How to freeze your credit with TransUnion

Credit freezes are easy, effective and free

A quick, easy and free way to shrink your chances of identity theft is to freeze your credit. Once you do, it'll be nearly impossible for someone else to open an account in your name, or even to see your credit file.

The downside is that you won't be able to open a new account either. So each of the Big Three credit-reporting agencies — Equifax, Experian and TransUnion — makes it possible to temporarily (or permanently) "unfreeze" your credit for as long as you want.

Thanks to a federal law that went into effect in 2018, setting up and managing credit freezes is free across the United States. But you still have to set up individual freezes at each credit bureau, unlike fraud alerts with which you have to notify only one.

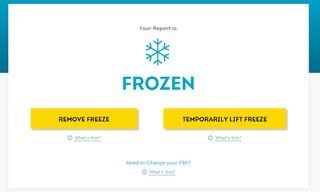

Like Equifax, TransUnion makes you create an account to set up a credit freeze online, but the account is specifically for managing your credit files and is separate from TransUnion's identity-theft-protection service. You'll also have to set up a PIN for quick unfreezes.

TransUnion also offers something called a "Credit Lock," which is similar to a credit freeze but is subject to fewer government regulations. It gives you the advantage of "instant" locks and unlocks, whereas a change to a credit freeze can take a couple of hours to go into effect. Depending on the features you select, a Credit Lock may not be free.

Below is how to set up a TransUnion credit freeze. We also have guides on how to request an Equifax credit freeze and how to set up an Experian credit freeze.

How to set up a TransUnion credit freeze online

Go to https://www.transunion.com/credit-freeze and click "Add a freeze." You'll then need to set up an account: Enter your full name, address, email address, phone number, date of birth and the last four digits of your Social Security number.

Sign up to get the BEST of Tom’s Guide direct to your inbox.

Upgrade your life with a daily dose of the biggest tech news, lifestyle hacks and our curated analysis. Be the first to know about cutting-edge gadgets and the hottest deals.

Submit that information, and TransUnion will then ask you some verification questions, such as where you lived the past and which companies you've had accounts with.

Once that's done, you'll be asked to create a password for your account and a PIN to freeze and unfreeze your credit. Write those both down.

How to set up a TransUnion credit freeze by telephone

To set up a TransUnion credit freeze by phone, call 888-909-8872. You'll be asked for your name, address, date of birth and Social Security number, and will have to answer identity-verification questions. You'll also have to choose a PIN to unfreeze and freeze your credit.

How to set up a TransUnion credit freeze by mail

Send a business letter (via certified mail, if possible) containing your name, address and Social Security number to:

TransUnion

P.O. Box 160

Woodlyn, PA 19094

TransUnion's website doesn't specify it, but you may want to include with your letter photocopies of your driver's license and recent utility bills or bank statements in your name.

Paul Wagenseil is a senior editor at Tom's Guide focused on security and privacy. He has also been a dishwasher, fry cook, long-haul driver, code monkey and video editor. He's been rooting around in the information-security space for more than 15 years at FoxNews.com, SecurityNewsDaily, TechNewsDaily and Tom's Guide, has presented talks at the ShmooCon, DerbyCon and BSides Las Vegas hacker conferences, shown up in random TV news spots and even moderated a panel discussion at the CEDIA home-technology conference. You can follow his rants on Twitter at @snd_wagenseil.