credit card information into Apple's Wallet app on an iPhone X, iPhone 8/8Plus iPhone 7/7 Plus, SE, 6/6 Plus or 6s/6s Plus. In a store that accepts Apple Pay, just hold your iPhone near the reader with your finger on the Touch ID, Apple’s fingerprint identity sensor. If you're using an iPhone X, you'll use Face ID to authenticate a purchase instead of Touch ID. Double click the side button and then look at your iPhone to confirm the purchase. After looking at your phone, hold it up to the terminal to make sure the transaction goes through.

To pay with an Apple Watch, double-click the side button, and position your watch to face the NFC reader. Users with an iPhone 5 series handset can also access Apple Pay via an Apple Watch, but without the security of Touch ID. Just activate Apple Pay with a passcode that remains active for as long as the watch is strapped to your wrist.

Should you lose your phone, just use the Find My iPhone feature to remove all cards from your handset — no need to cancel your credit cards.

MORE: How to Find Your Lost or Stolen iPhone

With macOS Sierra and later, you can use Apple Pay for shopping on your Mac. After you set up Apple Pay on an iPhone or Apple Watch, you can use your cards on websites in Safari on your Mac, if you enable Bluetooth and are signed in to iCloud. An online Apple Pay button requires users to authenticate from a Touch ID device, such as an iPhone or Apple Watch, for security. A Touch ID sensor is also present on the MacBook Pro with Touch Bar.

You can also transfer money to friends or family with the Apple Pay feature in Messages, a feature introduced in iOS 11. It works similarly to Venmo, except instead of opening a third-party app to send or request cash, you can do so in a text message.

MORE: How to Send Friends Money Through Apple Pay in iOS 11

Security: Like most mobile payment schemes, Apple Pay transactions are “tokenized” to enhance security. In other words, instead of storing credit card numbers, Apple Pay generates virtual account numbers while a unique dynamic security code is generated for each transaction; no traceable credit card numbers are stored by the retailer or by Apple. For additional security, transactions are authorized with Touch ID or a PIN number.

Despite those measures, controversy has swirled around reports of credit card fraud involving Apple Pay. Part of the problem stems from various banks’ differing protocols and processes for verifying identity and authorizing the credit cards scanned into the iPhone. Thieves can steal credit cards or buy stolen card information online, enter the cards into their own iPhones, and get them authorized through various means. Because Apple Pay retail transactions don't require an ID, that sort of infiltration spells trouble.

Participating financial institutions: According to LoopVentures analyst Gene Munster, 2,091 companies globally accept Apple Pay as of March 2017, up from 1,439 in July 2016. These institutions include Visa, MasterCard, Discover, American Express, Bank of America, Barclays, Capital One, Chase, Citi, PNC, TD Bank, U.S. Bank, and Wells Fargo. In addition to the U.S., Apple Pay is now accepted in Canada, Denmark, Finland, France, Ireland, Italy, Spain, Sweden, Russia, Switzerland, the U.K., the United Arab Emirates, Australia, mainland China, Taiwan, Hong Kong, Japan, New Zealand and Singapore. In addition, while 13 percent of active iPhones have activated Apple Pay, 30 percent of new iPhones are activating the service, Munster said.

Where it works: More than 4 million retail stores, including popular chains such as Duane Reade, Foot Locker, Panera Bread, Sephora, Whole Foods, and Crate & Barrel, accept Apple’s wallet system — up from 220,000 in 2014. Apple Pay also supports hundreds of apps and online stores, including Starbucks, Target, B&H Photo, Video & Pro Audio, and New Balance. The Gap is currently on Apple’s list of targeted in-store retailers.

Last October, the New York Metropolitan Transportation Authority debuted the MTA Etix mobile app, which supports Apple Pay for Metro-North Railroad and Long Island Rail Road commuters, letting them purchase a variety of ticket packages and passes. Users can even order money transfers from Apple Pay at Western Union locations. Apple also allows nonprofit organizations to accept Apple Pay, while charities in the U.S. and the U.K. can use it to accept donations.

To support Apple Pay transactions in smaller retail locations, Apple has teamed up with PayAnywhere to sell a compact mobile NFC card reader that attaches to iOS devices. In January 2017, electronic payments company Square partnered with Apple to offer small businesses free processing with Apple Pay using compatible Square readers.

Google Pay

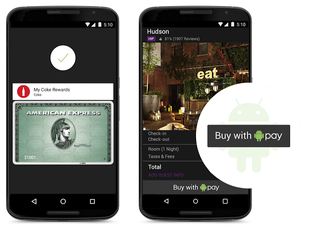

What it is: Google Pay is the rebranded mobile payment service on Android phones that combines the peer-to-peer payments in Google Wallet with the tap-to-pay functionality of Android Pay. Working in conjunction with retailers and financial institutions, Google Pay stores your credit, debit, loyalty and gift card info, letting you make quick payments with supported point-of-sale (POS) systems at retail outlets, as well as via apps and online.

Devices: Google Pay works with any Android device with NFC that’s running Android KitKat or higher, regardless of the brand.

Who should use it: Google Pay sweeps across the entire Android device landscape — phones, tablets and watches.

How it works: Google Pay credit card information is stored on your device and accessed at tap-to-pay retail locations or store-specific apps. It uses a similar token-based system as Apple Pay to protect user data during transactions, except the tokens are generated in the cloud rather than on the device.

