Tom's Guide Verdict

The MyFICO ID protection service goes to the source to not only monitor your credit and insure your identity but the service provides the actual FICO scores that loan officers use to assess your creditworthiness. Too bad it’s an expensive service that has security holes in it.

Pros

- +

Tops in credit monitoring

- +

Excellent credit simulator

- +

Monthly 3-bureau credit reports

- +

Access to several FICO credit scores

Cons

- -

Expensive

- -

Lacks annual plan discount

- -

No malware protection or VPN

Why you can trust Tom's Guide

Monthly cost: $40

Yearly cost: No annual plan

Family plan: No

No. of bureau scores: 3

No. of bureaus monitored: 3

Frequency of credit reports: Monthly

Type of credit score: FICO

Credit-improvement simulator: Yes

Credit-lock/freeze button: No

Security software: No

Investment account monitoring: No

Max. ID-theft coverage: $1 million

Data Breach Alerts: No

Medical Records Monitoring: No

Payday loan monitoring: No

Sex Offender Alert: No

Title Change Alert: No

Two Factor Authentication (2FA): Yes

If your focus is on thorough credit monitoring, MyFICO is the place to go. It not only has credit score monitoring from all three major bureaus in the U.S. but also has the choice of several actual FICO scores used to rate loans and mortgages.

Its excellent credit simulators can be a big help, but the service falls short without a credit freeze button as well as a slew of ID protection services, like looking for title and address changes, data breaches and investment accounts.

Even though it falls short of the mark on ID protection services, MyFICO remains one of the most expensive services available with a price tag that’s double what others cost while providing less. Our MyFICO review will help you determine if it fits in with your lifestyle and budget.

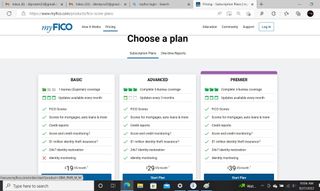

MyFICO review: Costs and what’s covered

With its connection to Fair Isaac and Company (of FICO fame), MyFICO’s three tiers focus on credit monitoring but less so on identity protection. The $20 a month Basic plan includes Experian credit scores and reports as well as your main FICO score. As is the case with the other two subscriptions, Basic includes $1 million in insurance to cover lost funds and experts, like lawyers, accountants and consultants to get your identity back.

MyFICO’s Advanced plan adds access to scores and reports from all three credit bureaus, but only quarterly. It comes with something the others lack: 12 of the most used FICO scores. The plan also includes dark web identity monitoring and costs $30 a month.

At the top of MyFICO’s offerings is the $40 per month Premier plan that I looked at, making it among the most expensive around. It covers all three credit agencies but scoring and reports are issued monthly.

Unfortunately, MyFICO has neither a family plan nor an annual one. It is one of the most expensive ID protection services around, topping the cost of Norton LifeLock, Bitdefender or McAfee. Still, it lacks things like a VPN, password manager and malware protection.

The company received a desirable A+ rating from the Better Business Bureau, meaning that MyFICO is seen by its customers as very reputable.

MyFICO review: How we tested

During the summer of 2022, I signed up for the MyFICO Premier plan and paid for it with my credit card. Later, Tom’s Guide reimbursed me for the cost.

Over the next three months, I checked in with the service several times a week using a variety of systems. I dropped the service at the end.

MyFICO review: Credit scores and monitoring

The MyFICO service comes the closest to providing the actual credit worthiness scores that banks and mortgage companies use on a daily basis to approve or deny loans. Tightly focused on credit monitoring and alerts, MyFICO was the only service that provides FICO scores, not VantageScore substitutes. They show what the banks, loan companies and credit card issuers really use to determine your creditworthiness with a dozen scores available that use data from the three credit bureaus. In other words, it’s a 360-degree view of your credit data and history.

For instance, the FICO 8 score is the default because of its long use with credit card companies and those who write up car loans. There are also FICO scores aimed at mortgages and credit cards as well as four recently added FICO scores, including the increasingly popular AutoScore 10 rating for car loans.