When you want to buy something, you wait for your purchase to be rung up, unlock your phone and hold the back of your device against the designated part of the terminal for a few seconds. There’s no need to launch an app; just make sure to enable NFC on your phone. A green check mark should appear on your device to signal that the payment has been accepted.

Security: Google Pay can use your device’s fingerprint sensor to confirm payment within an app. But if your handset doesn’t have the sensor, you can use a passcode. Before Google announced that it would fold Android Pay into Google Wallet, you could set up a default card to use in the Android Pay app. It's unclear if Google will rename this app Google Pay, but it seems likely.

Participating financial institutions: Financial institutions that signed onto Android Pay included American Express, Discover, MasterCard, Visa, Capital One and over 600 U.S. banks, including Chase, Wells Fargo, Citibank and Bank of America. In addition to the U.S., Android Pay was available in Japan, Ireland, Singapore, Australia, New Zealand, Hong Kong and Poland. Presumably Google Pay will be available there as well.

Where it works: Android Pay worked at more than 1.5 million retail locations, as well as with numerous Android apps. Google Pay is expected to take its place. You can already see Google Pay branding in Airbnb, Dice, Fandango, HungryHouse, Instacart and other Android apps. Capital One has activated the tap-to-pay functionality in its Android app, so shoppers can pay directly from their bank account instead of having to enter a credit card or routing number into a third-party program.

Participating retailers include American Eagle, Best Buy, Bloomingdale’s, Coca-Cola, GameStop, Jamba Juice, JetBlue, Macy's, McDonald's, Office Depot/Office Max, Panera, Pepsi, Petco, Subway, Toys R Us, Walgreens, and Whole Foods. In-app retailers include Domino's, Dunkin’ Donuts, Eat24, Etsy, Eventbrite, Hotel Tonight, LivingSocial, Lyft, Newegg, OpenTable, Priceline, Seamless, Uber and Wish.

Samsung Pay

What it is: Samsung Pay is Samsung's answer to Apple Pay, and unlike its competitors, it works with just about any POS system. Samsung Pay works not only with NFC, but also with standard magnetic-stripe retail terminals featuring MST (Magnetic Secure Transmission) and EMV (Europay MasterCard Visa) readers, currently used for traditional and chip-based credit card transactions.

Devices: Samsung Pay works with the Galaxy Note 8, Galaxy S8/S8+, Galaxy S7/S7 Edge, Galaxy S6/S6 Edge/S6 Edge+, Galaxy Note 5, Galaxy S6 Active, and Gear S2/S3.

Who should use it: For now, Samsung Pay works only on the Samsung Galaxy phones and Gear watches, but the new Samsung Pass will make contactless transactions easier in the future for an expanded slate of budget and midlevel devices.

How it works: Enter your credit cards into the Samsung Pay app in a method similar to Apple Pay. At a retail location, open Samsung Pay from the home screen, apps menu or lock screen. Then, swipe up from the bottom of the screen to choose the card you want to use and verify the payment via the home button fingerprint sensor or a PIN. Finally, place the back of your device on the card or NFC reader. When the payment goes through, you’ll get a notification confirming the merchant and the purchase amount, which is also documented in the Samsung Pay app.

MORE: Samsung Galaxy S8 User Guide - Tips, Tricks and Hacks

An even easier way to use Samsung Pay on websites and other online services is Samsung Pass, a password manager for mobile banking apps and websites used with the Samsung Internet browser.

Samsung Pass stores your info and then lets you log in to your accounts with biometric data, like a fingerprint or retinal scan, so you don’t need to enter individual passwords for each service. Samsung Pass is currently in expansion mode with additional financial services expected in the U.S., Europe and Asia.

Security: Like its competitors, Samsung Pay uses tokenization for transactions. With each purchase, the handset sends a 16-digit token representing the credit or debit card number and a one-time code generated by the phone's encryption key.

Participating financial institutions: More than 650 banks and credit unions — including Visa, MasterCard, American Express, Bank of America, Citi, Chase and U.S. Bank — are part of Samsung Pay.

Where it works: More than 30 million retail locations worldwide that are equipped with an NFC or a magnetic stripe POS terminal can be used with Samsung Pay.

Samsung Pay works on nearly any card with a bar code, which means you can add loyalty, membership and rewards cards to your phone or wearable device. Samsung generates its own rewards program for using the pay system. You can even store, purchase, or send and receive gift cards directly from the app. Participating gift card merchants include Best Buy, Hyatt, Kohl’s, Old Navy, Toys R Us and many others. In-app payment partners include Exxon Mobil, Fancy, Hello Vino, and Raise.

The service is available in the U.S. on all major networks, as well as in Spain, South Korea, China, Australia, Singapore, Thailand, Brazil, Canada, Russia, Sweden, United Arab Emirates and India, with more countries to follow this year.

Samsung and Visa also inked a deal to let Samsung Pay users shop online at more than 350,000 retail websites.

Stewart Wolpin contributed to an earlier version of this report.

Sign up to get the BEST of Tom’s Guide direct to your inbox.

Upgrade your life with a daily dose of the biggest tech news, lifestyle hacks and our curated analysis. Be the first to know about cutting-edge gadgets and the hottest deals.

Jackie is an obsessive, insomniac tech writer and editor in northern California. A wildlife advocate, cat fan, and photo app fanatic, her specialties include cross-platform hardware and software, art, design, photography, video, and a wide range of creative and productivity apps and systems. Formerly senior editor at Macworld and creativity editor at The Next Web, Jackie now writes for a variety of consumer tech publications.