There’s also access to your full credit report on a monthly basis, while some of the others do this quarterly, annually or not at all. At any time, it’s easy to buy an instant report for $16 each.

Under each score is an excellent Insights section that details the variables that play a role in the FICO scoring. It not only appraised my credit mix, length of credit history and payment history, but debt load. My favorite, though, is the Resilience score for how well I might survive bad financial times ahead.

There’s a useful score tracker for the all-important FICO Score 8 rating to see changes over time. You can dig into each FICO score to see its changes over time too.

The service falls short of the best by lacking the ability to track investment accounts and action at payday loan companies. All of MyFICO’s plans concentrate more on scores than what you can do with them, while Bitdefender, LifeLock and most others offer instant credit freeze options, even the top MyFICO plan does not.

It may not warn of data breaches, but MyFICO Premier has dark web scanning for personal identifiers. However, it lacks things like monitoring data brokers and the ability to track an address for a home title change.

MyFICO review: Insurance and services

All three MyFICO plans include $1 million of identity insurance for getting back lost money as well as fixing your life after an identity crisis. These funds can be used to pay for consultants, investigators, lawyers and accountants to get an idea of the scope of the crime and to remedy the situation.

The plan promises to cover lost wages with no limit, unlike other ID protection services that stop at about $7,500. It can also help with travel expenses and getting new documents, like a passport or driver’s license.

The service uses the American Bankers Insurance Company of Florida to underwrite the protection.

MyFICO review: Notifications and alerts

In addition to putting alerts in your face on the web-based interface, MyFICO displays them in its mobile app. These items can also be sent via email for prompt action.

The notifications I did get were among the most detailed with actual facts about the incident, rather than making me go to the interface to get answers. They can overwhelm you, though. However, it falls short because there’s neither a sex offender alert nor the ability to have MyFICO monitor court records for a home title change.

Over my three month use of MyFICO, I got 32 alerts, mostly for changing bank balances, although I did adjust the threshold to a higher level. Often the same alert would be repeated for the three credit agencies reporting it. For good or bad, it alerted me when my score changed.

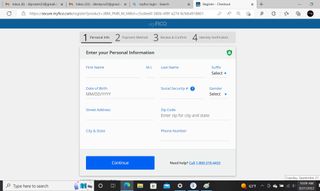

MyFICO review: Setup

Protecting my identity and checking my credit with MyFICO went off without a hitch. I started by picking the $39.95 Premier plan from the website.

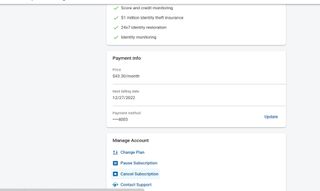

Next, I entered my email and a password, followed by my Social Security number, date of birth and address. I paid with a credit card but could have used PayPal. The summary page showed the monthly charge increased to $43.30 with sales tax, something that some ID protection services don’t charge.

I received a summary email and then had to answer four challenge questions, including ones about mortgages, roommates, credit cards and oddly, my astrological sign. Done, the site took me to MyFICO’s Dashboard, where I immediately saw my credit scores.

Still, I needed to get and install the MyFICO: FICO Score & Reports app for my phone. Finally, the first time I used the MyFICO app I needed to add my fingerprint or a PIN as a second level of authentication. The service also has two-factor authentication.

This added a minute to the setup process for a total of less than 10 minutes. All my data that traveled on the internet and was saved on the company’s servers in encrypted form. This made a data breach less of a worry.

The company has tech support personnel on call from 6:00 a.m. to 6:00 p.m. PT Monday through Friday as well as 7:00 a.m. to 4:00 p.m. on Saturdays; they’re closed on Sundays. If you have an identity crisis, they’re available 24/7. The browser interface has a direct link to the support technicians as well as a way to send them a quick email.

MyFICO review: Interface and utilities

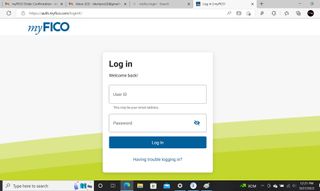

The MyFICO web-based interface and mobile app combine and were quick to accept my log-in credentials in under 3 seconds, making it one of the most responsive.

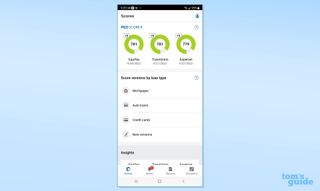

Setting the browser to 50% provides a comfortable HD workspace that requires a little scrolling. At 33% every item is visible, but the type is too small to read. There are four tabs at the top of the Member Center: Scores (for credit ratings and advice), Alerts (recent notices), Reports (the monthly credit summaries) and Simulator (for an excellent array of credit calculators).

The Scores are shown in the expected partially filled circles with the actual rating in the center and any recent changes in a box to the left. It’s important to note that the actual FICO score being used is in the upper left. The default is FICO 8 but there are many others that use data from any of the three credit agencies for maximum flexibility. The Reports section has the full credit report’s contents, including three months of payment history for each major creditor. A level down is a two-year timeline of payments.

MyFICO’s Simulator really shines. Access to not only the credit scores but the mathematical algorithms behind them really gives MyFICO an advantage with its what-if simulator. Just move the top slider to decrease or increase monthly payments or the bottom one to set the payment period. The estimated scores for each agency show up above.

There’s also a drop-down menu in the interface’s upper right that shouldn’t be overlooked. It has links for disputing errors on reports, getting help if your wallet is lost or stolen and a link for getting an identity theft case started. The Education service is a gem and central to MyFICO’s mission. While others treat this as an add-on that few will use, it’s at the heart of MyFICO. They come out every week or two and the latest concerned managing credit card debt in an inflationary environment.

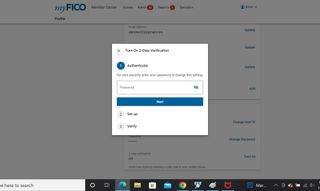

The MyFICO service has two-factor authentication (it calls it “2-step verification”) that sends a code to your phone for log-ins. It took less than a minute to set it up.

As good as MyFICO is at credit monitoring and providing scores, it falls short in basic security. Unlike Bitdefender, McAfee, LifeLock and others, it does without three essentials of modern online life: a VPN, malware protection or browser extensions.

My three credit scores showed up immediately with the ability to change to different FICO ratings below. Further down are all the other items that the web interface offered, including the Insights section as well as tabs leading to other parts of the service.

MyFICO review: Cancellation

In addition to calling and emailing to cancel a MyFICO subscription, it can be done through the company’s website. After logging in, I went to the Subscriptions & Billing page and at the bottom and clicked on “Cancel Subscription, but that was only the beginning. After I read about the virtues of MyFICO’s protection, I had to click on “Continue to Cancel Next Step” and then again after the site offered to pause the coverage.

Finally, I was able to click on “Cancel my Subscription”. I was told it would take effect on the next billing day. It took an hour to get a confirmation email.

MyFICO review: Verdict

Built around credit scores and reports, the MyFICO Premier plan is an expensive way for those who care about keeping an eye on credit card and bank fraud to feel safe. It does without things like investment account and home-title theft and lacks security basics such as malware protection and a VPN. However, it excels with excellent simulators and articles.

Finally, there’s one big reason to choose MyFICO: it is the only major ID protection service whose reports use actual FICO scores, and for me that’s worth a lot.

Brian Nadel is a freelance writer and editor who specializes in technology reporting and reviewing. He works out of the suburban New York City area and has covered topics from nuclear power plants and Wi-Fi routers to cars and tablets. The former editor-in-chief of Mobile Computing and Communications, Nadel is the recipient of the TransPacific Writing Award.